Pgiam/iStock via Getty Images

Introduction

Encountering Lumen Technologies’ (NYSE:LUMN) valuation ratios, particularly the shallow 0.11 price-to-sales relationship, was truly astonishing. The substantial pessimism around the stock is mainly due to the extreme uncertainty regarding Lumen’s ability to successfully conduct its turnaround plan to unlock new secular growth drivers. However, I believe that the extract from one of the most famous quotes by Warren Buffett, which says, “Be Greedy When Others Are Fearful,” fits well when we speak about Lumen. My fundamental analysis suggests that the company still does well across different key metrics, and its balance sheet is not that weak. My discounted cash flow analysis shows that the stock is multiple times undervalued. In summary, I believe that Lumen provides a strong turnaround play for long-term investors seeking a decent high-risk and high-reward opportunity. The upside potential outweighs the risks here, which makes me give LUMN a “Buy” rating.

Fundamental analysis

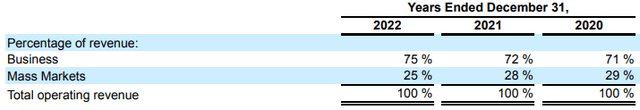

According to the 10-K report, Lumen Technologies is an international facilities-based technology and communications company. The company operates approximately 160,000 on-net buildings and 400,000 route miles of fiber optic cable across 60 countries. The major portion of revenue is generated from enterprise and commercial customers under the Business Segment. The remainder is contributed from the Mass Market segment.

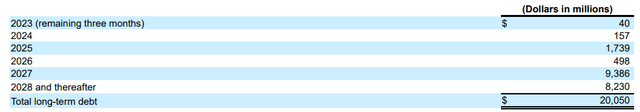

I want to start my financial analysis by emphasizing Lumen’s balance sheet due to the substantial amount of debt. Lumen had more than $20 billion in total debt as of the latest reporting date, September 30. The amount is huge for Lumen; the company’s total 2022 full-year revenue was $17.5 billion. But the good side is that less than $200 million is due by the end of 2024. About 88% of the total debt is due in 2027 and thereafter, meaning Lumen has sufficient space for maneuvering. Lumen had more than $300 million in cash as of September 30, and its current ratio was well above 1. The $2 billion revolving credit line facility is also available to Lumen. To sum up, Lumen has sufficient liquidity.

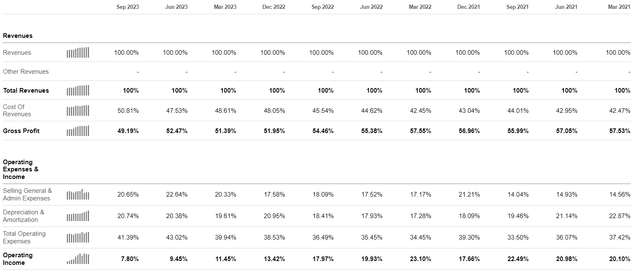

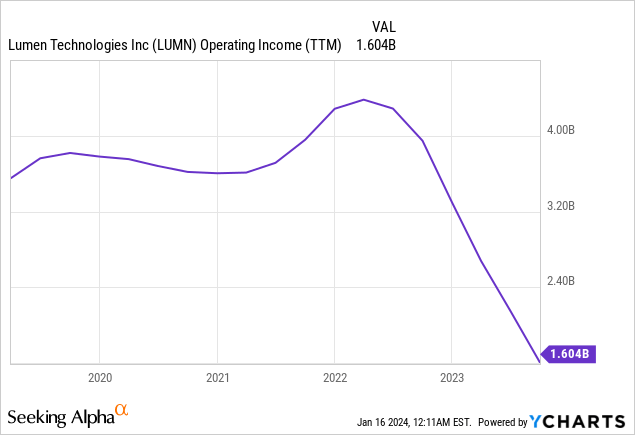

Now, I want to look at how the company’s substantial outstanding debt looks against trends in profitability. As can be seen below, there was a sharp decrease in the operating income since early 2022, but still, the TTM operating income of $1.6 billion represents almost an 11% margin compared to the TTM revenue. Before the sharp decline, LUMN generated more than $4 billion in operating income, which was around 20-21% in operating margin.

We need to understand the reasons for such a sharp operating income decline to assess whether the drawdown is temporary or not. When I look at the company’s quarterly financial performance in 2022 and 2023, I see that the costs side did not change much on a YoY basis, even demonstrating slight declines. The problem here is that revenue declined substantially, which is linked to the company’s October 2022 divestiture of a notable part of the ILEC business across 20 states. That said, the decline in the operating margin of LUMN is not temporary and now investors should get used to new levels of this profitability metric. Lumen’s operating margin is now in single digits but is still far above zero. It is also important to understand that divestiture is not a desperate move but rather a strategic step to reshape the company’s business to be more enterprise-oriented.

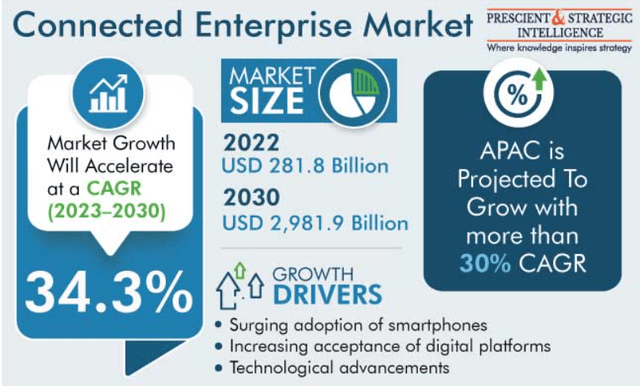

The strategic shift towards focusing on enterprise services looks sound to me, given the expected growing demand for data and connectivity services for businesses. We live in a world where households and individuals are more digitalized than businesses because the smaller the unit is, the more flexible it is to changes. But the trend towards more digitalization, which will require more connectivity, is inevitable. I am quite sure about this trend’s sustainability because businesses seek to achieve more efficiency and higher profitability, and the massive potential is hidden within streamlining internal processes and improving business process analytics. Overall, the connected enterprise market is expected to grow by about tenfold over the next eight years, which is a strongly favorable shift for Lumen. And I believe it will snowball because the more sophisticated digital platforms are used, the higher the demand for connectivity and bandwidth will be.

Although Lumen is considered by investors to be a poor investment, which I see from the stock price dynamics over the long term, I believe these fears are in the rearview mirror. It seems that the previous management did not do much to address the trend of the declining demand growth for mass markets and made some quite poor capital allocation moves. For example, the company paid out $11.4 billion in dividends between 2013 and 2022, and at the same time, the debt level grew substantially between 2013 and 2021. The dividend was eliminated at the end of 2022, debt levels are still substantial, and the company has sold its quite profitable ILEC operations. These all look like quite poor capital allocation moves, but I attribute all of them to the previous management.

As of today, it is important to acknowledge that the company is exposed to a promising business connectivity market, where the demand growth for bandwidth will be solid for the next decade. The company has an extensive long-haul fiber network of over 450,000 route miles in its network, which is not replicable. The new CEO, who stepped in early 2023, has already demonstrated solid moves, which included headcount cuts and seeking opportunities to restructure the debt. The appointment of Satish Lakshmanan as Lumen’s new chief product officer, who previously served as the global leader for artificial intelligence services at Amazon Web Services, will also highly likely add value to the company’s ability to innovate.

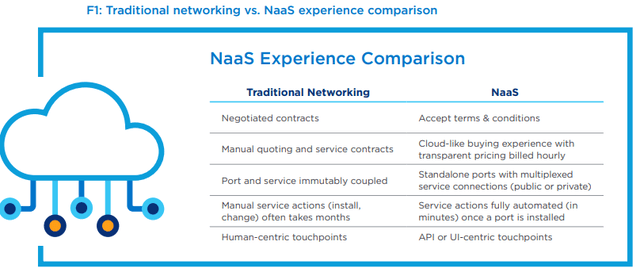

During the Q3 earnings call, the management shared the vision that one of the future growth drivers will be new capabilities like Network-as-a-Service (“NaaS”). The company already entered this space with its first NaaS offering called “Lumen Internet On-Demand”, which is already available across various industries. This endeavor looks very promising because the overall NaaS industry is expected to grow at a stellar 35% CAGR for the next several years. This is a massively favorable trend for Lumen, especially considering the company’s notable experience and extensive assets base in the connectivity business. It is worth mentioning that Lumen’s NaaS offering has been called an “industry disruptor” by Telecom Review.

To summarize my fundamental analysis, the new management’s strategic shift toward enterprise clients is sound, considering the expected rapid growth of the demand for bandwidth from businesses. The company’s extensive asset base and vast expertise in connectivity make Lumen firmly positioned to benefit from the overall global digitalization trend, which will inevitably drive up the demand for connectivity services. The new management also has initiatives in cost optimization and balance sheet improvement. All these measures should create sustainable value for shareholders over the long term, especially considering industry tailwinds like the expected rapid transition from traditional networking to NaaS.

Valuation analysis

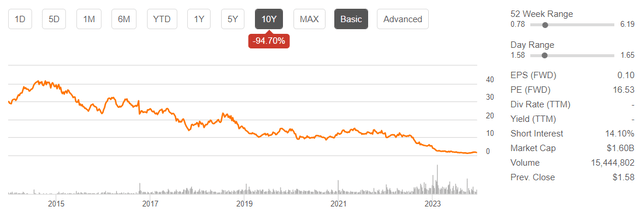

The stock lost around 95% of its value over the last decade and currently trades closer to the lower edge of the last 52 weeks’ range. LUMN demonstrated solid short-term momentum with a 17% rally within the last month.

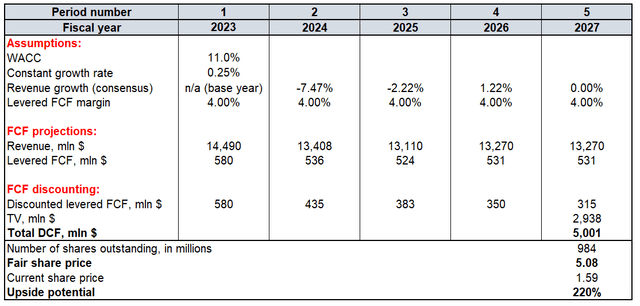

To derive LUMN’s fair price, I will run a discounted cash flow (“DCF”) model. Finbox suggests an 11% WACC for LUMN. I use it as a discount rate for my DCF. Consensus revenue growth projections for the next five years are very conservative as they project a decline in sales. I prefer to be conservative, too and will apply consensus forecasts here. Considering LUMN’s substantial indebtedness, I implement a very conservative 4% free cash flow margin, which is more than twice lower than the last five years’ average of almost 11%. I also use a very conservative constant growth rate of just 0.25%.

The total value of discounted cash flows returned by my DCF model is $5 billion. When I divide it by 984 million shares outstanding, I get the fair share price of $5.1. This is multiple times higher than the current share price, which means a “multi-bagger” upside potential.

Risk factors

Even though I am optimistic about the company’s turnaround prospects, it is unlikely to be an overnight process. The company can face notable challenges before all potential benefits are unlocked. While the new management’s moves have been sound so far, the team’s tenure as LUMN’s leadership has been relatively short, and there is still a high level of uncertainty regarding this management’s ability to complete turnaround plans successfully.

The rapidly evolving technological environment also poses substantial risks for Lumen. The bandwidth demand growth might outpace the company’s capacity, forcing Lumen to invest heavily in its network capacity expansion. The business is capital intensive, which means there are substantial risks of capex budget overruns and investment payback horizons being longer than planned. If such a scenario unfolds, this might lead to the investors’ disappointment and further stock sell-off.

When the stock price has consistently declined for several years, it might take a long time for the sentiment to become more optimistic. Without the improved investors’ sentiment around LUMN, it would be difficult to expect a spike in the demand for the stock. It could take several quarters of delivering earnings above consensus coupled with deleveraging that might return positive sentiment around LUMN.

Also worth mentioning is that while I believe that the company’s current substantial level of debt does not mean a significant credit risk, I have to emphasize that high leverage limits adversely affect Lumen’s financial flexibility if a new promising investment opportunity pops up. Having a highly leveraged balance sheet means there is not much room to raise more debt finance, and potentially good growth opportunities might be missed due to this factor.

Conclusion

I recognize all the risks and uncertainties related to investing in LUMN, but it is apparent to me that the massive upside potential makes the stock a very good high-risk, high-reward play. It seems that the current valuation reflects the worst scenarios, including bankruptcy, but my fundamental analysis suggests that LUMN still has resources and sufficient profitability to survive the ambitious turnaround successfully. The substantial amount of total debt on the face of the balance sheet should also not mislead investors because the lion’s part of it is due after 2027. To conclude, LUMN deserves a buy rating as it represents a good play for investors with a high tolerance to risk.