Yuichiro Chino/Moment via Getty Images

Dear Friends and Clients:

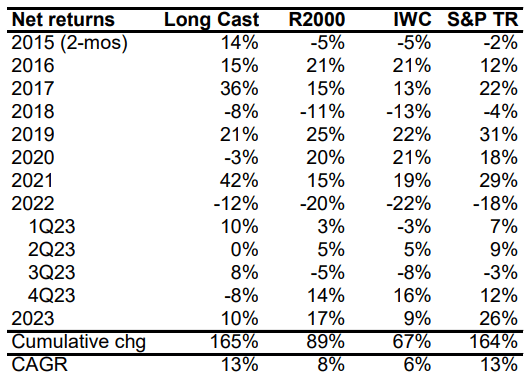

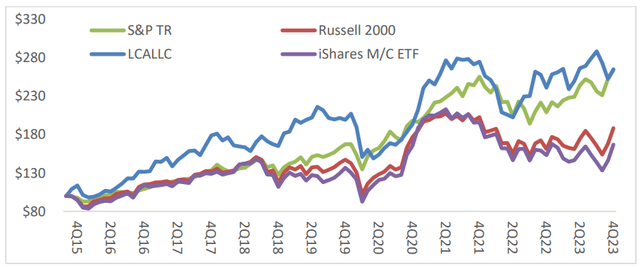

For the 4Q23 quarter (ended December 31, 2023), cumulative returns were -8% while the predominant indices improved, in some cases double digits. For the year, cumulative net returns were +10%. Since inception in November 2015 through quarter end 3Q23, LCA has returned a cumulative 165% net of fees, or 13% CAGR. As a backdrop to returns, since inception through 4Q23 we comfortably exceed two widely used representative indices for passive small company investing, the iShares MicroCap ETF (IWC) and Russell 2000 Index (RTY), and we are roughly in line with the S&P.

Past performance is no guarantee of future results. Individual account returns may vary.

Whether returns are up or down, ours’ isn’t a quarter-to-quarter approach. Our traditional, fundamental, long-term approach is about valuing individual companies based on their expected cash flows, an assessment that relies on financial statement analysis and industry specific indicators. “The market” as discussed every 15-minutes on the radio and covered 24/7 on the bizfotainment networks has very little to do with this practice, and the small companies we invest are rarely included in the major indices. Although it’s challenging to not participate in a market rally, it won’t affect our strategy of concentrated investing in well-researched and well-understood companies that offer compelling opportunities for high returns. I’m grateful to have clients that appreciate this and welcome the continued interest from other knowledgeable and experienced investors who share this perspective.

PORTFOLIO UPDATE

MAMA was the top performer in the quarter, followed by RELL, PDEX and RSSS. Our two largest holdings, MTRX and CCRD were significant detractors. Given our portfolio concentration, volatility in the price of these two stocks will have an outsized impact on our portfolio. Our top five holdings at quarter end were MTRX, CCRD, QRHC, PESI and RSSS.

MTRX enters calendar year 2024 with $1.4B in backlog, near its prior historical peak. The last time backlog was this high, the following year the company earned $1.07. History doesn’t necessarily repeat itself, but this is a cyclical business that follows long term trends. MTRX should quickly return to profitability, and earnings will be shielded by NOL’s generated during the COVID downturn. Assuming next year generates $1 EPS – a very conservative estimate – this is trading ~9x forward P/E, very cheap for an E&C with historically high backlog.

Concurrently, since many of the projects in backlog are fairly new, the risk of project write-downs in the near term is low (losses typically are not recognized until a project is more than 60% or 70% complete). All in, I think this presents a very attractive setup in an industry I know well, which is why it is our largest position.

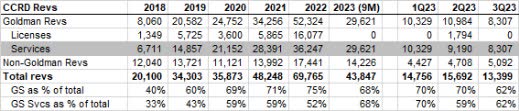

Towards the ends of the year, you received an email from me explaining why I’ve substantially added to CCRD despite the slide in the stock price. I’ve appended a copy of that email at the end of this letter. (TLDR: The market is valuing this as if Goldman revenues are going away. They aren’t going away, at least for the next two years, if at all).

Concurrently as I sit writing this, Apple has issued a news release about the card quoting the most senior executives responsible for the Apple Card program at Apple and Goldman, including this from Goldman: “We are committed to continuing to deliver an excellent experience for Apple Card customers.” Not a comment one would expect from a stilted partner.

That news release also indicated that the card yielded $1B in “Daily Cash” last year, which at the mid- point of the 1%-3% cash back range, puts gross volume processed at $50B. Even though CCRD doesn’t get paid on volume it’s a significant figure that further reinforces the company’s capabilities.

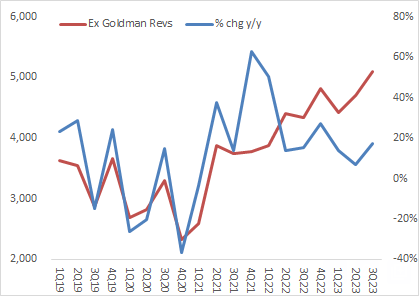

Though the stock may remain volatile and overshadowed by noise around the Apple / Goldman relationship, our sole concern is what’s going on at the business level. Revenues excluding Goldman annualize to $20M / year; these are recurring and growing. Management, which is seasoned, entrepreneurial and far sighted, is making the necessary adjustments to diversify its client base. The market expects the worst and has priced it at unreasonable levels given. Buying at these prices and at this concentration seems appropriate given the opportunity.

One of our longest-term holdings, QRHC, has had a quiet quarter. Last year the company swallowed a series of acquisitions and carries a hefty debt load at high interest rates as a result. I’d initially expected that by year end they would refinance the debt, but it now appears perhaps before the end of 1Q24. The benefits from a refinancing would fall directly to the bottom line. We’ve owned this as the company evolved from “crawling to a walking” and I expect soon it will be set up for the long haul to “run” with the opportunity to blossom into something bigger.

I recently met someone who worked at the Hanford site who spoke highly of PESI’s management and indicated that despite persistent squabbles between state, local and federal agencies eventually PESI would get the grouting project. Signs continue to point to a likely 2024/2025 start. That alone could contribute +$2 / share in earnings. As I wrote two quarters ago, it seems worth the wait.

Finally, following its acquisition of Resolute AI in July for $4.6M, RSSS acquired the larger AI related company Scite in November for $14M, completing its long-anticipated acquisition strategy. Together these companies add over $5M in recurring revenues. More importantly, they add more solutions in the core life sciences business and cross selling opportunities in the academic space, where Scite has a larger presence.

IN CONCLUSION: ON LEARNING

I asked our teenage son while he was home from college if he thought learning required some degree of humility. The question, asked during one of those “parents don’t know anything” jeremiads, garnered a dirty look from Mrs. LongCast, who astutely suggested there’s many paths to learning (she’s often always right). I suppose I revealed in the asking that humility is one of mine. With investing, it’s part of a virtuous cycle of curiosity, observation and reflection.

Curiosity: As with every endeavor, and with rare exception, everybody starts out knowing nothing, learns as they go and gives up when they decide they know enough. Alternatively, those who stay curious continue to learn and perhaps even acquire some expertise. Investing offers a near insatiable opportunity for learning about a company or an industry.

Observation: Portfolio management goes beyond just knowing. It weighs and it compares against alternatives with uncertainty always looming over. As PM, I act on expectations around possible futures and observe how business unfolds relative to those expectations. Looking for companies with long and wide opportunity pathways means the business environment doesn’t need to be ideal, the balance sheet isn’t stretched and management can recover from invariable stumbles. Still, a thing about expectations is the seemingly universal experience of frustration when they are unmet.

Reflection: Not just looking back but looking in, and exemplified by the questions “what don’t I know” and “what does the market know that I don’t.” When reality veers from expectations I reassess and humility offers the feedback mechanism to convert frustration back into curiosity.

All of which is to say investing is hard, patience is an active process and enduring the frustration without acting rashly when our stocks don’t work in the near term is how we will grow our wealth, and I will earn my fees, in the long term.

As always, I remain committed to building a durable and sustainable business based on a repeatable investment process and intelligent capital allocation. I appreciate your entrusting me with your capital and the responsibility associated with being its steward. If you have any comments or questions, please don’t hesitate to call.

Sincerely

Avi Brooklyn

Appendix

|

Dear XXX – Hope this finds you well. I wrote something about a stock in our portfolio that I wanted to share with you, with a warning that this isn’t as sanguine as our 3Q23 letter when we were up 20% YTD across all accounts. Since the end of the quarter, CCRD has taken a significant downturn, driven by weak 3Q23 results and more recently by reports that Apple is ending its credit card relationship with Goldman Sachs. As a reminder, CCRD is the issuer processing software for the Apple Card, with Goldman as the issuing bank. I think the market is misunderstanding what’s going on, giving us an opportunity to lower our cost basis and enlarge our position in what I think is a terrific company in a business with a lot of operating leverage that I believe will offer a high IRR for patient investors. A bit of history: In 2018, Goldman licensed CCRD’s issuer software for the Apple card. In 2022 Goldman added a license for the General Motors card, with further expectations (according to various reports) that it would acquire an additional license for the T-Mobile card. Goldman however is now retrenching from efforts to grow its consumer facing businesses so what was once a “feather in the cap” for CCRD – having a brand name high profile client – is now seen by the market as a weight around CCRD’s neck, for the obvious reason that Goldman represents a significant amount of CCRD’s revenues. The “headline” is that 75% of revs are disappearing, but I don’t believe this is accurate.  “Goldman revenues” fall into two categories: License fees are driven by the number of active monthly credit card accounts and relates to growth in the underlying card; if you’re using the platform and the card grows, you pay the license. As long as the Apple Card grows monthly active accounts, CCRD will continue to receive license fees. Services and maintenance are generally variable “man hours”; if you’re using the platform and know nothing about consumer credit, you’re going to consume a lot of CCRD time getting help figuring things out. Goldman was paying through the nose for these services and maintenance fees. With Goldman trying to rein in costs, CCRD revised its agreement with Goldman converting these services and maintenance fees from variable to fixed. Under the revised contract, Goldman will pay CCRD minimum quarterly fees of $5M (ie ~$20M / year) for the next three years. It’s my understanding that if Goldman offloads the Apple Card to another bank, it will assign this contract to that bank. If that bank switches to another issuer software, Goldman will have to pay all the future contracted revenues up front, though CCRD will lose future license fees. In short, 2023 GS services revenues looks likely to be flat and I anticipate 2024 GS services revs will decline to the $25M range next year (annualizing 3Q23). Bad, but not in my opinion worthy of a 50% valuation haircut. Apple has significant clout in choosing the issuer software. I’ve heard reports that Apple now has ~15M credit cards, which puts it nearly on par with AMEX, and making it one of the most successful credit card launches in history. CCRD management, which has a deep relationship with payment folks at Apple, believes there will be no change in the issuer software. Obv they could be wrong. The WSJ reports that two potential candidates to take over the card are Synchrony and AMEX. Synchrony currently uses VisionPlus as its issuer software, which coincidentally was the precursor to CCRD. AMEX has its own issuer processing software but uses CCRD on its “new-Kabbage” commercial card (“blueprint”), so is not unfamiliar with the platform. I don’t know the future, but I think the odds are favorable that it’s not as bad as the market thinks. Concurrently, CCRD is growing the “non-Goldman” business and is accelerating efforts to speed this growth. It has never had a sales and marketing function to market to “the masses” (ie hundreds of publicly traded regional banks) because it’s never needed one; revenues were relationship-driven through management or through third parties. Now the company is building a small team to hunt for business, including the recent hire of a mid-level sales person from i2c, a large competitor. And the aforementioned “third parties” are active as well. CCRD has long been the processor behind the scenes for two well funded “fintech” companies Deserve and Cardless. Any card issued by these companies is processed by CCRD. This recent interview by the CEO of Cardless indicates some potentially large new offerings going live early in ’24 (minute 21 if you don’t want to listen to the whole thing). All this points to continued positive trends and possibly accelerating growth for revenues excluding Goldman.  All this will take time, and 2024 may not likely be a great year, but the groundwork it lays today will expand the opportunity set in the future. Credit cards are high margin products for banks and I expect they will seek them out when the tightening credit cycle ends and delinquencies normalize. To quote one investor you’ve likely heard of (Charlie Munger, RIP): “The big money is not in the buying and the selling but in the waiting.” And to quote another you likely haven’t (my friend Travis Cocke at Voss Capital):  I think this situation fits both these views. CCRD, whose software is responsible for the most successful credit card launch in history, and whose operations have long been self funded, profitable and cash flow positive, now trades at a ~$75M enterprise value while competitors are valued in the hundreds of $M’s or $B’s. (In July, Visa acquired a Brazilian processor called Pismo for $1B). Given interest rate headwinds (which have likely peaked) and the overhang of uncertainty and confusion around Goldman, I understand why the stock is depressed, but for investors like us taking the long view, it seems ridiculous. The waiting is sometimes a painful process but I think it will prove remunerative in the end. Please let me know if you have any questions. I always welcome your call. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.