The shrinking universe of London-listed real estate investments trusts (REITs) is tipped to diminish further in 2024, as the sector struggles under the weight of low assets, weak share prices and high discounts.

Warehouse investor Tritax Big Box on Monday revealed a £924million deal to buy rival UK Commercial Property REIT, lining-up the creation of an almost £4billion real estate giant that some experts have said has the potential for future FTSE 100 membership.

The takeover of UK Commercial Property follows LondonMetric‘s £1.9billion all-share takeover of LXi, and the announced merger of Abrdn Property Income with Custodian Property Income REIT in January.

Merger and acquisition activity among UK REITs has gathered pace since 2019 and is expected to continue, but some analysts say consolidation bodes well for the flagging sector’s future fortunes.

Real estate is generally negatively affected by rising interest rates

Analysis from lawyers at Bryan Cave Leighton Paisner in May 2023 found the number of London-listed REITs had fallen 20 per cent, from 83 at the beginning of 2019.

That figure now stands at 48 REITs, according to the London Stock Exchange Group website.

Association of Investment Companies data shows just seven UK listed property trusts currently show a positive one-year share price performance, while 17 funds have posted double-digit declines.

Hefty double-digit discounts to NAV are also commonplace, with trusts in the UK Residential, UK Commercial and UK Logistics subsectors currently on an average discount of 42.6, 21.3 and 19.4 per cent, respectively.

The two existing Healthcare REITs are on a discount of around 29 per cent each.

CEO of London and Scottish Property Investment Management Stephen Inglis recently described 2023 as ‘one of the most challenging years for REITs in recent memory.’

Inglis’ company manages Regional REIT, which is currently sitting on an eye-watering discount of more than 70 per cent and was ‘not immune from the macro-economic difficulties faced by the sector’, he added.

BCLP said: ‘For as long as share prices are depressed, equity capital-raising remains challenging and credit markets are tight, we anticipate that takeover activity in this market will continue as more companies pursue scale through merger transactions or are the targets of cash-rich investors including private equity firms.’

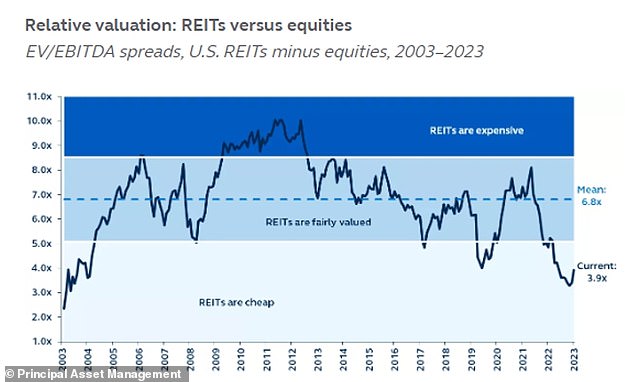

London is not alone: REITs in the US also look cheap relative to equity market valuations

REITS hit by rate hikes

While the issue is particularly stark in the UK, London-listed REITs are not alone among global peers in facing a difficult trading environment.

REIT share prices have struggled globally for two years amid rising interest rates, which generally weigh on the attractiveness of real estate assets.

Analysts at Principal Asset Management said: ‘REITs are trading at historically significant discounts relative to broader equity markets, thanks mainly to the interest rate sensitivity of the REIT market.’

They added that weak share price performance also reflects ‘investor concerns about real estate’s challenges: rising financing costs, lower capital availability, outsized debt maturities, and office market struggles’.

Principal AM said: ‘However, these concerns are largely misplaced as balance sheet leverage is, on average, below 30 per cent, REIT debt maturities are quite manageable, multiple capital sources, such as equity or unsecured debt, are open, and exposure to US traditional office is below 4 per cent.’

And as interest rates peak with central banks set to start easing monetary policy against a backdrop of falling inflation, 2024 could mark a ‘bounce-back year for REITs,’ it added.

Bigger is better

While REITs have suffered a sharp rise in interest rates globally, UK firms have struggled relative to US peers largely as a result of their stark size difference.

The lions’ share of London-listed property companies has less than £1billion it total assets, according to AIC data, with the sector dwarfed by US peers.

John Moore, senior investment manager at RBC Brewin Dolphin, said: ‘At their current scale, the UK’s REITs are limited by their size.

‘This has an effect on the capital they can attract, the terms on which they can borrow, and ultimately the deals they can do.

‘Combine them all and you have just one of the main North American property asset managers – they simply can’t compete on a global scale.

‘Some REITs are having to raise substantial sums privately, which restricts them and means they can only invest £1billion when, really, they should be talking about multiples of that figure.’

Consolidation in the UK REIT sector therefore has the potential to improve performance and shareholder returns going forward, according to BCLP.

It said: ‘While it is disappointing to see the UK’s listed real estate sector shrinking, there are many sub-scale companies and there is little doubt that investors would be better served by larger companies with greater share liquidity, lower cost ratios (as a result of economies of scale) and greater access to debt capital markets.’

London-listed property trusts suffer heavy discounts, weak share prices and low assets

The tie-up between Tritax Big Box and UK Commercial Property REIT fits this rationale, with the combined property company ‘potentially the fourth largest in the UK and a contender for future inclusion in the FTSE100’, according to Oli Creasey, property research analyst at Quilter Cheviot.

Tritax Big Box is the largest in the property sector and had posted a one-year share price return of almost 10 per cent, but continues to trade at a 17.2 per cent discount to NAV of around £11million.

UK Commercial Property is also among the biggest and best-performing trusts, with a one-year return of 23.5 per cent, but sits on a 20.7 per cent discount to NAV of £81million.

Creasey added: ‘It would make sense if [Tritax’s] manager, Abrdn, was now looking for a… deal that would help the trust build scale, presumably with input from the largest shareholder.

‘It follows a recent trend of consolidation in the property industry, with the other notable transaction currently ongoing between LondonMetric and LXi being another example of two companies looking to build scale.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.