NurPhoto/NurPhoto via Getty Images

Lockheed Martin (NYSE:LMT) is a popular investment among dividend investors, being viewed as a long-term safe haven.

The F-35 maker shares have essentially treaded water since the geopolitical-driven upswing at the end of February 2022, as investors are waiting for higher defense budgets to translate into profits.

This turned out to be harder than expected, as the combination of supply chain issues, limits on pricing power, and continued macro uncertainty are making investors question Lockheed’s ability to accelerate growth.

Let’s dive in.

Introduction To Lockheed Martin

Who doesn’t know Lockheed Martin? The company has been one of the largest contractors for the U.S. government for several decades, as it plays a crucial role in the protection of the U.S. and its allies.

I’ve been covering the company on Seeking Alpha since early March 2023. At first, I rated the company a Strong Buy, viewing its growth and margin problems as temporary. Several months later, I came to realize that the supply chain issues were persisting, and even worse than that, the profitability issues were more structural than I initially thought, which led me to downgrade the stock to a Hold.

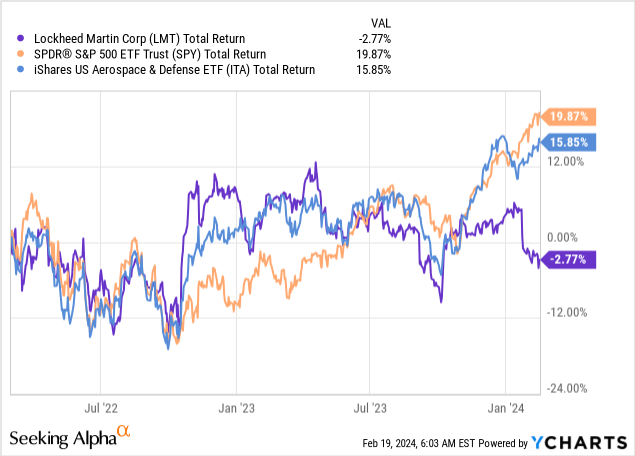

I think the following graph paints a clear story:

After the initial jump following the Russian invasion of Ukraine, the stock started declining, as the company failed to solve its supply chain issues. Then, management fueled optimism, citing improvements and providing better-than-expected results.

And then came the earnings announcement in July 2023, when management essentially said that higher demand would not result in better profitability and that it would be a multi-year revenue story, rather than accelerated near-term growth.

As market preferences shifted to higher risk, and investors digested the mid-term outlook for Lockheed, the stock continued to trail both the market and its peers.

If that wasn’t enough, the latest blow came last week.

Biden Plans Cutting F-35 Orders By 18%

Coming out of the pandemic, governments all over the world are being scrutinized for their spending, amid inflation uncertainty and high interest rates.

However, due to increasing geopolitical tension, investors shrugged off the notion that governments would be willing to cut their defense budgets, with the majority of market participants, myself included, expecting consistent growth in defense spending in the near term.

Well, according to Reuters, U.S. President Joe Biden is asking for an 18% cut in the number of jets bought by the Pentagon in 2025, viewing it as one area where he can ease some of the pressure from Congress.

That would be a major blow to a company that’s currently going through intensive efforts to scale its production capacity, with approximately 40% of sales and profits coming from the Aeronautics segment, which primarily consists of F-35 aircraft.

Stagnation Continues

Even before the recent news, Lockheed had already suffered from stagnation. In 2023, the company generated revenues of $67.6 billion, only 3% above 2020, remaining in the $65-67 billion range for the past four years.

Not only did margins not improve, they declined slightly, resulting in a consolidated operating profit of $8.5 billion, below 2020 levels.

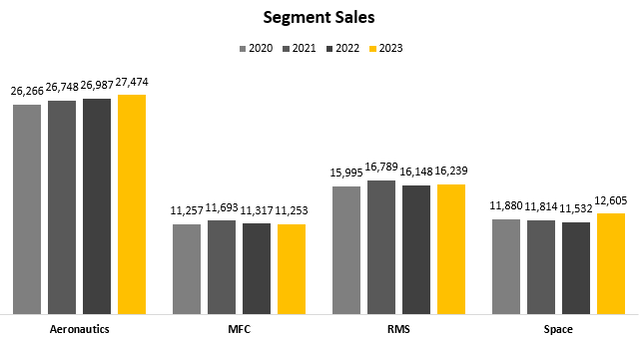

Created by the author based on data from Lockheed Martin financial reports; MFC = Missiles & Fire Control; RMS = Rotary & Mission Systems.

As we can see, stagnation is pretty much broad-based across all segments, with Space being the only outlier. Still, even the fastest-growing segment is only 6% above 2020 levels.

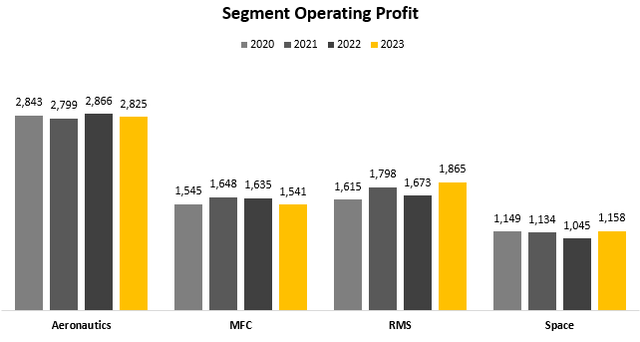

Created by the author based on data from Lockheed Martin financial reports; MFC = Missiles & Fire Control; RMS = Rotary & Mission Systems.

Furthermore, the only segment that experienced margin improvement between 2020 and now is RMS, with a 138 bps expansion. The rest of the segments are essentially flat.

By now, you’d expect Lockheed to be able to solve at least one of these issues, either growth or profitability, but that is not the case. There are no signs of improvement heading into 2024 as well.

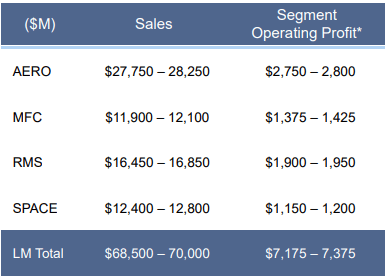

Lockheed Martin Q4’23 Presentation

Looking at management’s guidance for 2024, we can see that the only segment that’s expected to grow meaningfully is MFC, while the rest are due for another flat year. Additionally, margins are again expected to remain essentially unchanged.

Deteriorating Balance Sheet & Capital Returns

As Lockheed’s struggles continue, the soon-to-be dividend aristocrat is becoming more and more reliant on outside capital to fund its cash returns to shareholders.

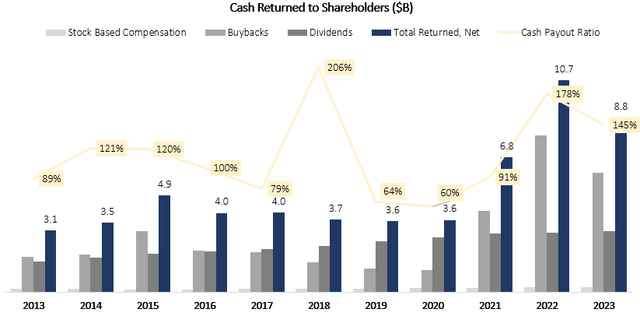

Created and calculated by the author based on data from Seeking Alpha.

In the last two years, Lockheed’s cash payout ratio was 178% and 145%, two of the highest numbers in the last decade, aside from a one-time jump in 2018. A higher than one payout ratio means the company is using either dilution or debt to fund buybacks and dividends, a feat that in today’s interest environment isn’t necessarily beneficial for shareholders.

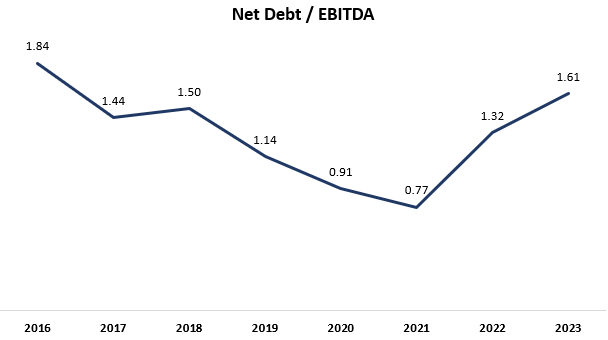

Created and calculated by the author based on data from Lockheed Martin financial reports.

Therefore, we can see that net debt is increasing while EBITDA remains flat, leading to an increasingly higher net debt / EBITDA ratio. Furthermore, the company’s net interest expense continues to increase, reaching 1.4% of revenues in 2023, compared to the historical average of 1%. For a company with sub-10% profit margins, that is meaningful.

Valuation

By now, I think we established Lockheed Martin is the definition of a stalwart. Low or no growth, and really no potential for significant margin expansion. At its best, Lockheed achieved operating margins in the 14% range, as the company’s profitability is capped due to the cost-plus nature of the business.

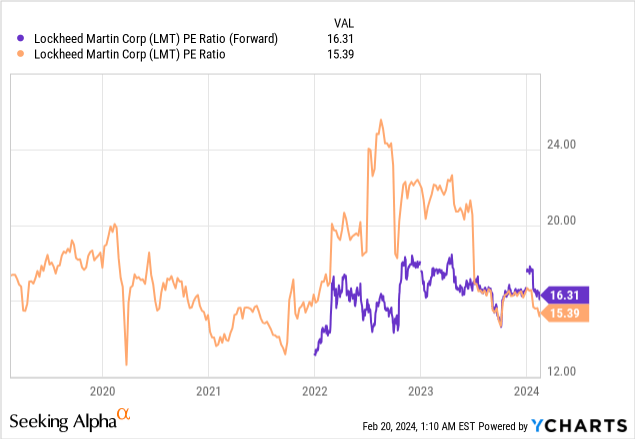

Historically, LMT traded in the 16x-18x P/E range. Today, as the company is expected to see an EPS decline in 2024, bad news continues to pile up, and there’s no sign of tangible improvement in the near term, I believe it’s very justifiable it will trade in the low end of that range.

In other words, I find Lockheed Martin fairly valued. There are two problems with being fairly valued in today’s market. One, investors are generally in a risk-on mode, looking for fast growers to beat the market rather than stalwarts to protect their downside. Two, there are plenty of profitable fast growers out there.

As many unprofitable and non-self-sufficient companies learned in 2022, the market is way less forgiving of inefficiency. This has resulted in plenty of companies going through a major shakeup in operations, and significant layoffs. We’re seeing many companies with a margin expansion and top-line growth story.

As such, the only real path for Lockheed to beat the market is if the market goes down. For some investors, especially those who are looking for a steady dividend income, that is enough to justify a position.

Conclusion

Lockheed Martin is a cornerstone of America’s defense capabilities and should remain so for the foreseeable future.

The company that plays a major role in producing the world’s most sophisticated fighter jet has been struggling to reignite top-line growth despite growing demand amid increasing geopolitical tension.

In a business that is based on cost-plus arrangements, a margin expansion story isn’t there to generate bottom-line growth as well.

As headwinds continue to pile up, with the recent news of an expected 18% cut to F-35 orders, I see no path for improvement in the near term.

As such, I expect Lockheed Martin to continue to trade at the low end of its valuation range and rate the stock a Hold.