War has been a part of civilization for as long as recorded history. The two major ongoing conflicts are a stark and sobering reminder of this, and as long as there is war, governments will want the latest technologies and equipment to be the most prepared for conflict.

The United States, the country with the largest defense budget by a country mile, outsources a lot of its military technology development to defense contractors. These companies generally have just one customer (the U.S. government) but see a steady and growing stream of product demand due to the increasing defense budgets of the U.S. military and its allies.

The largest and most innovative of these contractors is Lockheed Martin (LMT -0.58%). A predictable business generally leads to a steady and reliable stock price, so if you’re getting sick of the volatility in growth stocks, Lockheed Martin might be just the stock you need for your portfolio. Here’s why.

Get defensive with the leading defense stock

Lockheed Martin was formed in a merger in 1995 from two of the largest defense contractors and now dominates the industry. From aeronautics to missiles to space systems to naval equipment, its subsidiaries have been developing cutting-edge equipment for decades. With cost-plus contracts that guarantee profits, the company has generated positive operating income every year since the merger. Few companies can say the same.

So why is the business so predictable? First, the U.S. military sets its budgets well in advance and rarely decreases its spending.

Second, contracts have long durations. For example, the U.S. government plans to buy planes from Lockheed until 2044, and they will need to be serviced for even longer. For this entire time, the company will be earning revenue from the deal. You can see this in its backlog, which hit $156 billion last quarter.

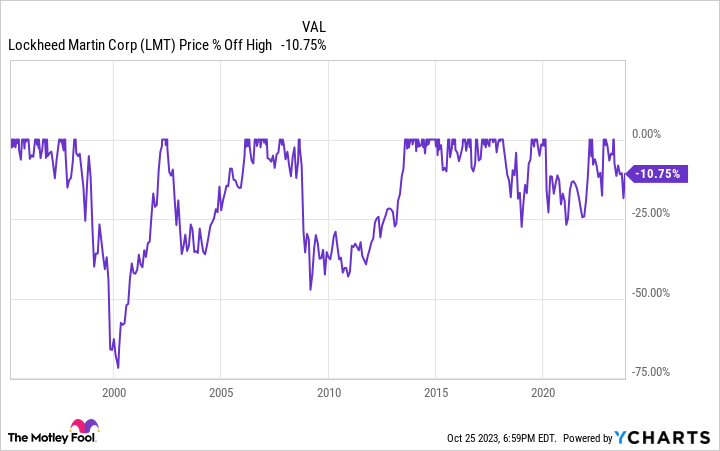

This is why defense stocks such as Lockheed can act, well, defensively for your portfolio. Its shares have fallen more than 50% just once since 1995 and by 25% only a few times. It might not be a hypergrowth company, but investors have a great line of sight into its future financials. This gives the stock minimal volatility.

An old company, but still innovating

Some investors might argue that older defense contractors such as Lockheed Martin are stodgy and ready to have their antiquated technologies and business models disrupted. But that couldn’t be further from the truth. Lockheed is one of the most innovative companies in the world, which it proves year after year.

It powered the Mars Curiosity Rover, as well as other projects on the red planet, and came up with breakthrough technologies such as the SR-71 Blackbird and F-117 Nighthawk fighter planes. Given its track record, the government goes to Lockheed when it looks for the most cutting-edge military technology.

Recently, it came out that the company was working with the military on advanced laser systems that can shoot down cruise missiles. It just won a contract to work on a nuclear-powered spacecraft.

This reputation and product execution should give Lockheed an advantage over other defense contractors for years to come.

Buy now and watch the dividends pile up

Patient investors have reaped the rewards of this durability through steady dividend growth. Since the merger, its dividend per share has grown by 1,590% and currently has a yield of 2.8%.

Yes, the current yield is much lower than the 5.5% rate you can get on short-term U.S. Treasuries, which have extremely low risk and are backed by the U.S. government. But Lockheed’s revenue comes almost entirely from the U.S. government and should be able to grow its dividend payout (on a per-share basis) for the foreseeable future.

If it can multiply its dividend per share by a factor of 10 over the next 20 years, the yield on the price you pay today will be 28%. That is $280 paid to you each year for every $1,000 worth of Lockheed stock you buy today.

Not a bad way to build a retirement nest egg.