sefa ozel/iStock via Getty Images

Introduction

LNG sector’s journey in 2023 was quite a bumpy ride due to the persistent weakness in prices. That left many companies grappling with their performance. Cheniere Energy Partners (NYSE:CQP), the operator of the Sabine Pass LNG Terminal in Cameron Parish, Louisiana, faced its fair share of challenges as its earnings took a hit.

In a previous article, I pointed out that despite these challenges, the Master Limited Partnership managed to maintain decent levels of cash flows. Back then, I made a case for Cheniere as an attractive investment option, and that perspective might still hold true in the near term. However, it’s time to delve deeper into the company’s performance during the first nine months of 2023, and it raises some questions about its long-term outlook.

LNG Price Rollercoaster

LNG prices reached unprecedented heights in 2022, driven by European countries urgently seeking alternatives to Russian natural gas following Russia’s invasion of Ukraine. This surge led to the Platts JKM price benchmark skyrocketing from approximately $30/MMBtu at the beginning of the year to over $80/MMBtu in just a few months, significantly boosting the earnings of LNG producers. However, as Europe bolstered its gas inventories and demand diminished, prices began to fall. In 2023, we observed a dramatic decline in LNG prices, dropping by more than 50%, as the market stabilized and concerns over a natural gas shortage eased. Additionally, the milder winter weather in Asia and Europe contributed to capping the prices.

Recently, the Platts JKM predominantly fluctuated between $15 to $17/MMBtu in November, then progressively declined from just below $16 at December’s onset to $11 by year-end. Intriguingly, LNG demand appeared to strengthen in December, with top Asian buyers importing 26.61 million metric tons, an increase from 23.35 million tons in the preceding month and even exceeding the monthly peak of 26.15 million tons observed in January 2021.

This uptick in demand was primarily driven by China, which imported 8.22 million tons of LNG in December, a significant jump from 6.97 million in November, marking China’s highest level of monthly LNG imports in nearly three years. Japan and South Korea, following China as the world’s largest LNG importers, also saw their imports reaching peak levels in January 2023 and February 2021, respectively. In Europe, LNG imports surged to 11.80 million tons, the highest level since April 2022. The fact that the spot price still declined in December shows that the increase in demand was likely met with rising supplies.

CQP’s 2023 Performance

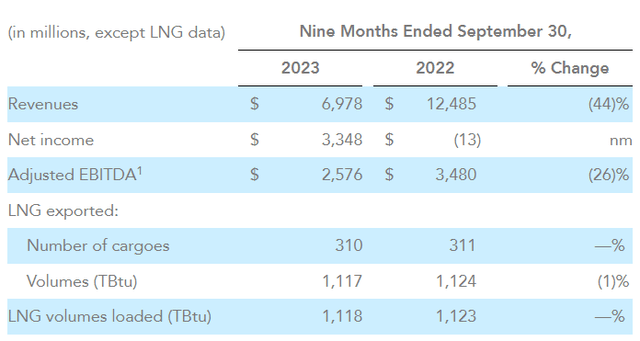

The downturn in LNG prices significantly impacted Cheniere Partners’ financial performance in the first nine months of 2023. The MLP reported a substantial 44% decrease in total revenues compared to the previous year, amounting to $6.98 billion. This decline was predominantly due to a 41% reduction in LNG revenues, which fell to $5.08 billion. Additionally, there was a notable 83% decrease in regasification revenues, plunging to $101 million.

Despite the revenue drop, Cheniere Partners maintained a steady flow of LNG volumes, a testament to the strength of its business model anchored by long-term contracts with buyers. In the first three quarters of 2023, the company managed to ship 310 LNG cargoes, translating to 1,117 Tbtu of LNG exported — figures mirroring those of the previous year.

However, the challenging LNG market environment led to decreased total margins per MMBtu of LNG delivered, directly impacting the company’s LNG revenue stream. Further exacerbating the situation was the early termination of an agreement, which resulted in lower regasification revenues. Consequently, Cheniere Partners’ adjusted EBITDA saw a 26% decline, settling at $2.58 billion.

Cash flows

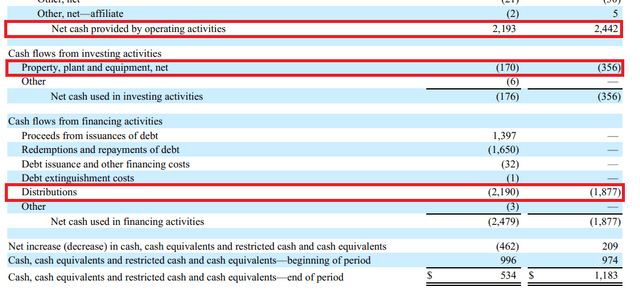

Cheniere Partners grappled with a notable decrease in cash flow from operations due to the downturn in earnings. Despite this challenge, the company managed to generate sufficient cash flows to cover its capital expenditures and nearly all of its distributions. This achievement is particularly noteworthy given the significant earnings pressure the company experienced, compounded by increased distributions which led to a rise in cash outflows. Nevertheless, Cheniere Partners effectively fulfilled most of its funding needs.

The company’s cash flow from operations dipped by 10% to $2.19 billion (when adjusting for working capital changes, operating cash flows were down 30% to $2.03 billion) However, Cheniere Partners benefits from relatively low capital expenditure requirements. Its primary expenditure is the maintenance of the Sabine Pass facility, which includes six LNG trains (the last of which became operational in Q1-2022), three marine berths, and regasification facilities. In the first nine months of 2023, the company’s capital expenditures totalled just $170 million. Consequently, it ended the period with $2.02 billion in free cash flows, nearly covering its distributions of $2.19 billion and resulting in a modest cash flow deficit of $167 million.

Looking Ahead

The persistently low LNG prices in the final three months of 2023 suggest that Cheniere Partners likely encountered similar market conditions as in the previous quarters. It will be intriguing to observe how the global LNG market evolves in 2024. I think a significant development could be the re-entry of price-sensitive buyers in Asia, especially as the Platts JKM benchmark fluctuates between $15 and $10.

Countries like Pakistan, for example, were largely excluded from the LNG spot market due to the prohibitive prices in both 2022 and 2023. However, as prices have softened, such nations may reengage in purchasing activities. With the JKM dropping to $17, Pakistan resumed spot market orders in October and made another purchase in late November. Similarly, activity in India, a key LNG consumer in Asia, appears to have increased. India relies on LNG for its extensive fertilizer industry, as well as for power generation and other industrial uses. The reduction of JKM to around $11 prompted Indian companies like GAIL, Indian Oil, and Gujarat State Petroleum Corp. to place orders in the spot market, indicating a potential resurgence in LNG demand from price-sensitive markets.

Remembering that LNG prices plummeted by over 50% in 2023, the upcoming year may paint a different picture. With the Japan Korea Marker (JKM) dropping to $10, I anticipate a resurgence in demand from price-sensitive buyers in Asia. India, in particular, could play a crucial role in pushing LNG demand higher, potentially stabilizing and supporting LNG prices, thereby establishing a stronger price floor in the market.

The potential scenario seems favourable for Cheniere Partners. The company does not currently have any significant projects slated for 2024, resulting in anticipated low capital expenditures. With LNG prices maintaining stability, Cheniere Partners stands a chance to sustain robust levels of free cash flows. These funds can then be allocated to support distributions.

However, Cheniere Partners’ cash flow performance throughout 2023 highlighted its limited capacity to finance major new projects or facilitate distribution growth. The MLP’s cash flow generation currently suffices solely to cover its existing distributions, with no surplus for other purposes. In this context, the company’s cash flow profile appears less robust in comparison to some of the other established MLPs such as Energy Transfer (ET), whose operating cash flows not only cover its distributions but also growth projects. During the first nine months of 2023, Energy Transfer amassed $8.25 billion in operating cash flows, earmarking $2.4 billion for capital expenditures and $4.4 billion for distributions.

This raises concerns about the sustainability of Cheniere Partners’ long-term distributions growth. It’s worth noting that I am not implying an immediate threat to the MLP’s current distributions; they appear adequately funded at present. However, in a challenging business environment where Cheniere Partners continues to generate cash flows at the 2023 level, increasing distributions and financing growth projects solely from internal cash flow could pose challenges. While this may not manifest immediately, it could become a potential long-term issue, particularly as the SPL Expansion Project gets underway in the upcoming years.

The SPL expansion project remains in its early stages, pending regulatory approvals. Cheniere Partners aims to establish up to three new LNG trains adjacent to its Sabine Pass facility, boosting its LNG production by 20 million tonnes annually. The company anticipates commencing work on this venture in 2026, with completion slated by the end of the decade. Consequently, the company’s capital expenses will remain minimal for the time being, allowing it to sustain robust levels of free cash flows. However, as Cheniere Partners progresses towards a Final Investment Decision, potentially in 2024, and advances closer to the commencement of construction, its cash flows, and its capacity to support distribution growth and fund the forthcoming project may face scrutiny. This potential challenge could be exacerbated if LNG prices continue to hover around current levels and the company maintains its current operating cash flow figures.

Takeaway

During the first nine months of 2023, Cheniere Partners managed to generate sufficient cash flows to nearly cover its capital expenses and distributions, despite a decline in operating cash flows and an increase in distributions. This trend might persist in the near term. However, in the long term, as dividends grow and capital expenses rise, the company’s operating cash flow profile could weaken, particularly if LNG prices remain stable at current levels. Therefore, I believe investors should adopt a cautious stance until there is more clarity regarding the SPL expansion project’s development and the outlook for distribution growth in the long term.