Denis_prof

Synopsis

LKQ Corporation (NASDAQ:LKQ) is a worldwide distributor of vehicle products and specialty aftermarket products. It is also a constituent of the S&P 500 Index. Despite volatile revenue growth throughout the years, it has maintained a healthy profitability margin. Its Europe segment is the biggest in the mix for FY2023, and LKQ has been undergoing integration and centralization of its key operations in Europe, so as to centralize its distribution networks, streamline operations, and improve its trade working capital. Average vehicle age has been rising consecutively in the past 6 years, giving a positive outlook for aftermarket parts as demand for repair and maintenance services increases. My relative valuation has shown that LKQ outperformed its peers in terms of revenue growth outlook and profitability margins. With a 2025 target price of $60.93, it indicates an upside potential of 18%. Therefore, I recommend a buy rating for LKQ.

Historical Analysis

Parts & services revenue is derived from the sale of parts used in the repair and maintenance of vehicles, specialty goods, and accessories. Parts & services make up the majority of the revenue, while Others revenue comes from the sale of scrap and other metals. Other revenue is about 6–7% of the total revenue.

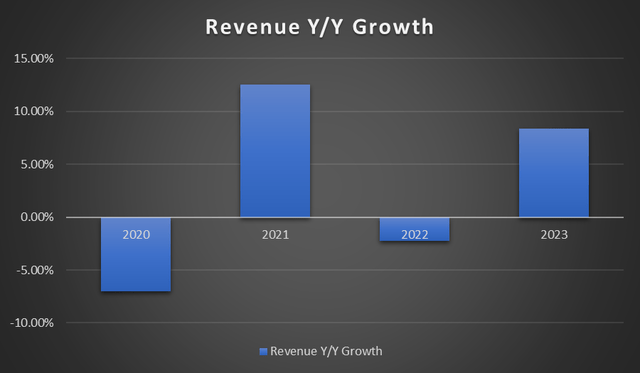

Author’s Chart

Revenue has been fluctuating throughout the years but ended with a ~8.38% increase year-over-year in 2023. The overall rise is due to a 4.7% increase in organic growth and a 4.8% increase from acquisitions and divestitures. This was slightly offset by a decrease in Other revenue of 19.6%, which was due to unfavourable price movements in precious metals and scrap steel. 2023 has shown an increase in aftermarket parts volume due to declining pressure on the supply chain, State Farm’s rollout of aftermarket products, and the positive impact of the UAW strike. Pricing strategies across Europe have helped to cancel out increased costs from inflationary pressures in the Europe segment. 2022 showed a slight negative growth of 2.3% due to the adverse impact on operations and product lines as a result of the Ukraine and Russia conflict, impacting the Europe segment.

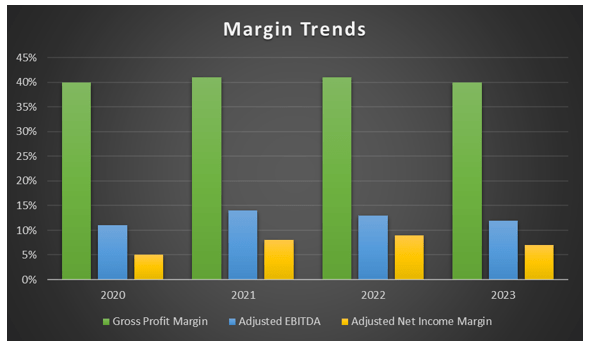

Author’s Chart

Moving on to margins, it has stayed robust throughout the years despite a volatile revenue growth trend. COGS has remained flat throughout the years, within the range of 59%–60%. On a non-adjusted basis, operating income margin was 9.8% vs. 12.4% in 2022. There is a slight contraction in operating income due to an increase in SG&A, restructuring and transaction-related expenses, a gain on the disposal of PGW Auto Glass, and a $4 million sale of business under Self-Service segment in 2022. Therefore, on an adjusted EBITDA basis, the margin remained flat.

Segment Overview

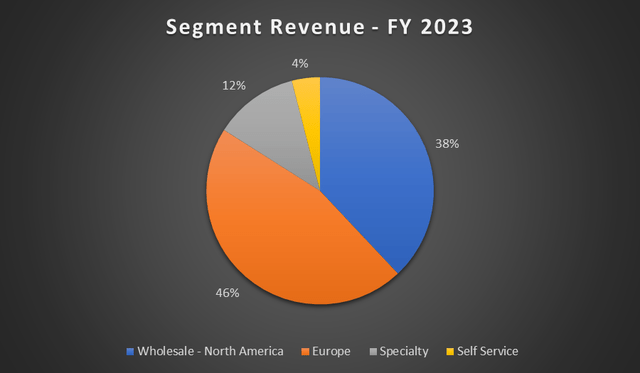

Revenue can be segmented into 4 groups: Wholesale – North America, Europe, Specialty, and Self-Service. Wholesale – North America Group has aftermarket and salvage operations and sells products to collision and repair businesses, which accounts for the majority of the revenue generated in this segment. Sourcing from a handful of suppliers of aftermarket goods, a huge portion of aftermarket products are from Taiwan. Their end market is towards wholesale customers such as collision shops, mechanical repair centers, dealerships, and also retail customers. The majority of them are privately owned small businesses, despite the fact that the population of independent and dealership repair centers has fallen due to consolidations.

Car insurance companies do influence demand for collision and repair products. As these insurance companies aim to minimize the cost of repairs, they favor alternative parts that are provided by LKQ instead of new OEM parts. It has a vast distribution network of aftermarket parts and accessories for the collision and repair market in North America. Its Europe segment operates across 20 different European countries. It has a large footprint in the aftermarket industry that is comparably larger than any of its competitors. LKQ is a major provider of vehicle replacement and maintenance items in Germany, the United Kingdom, and many other European countries.

Author’s Chart

Centralization of Operations in Europe Segment

The 1 LKQ Europe plan would be to form a structural centralization and integration of major functions for LKQ to conduct operations in Europe as one business. Till today, its operations are country-specific across Europe, independent within one another. LKQ plans to speed up the integration process so as to completely leverage its network of inventory. By centralizing and connecting the distribution network across LKQ’s European operations, this will streamline operations, boost efficiency, and improve service levels by forming a more unified and cohesive European operation.

LKQ will be able to drive a higher level of productivity and improve its fulfilment rate. Ensuring the right parts are available at the right time and place. Better inventory management practices, procurement processes, and streamlined operations will greatly reduce costs, free up resources, and improve trade working capital. In addition, there are opportunities to expand LKQ’s product offering in Europe, such as private label lines, collision products, recycling, EV aftermarket parts, and more. This ongoing, comprehensive strategy is designed to help solidify LKQ’s position in the automotive aftermarket industry in the European market in the long run.

Tailwinds from State Farm and UAW

LKQ ended the year with an increase in sales, and part of the reason is a slight rise in alternative part usage. This trend is partially due to the State Farm decision to cease the suspension of the use of non-OEM crash components as of October 2023. State Farm is one of the largest auto insurance companies in the US, and they are directing more business towards aftermarket solutions. This is likely also due to greater availability and recognition of the quality and cost-effectiveness of aftermarket parts, thus leading to increased utilization of parts in vehicle repair centers covered by State Farm policies.

The UAW strike is a headwind for the Detroit Big Three; however, it may have proven to be a tailwind for LKQ. The UAW strike created a temporary disruption in the supply of new OEM parts. This situation has likely caused a temporary shift in demand for alternative/after-market parts, and this was partially the reason that boosted LKQ’s sales in 4Q23.

Rising Age of Vehicles

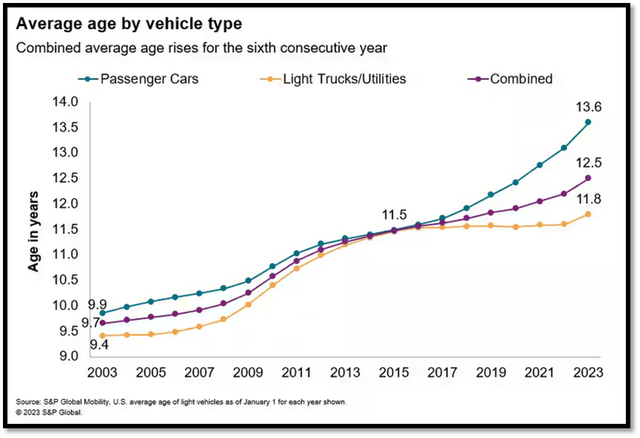

S&P Global

The average age of a car has reached an all-time record of 12.5 years in 2023, and it has been increasing for the 6th consecutive year. This increasing trend, combined with new vehicle sales constraints, will continue to exert upward pressure on the average age of vehicles. This is partially due to supply limitations that led to low inventory levels of new vehicles. This is followed by falling demand for new cars due to lingering inflation and high borrowing costs, pressuring Americans to repair their old vehicles instead of buying new ones, driving up demand for spare parts. This would be favorable for the vehicle service industry.

Older fleets would require more repair services to function properly, resulting in higher demand for auto parts. The typical age of vehicles that require aftermarket repair is between 6 to 11 years, and the average age is now 12.5 years. There are ~122 million vehicles that are at this age. S&P Global estimates that by 2028, 74% of vehicles will be older than 6 years. Therefore, LKQ is well positioned to meet this growing demand for vehicle and aftermarket products, as there will be more consumers who require the repair and maintenance of their aging cars.

Disruption due to Red Sea Crisis and Strike in Bavaria

The Red Sea crisis has been disrupting LKQ’s procurement in Europe. As the Yemeni militant group has been launching a campaign of attacks on one of the busiest shipping routes, this has been causing firms to divert their freight vessels around South Africa, leading to higher freight costs and longer shipping times. Freight rates have risen by more than double as routes divert to avoid attacks in the Red Sea. LKQ is taking measures by placing more orders to address the longer shipping times. However, this would be a temporary measure; attacks have been persistent and are causing a surge in transportation costs. Therefore, this supply chain disruption is a test of resilience for LKQ.

In Germany, LKQ’s operations have been affected by employee strike activities at their Bavaria distribution center. Although strikes still persist, management is taking action to fill up temporary capacity to support its operations and services. These social and geopolitical tensions have been adversely affecting the Europe segment’s revenue, testing LKQ’s resilience in times of unrest.

Relative Valuation

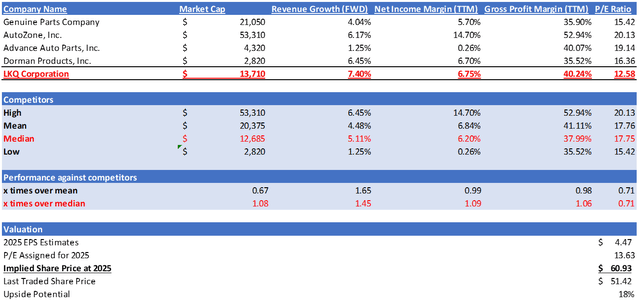

Vehicle collision & mechanical products suppliers and alternative part distributors can be considered competitors of LKQ. I will be comparing LKQ with its peers in terms of revenue growth outlook and profitability margin. In terms of profitability, although to a small extent, LKQ outperformed its competitors in terms of net income margin TTM and gross profit margin TTM. With a 6.75% net income margin TTM and 40.24% gross profit margin TTM, it is 1.09x and 1.06x over its peers’ medians of 6.20% and 37.99%, respectively. In terms of revenue growth outlook, it has a strong forward revenue growth rate of 7.40%, which is 1.45x over its peers’ median of 5.11%.

Currently, LKQ is trading at a forward P/E ratio of 12.58x, which is way lower than its peers’ median of 17.75x. Comparing with its peers’ metrics, LKQ shows a stronger growth outlook and profitability margin. With that, I would argue that LKQ should be trading at a higher forward P/E ratio. In order to remain conservative, I will cap LKQ’s P/E ratio at its 5-year average of 13.63x.

For 2025, the market EPS estimate is $4.47 and the revenue estimate is $15.85 billion. Market estimates are reasonable as they align with the growth factors that were covered earlier. By applying 13.63x to its 2025 EPS estimates, my target price for LKQ for 2025 would be $60.93, an upside potential of 18%.

Author’s Relative Valuation

Risks

Thus far, LKQ has shown resilience in a challenging macroenvironment in 2023, but there are potential downside risks. This includes disruptions in the global supply chain, which have the potential to impact part availability. The ongoing Red Sea crisis has been disrupting multiple European operations, pressuring LKQ to place more orders as a precautionary action. However, if this continues to persist even further, it might cause further delays in delivery and an increase in transportation costs. Geopolitical tensions can have broad impacts, affecting LKQ, which is reliant on international trade. Logistic disruptions, sanctions, and even the threat of war [the Ukraine and Russia conflict] may pose a threat to LKQ’s supply chain, especially in North America, Europe, and Taiwan.

Conclusion

LKQ has been navigating its way through a tough year, facing supply chain disruption from the Red Sea crisis, the Ukraine-Russia conflict, and the worker strike in Bavaria. However, LKQ has stayed resilient, maintaining a healthy margin throughout and outperformed its peers in terms of revenue outlook and profitability margins. In addition, there will be more demand for aftermarket products as the mean age of vehicles has been rising and consumers are reluctant to buy new ones due to inflationary pressures and high borrowing costs. With a double-digit upside and its growth catalyst, I recommend a buy rating for LKQ.