simonkr

Welcome to the February 2024 edition of the lithium miner news.

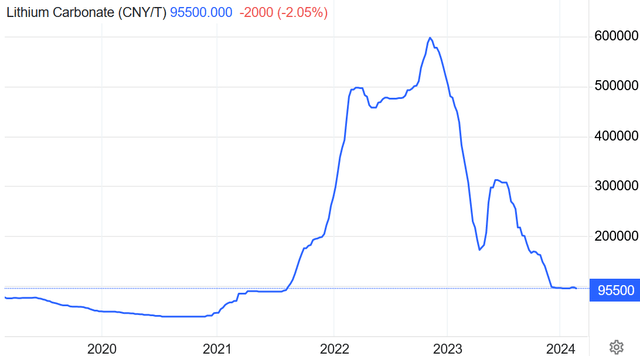

The past month saw lithium prices generally flat.

Lithium price news

Asian Metal reported during the past 30 days, the China delivered lithium carbonate (99.5% min.) spot price was down 0.59% and the China lithium hydroxide (56.5% min.) price was down 2.18%. The Lithium Iron Phosphate (3.9% min) price was flat (0.0% change). The Spodumene (6% min) price was flat (0.0% change) over the past 30 days.

Metal.com reported lithium spodumene concentrate Index (Li2O 5.5%-6.2%, excluding tax/insurance/freight) spot price of USD 910/t, as of Feb. 22, 2024.

China lithium carbonate spot price 5 year chart – CNY 95,500 (~USD 13,281) (source)

Lithium demand versus supply outlook

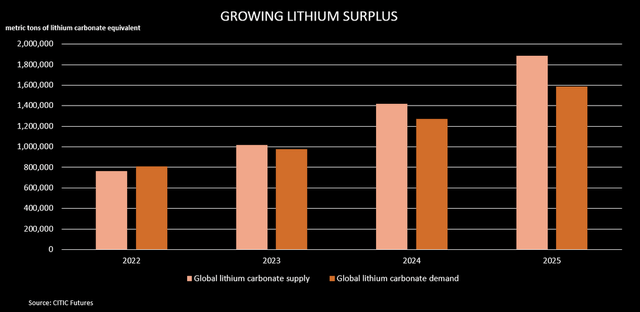

China’s CITIC Futures forecasts lithium surpluses in 2024 and 2025 (source) – In 2024 they forecast a China lithium carbonate price average of CNY 100,000/t (~US$14,000/t)

Mining.com courtesy CITIC Futures

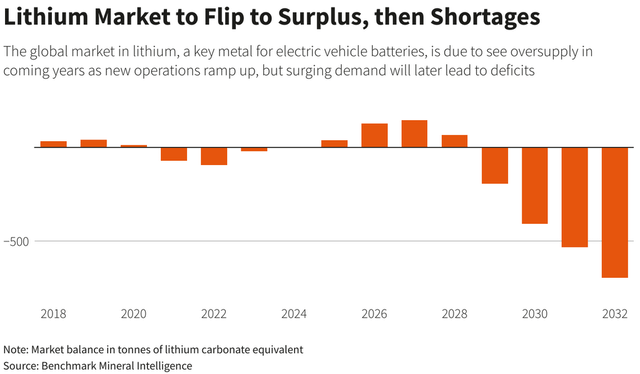

Benchmark Mineral Intelligence forecasts lithium surpluses to end 2028, then deficits to increase significantly from 2029 (as of May 2023)(source)

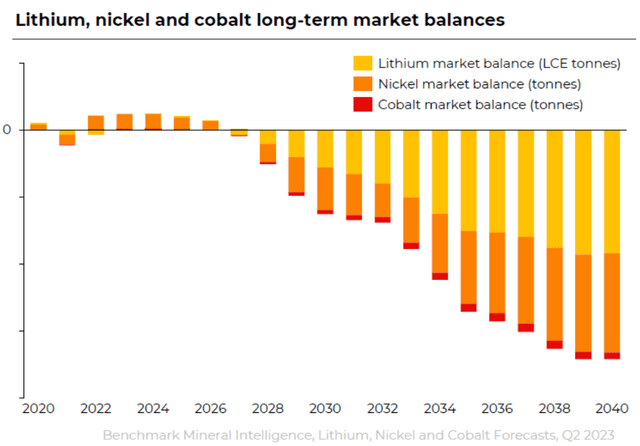

Benchmark Mineral Intelligence forecasts small lithium surpluses then deficits for lithium, nickel & cobalt to increase from 2027 onwards (source)

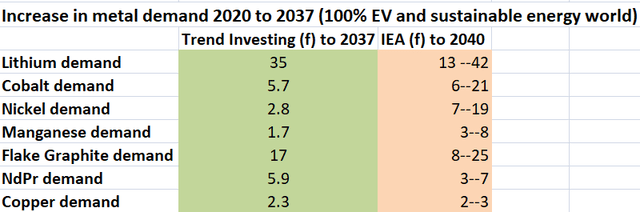

Trend Investing v IEA demand forecast for EV metals (IEA)

Lithium market and battery news

On January 22 Fastmarkets reported:

Battery materials market facing oversupply and macroeconomic headwinds in 2024…Looking forward to 2024, we are now in a situation where some new supply is being ramped up while some high-cost production is being cut. Fastmarkets expects lithium supply to increase by 30% in 2024. However, we await to see the impact the current price environment will have on supply, as some producers may choose to reduce production or delay expansions. Furthermore, whilst Chinese production seems less prone to suffering delays – as seen with the ramp-up of domestic lepidolite and African spodumene projects, in most cases we expect new capacity to experience some start-up delays, contributing to supply-side risk. Market participants expect downstream lithium demand to remain relatively weak and with no imminent concerns about supply shortages, we forecast a tentatively balanced market in 2024.

On January 22 Mining.com reported:

Bolivia Uyuni plant to yield first lithium by 2025-end. Bolivian state-owned lithium company YLB has inked a new deal with a Chinese consortium to install a pilot plant at the vast Uyuni salt flat, which would use Direct Lithium Extraction (DLE) technology. The project will see the construction of a 2,500 tonnes-per-year lithium carbonate facility that will be operated by the CBC consortium, formed by CATL, BRUNP and CMOC…The partners, which expect lithium from the project within 18 months, hope that the pilot plant will demonstrate the feasibility and profitability of extracting the coveted light metal from the brine under the salt crust using DLE technology, and pave the way for larger-scale operations in the future.

On January 26 Mining.com reported: “Bolivia launches new international tender for lithium extraction.”

On January 29 Imerys announced:

Imerys has reached a new milestone in the implementation of its lithium production project for batteries… The La Loue conversion plant would be designed to produce around 34,000 tonnes of lithium hydroxide each year, enabling French and European battery manufacturing plants to equip the equivalent of 700,000 electric vehicles a year.

On January 29 Paul Lock posted on LinkedIn:

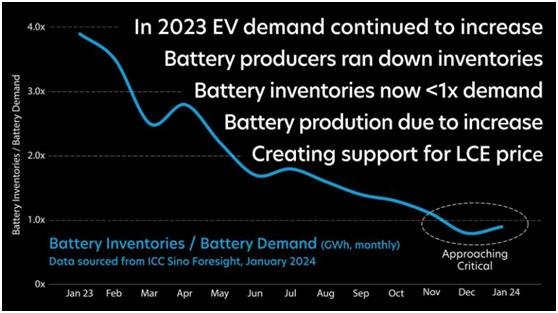

This chart is based on #lithium#battery demand, production, and inventory data published by ICCSINO this month. Despite continued strong growth in #EV demand, #batterymanufacturing has been falling throughout 2023 as #batterymanufacturers have been running down their inventories. The chart shows battery inventories fell from 4x monthly demand in January 2023, or ~260GWh, to less than 1x Jan 24 demand, or ~90GWh… But at less than 1x demand, inventory levels are approaching a critical level and this will need to be addressed, #electricvehicle growth is still strong… As a result, we should start seeing support come into the #LCE price as battery production increases.

Lithium-ion battery inventory levels approaching a critically low level (1x monthly demand) as of Jan. 2024 (source)

Paul Lock LinkedIn courtesy of ICCSINO

On February 2 Bloomberg reported:

Germany invests €1 billion to counter China on raw materials… As Germany’s parliament approves Scholz’s 2024 budget on Friday, the billion-euro fund is to be set up for four years. Investments will be coordinated with Italian and French initiatives in the raw materials sector, the people said. Policymakers will focus on mineral projects defined as critical in the European Union’s Critical Raw Materials Act… “The raw-material fund can be an element, but it won’t be a enough,” Grimm told Bloomberg.

On February 7 The Detroit News reported:

GM, LG Chem establish $19 billion battery supply deal… Through the long-term supply contract, starting in 2026 and running through 2035, LG Chem will supply GM with more than 500,000 tons of cathode materials, which is enough to power 5 million battery electric vehicles with a range of 310 miles (500 kilometers) on a single charge. The materials supplied will come from LG Chem’s under-construction plant in Tennessee, which will enable GM to meet EV subsidy criteria set by the U.S. Inflation Reduction Act.

On February 9 Mining.com reported: “EU, US to align global minerals push against China’s supply grip.”

On February 12 Nikkei Asia reported:

CATL, BYD, others unite in China for solid-state battery breakthrough. Beijing forms national alliance in all-out effort to revolutionize the EV market. China’s battery and car makers have united as part of a government-led drive to commercialize all solid-state batteries, challenging Japan and the West in an area of technology that could revolutionize the electric vehicle market.” Aiming to build a supply chain for solid-state batteries by 2030, Beijing in January set up a consortium, the China All-Solid-State Battery Collaborative Innovation Platform (CASIP), which brings together government, academia and industry, including EV battery rivals CATL and BYD.

On February 12 Investor News reported:

Experts warn of supply cliff for battery raw materials as Gigafactory demand builds. “We have to be very frank about where we’re at with this situation. So really, we are at a cliff edge in terms of raw material supply,” said Terry Scarrott of Benchmark Mineral Intelligence… Benchmark is currently tracking around 408 gigafactories. Of these, only 191 are active, and not all of those are operating at full capacity. As more and more of these gigafactories come online and their production rates increase, so too will their consumption of lithium and other battery metals… Although Benchmark is forecasting higher lithium supply for 2024, Perks said that supply overhang is expected to be short-lived and the sector will enter a deficit period much sooner than previously forecasted…According to Benchmark’s Lithium-ion Battery Database, lithium-ion battery demand is forecast to grow almost 400 percent between 2023 and 2030 to reach an impressive 3.9 terawatt hours. Meeting this overwhelming and fast-paced demand growth will require expedient mobilization of capital in the global lithium-ion battery supply chain, Scarrott apprised.

Note: Bold emphasis by the author.

On February 16 Bloomberg reported:

Top lithium supplier Albemarle says prices are unsustainably low. Low lithium prices are “unsustainable” and will have to rise in order to trigger the supply investments needed to meet long-term demand growth, according to Albemarle Corp., the world’s biggest producer.

On February 18 Seeking Alpha reported:

Top lithium producer cuts 2030 demand forecast on slower EV adoption – FT… Albemarle (ALB) forecast 3.3 million tonnes of lithium carbon equivalent to be needed globally by 2030, a 10% cut from its previous forecast of 3.7 million tonnes… “Some models have been delayed, largely out of North America, which is pushing out the length of time of penetration [of EVs] in the US,” said Norris, adding that “potentially in parts of Europe” the shift is also expected to take longer.

On February 18 Seeking Alpha reported:

Top lithium producer cuts 2030 demand forecast on slower EV adoption – FT… Albemarle (ALB) forecast 3.3 million tonnes of lithium carbon equivalent to be needed globally by 2030, a 10% cut from its previous forecast of 3.7 million tonnes, according to a Financial Times report on Friday, which cited an interview with Eric Norris, Albemarle’s president of lithium.

On February 19 Mining.com reported:

US moves to restore stockpiling ‘panic button’ in EV metals fight with China… the US faces serious shortages of the raw materials needed to execute the energy transition at the scale envisioned by Biden and his team… In December, Congress passed a new National Defense Authorization Act, which gives the logistics agency greater freedom to make long-term purchases without the congressional approval it had previously needed. It also guarantees $1 billion a year in future funding.

On February 21 Reuters reported:

China’s lithium carbonate futures jump on talk of environmental crackdown. The most-active July contract on the Guangzhou Futures Exchange ended morning trade 6.35% higher at 99,600 yuan a metric ton after touching an intraday high of 103,000 yuan a ton earlier the session, the highest since Jan. 25… Information provider Shanghai Metals Market said in a note that there was market talk that Yichun, a city in the southern province of Jiangxi, will face environmental checks and producers that are unable to properly handle lithium slag may face curbs on their operations.

On February 22 Bloomberg reported: “Australia’s Pilbara Minerals sees signs of lithium slump ending.”

Lithium miner news

Albemarle (ALB)

On February 14, Albemarle announced: “Albemarle reports fourth quarter and full year 2023 results.” Highlights include:

“Full Year 2023 Results (Unless otherwise stated, all percentage changes represent year-over-year comparisons)

- “Net sales of $9.6 billion, the highest in company history, up 31%, of which 21% was total volume growth; Energy Storage sales volumes were up 35%.

- Net income of $1.6 billion, or $13.36 per diluted share, the second highest in company history, which included a lower of cost or net realizable value (LCM) pre-tax charge and a tax valuation allowance expense in China, both recorded in the fourth quarter.

- Adjusted EBITDA of $2.8 billion, or $3.4 billion excluding the $604 million LCM charge, which is in-line with previous outlook as higher volumes offset lower pricing.

- Adjusted diluted EPS of $15.22 per share, or $22.25 excluding the LCM charge and the $223 million tax valuation allowance expense, which is in-line with previous outlook.”

Fourth Quarter 2023 Results and Recent Highlights

- “Net sales of $2.4 billion, primarily driven by 35% volume growth in Energy Storage.

- Net loss of $618 million, or ($5.26) per diluted share, including the LCM charge and tax valuation allowance expense.

- Adjusted EBITDA of ($315) million, or $289 million excluding the LCM charge.

- Adjusted diluted EPS of ($5.19), or $1.85 excluding the LCM charge and tax valuation allowance expense.

- Announced proactive measures expected to unlock >$750 million of cash flow including reduced capital expenditures, costs and working capital.

- Meishan lithium conversion plant achieved mechanical completion in December 2023.

- Recognized by Newsweek as one of America’s greatest workplaces for diversity and one of America’s most responsible companies; featured in JUST Capital’s 2024 JUST 100.

- Completed amendment to the company’s credit agreement to ensure on-going financial flexibility; amendment utilizes an updated adjusted EBITDA definition that more accurately reflects the value of Albemarle’s strategic ownership in the Windfield (Talison) joint venture.

- Introduced full-year 2024 outlook considerations, including Energy Storage ranges based on lithium market price scenarios and utilizing an updated adjusted EBITDA definition similar to that in the company’s amended credit agreement.”

On February 14, Albemarle announced:

Albemarle and the BMW Group announce long-term partnership. Multi-year agreement will secure supply of lithium hydroxide for automaker and accelerate lithium material innovations…This multi-year agreement, which takes effect in 2025, is one of the company’s largest ever globally and is of significant volume and value. In addition to supplying the BMW Group with lithium hydroxide, the two companies will partner on technology for safer and more energy dense lithium-ion batteries…

Sociedad Quimica y Minera S.A. (SQM), Wesfarmers [ASX:WES] (OTCPK:WFAFY), Covalent Lithium (SQM/WES JV)

On February 15 the AFR reported:

Wesfarmers won’t make money off lithium at current prices. Wesfarmers, the conglomerate behind retail giants Bunnings and Kmart, confirmed it will make lithium concentrate this half, but its foray into critical minerals will be unprofitable at current prices. Chief executive Rob Scott declined to declare whether the lithium price had bottomed, but is betting that stalled projects by other producers will lead to supply tightening and prices bouncing back.

Upcoming catalysts:

H1, 2024 – Mt Holland spodumene production targeted to begin (SQM/Wesfarmers JV).

H1, 2025 – Production to start and then ramp to 50ktpa Lithium hydroxide [LiOH] at the Kwinana refinery in WA (SQM/Wesfarmers JV).

Arcadium Lithium (ALTM) [ASX:LTM](formed from the Allkem and Livent merger in Jan. 2024)

On February 4, Arcadium Lithium announced: “Combination creates a leading global integrated lithium chemicals producer.”

On February 22 Arcadium Lithium reported: “Arcadium Lithium plc Non-GAAP EPS of $0.34 beats by $0.11, revenue of $181.8M misses by $36.89M.

- Arcadium Lithium plc press release (ALTM): Q4 Non-GAAP EPS of $0.34 beats by $0.11.

- Arcadium Lithium 2024 outlook highlighted by a 40% increase in lithium carbonate and hydroxide volumes as a combined company

- Projecting $60 to 80 million of Realized Synergies / Cost Savings in 2024

- Revenue of $181.8M (-17.1% Y/Y) misses by $36.89M.”

Note: “Arcadium Lithium expects to provide additional calendar year 2023 pro forma financials early in the second quarter of 2024 and will release combined results for the new company beginning with the first quarter of 2024.”

Jiangxi Ganfeng Lithium [SHE:002460] [HK: 1772] (OTCPK:GNENY)

No news for the month.

(Chengdu) Tianqi Lithium Industries Inc. [SHE:002466], Tianqi Lithium Energy Australia (TLEA) is a JV with Tianqi Lithium (51%) and IGO Limited (49%). TLEA owns the Kwinana lithium hydroxide facility in WA

On January 30: Tianqi Lithium announced:

Profit warning… for the year ended 31 December 2023 (the “Reporting Period”), (i) the net profit attributable to the shareholders of the Company would range from RMB6,620 million to RMB8,950 million, representing a decrease of approximately 62.90% to 72.56% as compared with that of RMB24,124.58 million for the corresponding period of last year; (ii) the net profit after deducting the non-recurring profit or loss would range from RMB6,500 million to RMB8,820 million, representing a decrease of approximately 61.75% to 71.81% as compared with that of RMB23,059.43 million for the corresponding period of last year; and (iii) the basic earnings per share would range from RMB4.04 per share to RMB5.46 per share (the corresponding period of last year: RMB15.52 per share).

Pilbara Minerals [ASX:PLS] (OTC:PILBF)

On February 7, Pilbara Minerals announced: “Pilbara Minerals extends offtake agreement with Chengxin Lithium.” Highlights include:

The amendment results in a significant extension and expansion of the offtake agreement until the end of calendar year 2026 (CY26). The terms of the amendment are detailed below:

- “CY24 – Pilbara Minerals will supply an additional 60kt of spodumene concentrate taking the total supply in CY24 to 85kt.

- CY25 – Pilbara Minerals will supply 150kt of spodumene concentrate.

- CY26 – Pilbara Minerals will supply 150kt of spodumene concentrate.”

On February 22, Pilbara Minerals announced: “FY24 interim results. Solid operating performance delivers 55% EBITDA margin.” Highlights include:

- “Spodumene concentrate production increased 4% to 320.2 thousand tonnes (kt), compared to the prior corresponding period (half year ended 31 December 2022 or H1 FY23). Sales increased 7% to 306.3kt (H1 FY23: 286.9kt).

- The average estimated realised price for spodumene concentrate was US$1,645/dry metric tonnes 3 (dmt) (CIF China) on a ~SC5.3 basis. On an SC6.0 equivalent basis, the average estimated sales price was US$1,880/dmt (CIF China).

- Revenue declined 65% to $757M, reflecting a 67% decline in average realised price partly offset by a 7% increase in sales volume.

- EBITDA was 77% lower than prior corresponding period at $415M, before depreciation and amortisation costs of -$65M, tax expense of -$121M, and net financing income of $44M resulting in an underlying profit after tax of $273M.

- EBITDA margin remained strong at 55% for the period.

- Statutory Profit after Tax was 82% lower than prior corresponding period reflecting the lower average realised sales price.

- Ending cash balance was $2,144M, with positive cash margin from operations of $536M and a 4% decline in cash of $82M compared to the prior corresponding period.

- P680 Expansion Project (P680 Project) and P1000 Expansion Project (P1000 Project) progressed on schedule and budget.

- Commissioning commenced on Train 1 at the POSCO Pilbara Minerals’ JV chemical plant in South Korea and Final Investment Decision [FID] made to construct the Mid-Stream Demonstration Plant Project (Demonstration Plant Project).

- Pilgangoora Ore Reserves7 increased by 35% to 214Mt, and study commenced to explore further expansion of production capacity beyond 1Mtpa.

- Pilgangoora Operation Power Strategy released which is expected to materially reduce power related emissions intensity and unit costs over time.”

Upcoming catalysts:

- End Q2, FY 2024 – P680 Expansion Project set to reach full capacity.

- Q3 FY, 2025 – P1000 Expansion Project set to begin production.

Mineral Resources [ASX:MIN] (OTCPK:MALRF)

Mineral Resources lithium assets include Mt Marion Mine (50% MIN: 50% Ganfeng). Wodgina Lithium Mine (50% ALB: 50% MIN).

On February 21, Mineral Resources announced: “Strong half-year operational performance across all businesses.” Highlights include:

Solid underlying financial results:

- “Revenue increased 7 per cent on prior corresponding period to $2,514.7M.

- Underlying EBITDA of $674.9M, representing an EBITDA margin of 27 per cent.

- Fully franked interim dividend of $0.20.”

Robust liquidity position maintained:

- “Completion of US$1,100.0M Senior Unsecured Notes Offering in October 2023.

- Net debt at $3,546.7M and Net debt/Underlying EBITDA of 2.4x (calculated on a rolling 12 month basis).

- Available liquidity at 31 December 2023 of $1,783.1M, including cash on hand of $1,383.1M…

Lithium:

- “Mt Marion plant expansion commissioned, with 99k dry metric tonnes (dmt) of SC6 equivalent spodumene concentrate shipped, up 39%.

- Pre-strip activities at Wodgina well advanced and 87k dmt of SC6 equivalent spodumene concentrate shipped, up 36%.

- Acquired Bald Hill effective 1 November 2023, with 18k dmt of SC6 equivalent spodumene concentrate shipped.

- Completed the restructure of the MARBL joint venture in October 2023, increasing ownership in Wodgina to 50%. Received US$383.6M ($587.8M) from Albemarle Corporation (Albemarle)…”

On February 21, Mineral Resources announced:

Mt Marion underground Mineral Resource update… has increased 111%1 to 19.3Mt at 1.22% Li2O as at 31 January 2024.

AMG Critical Materials N.V. [NA:AMG] [GR:ADG] (OTCPK:AMVMF) (Formerly AMG Advanced Metallurgical Group NV)

On February 21, AMG Critical Materials N.V. announced:

AMG reports record-setting earnings for the full year 2023. AMG Critical Materials N.V. (“AMG”, EURONEXT AMSTERDAM: “AMG”) reported record-setting adjusted EBITDA $350 million in 2023, due largely to strong profitability in our lithium and vanadium businesses. Fourth quarter 2023 revenue was $367 million, a 6% decrease versus the fourth quarter of 2022. Fourth quarter 2023 adjusted EBITDA of $71 million decreased 32% compared to the fourth quarter of 2022. Cash from operating activities was $223 million in 2023, the highest in AMG’s history, and 33% higher than the $168 million in 2022…

Upcoming catalysts:

- H1, 2024 – Stage 2 production at Mibra Lithium-Tantalum mine (additional 40ktpa) forecast to begin, bringing total production capacity to 130ktpa. The lithium concentrate plant shutdown to facilitate the expansion from 90,000 tons to 130,000 tons will take place in the first quarter of 2024.

- 2025-2028 – German LiOH facility expansion plan with Modules 2-5 (100,00tpa LiOH).

Sayona Mining [ASX:SYA] (OTCQB:SYAXF)

On January 31, Sayona Mining announced:

December 2023 quarterly activities report… The balance of cash and cash equivalents at the end of the quarter was $158.0 million, a $74.8 million decrease over the equivalent balance of $232.8 million at 30 September 2023…

On February 20, Sayona Mining announced: “Moblan Lithium Project Definitive Feasibility Study: Positive results deliver c$2.2b NPV.” Highlights include:

- “Annual production rate of 300ktpa spodumene concentrate over 21-year Life of Mine (“LOM”) via open pit mining at rate of 1.8Mtpa, based on Ore Reserves estimate of 34.5Mt at grade of 1.36% Li2O.

- Process plant feed rate at 4,800 tonnes per day (tpd); average LOM recovery of 74.7%; spodumene concentrate grade at 6% Li2O.

- Post-tax NPV(8%) of C$2.2 billion; net cash flow of C$6.0 billion from LOM net revenues of C$14.4 billion; post-tax IRR of 34.4% and payback of 2.3 years.

- Cost competitive operating unit cost of C$555/t and all-in sustaining costs of C$748/t.

- Low-risk operation to form centrepiece of Sayona’s emerging northern lithium hub in Québec’s Eeyou Istchee James Bay territory.”

Upcoming catalysts include:

- 2024 – Spodumene production ramp up at NAL operations (owned SYA 75%: PLL 25%). Results of costs optimization review expected end Q1, 2024.

Piedmont Lithium (PLL)[ASX:PLL]

Piedmont Lithium 100% own the Carolina Lithium spodumene project in North Carolina, USA; as well as 25% of the North American Lithium [NAL] Project in Canada and up to 40.5% of the Ewoyaa Lithium Project in Ghana (JV with Atlantic Lithium and Ghana Gov + Ghana MIIF).

On February 5, Piedmont Lithium announced:

Multiple broad and high-grade drill intersections resource extension drilling results Ewoyaa Lithium Project, Ghana, West Africa. 83m at 1% Li 2O from 36m returned at Dog-Leg Target.

On February 6, Piedmont Lithium announced: “Piedmont Lithium provides corporate update.” Highlights include:

- “North American Lithium ramp up continues with record quarterly production in Q4’23.

- Operating cost improvements expected upon completion of key capital projects.

- Piedmont offtake agreement provides strong leverage to anticipated recovery in lithium prices.

- Ewoyaa advancing through approvals process with Final Investment Decision anticipated in 2025.

- Piedmont and Atlantic currently co-funding modest project development costs in advance of FID.

- Pursuing financing options non-dilutive to Piedmont’s shareholders to fund capex in 2025+.

- Permitting, partnering, and debt funding discussions progressing for domestic projects.

- Large, strategic projects positioned for development in stronger markets.

- Initiated cost savings plan in Q1’24 targeting ~$10 million in annual run rate savings…”

On February 21, Piedmont Lithium announced:

Piedmont Lithium sells Sayona Mining shares… The Company has agreed to sell 1,152.2 million shares of Sayona for A$0.052 Australian Dollars (“A$”) per share through a secondary block sale via Canaccord Genuity… and will result in gross proceeds of approximately A$59.9 million, or US$39.4 million for Piedmont. Following the transaction and some smaller recent public market share sales, Piedmont will no longer hold any shares of Sayona. The sale of these shares has no impact on Piedmont’s joint venture or offtake position with Sayona Quebec.

On February 23 Piedmont Lithium announced:

PIEDMONT LITHIUM REPORTS Q4 & FULL YEAR 2023 RESULTSNAL Operations Ramping, Growth Projects Progressing, and Balance Sheet Reinforced

• $39.8 million full year revenue on sales of 43.2 thousand dry metric tons (dmt) of spodumene concentrate

• $5.7 million full year gross profit, reflecting settlement accruals in Q4’23

• Ramp up continues at NAL with further improvements in production and costs expected in 2024

• 2024 shipments expected to shift toward multi-year customer contracts; de-emphasizing volatile spot sales

• Permitting and regulatory approvals advancing in Ghana and North Carolina

• $71.7 million in cash and cash equivalents at December 31, 2023

• Net proceeds of approximately $49.1 million from sales of Sayona Mining and Atlantic Lithium shares in Q1’24.

We are completing a few remaining capital projects in the first half of 2024 that we expect will result in further improvements in production and operating costs as NAL looks to achieve full run-rate production levels later this year… Ewoyaa continues to advance through the permitting and approvals processes, and the project is poised to be a near-term spodumene producer with exceptional logistics and relatively modest capital and operating costs. “We continue to make advances towards our mining permit in North Carolina for our Carolina Lithium Project, with the most recent set of questions from the state indicating that the review process for this important milestone could be approaching its conclusion.

Upcoming catalysts include:

- Early 2025 – Ewoyaa Project in Ghana (up to 40.5% PLL) targeted to begin.

- 2026 – Tennessee Lithium hydroxide project targeted to begin.

- 2024-25 – Carolina Lithium (100%) – Permitting, off-take or project funding announcements.

Core Lithium Ltd. [ASX:CXO] [GR:7CX] (OTCPK:CXOXF) (OTC:CORX)

Core 100% owns the Finniss Lithium Project (Grants Resource) in Northern Territory Australia.

On January 25, Core Lithium Ltd. announced: “2023 Exploration Program update.” Highlights include:

- “A three-phase exploration program was undertaken in 2023 and is now complete.

- Phase 1: Focused on infill and resource definition drilling at BP33 and Carlton. BP33 drill results include 90.17m @ 1.80% Li2O from 568.83m (hole NMRD085). This hole exceeded expectations and is yet to be included in the BP33 resource model.

- Phase 2: Encouraging results have been received from infill and extensional drilling at the Lees-Booths, and Penfolds prospects and are now being interpreted and incorporated into updated resource estimations. At Lees-Booths, detailed interpretation of the drilling results is underway, with early analysis highlighting strike and down dip extensions (to the northeast) to known mineralised pegmatite bodies. Some of the deeper intersections at Penfolds are up to 100m below the bottom of the current mineral resource and confirm a steep westerly dip to the pegmatite system.

- Phase 3: Testing of new priority targets generated in 2023 from geophysical and geochemical surveying commenced in the December quarter – drill results are pending.”

Catalysts include:

- 2024 – Any resumption of mining operations at the Grants open pit at Finniss where mining has been suspended in Jan. 2024.

Sigma Lithium Resources [TSXV:SGML] (SGMLF) (SGML)

Sigma is developing a world class lithium hard rock deposit with exceptional mineralogy at its Grota do Cirilo Project in Brazil.

On January 31, Sigma Lithium announced:

Sigma Lithium significantly increased audited Mineral Resource by 27% to 109mt: Grota do Cirilo in Brazil becomes world’s 4th largest operating industrial pre-chemical lithium beneficiation & mining complex; Grota do Cirilo expected to further increase to 150mt.

On February 5, Sigma Lithium announced: “Sigma Lithium ships 22,000 tonnes of lithium concentrate: Glencore prepaid 50% at premium prices.”

On February 12, Sigma Lithium announced:

Sigma Lithium is awarded by BNDES a letter of intention for development bank debt to fund construction of its environmentally fully licensed second greentech industrial lithium plant. Sigma Lithium completed the certification process with BNDES, which included the filing of the final FEL3 Capex for Construction and Engineering of the Second Greentech Plant totaling R$ 492,4 million or approximately US$ 100 million… Sigma anticipates initiating construction in the first quarter of 2024 at the end of the wet raining season, following a Final Investment Decision to be made by its Board of Directors.

Upcoming catalysts:

- 2024 – Possible acquisition of Sigma Lithium by ? (VW, CATL, BYD).

Lithium Americas Argentina [TSX:LAAC](LAAC)

Lithium Americas Argentina owns the Argentina assets (Cauchari Olaroz JV, Pastos Grandes, Sal de la Puna) from the LAC split.

No news for the month.

Upcoming catalysts:

- By mid 2024 – Cauchari-Olaroz lithium production ramp to 40ktpa. From 2025+ a Stage 2 20ktpa+ expansion is planned.

NB: Ganfeng Lithium (51%) and Lithium Americas Argentina (49%) own the JV company Minera Exar S.A., which owns 91.5% interest and is entitled to 100% of the production from the Cauchari-Olaroz Project. The 8.5% interest is owned by Jujuy Energia y Mineria Sociedad del Estado (“JEMSE”) (a company owned by the Government of Jujuy province).

Zijin Mining Group [SHA:601899] [HKSE:2899] (OTCPK:ZIJMF)

Zijin Mining owns 100% of the 3Q Lithium Mine in Argentina, with Stage 1 production started producing 2,903t LCE in 2023 and planning to ramp to 20,000tpa LCE. Zijing Mining is a large diversified mining group with global mines focused on copper, gold, zinc/lead, silver and lithium.

On January 29, Zijin Mining Group announced:

Announcement on estimated increase in operating results for the year ended 31 December 2023… Based on the preliminary estimation by the Company’s Finance Department, it is estimated that the Company realised a net profit attributable to owners of the listed company of approximately RMB21.1 billion for the year 2023, representing an increase of approximately RMB1.058 billion, or an increase of approximately 5.28% compared with the same period last year (same period last year: RMB20.042 billion)…

On January 29, Zijin Mining Group announced:

Announcement in relation to the Production Volume Plan of the Major Mineral Products of the Company for the Year 2024. According to the overall requirements of the Company’s Outline of Three-Year (2023-2025) Plan and Development Goals for 2030, the Board proposed the production volume plan of the major mineral products of the Company for the year 2024: 1.11 million tonnes of mine-produced copper, 73.5 tonnes of mine-produced gold, 470 thousand tonnes of mine-produced zinc (lead), 25 thousand tonnes of lithium carbonate equivalent, 420 tonnes of mine-produced silver and 9 thousand tonnes of mine-produced molybdenum…

Argosy Minerals [ASX:AGY][GR:AM1] (OTCPK:ARYMF)

Argosy has an interest in the Rincon Lithium Mine in Argentina, targeting a fast-track development strategy. Argosy initially plans to ramp Stage 1 to 2,000tpa lithium carbonate.

On January 29, Argosy Minerals announced: “Quarterly activities report – December 2023.” Highlights include:

- “Upgraded Total Mineral Resource Estimate (MRE) of 686,875 tonnes of Li2 CO3 with a weighted mean average lithium concentration of 329mg/L – a 180% increase from previous resource estimate…with a weighted mean average lithium concentration of 351mg/L.

- 2,000tpa operation works progressing; Comprehensive test works being conducted to determine optimum operational parameters and improve filtration rates. Planned critical works schedule to improve operational performance and increase production operations.

- Pre-development engineering works progressing for 10,000tpa operation expansion.

- Positive progress with EIA regulatory approval for 10ktpa expansion operation.

- International lithium carbonate price outlook still supportive to realise Argosy’s growing lithium production development strategy.

- Argosy becoming only the 2nd ASX-listed battery quality lithium carbonate producer.

- Strong financial position with cash reserves of ~$13.8 million at 31 December 2023 (with an additional US$281,000 held in Puna Mining S.A. bank account).”

On February 19, Argosy Minerals announced: “Rincon Lithium Project – progress update.” Highlights include:

- “…the Company continued progressing operational and testing works at the 2,000tpa lithium carbonate facility, which has successfully produced ~67 tonnes of battery quality lithium carbonate product to date, on the path toward continuous production operations.”

Upcoming catalysts:

- 2024 – Rincon Lithium full ramp-up toward steady-state production targeted, 2,000tpa operation.

Lithium miner ETFs

- Sprott Lithium Miners ETF (LITP) – A pure play lithium ETF

- Global X Lithium & Battery Tech ETF (LIT)

- ProShares S&P Global Core Battery Metals ETF (ION)

- The Amplify Lithium & Battery Technology ETF (BATT)

Global X Lithium & Battery Tech ETF (LIT) 10 year price chart (source)

Seeking Alpha

Trend Investing lithium demand v supply model forecasts

Trend Investing forecasts lithium demand to increase 10.7x this decade.

Note: A Nov. 2020 UBS forecast is for “lithium demand to lift 11-fold from ~400kt in 2021 through to 2030.”

Conclusion

February lithium prices were flat.

Highlights for the month were:

- Fastmarkets – Battery materials market facing oversupply and macroeconomic headwinds in 2024. Forecast a tentatively balanced lithium market in 2024.

- Lithium-ion battery inventory levels approaching a critically low level (1x monthly demand) as of Jan. 2024.

- Germany invests €1 billion to counter China on raw materials.

- GM, LG Chem establish $19 billion battery supply deal.

- EU, US to align global minerals push against China’s supply grip.

- China’s battery and car makers have united as part of a government-led drive to commercialize solid-state batteries (& supply chain) by 2030.

- Albemarle forecasts 3.3mtpa of lithium carbon equivalent to be needed globally by 2030, a 10% cut from its previous forecast of 3.7mtpa.

- US moves to restore stockpiling ‘panic button’ in EV metals fight with China.

- China’s lithium carbonate futures jump on talk of environmental crackdown in Yichun, Jiangxi, China.

- Australia’s Pilbara Minerals sees signs of lithium slump ending.

- Albemarle announces proactive measures expected to unlock >$750 million of cash flow including reduced capital expenditures, costs and working capital.

- Wesfarmers (Mt Holland Project JV) confirmed it will make lithium concentrate this half, but its foray into critical minerals will be unprofitable at current prices.

- Arcadium Lithium 2024 outlook highlighted by a 40% increase in lithium carbonate and hydroxide volumes as a combined company. Projecting $60 to 80 million of Realized Synergies / Cost Savings in 2024.

- Tianqi Lithium issues large negative profit warning for the year ended 31 December 2023.

- Pilbara Minerals – FY24 interim results. Solid operating performance delivers 55% EBITDA margin. Revenue declined 65% to $757M.

- Mineral Resources half year results – Revenue increased 7 per cent on prior corresponding period to $2,514.7M. Underlying EBITDA of $674.9M.

- AMG reports record-setting earnings for the full year 2023.

- Sayona Mining Moblan Lithium Project DFS positive results deliver c$2.2b NPV, post-tax IRR of 34.4% and payback of 2.3 years.

- Piedmont Lithium – Ewoyaa Lithium Project JV, Ghana drills 83m at 1% Li2O from 36m. Piedmont Lithium sells Sayona Mining shares. Permitting and regulatory approvals advancing in Ghana and North Carolina.

- Core Lithium – BP33 drill results include 90.17m @ 1.80% Li2O from 568.83m (hole NMRD085).

- Sigma Lithium significantly increased audited Mineral Resource by 27% to 109mt. Receives letter of intention for Grota do Cirilo debt funding to support the construction of a second lithium concentrate production plant.

As usual all comments are welcome.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.