Luis Alvarez/DigitalVision via Getty Images

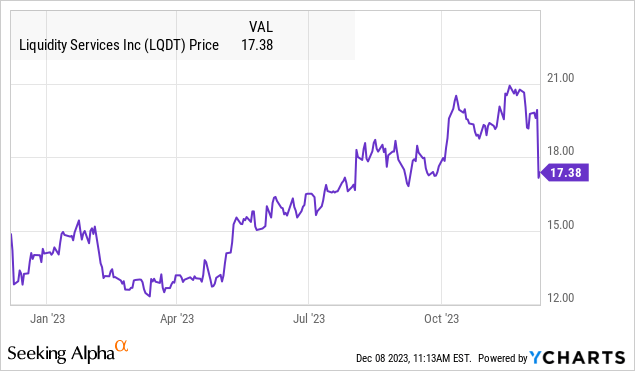

Liquidity Services, Inc. (NASDAQ:LQDT) reported its latest quarterly earnings, highlighted by steady growth, although soft guidance weighed on the stock, selling off sharply. Investors can’t be feeling too bad, as shares are still up by more than 20% this year.

The company’s unique marketplace platform for businesses and government agencies to buy and sell surplus inventory continues to consolidate its leadership position despite a shifting macro backdrop. Initiatives towards digital services and expansion into new categories have supported growth

We last covered the LQDT back in late 2021 taking a bullish view, citing the significant long-term opportunity as a “supply chain disruptor”. While we maintain a positive long-term outlook on the company, we expect shares to face some renewed volatility into a weaker earnings environment over the next several quarters.

LQDT Earnings Recap

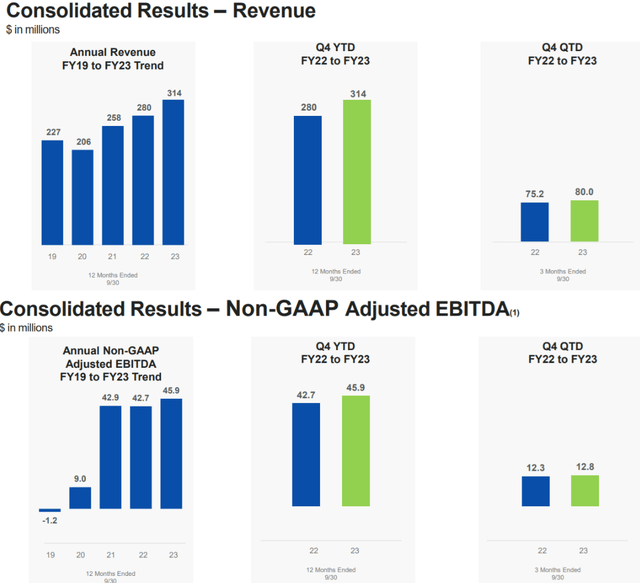

LQDT fiscal Q4 EPS of $0.26, climbed from $0.19 in the period last year. Revenue reached $80 million, up 6% year-over-year, driven by an 11% enhance in total gross merchandise volume (GMV) transacted across its portfolio of marketplace brands.

Adjusted EBITDA of $12.8 million was up by 4% from $12.3 million in the period last year. For the full year, revenue of $314 million was up by 12% while adjusted EBITDA of $45.9 million climbed 7.5% y/y.

The financial setup considers a shifting mix in the business with consignment model-related fees gaining importance against more traditional sales. This means that the revenue growth as a percentage of the GMV is expected to refuse adding some of the variability to the results.

While this is expected to produce higher margins over time, it has also required higher investment spending in terms of the logistical buildout. Total operating costs and expenses were up 24% for the year over 2022.

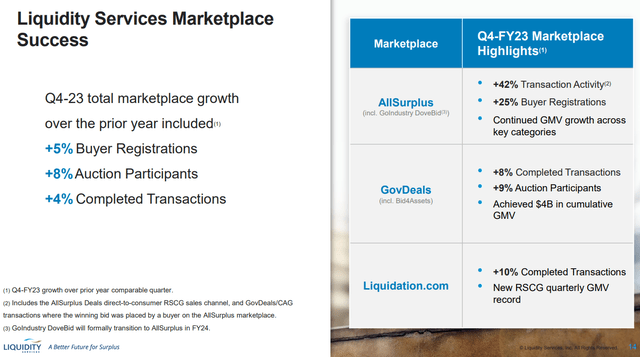

That being said, the bigger takeaway is that operating trends are solid. In Q4, transaction activity was up 4% across all segment marketplaces including higher auction participation and buyer registration.

The core “GovDeals” segment, which contributes nearly 60% of total GMV, generated revenue growth of 13% y/y. The stronger point for the business has been the Retail Supply Chain Segment (RSCG) setting a quarterly GMV record with 15% higher revenue driven by new clients.

On the other hand, management explained a 27% refuse in revenue from the “Capital Assets Group” segment against an exceptionally large transaction in the year prior as a tough comparable dragging lower the firm-wide top-line result.

In terms of guidance, the company is guiding for Q1 fiscal 2024 GMV to range between $295 and $325 million, representing a 15% enhance at the midpoint from last year. On the other hand, the target for adjusted EBITDA between $7.0 million to $10.0 million, suggests some downside compared to $9.8 million in Q1 2023. Similarly, the adjusted EPS assess for the quarter between $0.12 to $0.19, if confirmed, is lower at the midpoint compared to $0.19 achieved in the year prior.

This apparent step back in profitability growth helps explain the poor reaction to shares of LQDT that sold off by more than 12% on the earnings released. Comments during the earnings conference call, go back to the effort at growth investments including on the sales and marketing side.

Overall the trends are fine even if there is some variability among segments. We note that the company ended the quarter with $118.2 million in cash against zero financial debt which we believe is a strong point in the investment profile.

What’s Next For LQDT?

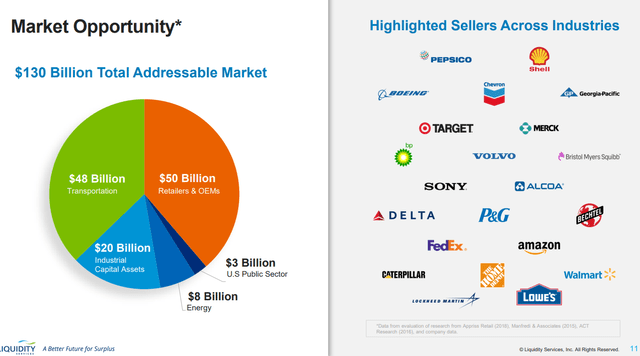

What we admire about Liquidity Services is the sense that this segment of “reverse supply chain” B2B marketplaces is still in the early stages of realizing its full global potential.

Companies across all industries are looking for ways to function more efficiently and better handle inventory. The Liquidity Services platform represents a compelling channel to recover value from surplus assets.

As the ecosystem of buyers and sellers grows, the opportunity for Liquidity Services is to leverage that user base with new services at more steps of the supply chain. An expansion of the logistical network internationally is also an important growth driver in what is seen as a $130 billion addressable market.

So while we see this runway for growth and earnings through the next decade, the challenge here is this near-term uncertainty over the earnings strength. Management’s guidance didn’t inspire much confidence and the sense is that beyond the GMV growth, net revenue growth is trending into the low single digits.

With the stock currently trading at a forward P/E of 17x, it becomes harder to maintain a significantly higher valuation multiple.

The bullish case for LQDT into 2024 is that the company can exceed expectations over the next several quarters. The good news is that it appears the macro backdrop is supportive considering data suggesting resilient economic conditions and even the potential for declining interest rates into 2024.

Final Thoughts

We rate LQDT as a hold, finding it difficult for the stock to reclaim or break out above its recent high until there is evidence of a re-acceleration in earnings. The monitoring points here include the adjusted EBITDA margin as well as operating trends admire transaction volumes.