David Taljat/iStock Editorial via Getty Images

Introduction

Let me just put this out there… I love chocolate, and I especially love Swiss chocolate.

In the world of investing, it’s not always the case that you can invest in something you genuinely love. But in the case of Lindt & Sprungli AG (OTCPK:LDSVF), you can.

Lindt’s success formula hinges on its unwavering commitment to quality and brand prestige, a strategy that has yielded solid yet predictable returns over many years.

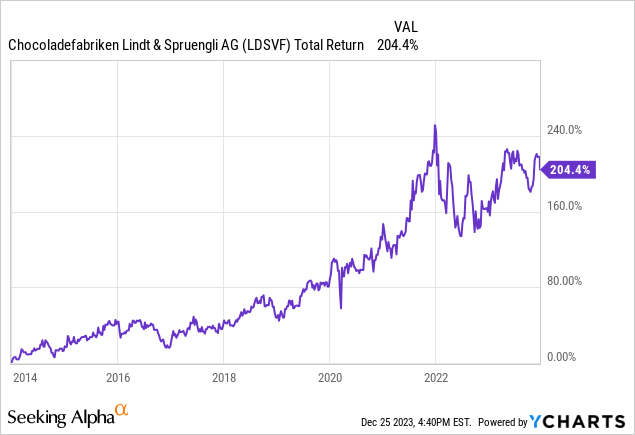

An investment in this steady compounder would have more than tripled your capital over a period of just ten years. Not bad for a “boring” chocolate maker.

In today’s article will explore Lindt’s journey from its modest beginnings to global fame, evaluate its long-term financial performance, and compare it against peers.

Brief History

Before we move into the financial performance, let’s briefly discuss the history of this legendary Swiss chocolatier.

Lindt & Sprungli AG’s store is one of Swiss craftsmanship and innovation. It began, literally hundreds of years ago, in the 1800s, with David Sprüngli’s first confectionery in Zurich.

What started as a humble, tiny operation led the way to a chocolate revolution sparked by one big hit-the chocolate bar. The creation of Switzerland’s first solid chocolate bar by David and his son, Rudolf, marked an early triumph, captivating the hearts and palates of the Swiss and setting the path for even more growth.

Moving forward in time, the 19th century also saw Rodolphe Lindt in Berne revolutionize chocolate’s texture with his conching process, a milestone in chocolate history through an innovative new process. Looking to join forces, Sprungli and Lindt enterprises merged at the century’s close and created a brand that would become synonymous with premium chocolate worldwide.

Despite some challenges, like two World Wars in the heart of Europe, the 20th century witnessed Lindt & Sprungli’s rise to global prominence. Iconic products with clever branding like the Lindor chocolate and the Gold Bunny not only delighted consumers but also cemented the company’s reputation as a luxury chocolatier.

Later acquisitions, such as Ghirardelli, helped solidify their position in the US market, which grew rapidly in the 20th century.

Today, Lindt & Sprungli is a beacon of Swiss quality and innovation in the chocolate world. Its global presence continues to enchant chocolate lovers everywhere, maintaining its status as a symbol of Swiss confectionery excellence.

Financial Performance

Now that you are familiar with the great, long history of Lindt, let’s take a look at how that is translated into financial performance, and particularly how they’ve held up compared to US-based confectioners, Tootsie (TR), Mondelez (MDLZ) and Hershey (HSY).

Revenue Growth

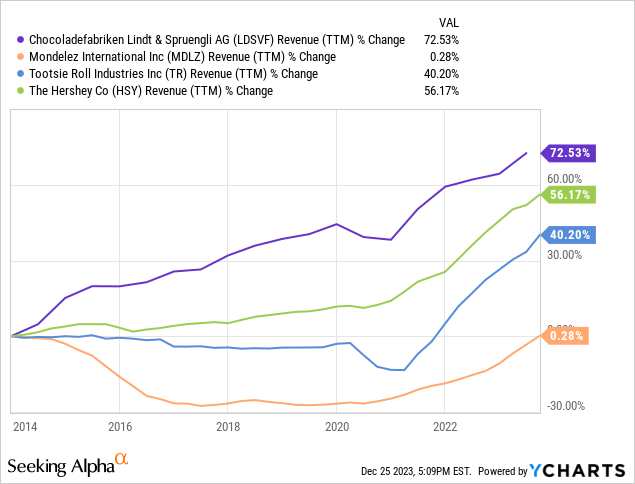

Looking first at revenue growth, we can see that Lindt, up 73% over ten years, has had the best track record of growth by far compared to its peers. It’s steadily grown year after, only suffering a minor setback in 2020, primarily driven by the coronavirus pandemic.

Not far behind was the US-based giant Hershey, at 56% growth. Impressively, Hershey was less affected by the pandemic slowdown compared to Tootsie and Lindt. The slowest growing of the bunch was snacking giant Mondelez, which saw flat revenues over the same period.

In terms of scale, Tootsie is the smallest of these companies, whereas Mondelez is the largest by far. Given the differences in scale, new product launches can have an outsized impact on growth, perhaps supporting Lindt and Tootsie’s growth story.

Margins

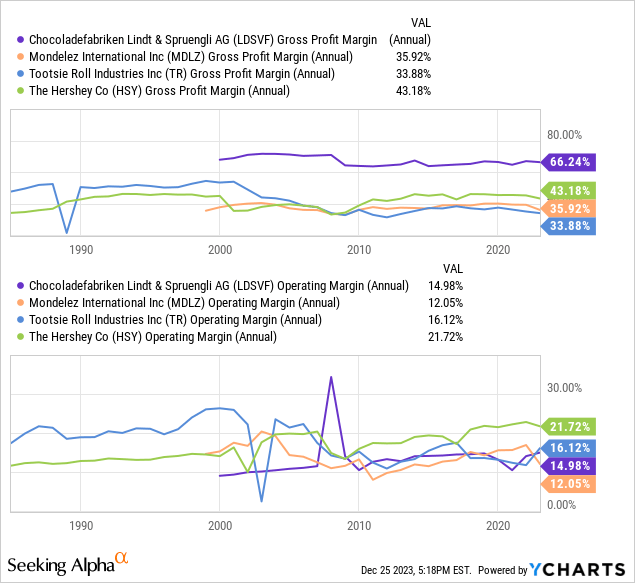

As the producer of premium, “luxury” chocolates, Lindt has the highest gross margins among other peers, at 66%. The premium nature of the chocolates, alongside its rich branding, allows Lindt to command superior pricing power in many markets, resulting in an impressive gross margin profile that has been stable for many years.

In fact, Lindt’s gross margins are so strong they are practically twice as high as Tootsie’s at 34%. Mondelez fairs somewhat better at 36%, and Hershey falls somewhere in between at 43%.

While Lindt’s operating margins leave room for improvement at just 15%, this is somewhat expected given their smaller scale compared to companies like Hershey. As the company continues to scale, its impressive gross margins should naturally lead to better operating margins.

Returns on Invested Capital

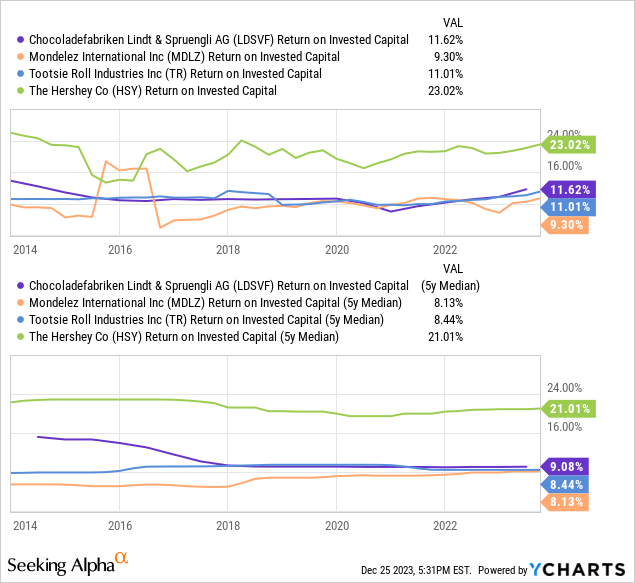

One area where Lindt falls behind on is its returns on invested capital, with an average return of 9% over the past five years. While 9% is by no means horrible, it leaves much to be desired compared to the market at large and even peers within its industry. Hershey, for example, has historically generated returns on capital upwards of 20%.

Earnings Call Insights

In its earnings call from this July, management shed light on some of the trends underway in the space.

Notably, the company forecasted organic growth guidance at 7-9% for 2023. This was a higher adjustment due to a stronger-than-anticipated recovery in the year’s first half. Despite these positive growth trends, the company said it was preparing for significant cost pressures in the second half, mainly due to increasing raw material costs, particularly cocoa and sugar.

Later in the call, the dynamics in the Retail and Travel Retail segments were also discussed. Management said their operated retail channels are showing growth and are expected to surpass 2019 levels by the end of the year slightly. However, the Travel Retail segment is still recovering. It is expected to be around 10% below 2019 levels, mainly due to reduced travel from Chinese consumers, who have yet to return to pre-2020 levels of travel.

Valuation

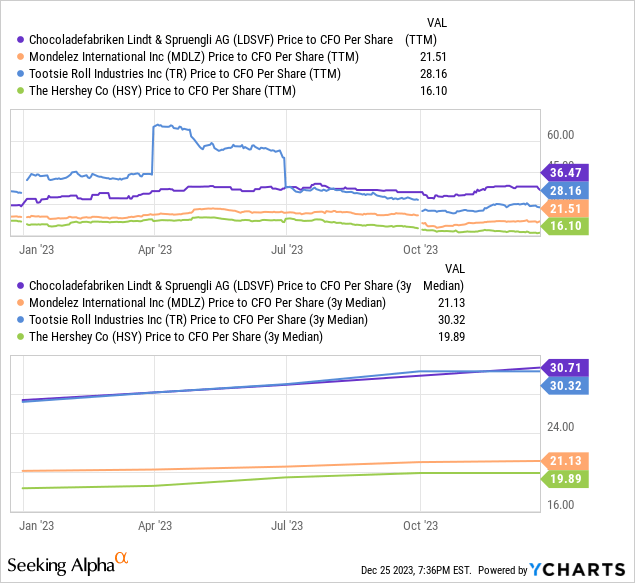

Moving forward, when comparing the valuation of Lindt against its peers, the picture becomes clearer. Lindt is a great company, and it’s been more than recognized by the market for being so. At 36.5X its operating cash flow, Lindt trades at a substantially higher valuation than its peers and trades at a premium compared to its historical valuation of 30.7X CFO.

Interestingly, Hershey trades at a steep discount by comparison at just 16.1X CFO, despite its robust revenue growth and returns on invested capital history. Tootsie Roll is perhaps the strangest of the bunch, trading at such a high valuation despite its modest growth rate and returns on invested capital; perhaps that is driven by the low float.

Conclusion

In conclusion, Lindt & Sprungli, with its strong heritage and financial robustness, is an attractive option for long-term investors. The company’s long-term commitment to quality and innovation has driven consistent growth, high margins, and superior customer loyalty. However, the current high valuation suggests it creates substantial risk for short-term investors.

I rate Lindt & Sprungli a “Buy”

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.