Orest Lyzhechka/iStock via Getty Images

Investment Thesis

After seeing a Y/Y decline in revenues over the past year, Lindsay Corporation’s (NYSE:LNN) sales growth should turn positive moving forward as the Y/Y comparisons are becoming easier in the coming quarters. Further, the demand outlook in the North American irrigation market is good as farmers are coming out of wait-and-see mode and international demand should also pick up as some of the temporary headwinds from last quarter wane. In addition, the infrastructure segment’s sales should benefit from increased deployment of IIJA funding.

On the margin front, the company’s margins should also improve with the help of operating leverage from sales recovery and an increased mix of high-margin Road Zipper leasing revenues in the infrastructure segment. Moreover, the company is trading at a discount compared to its historical averages. Given the discounted valuation and improving revenue and margin growth prospects, I rate LNN stock a buy.

Revenue Analysis and Outlook

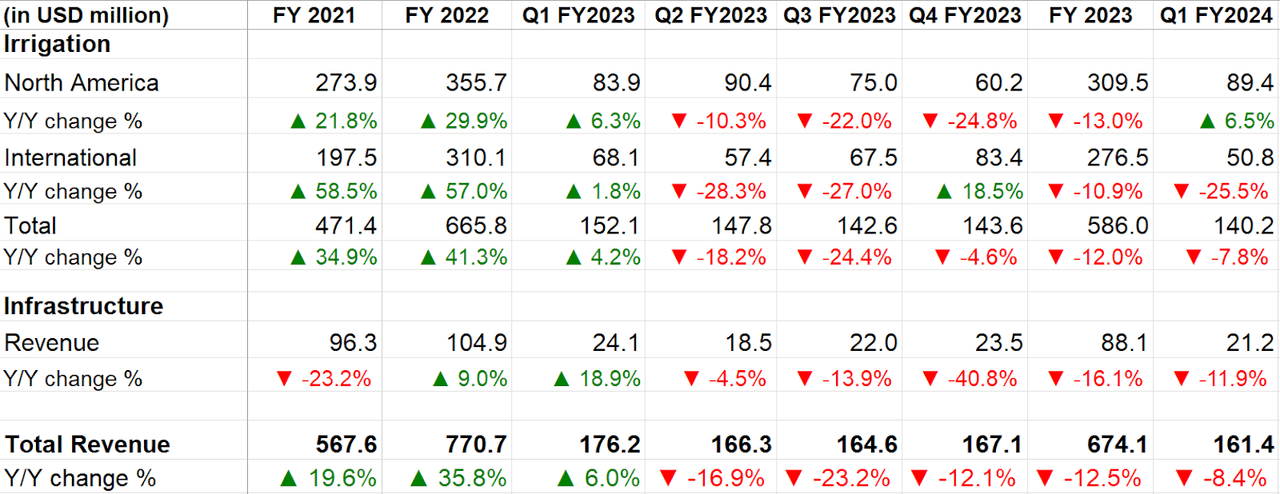

I last covered LNN in September. After seeing strong growth in FY21 and FY22 thanks to the good demand in the agriculture market due to high agriculture commodity prices, LNN’s revenues were facing a decline at that time and my outlook for the company’s growth was muted. The company has reported Q4FY23 and Q1FY24 revenues since then and saw its revenues decline in both quarters.

In the first quarter of 2024, while the company saw improvement in demand for its irrigation equipment in the North American irrigation segment, the weakness in the international irrigation market more than offset it. This resulted in a 7.8% Y/Y decline in revenues in the irrigation segment. Higher unit sales volume and flat Y/Y average selling prices contributed to 6.5% Y/Y growth in North American irrigation revenues, while changes in the timing of funding under the financing program in Brazil and the government transition in Argentina following the presidential election resulted in a 25.5% Y/Y decline in international irrigation revenues.

In the Infrastructure segment, lower road zipper system sales more than offset higher road zipper system lease revenue and higher sales of road safety products. As a result, the infrastructure segment’s revenue declined 11.9% Y/Y. On a consolidated basis, lower revenues in both the irrigation and infrastructure segments led to an 8.4% Y/Y decline in revenue to $161.4 million in the first quarter.

LNN’s Historical Revenue Growth (Company Data, GS Analytics Research)

Looking forward, I believe we are close to the bottom in terms of revenues and the company should return to growth in the coming quarters.

If we look at the company’s revenue growth cadence from the last year, Q1 FY23 revenue was up 6.0% Y/Y while Q2 FY23 and Q3 FY23 witnessed a sharp decline and were down 16.9% Y/Y and 23.2% Y/Y, respectively. So, the comparisons are getting meaningfully easier in the coming quarters which should help revenue growth return to Y/Y growth from the next quarter onwards.

Segmentwise, in the North American Irrigation business, the company has noted increased activity of late post the wait-and-see approach followed by the farmers in most of FY2023. If we look at crop prices, they seem to have stabilized at lower levels in the last couple of quarters after seeing a sharp correction in the first 9 months of CY2023. The agri commodity price not getting worse has resulted in some of the pent-up demand getting unleashed which should help the company’s North American sales in the coming quarters.

In the International Irrigation business, there were a couple of temporary headwinds last quarter. In Brazil, there was a change in the financing program offered by BDNES which was modified to distribute funding in quarterly increments. While this shouldn’t have an impact on full-year results, it caused short-term disruptions related to order confirmation last quarter. In Argentina, the government transition following the presedential election impacted the company’s sales last quarter but the outlook for Agriculture investments under the new government remains positive. So, moving forward, I expect international sales to see a good recovery compared to the 25.5% Y/Y decline it saw last quarter.

The broader agriculture end market should also improve in both the U.S. and internationally with the expectation of a reversal in the interest rate cycle. I believe the high-interest rate environment should reverse across the globe with inflation getting under control. Lower interest rates improve return on investment for the farmers investing in Agriculture equipment and this should help LNN’s sales.

On the Infrastructure side, the company has started seeing the positive impact of IIJA which is resulting in increased construction activities. Management believes that the program is still in the early stages of deployment of funds and, as the funding deployment accelerates, we should see a good acceleration in the demand. One thing that investors should note is that the company is focusing more on Road Zipper leasing compared to outright sales. While this negatively impacts sales in the near term, leasing has a better margin and provides longer-term revenue visibility compared to one-off sales. So, I believe this translation should be good for the company’s revenues and margin in the long run.

Overall, I am optimistic that the bottom is in place and the company’s revenues should see an improvement from here.

Margin Analysis and Outlook

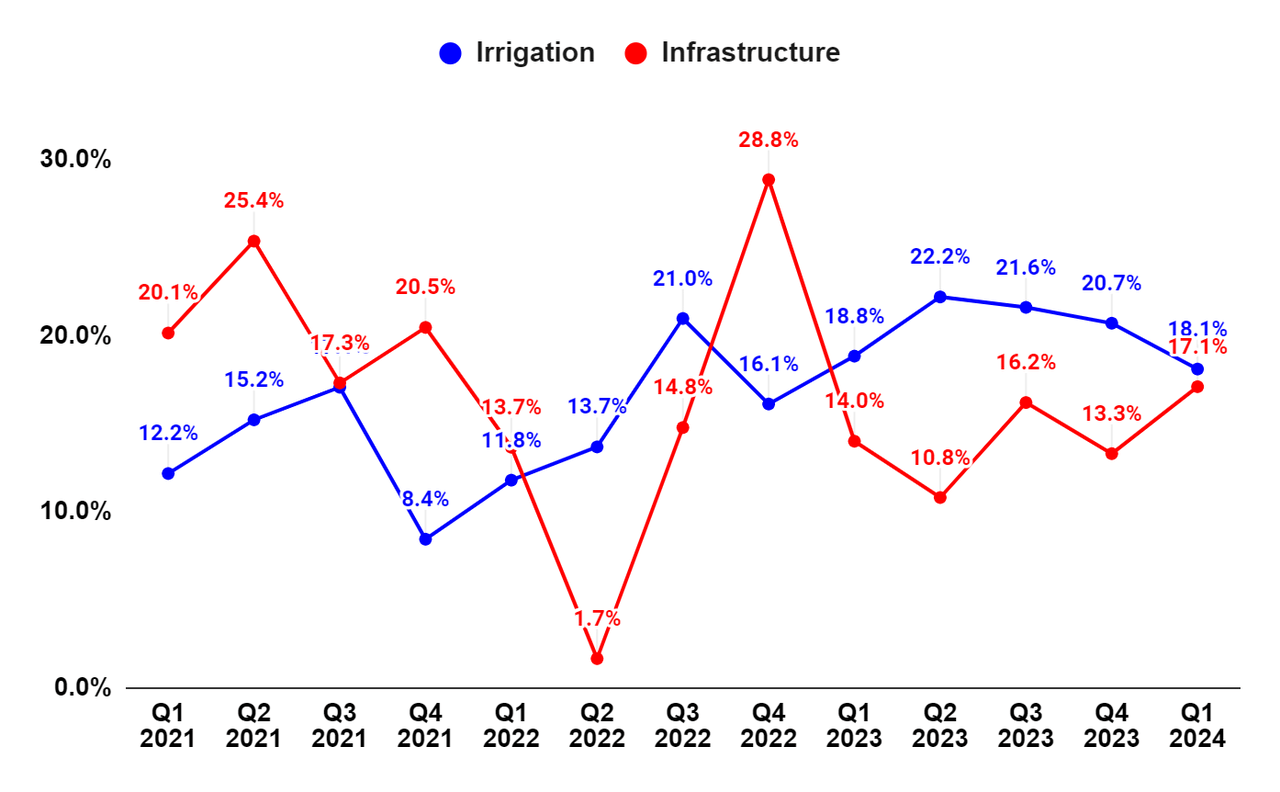

In Q1 2024, the infrastructure segment’s margin was positively impacted by a favorable margin mix of revenues with higher Road Zipper System lease revenues resulting in a 310 bps Y/Y operating margin expansion. In the irrigation segment, the Y/Y decline in international irrigation revenues and the resulting impact of deleveraging of fixed operating expenses resulted in a 70 bps Y/Y contraction in the segment’s operating margin.

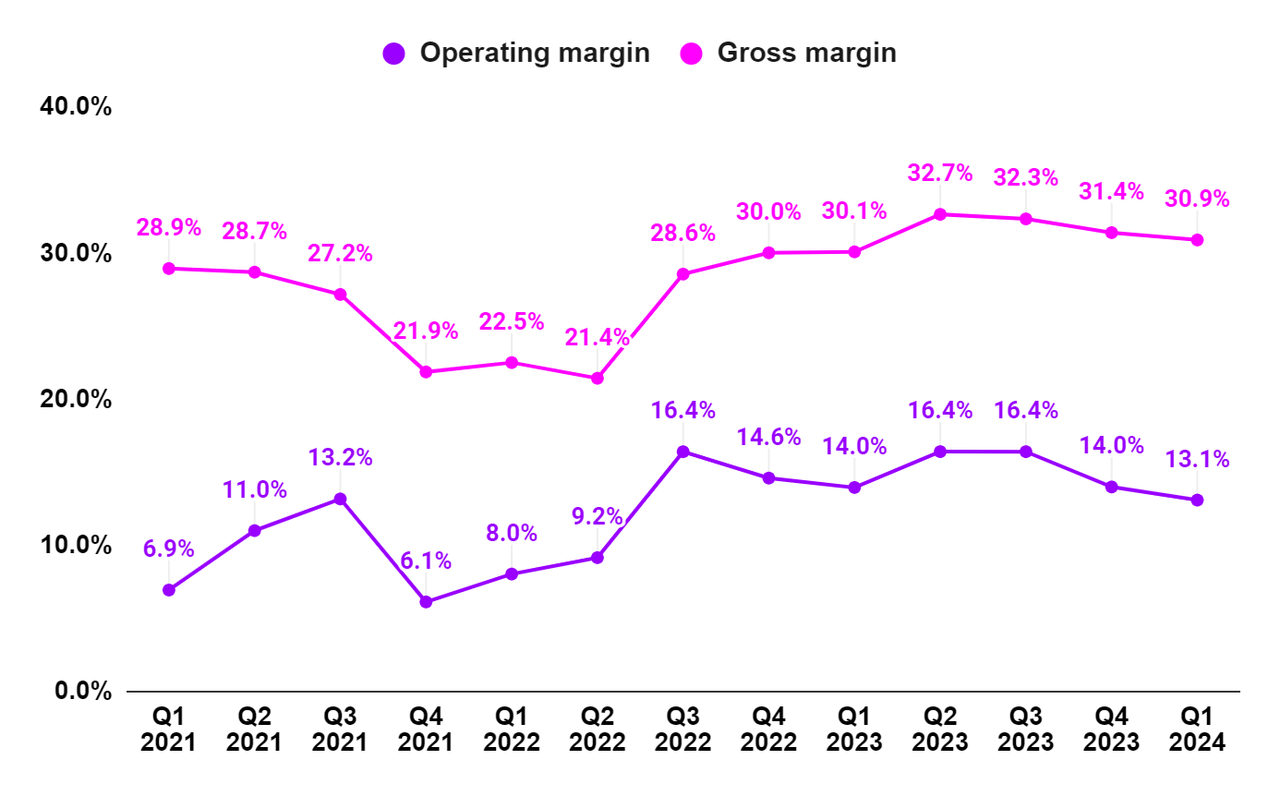

On a consolidated basis, the company’s gross margin benefitted from a favorable margin mix in the infrastructure segment which resulted in an 80 bps Y/Y increase in gross margin to 30.9%. However, operating deleverage resulting from lower revenues in the irrigation segment outweighed the positive impact of gross margin expansion and led to a 90 bps Y/Y decline in operating margin to 13.1%.

LNN’s Segment-Wise Operating Margin (Company Data, GS Analytics Research)

LNN’s Gross margin and Operating Margin (Company Data, GS Analytics Research)

Looking forward, the operating leverage from revenue recovery should help the company’s margin in the coming quarters.

Further, as explained in the revenue section, the company’s focus on increasing Road Zipper leasing sales should help improve the margin mix for the segment. So, I believe the worst is behind us from the margin perspective as well and we should see some margin improvement in the coming quarters.

Valuation and Conclusion

LNN is currently trading at a 20.80x FY24 consensus EPS estimate of $6.29 and an 18.91x FY25 consensus EPS estimate of $6.93, which is at a discount versus the Company’s 5-year average forward P/E of 32.57x. The worries around the sales and earnings decline in the past few quarters have negatively impacted the investor’s sentiments and resulted in the company’s valuation multiple compressing. However, with the worst already behind us, the P/E multiple should see some re-rating.

Moving forward, I believe the fundamentals should improve and the company’s revenue growth should recover with the help of easier Y/Y comparisons, pent-up demand in the North American irrigation market, temporary headwinds waning in the International irrigation market, an upcoming reversal in the interest rate cycle improving demand for agriculture equipment in the coming years, and an increased deployment of IIJA funding benefiting Infrastructure segment. The margins should also benefit from operating leverage derived from sales recovery and mix benefit from higher leasing revenues in the infrastructure segment. The valuation is also lower than historical. Given the company’s improving growth prospects and a discounted valuation, I am upgrading my rating to buy.

Risk

If the prices of agricultural commodities see another leg down, it may negatively impact the company’s sales, and my thesis of revenue and earnings improvement might not work out as expected.