TOLGA AKMEN/AFP via Getty Images

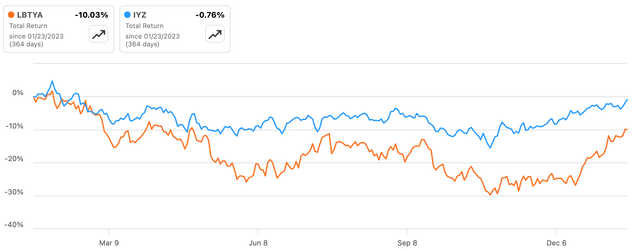

Despite rebounding sharply over the past few weeks, shares of Liberty Global (NASDAQ:LBTYA) (NASDAQ:LBTYK) (NASDAQ:LBTYB) have had a pretty lackluster 12 months, losing around 10% of their value and underperforming U.S. telecoms (IYZ) by a decent margin in that time.

Liberty’s European telecoms businesses have faced a tough operating environment recently, with earnings coming under pressure from cost inflation and declining fixed subscribers. Liberty is also a difficult stock to get a handle on given its complex structure, another factor that may be weighing on the shares. Nonetheless, with the current sub-$20 stock price only implying a modest valuation for the core telecoms businesses, these shares look like a good bargain for value investors, and I open on the stock with a Strong Buy rating.

Liberty Global Overview

Liberty is a holding company that owns various telecoms businesses in select European countries. The company’s wholly-owned subsidiaries include Sunrise (Switzerland), Telenet (Belgium), and Virgin Media Ireland. In addition, the company has 50:50 joint ventures in the Netherlands (VodafoneZiggo) and the United Kingdom (Virgin Media O2, hereafter VMO2) which are not consolidated by Liberty.

Source: Liberty Global Q3 2023 Results Presentation

Broadly speaking, I like Liberty’s businesses for two reasons. Firstly, Liberty typically operates cable assets in the markets it is present in, with these networks requiring less onerous CapEx requirements to upgrade versus the incumbent operators. For instance, in the U.K., VMO2’s main competitor BT (OTCPK:BTGOF) has been spending heavily on upgrading its copper network to full fiber, resulting in a sharp increase in CapEx in recent years.

Secondly, although telecoms is an inherently competitive industry, Liberty’s markets are fairly stable, with the firm not present in the more competitive European markets such as Italy and Spain. The company’s broadband market shares land in the 50-60% area at the high end (e.g. Telenet, which doesn’t operate at the national level but is concentrated in the Flanders region) to around 20% (e.g. VMO2). Via M&A, Liberty has also been bolstering its traditional cable businesses with mobile services, resulting in greater convergence across its businesses. Among other benefits, cross-selling multiple services typically reduces customer churn, which in turn improves customer acquisition costs as it is cheaper to retain an existing customer than acquire a new one.

Inflation Weighing On EBITDA

Liberty has been operating in a challenging macro environment recently, with inflation and declining fixed-line customers putting downward pressure on EBITDA. Liberty lost almost 50,000 video subscribers across its consolidated businesses in the most recent quarter we have figures for (Q3 2023), accelerating from 40,000 losses in Q2. Fixed telephone and video are battling secular headwinds, but internet subscriber growth has also been negative recently, with the firm losing circa 25,000 subs across its consolidated businesses in Q3 plus another 34,000 at VodafoneZiggo, offset to a large degree by almost 41,000 net adds at VMO2.

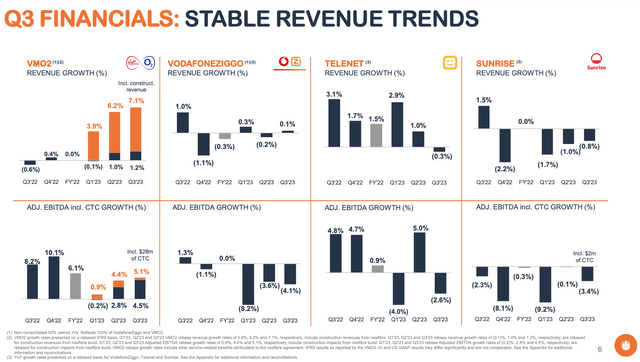

Price hikes are offsetting the above to a degree. The consolidated businesses posted $2.25 billion in 2023 fixed revenue through Q3, equal to a 1.3% year-on-year decline on an organic basis. Mobile has also helped up relatively well in comparison, with positive subscriber growth across both the consolidated businesses and JVs. This led to flat residential mobile revenue over the first three quarters of last year in the consolidated businesses, with VMO2 and VodafoneZiggo posting 2.9% growth and 3.7% growth, respectively, over the same period.

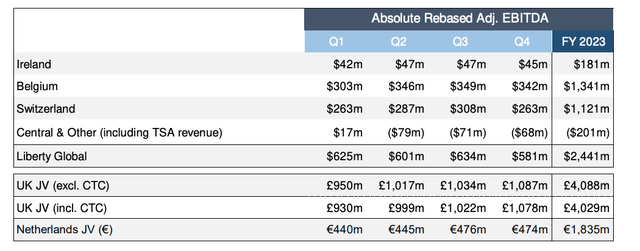

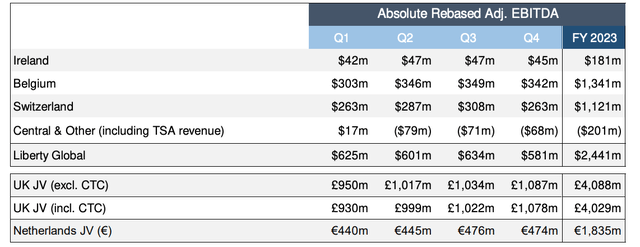

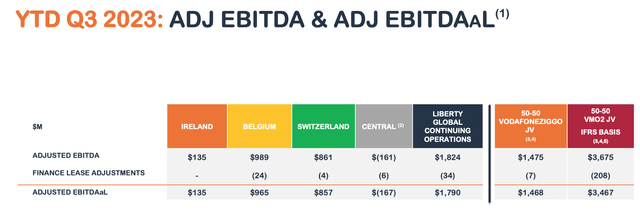

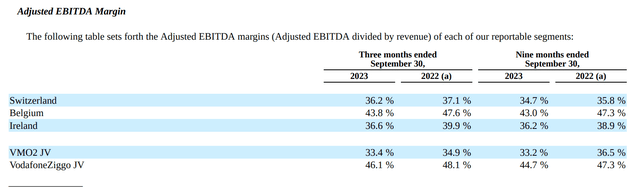

EBITDA has seen further headwinds from cost inflation, weighing on margins.

Source: Liberty Global Q3 2023 10-Q

While revenue at the consolidated businesses was down 1.2% on an organic basis over 9M’23, EBITDA is down more for the above reason. On the plus side, VMO2 is a bright spot, posting accelerating EBITDA growth in Q3:

Source: Liberty Global Q3 2023 Results Presentation

Looking ahead to Q4 and full-year results, there are good reasons to expect this to mark a bottom in earnings. Firstly, though up slightly month-on-month in December, inflation in the Eurozone is now around 2ppt lower than the Q3 average. This should help ease pressure on the cost base as we lap 2023 results this year. Price hikes will also benefit from having a complete period behind them, with VodafoneZiggo, for example, putting through a 10% mobile price hike in Q4:

Meanwhile, VodafoneZiggo continues to grow postpaid mobile ads supporting our 10th consecutive quarter of mobile service revenue growth, and we just announced a 10% mobile price rise from October, which should support the full year outlook as well.

Mike Fries, Liberty Global CEO, Q3 2023 Earnings Call

Furthermore, both Sunrise and Telenet have seen some company-specific issues weigh on subscriber numbers, with Sunrise migrating customers over from the UPC brand and Telenet operating with depressed marketing spending recently due to some IT issues. The latter has now been resolved, while Sunrise has moved over its most value-sensitive customers. This should also support comps this year.

By year, for example, we’ll have migrated nearly half the UPC base, and importantly, the most value sensitive segment of that base. The Belgium market remains relatively rational with price rises offsetting inflationary pressure, but Telenet continued to be impacted by a reduced marketing spend as it managed through some IT issues in Q3. As a result, both postpaid and broadband ads were negative in the quarter. On a positive note, though, September saw a recovery and subscriber volumes and the marketing machine has ramped back up in Q4.

Mike Fries, Liberty Global CEO, Q3 2023 Earnings Call

Finally, I would note that analysts continue to expect growth at VMO2, which would offset the above struggles in the consolidated businesses in any case, resulting in flatter EBITDA overall:

Stock Looks Materially Undervalued

Liberty Global’s Class A shares trade for $19.37 each at the time of writing. Liberty has three classes of stock: A, B and C. The Class A shares entitle holders to one vote per share; the Class B shares entitle holders to 10 votes per share; and the Class C shares do not offer voting rights. In practice, the B shares trade on very little volume and we can ignore them, leaving investors to choose between the A and C shares. Now, the C shares currently trade at a premium to the A – around 6% at the time of writing. This is possible because buybacks have been targeted at the C shares recently, but this is not something that is set in stone – it is largely a reflection of historical trading patterns and can change in the future. With that being the case, I will reference the cheaper A shares in this piece.

Thanks, Polo. Listen, on the buyback question, our policy has been historically to buy Ks over As, principally because they have traded until more recently at a discount. And we don’t believe either shares should trade different than the other because even though one is voting and one is nonvoting, we’ve always viewed them as economically equal. The reason for historically buying Ks over As was to try to maintain the liquidity of the As since there were fewer of them, and there are still fewer of them so that we have two healthy trading markets. Of course, that’s changed more recently.

Mike Fries, Liberty Global CEO, Q3 2023 Earnings Call

Valuing Liberty is a slightly cumbersome undertaking because there are a few moving parts to consider. Firstly, we have the various European telecoms businesses, including the JVs. Liberty also sports significant cash at the holding company level, plus a portfolio of investments. The latter includes stakes in listed companies, including Vodafone (VOD) and U.K. broadcast network ITV (OTCPK:ITVPY) (OTCPK:ITVPF).

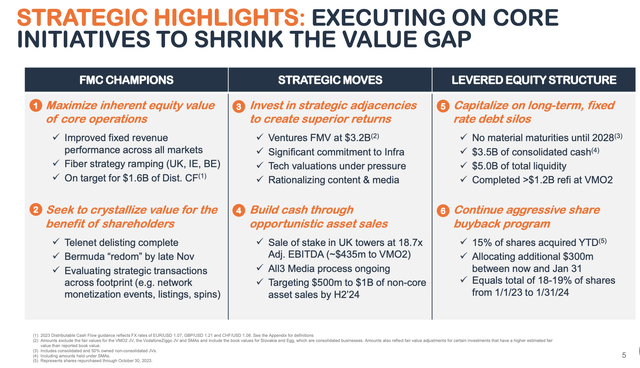

With the shares at $19.37, the market seems to be implicitly applying a very subdued valuation to the telecoms businesses. Including investments held under separately managed accounts, cash & equivalents at the holding company level stood at circa $3.5 billion at the end of Q3. Call it around $8.90 per share based on just under 400 million shares outstanding. As for its investments, Liberty put the fair value of its ventures at $3.2 billion, implying another ~$8.15 per share on top of that.

Subtracting these from the current $19.37 stock price leaves very little for the equity of the telecoms businesses. Now, Liberty does operate with substantial leverage at the subsidiary and JV levels, typically in the 4-6x EBITDA range. Even so, the implied valuation looks low. Analysts expect the telecoms businesses to collectively generate ~$9.4 billion in 2023 adjusted EBITDA. Including debt gets me to an implied EV/EBITDA of circa 5.7x. This is what the market appears to be valuing the telecoms businesses at in aggregate.

Comparing to peers suggests significant upside. According to Seeking Alpha, U.S. cable companies Comcast (CMCSA), Charter (CHTR) and Altice USA (ATUS) trade for around 7.2x forward EBITDA. Looking a bit closer to Liberty’s geographic footprint, comparable European telecoms peers like Dutch incumbent KPN (OTCPK:KKPNY) (OTCPK:KKPNF) and Swiss incumbent Swisscom (OTCPK:SCMWY) (OTCPK:SWZCF) similarly trade for around 7.4x EBITDA. Both companies of course compete directly with Liberty in these markets. While ~7.4x EBITDA represents a premium to other European telecom players, I would suggest these are better comps for the reason I set out earlier – namely that these markets are more rational, stable and less competitive than other European countries. Furthermore, certain other peers have company-specific issues that make a direct comparison somewhat tricky (e.g. U.K. incumbent BT is on the hook for large top-up payments to its pension fund, absorbing a significant portion of its free cash flow and depressing its multiple).

Even applying a conservative blanket multiple of 6.5x to Liberty’s telecoms assets points to significant undervaluation. At that level, and adjusting for Liberty’s share of the JVs, the telecoms businesses would be worth around $13.50 per share in total, leading to a circa $30.55 fair value overall after including cash and Liberty’s investments. Implied upside would be almost 60% from the current share price, further suggesting a significant margin of safety. A more realistic, but still very reasonable multiple of 7x EBITDA applied to the telecoms businesses gets me to a fair value of ~$37 for Liberty stock.

Closing The Gap

While there is no reason why the market couldn’t maintain this apparent discount indefinitely, Liberty is at least trying to close the gap with aggressive stock repurchases. It retired 15% of shares outstanding in 2023 through Q3, and that will have been extended to nearly 20% by the end of the month:

Source: Liberty Global Q3 2023 Results Presentation

Between cash generated by its consolidated businesses and dividends from the JVs, Liberty will have a stream of cash which will allow it to carry on buying back stock in the future. It doesn’t pay a dividend and probably never will, so buybacks are the primary source of capital returns to shareholders. I see this as a good thing given the current implied discount to fair value.

Risks

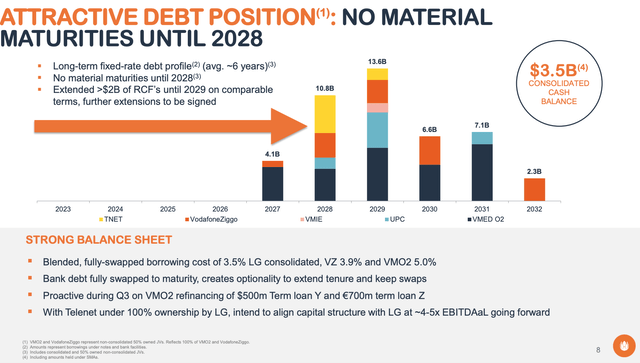

There are a number of risks to consider here. Firstly, and as mentioned in the piece, Liberty operates with significant leverage at the subsidiary and JV level. While there are no maturities over the next few years, leverage is high versus peers and leaves the equity more exposed to relatively modest changes in earnings. Liberty’s markets are currently stable and the cashflows generated by mature telecoms are likewise typically defensive, but it is possible that this could change in the future if additional competitors were to enter its markets.

Source: Liberty Global Q3 2023 Results Presentation

Another risk to consider is currency. Liberty stock trades in USD but the underlying revenue and earnings of its telecoms businesses are in CHF, EUR and GBP. Finally, the stated value of its ventures may not reflect their intrinsic value, which of course would negatively affect my fair value estimate of Liberty stock above.