Sean De Burca/The Image Bank via Getty Images

I was a small-town real estate developer before I began writing articles here on Seeking Alpha. I’ve written about this many times before, but it bears mentioning once again.

My real estate career dates back over three decades. Three decades filled with so many opportunities to learn about the ground-up value-creation process.

I’m very grateful for all of it. I have first-hand experience developing sites for big-box chains… restaurants… drugstores… auto parts stores… grocery stores… discount stores…

The list is long.

I also have experience in the industrial sector, where I leased space to companies like Goodyear Tire. And I’ve even personally rented out sites to billboard operators, cell tower providers, and video poker companies (when it was legal to do so in South Carolina).

My portfolio was small compared to the real estate investment trusts (REITs) I analyze today. We’re talking about assets under management (‘AUM’) of less than $100 million. So clearly not large enough to list.

However, I had ideas of becoming a REIT one day and making my portfolio investable for mom-and-pop investors.

It was a laudable dream. But it quickly became a nightmare due to a massively failed business partnership.

There was actual criminal activity conducted, unbeknownst to me for far too long… with far too much damage done by the time I did realize what was going on.

I learned many valuable lessons through that extreme hardship. And today, I’m going to discuss one of the most important ones.

Scrappy Is an Understatement

According to Cambridge Dictionary (online), the word “scrappy” means “the quality of being strong and determined, and willing to argue or fight for what you want.”

“Scrappy” is also a word used to describe something that’s makeshift but capable. It might not be the most attractive entity in existence; however, it finds a way to push through nonetheless.

That’s how I think of myself back when I was a young real estate developer. I was “bootstrapping” my business by using as much leverage as possible – which I’ll admit wasn’t that smart.

I had very little actual skin in the game for most of my projects. And while I was definitely growing my AUM (and net worth)…

I was also definitely taking on too much risk in the process.

It was fun while it lasted. But, more importantly, it taught me some very important lessons.

Thanks to the ultimately harsh results, I now know how essential it is to invest in well-capitalized businesses.

Had I maintained capital markets discipline, the $100 million portfolio I accrued back then wouldn’t have crashed and burned. Moreover, it would likely be worth over $300 million today.

Fast might feel good in the moment, but it so often leads to long-term disappointments and damage.

Cash Is King Now and Always

I’m having flashbacks of my foolishness these days, though not at my expense this time around. As many of you know, there will likely be a wave of loan defaults over the next 24 months.

Commenting on the current commercial real estate (‘CRE’) situation, Cantor Fitzgerald CEO Howard Lutnick pointed out:

“I think $700 billion could default… The lenders are going to have to do things with them. They’re going to be selling. It’s going to be a generational change in real estate coming, end of 2024 and all of 2025. We will be talking about real estate being just a massive change [with] $700 billion to $1 trillion in defaults coming.”

And he added:

“I think it’s going to be a very, very ugly market in owning real estate over the next… 18 months [to] two years.”

Now I don’t know about you, but I wouldn’t want to be a “scrappy” CRE developer or investor right now. Not along the lines as I used to be, anyway.

Now, Lutnick thinks the Federal Reserve will reduce rates by 50 to 75 basis points this year. And I agree with him.

Where I disagree is that the largest landlords – especially REITs – will be impacted. They’re too well-capitalized to suffer the kinds of losses we’re likely going to see.

Sure, some of the smaller REITs and those with weaker balance sheets will struggle. But I’m buying dominant players that boast scale and cost-of-capital advantages.

As loans come due over the next two years, these dominating landlords will be able to gain market share.

I wasn’t in a position to take advantage of the distress in 2008, thanks to my own struggles. But I am today.

If you are too, keep reading. Because I expect the following REITs to reap some significant rewards.

A Safe Harbor REIT

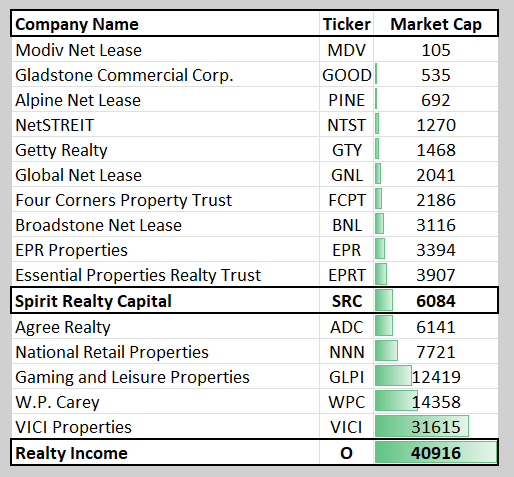

Realty Income (O) is a dominating landlord, and this massive S&P 500 REIT will soon become much stronger. The net lease REIT is in the process of acquiring Spirit Realty (SRC), and upon closing Realty Income will be the 4th largest REIT and 150th largest company in the S&P 500 (by total enterprise value).

iREIT®

There will be no capital markets execution required to complete the Sprit Realty transaction which is expected to achieve at least 2.5% accretion. In addition, the expected annual synergies include approximately $50 million (or approximately $30 million excluding stock-based compensation).

Realty Income is my largest holding and one of the primary reasons for that is because of the company’s scale advantage.

In addition to large-scale M&A (like SRC and Vereit) Realty Income is also able to selectively pursue large-scale sale-leaseback transactions without creating financing contingencies or concentration risks.

Due to Realty Income’s size the company has capacity to Buy in Bulk at “Wholesale” prices while maintaining diversification.

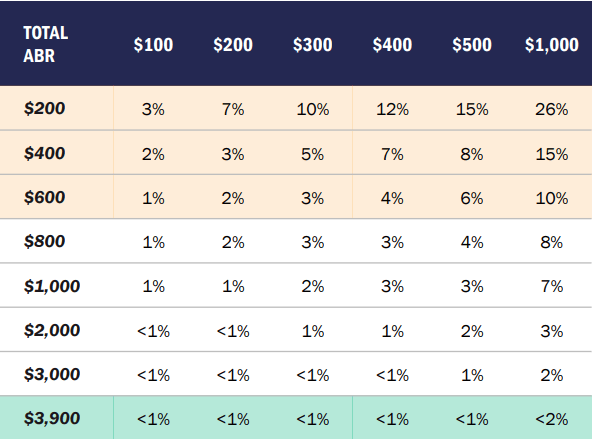

As shown below, peers with smaller denominators (yellow shaded area) lack the ability to buy in bulk without incurring material diversification risk.

Alternatively, Realty Income’s significant scale allows the company to pursue large sale-leaseback transactions without compromising diversification metrics (shaded green area below).

Realty Income

Many investors forget that Realty Income functions somewhat like a bank, in that it provides financing for many large corporations that own real estate.

There’s over $1.2 trillion in debt maturing in 2024-2027 for S&P 500 companies (in Realty Income’s universe) and elevated bond yields support a more attractive marketplace for sale-leaseback financing.

So, as you can see, Realty Income’s scale advantage is a significant “arrow in the quiver” for this REIT.

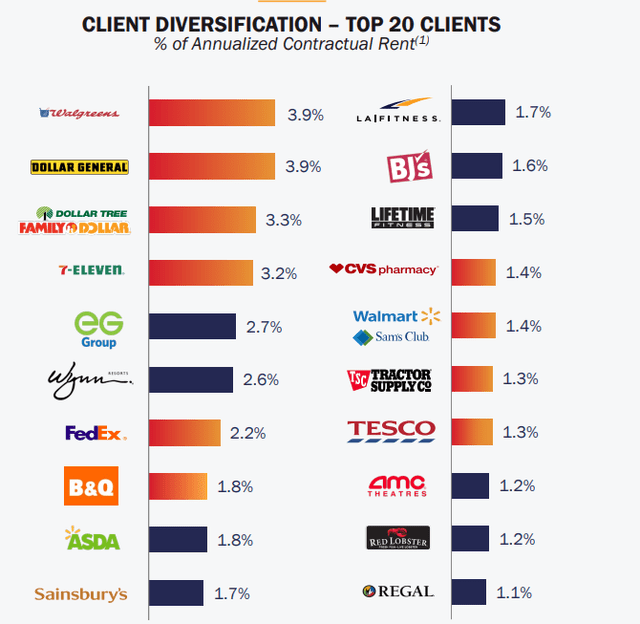

Unlike companies like Medical Properties Trust (MPW) – 20% exposure to Steward – or EPR Properties (EPR) – 39% exposure to theaters – Realty Income is one of the most diversified REITs in our coverage universe.

The other attractive part of the Realty Income investment thesis is the balance sheet.

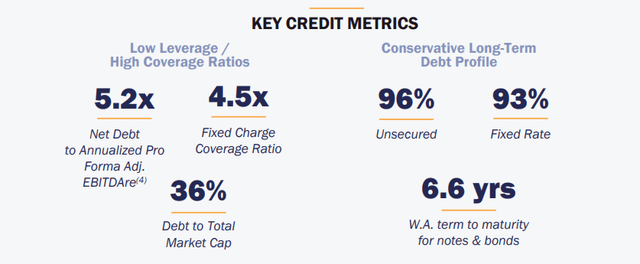

To grow, Realty Income utilizes capital markets discipline that can be reflected in the A3/A- credit ratings (just one of only eight US REITs with comparable ratings).

In Q3-23 the company’s net debt to annualized pro forma adjusted EBITDA was 5.2x and the fixed charge coverage was 4.5x. Combined with cash on hand ($344 million) and availability of $3.4 billion on the credit facility, liquidity stood at $4.5 billion.

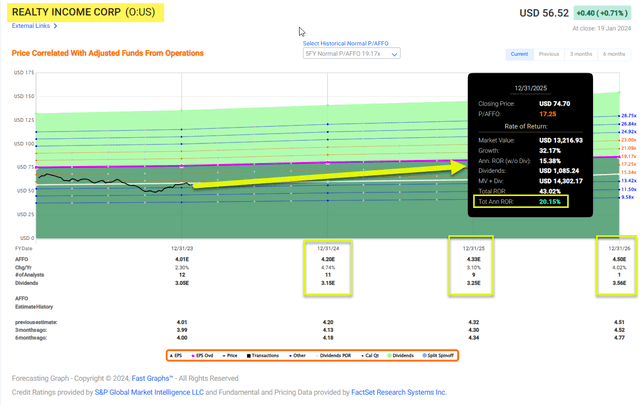

In terms of valuation, Realty Income remains one of my highest conviction picks.

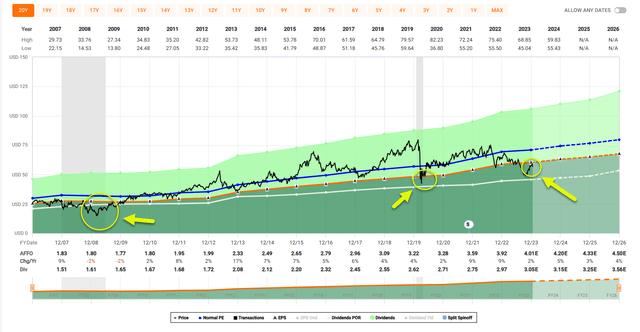

Shares are now trading at $56.52 with a P/AFFO multiple of 14.1x (normal multiple is 17.7x). The dividend yield if 5.5% and well-covered (payout ratio is 76%).

Importantly, Realty Income has only traded at this level a handful of times since the Great Recession.

Meanwhile fundamentals are getting stronger.

Better Diversification.

Better Balance Sheet.

That’s why I’ve been loading up the truck.

As seen above, analysts forecast Realty Income to grow by 4% in 2024, 3% in 2025 and 4% in 2026, and that does not include more M&A obviously. iREIT® has a Buy rating on the company with a forecasted annualized total return target of 20%.

A Tower of Power

American Tower (AMT) is a cell tower and date REIT that owns a portfolio of nearly 225,000 communications sites and a highly interconnected footprint of 28 U.S. data center facilities.

American Tower leases for its communications sites to wireless carriers with initial non-cancellable terms of 5 to 10 years with multiple renewal terms, with provisions that periodically increase the rent due under the lease.

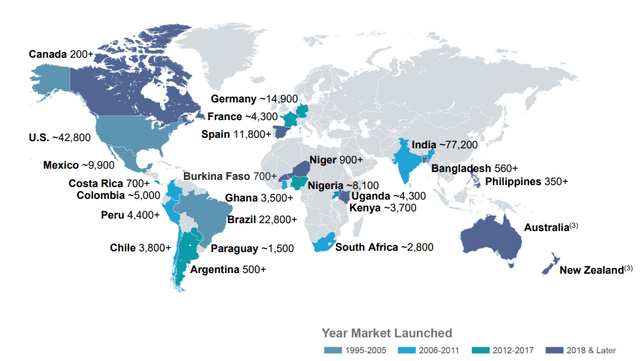

As seen below, American Tower has a very diversified footprint (US/Canada 47%, Asia-Pacific 10%, Africa 11%, Europe 7%, Latin America 16%, Data Centers 7%).

American Tower’s top tenants include:

- AT&T (T)

- T-Mobile (TMUS)

- Bharti Airtel Limited (“Airtel”)

- Reliance Jio

- Airtel

- MTN Group Limited (MTNOY)

- Telefónica S.A. (TEF)

- América Móvil (AMX)

- TIM S.p.A.

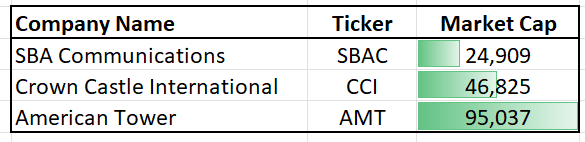

AMT competes with other public tower companies, such as Crown Castle (CCI), SBA Communications (SBAC), Telesites S.A.B. de C.V. and Cellnex Telecom, S.A. In addition, AMT competes with wireless carrier tower consortia such as Indus Towers Limited and private tower companies.

iREIT®

In addition, to its scale advantage, American Tower has also maintained solid capital market discipline. In Q3-23 the company reduced floating rate debt to below 11% and increased liquidity to $9.7 billion. Net leverage in Q3 was 5x.

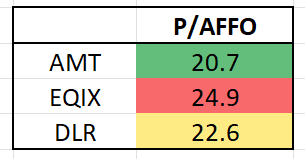

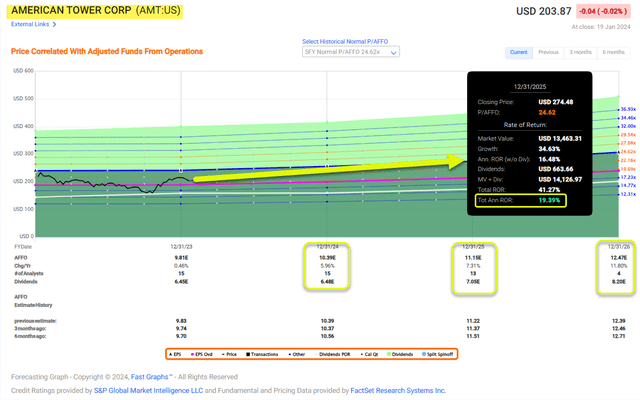

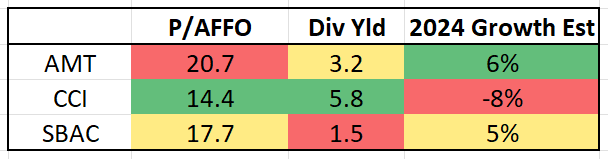

Although shares have moved up, we still find the company attractively priced, trading at $203.87 with a P/AFFO multiple of 20.7x (normal multiple is 23.1x).

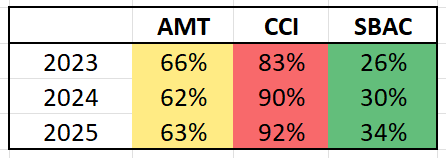

The dividend yield is 3.2% and well covered with a payout ratio of 66%. I put this chart together (below) which illustrates payout ratios using analyst estimates and AFFO per share for these three REITs:

iREIT®

In reference to valuation, I put together this chart:

iREIT®

Crown Castle is clearly the cheapest, but I prefer American Tower for its superior growth profile.

Also, remember that American Tower generates around 7% of revenue from data centers, so here’s a comparison with these peers:

As seen above, analysts forecast American Tower to grow by 6% in 2024, 7% in 2025 and 12% in 2026. iREIT® has a Buy rating on the company with a forecasted annualized total return target of 20%.

In Closing

I’m glad that I’m no longer at the mercy of my local bank.

Mark my words: It’s going to get nasty folks…

In this cycle, there’s no reason to get too cute.

Which is why we’re laser-focused on buying (and recommending) these so-called consolidators.

Over the next few quarters we’re going to see weaker hands fold (in commercial real estate) and many smaller landlords having trouble.

Don’t get caught up in these riskier REITs (see my latest article).

Instead, focus on these consolidators that will continue to gain market share and provide investors with long-term economic value.

Happy SWAN Investing!

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.