Kutay Tanir

Lesaka (NASDAQ:LSAK) is a South African fintech company offering solutions to both merchants and consumers. The share price has recently pulled back significantly and I think the risk/reward ratio now looks favorable.

The history of Lesaka is long and complicated. It used to be known as Net1 and was in the past mainly known for a drawn-out saga about its – eventually cancelled – contract with the South African government agency SASSA and accompanying (likely justified) criticism of their lending practices.

The current iteration of the company started when Chris Meyer was appointed CEO in 2021. He then led the acquisition of the privately-owned Connect Group, which now makes up the bulk of Lesaka’s merchant business and is really the reason Lesaka is worth considering as an investment.

A corporate rebranding from Net1 to Lesaka followed, with the goal of all these changes being to return the business to operational profitability. On that front, enough progress has been made that the company warrants a closer look to see if it is time to jump in.

When I started looking at Lesaka in mid-October, I found the then share price of ~$4.50 too expensive to defend the risk. The recent pullback to below $3.50 has, in my view, added enough safety margin to change that, and so I’ve established a position at $3.45.

What makes Lesaka interesting to me is that the company has spent the last three years going through a major turnaround. In my view, results show this turnaround has succeeded, yet the share price is back at exactly where it was when the turnaround process started.

I think most of the pullback is due to fear that the CEO Chris Meyer’s just announced departure indicates a problem in the business. While I have no inside knowledge and could be entirely wrong, I find it likely the official version is all there is to it: an executive wanting to return to his family in the UK after three years living abroad. Giving this some credence is the fact that Meyer will remain on the board, while the new executive chairman Ali Mazanderani started his tenure by buying almost 0.5% of the company.

Results, as I’ll come to below, have been trending in the right direction. If there is a huge iceberg about to be hit, it does at least not seem obvious to me. Lesaka faces a great deal of challenges, but none that I think have gotten so much worse from October to now that the company is worth ~33% less.

Lesaka as an investment proposition effectively has three parts to it, in order of importance: its merchant division, its consumer division and a stake in the Indian fintech Mobikwik.

Merchant Business

The merchant business of Lesaka mainly consists of the acquired Connect Group blended together with some parts of the old Net1.

The division serves both the formal and informal parts of the South African economy, with the latter being the primary focus for Lesaka (for background on the large informal economy in South Africa, this white paper from Lesaka is a good place to start). In practical terms, that means the company is focused on small to very small shops and merchants.

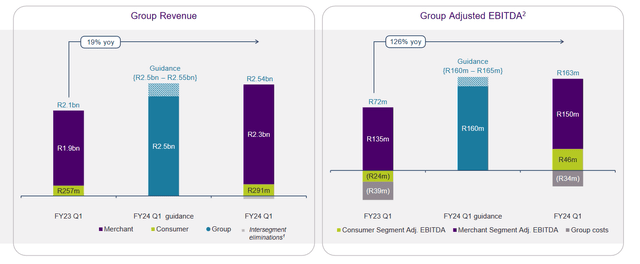

It is fair to say the merchant business is the heart of Lesaka, contributing by far the bulk of both profits and revenue (this image is from Lesaka’s Q1 2024 earnings released in November, as the company’s financial year doesn’t follow the calendar year):

Lesaka revenue by segment (Lesaka Q1 earnings presentation)

The informal sector in South Africa has, not surprisingly, traditionally been cash-based. Lesaka’s offerings can be thought of as either being about helping merchants supervise cash with less risk or helping them transition away from it. It also offers such services to the formal economy, but Lesaka management seems to find the competitive landscape better in the informal sector. The company does not break out its revenue numbers by formal vs. informal sector, but it is clear from management commentary that they are focused on the informal sector.

For managing cash, Lesaka’s offering effectively consists of placing an automated vault on the merchant’s premises. The merchant can then deposit cash into the vault and have a corresponding amount credited electronically, taking away the risks that otherwise comes with managing cash. Lesaka on their part can charge fees and also gains the data and access needed to offer working capital loans to merchants.

Recently Lesaka has gone a step advance and made these vaults function as ATMs, transforming the vaults into something that can also attract customers to the merchant’s premises. This probably isn’t of any material significance to the investment case, but does at least show Lesaka can deliver the kind of clever synergies one would hope for from a fintech company.

More interesting – as the informal sector is moving away from cash, at least according to Lesaka – is the non-cash merchant products. The starting point here is to place small handheld terminals with merchants.

The first use case for these terminals is to give merchants a way to pay suppliers electronically with large brands (e.g. breweries) preferring this. As such, Lesaka will often deploy these devices explicitly to ease such supplier payments, as explained on their Q1 earnings call:

I mentioned at our last results that during Q1 to Q3 of the 2023 financial year, we installed a large number of devices at informal merchants in order to uphold supplier payments to a few major FMCG companies that we partnered with. This has resulted in a more than double year-on-year boost in our supplier payments throughput.

The supplier payments platform is an important value-add service to our merchants as it significantly derisks the operations from a cash perspective and reduces admin time. We have a number of large FMCG partners on board, which is driving increased adoption and usage and is resulting in growth.

The other primary use case is what Lesaka calls “value-added services.” In simple terms, this allows the merchants to sell things appreciate mobile airtime or electricity, let customers do money transfers and so on. The theory being merchants gains additional revenue streams and a way to attract customers to their store, while Lesaka can charge fees and make a margin by buying things appreciate airtime in bulk and reselling it to merchants (a lot of this seems awfully vulnerable to eventually being done by customers directly through smart or feature phones).

On top of these “foundational” use cases, Lesaka can then offer additional services, the main one being to let merchants use the terminals to acquire card-based payments. Lesaka has also been experimenting with offering loans to merchants, but pulled this in late 2023 citing the tough economy and indicating they expect to reintroduce the product in late 2024. Quoting again from the Q1 earnings call:

We have a philosophy of experimenting with product. The — on the back of our Kazang Pay product, our advanced product is something that we brought to market last year. We had a number of vintages based on certain algorithms that we launched, and we were not happy with the performance of those loans.

Now as I mentioned, on an overall basis, we made a small profit but we decided to pull the product back into the warehouse. We’re going to make some tweaks and relaunch the product into what is a healthy Kazang Pay base, but we need to tweak some of the data points and some of the learnings in the credit piece,

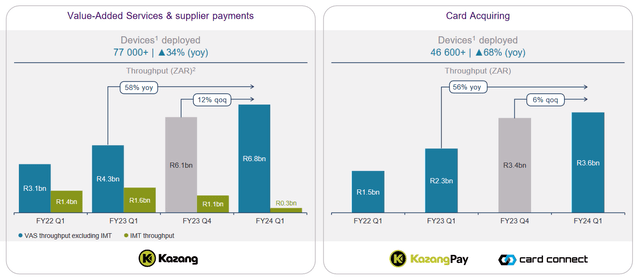

The merchant business has been growing quickly through aggressive deployment of the handheld terminals described above:

Lesaka device deployments (Lesaka Q1 earnings presentation)

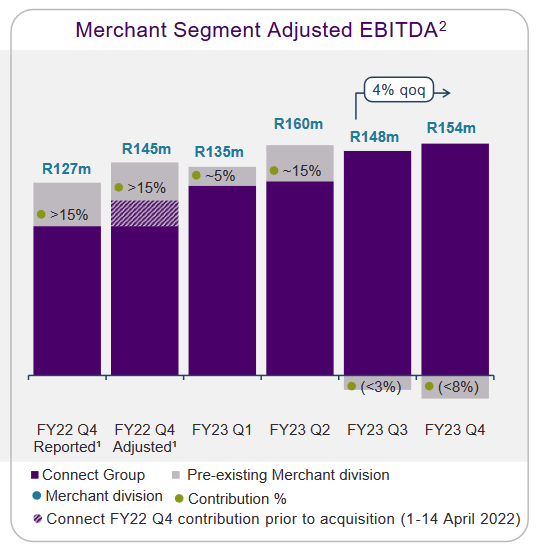

Income have also been growing steadily since Lesaka acquired the Connect Group, albeit this has been masked by struggles in the Lesaka’s existing merchant business (which, not surprisingly, is now being restructured under the leadership of the old Connect Group management). Note that these numbers are in South African Rands.

Lesaka Merchant EBITDA (Lesaka Q4 2023 earnings presentation)

Consumer Business

The consumer part of Lesaka is an inheritance from the “old” Net1 and exists mainly to serve the lower-income strata of the South African population.

The South African state provides a range of social grants, the two main ones being a child uphold grant and an old age grant. A significant part of the population relies on these grants, which by all accounts will not change in the foreseeable future. The recipients obviously need a way to not only acquire the grants, but also to convert them into cash, as that is still what especially South Africa’s large informal economy runs on.

For a while the old Net1 was the provider of this grant payout service on behalf of SASSA. That contract was eventually lost and the job as default payout provider moved to the South African post service. It is however possible for grant recipients to switch to other providers, including Lesaka (under the brand “EasyPay”). Given the state of the post service, convincing recipients to switch should be far from impossible.

What EasyPay offers grant recipients is effectively an account to acquire their grants in and access to ATMs to withdraw cash from. EasyPay then leverages that to offer two things to its account holders: 1) insurance, 2) micro-credit loans. As mentioned previously, the old Net1 faced a lot of criticism for its lending practices – rightly so, I believe – and while I think Lesaka now is taking a better approach, lending to the poorest parts of the population comes with moral risks.

I don’t consider lending morally bad in itself, and it may help consumers avoid black market loans and the dangers associated with those. Giving grant recipients access to private sector financial services also seems to an overall good thing in South Africa, considering the state itself seems to have failed to supply such services in decent quality through the post service. However, any lending needs to be non-predatory, and I will exit Lesaka if it becomes clear they are not living up to this.

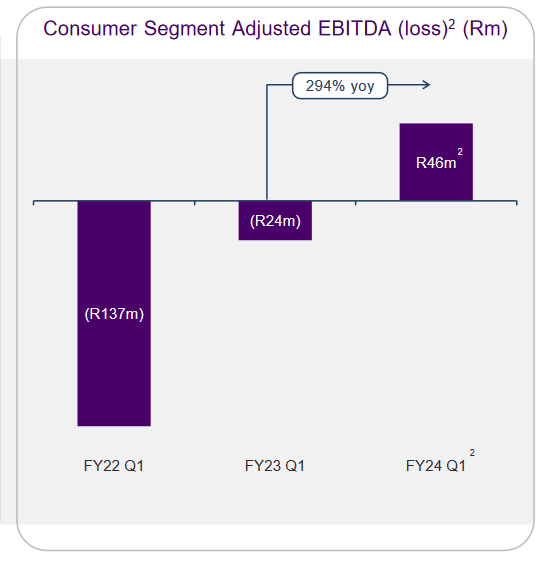

The EasyPay operation has been around for years, but had gotten into very bad shape when Meyer arrived as Lesaka CEO in 2021. New management was installed to run EasyPay and as of the latest quarter, it is now back to (just) being operationally profitable. This graph shows big the turnaround from 2022 to now has been (numbers are in South African Rands):

Lesaka Consumer EBITDA (Lesaka Q1 earnings presentation)

EasyPay has 1.3 million grant recipients signed up, with a growth rate of 10% year over year as of Q1 of the 2024 financial year. Other KPIs are also trending up – average revenue per user per month is up from 74 to 83 South African Rands year over year, driven by growth in both insurance penetration and an boost in the loan book.

The question is how much advance EasyPay can grow. There are a total of ~12 million grant recipients in South Africa, with about ~6 million of those currently using the post service. Recent developments around SASSA and the post office may help EasyPay bring some of those over. The situation is not easy to forecast as an outsider, however, and also depends on hard to forecast political developments.

In Q1 of Lesaka’s 2024 financial year, the consumer arm generated ~$15 million in revenue and ~$2 million in EBITDA. Given EasyPay seems to be reaching the point where cost leverage really starts to show, continued growth in active accounts could produce outsized EBITDA growth. I see this as one of the catalysts for Lesaka in 2024.

Lesaka talks about having a “dual-sided ecosystem,” but there does not seem to currently be any terribly meaningful synergies between the consumer and merchant parts of Lesaka. If such synergies do exist, they’ve not been explained well.

Overall, my views on EasyPay are mixed. I think Lesaka is well-placed to see major customer and EBITDA growth for its consumer arm in 2024, but the business comes with inherent moral risks and political entanglements. As such, I find the merchant arm the more interesting part of the company. Lesaka management seems to have somewhat similar sentiments, at least they were keen to stress on their Q1 earnings call that “the majority of our focus from an M&A perspective is on the merchant business.”

Mobikwik

As a legacy from its past, Lesaka owns a stake in an Indian consumer fintech company called Mobikwik. This stake was originally acquired with the likely intent of monetizing it when Mobikwik went public. That was meant to happen in 2021, but a dismal IPO by fellow Indian fintech Paytm meant it got pulled and Lesaka was left with what current management clearly sees as a non-core asset.

Mobikwik has been making positive noises about trying to go public again in 2024 or 2025. This could help Lesaka free up capital to either deleverage or invest in their own operations.

Lesaka carries the Mobikwik stake at the original cost of $76 million on its balance sheet. That is probably optimistic, but even if Lesaka can only achieve $30-40 million for it, that is still significant when compared to Lesaka’s long-term debt of $130 million. I suspect the market currently gives very little value to the Mobikwik stake.

Lesaka also has a few other legacy equity positions beyond the Mobikwik one, but none of them are big enough to matter much.

The South Africa Factor

Investing in Lesaka also means investing in South Africa. That, at least to me, is a significant drawback to the story.

It seems fair to say South Africa is currently struggling with inflation running at ~6% and expected GDP growth of an anemic 0.9% in 2023. The South African economy also has a number of structural problems, not least the fact that the country is quite literally struggling to keep the lights on. The political situation also does not encourage confidence.

While Lesaka’s focus on the informal part of the South African economy, as well as EasyPay being explicitly aimed at the poorer parts of the population, does to some extent insulate the company from these pressures (there is not a lot of discretionary spending to pare back). However, that only goes so far, and clearly the economic situation is causing Lesaka headaches: they pulled their merchant credit product from the market in late 2023 blaming the economic situation, as mentioned above, which is the kind of problem you would expect in a high inflation and low growth scenario.

On the other hand, none of this is new, and the fact Lesaka has been able to perform their turnaround in these conditions is probably a good thing for the company long-term. One would assume this has required Lesaka to be very disciplined about both costs and capital allocation. For what is still a growth story, having such discipline might be helpful going forward.

Overall, I think the problems of operating in South Africa are already more than fully included in Lesaka’s share price, except perhaps the scenario where the wheels come off completely and the country goes down the Argentinian path of 100+% inflation and major political upheaval. I do not find that likely myself, but anyone investing in Lesaka should definitely consider the risks carefully.

Financials and Valuation

For the financial year of 2024, Lesaka has given guidance for revenue of ZAR 10.7 billion to ZAR 11.7 billion and adjusted EBITDA of ZAR 680 million to ZAR 740 million. Using current exchange rates, and using the midpoint of the guidance, that translates to revenue of ~$590 million and EBITDA of ~$37.5 million.

Leverage is reasonable with a ratio of 3.1x as of the latest quarter, with management indicating on the Q1 earnings call they expect to get to below 2.75x in the remaining three quarters of the 2024 financial year.

Lesaka currently has an enterprise value of ~$340 million. Given that and the guidance mentioned above, you can certainly make Lesaka look cheap if you apply aggressive “fintech multiples”. I don’t think that would be right, since while Lesaka is indeed growing, there are also some significant risks that need to be reflected in the valuation.

I think a reasonable EV/EBITDA multiple is ~12 reflecting the fact the company’s turnaround seems to be a success, its merchant arm showing steady growth and EasyPay potentially being able to see significant EBITDA growth if it can continue growing its account base and gain additional cost leverage. It also matches the multiple Lesaka themselves paid when acquiring the Connect Group.

An EV/EBITDA ratio of 12 combined with the midpoint of 2024 EBITDA guidance gives a target share price of ~$5 (about 40% above where it is currently trading). I do not think this is an especially heroic target, considering the share price hit $4.50 as recently as October.

Conclusion

Given the recent share price pullback, I think the risk/reward ratio is now favorable for investing in Lesaka. The company seems to be executing on its turnaround, and its merchant arm holds significant potential. Its consumer arm is profitable again and could see significant customer and EBITDA growth in 2024. A Mobikwik IPO might unlock a lot of value currently ignored by the market.

There are plenty of risks, not least around the South African economy in general. For my personal investment, I would look to exit if the macro situation in South Africa deteriorates advance and/or Lesaka’s recent return to profitability show signs of going into reverse.

On the other hand, there is also significant upside potential here, especially if Lesaka manages to ramp up growth for its merchant part in the coming year whether through M&A or organically. Lesaka has the kind of “growing fintech ecosystem” story that in the right market conditions can be granted quite high multiples.

Some patience may be required, as well as being willing to sit through turbulence. Lesaka is not the most liquid of stocks and so the share price can be prone to large swings.

Note: For anyone interested in Lesaka, I would propose watching this hour-long presentation by the CEO Chris Meyer from October. It provides a good level of detail on many of the things mentioned above, including on how the company sees synergies between its consumer and merchant arms developing.