Jovana Kuzmanovic

Elevator Pitch

Lenovo Group Limited (OTCPK:LNVGY) [992:HK] is rated as a Hold. My prior August 18, 2023 write-up was focused on the company’s below-expectations Q1 FY 2024 (April 1, 2023 to June 30, 2023) financial performance and its AI-related investments.

Lenovo is a proxy for the rising penetration rate of AI PCs. But Lenovo’s shares are at best fairly valued, so the AI PC investment has already been priced into the company’s stock price and valuations to a large extent. This explains why I have decided to maintain a Hold rating for Lenovo.

Lenovo’s shares can be traded on the Over-The-Counter market and the Hong Kong Stock Exchange. The mean daily trading value of Lenovo’s OTC shares for the past 10 trading days was $0.8 million as per S&P Capital IQ data, while Lenovo’s Hong Kong-listed shares boasted a 10-day average daily trading value of $60 million. Investors can buy or sell Lenovo’s shares listed on the Hong Kong Stock Exchange with US brokers such as Interactive Brokers.

Stock Price Outperformance Was Driven By AI PC Investment Theme

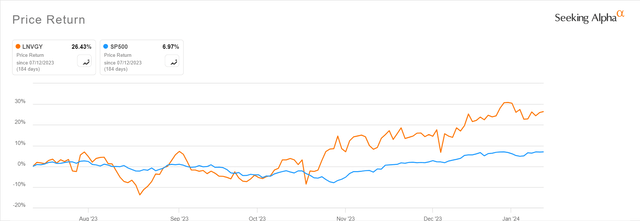

As per the chart presented below, Lenovo’s shares began outperforming the broader market as represented by the S&P 500 in November 2023.

LNVGY’s Six-Month Historical Stock Price Chart

I am of the view that Lenovo’s share price performance in the past few months has been boosted by the emergence of the AI PC investment theme.

In my earlier August 2023 update, I highlighted that LNVGY is ” is well-positioned to roll out new AI offerings in an aggressive manner” with an “incremental $1 billion being allocated to AI investments.” Lenovo Group subsequently outlined its views at its Q2 FY 2024 earnings briefing in mid-November last year that AI PCs “will be an inflection point for the PC industry, starting from 2024 and accelerating in 2025 and 2026.” LNVGY also disclosed at its most recent quarterly results call that it intends to “leverage generative AI to accelerate the launch of our next generation of AI devices, including AI PCs” in 2024.

Lenovo issued a media release in mid-December 2023 revealing that it plans to introduce “new business and consumer laptops designed to unlock new AI experiences.” At CES 2024 this month, a key technology trade show, Lenovo presented over 40 AI-related product offerings to the event’s participants.

According to its January 1, 2024 research report (not publicly available) titled “AI PCs Launching To The Market”, Goldman Sachs (GS) is forecasting that worldwide PC shipments will increase by +7% and +5% in 2024 and 2025, respectively with AI PC demand being a key growth driver. In contrast, PC shipments fell by -17% in 2022, and GS’ estimates point to PC shipments having declined by -13% for 2023. GS’ bullish projections are largely aligned with Lenovo’s expectations of AI PCs’ penetration rate potentially increasing from a single-digit percentage in 2024 to as high as 50%-60% by 2026 as per LNVGY’s management commentary at the Q2 FY 2024 earnings call.

In a nutshell, Lenovo’s Intelligent Devices Group business segment is likely to perform well in FY 2025 (April 1, 2024 to March 31, 2025) and FY 2026 (April 1, 2025 to March 31, 2026), thanks to the AI PC growth driver.

Analysts Are Overly Bullish On Lenovo’s Future Results

The current consensus financial estimates for Lenovo imply that the company’s revenue is expected to increase by +10.4% and +9.0% for fiscal 2025 (YE March 31, 2025) and fiscal 2026 (YE March 31, 2026), respectively as per S&P Capital IQ data. In comparison, Goldman Sachs’ forecasts suggest that PC shipments globally will grow by +7% and +5% for calendar years 2024 and 2025, respectively.

The sell side has very bullish expectations of Lenovo’s future financial performance, as analysts see the company growing faster than the overall PC market in the next two years. The consensus financial numbers for LNVGY also indicate that the company’s normalized earnings per share or EPS are forecasted to surge by +56% and +22% in FY 2025 and FY 2026, respectively.

It is important to note that there are other factors, apart from AI PCs, that affect Lenovo’s financial results for the years ahead, as LNVGY has a reasonably diverse revenue mix as detailed below.

Apart from its core Intelligence Devices Group business, Lenovo has the Infrastructure Solutions Group and Solutions & Services Group segments which accounted for 14% and 12% of the company’s 1H FY 2024 revenue, respectively in 1H FY 2024 as indicated in its interim results announcement. The company also highlighted in its Q2 FY 2024 earnings presentation that 40% of its Q2 FY 2024 top line was generated from non-PC products and services.

Revenue derived from Lenovo’s Infrastructure Solutions Group segment decreased by -23% YoY in Q2 FY 2024, which the company attributed to “headwinds from global economy slowdown” at its latest second quarter results briefing. It is natural for corporates to pull back on IT-related spending as economic conditions remain weak, so the near-term prospects of LNVGY’s Infrastructure Solutions Group business are expected to be challenging.

On the other hand, the YoY sales expansion for the company’s Solutions & Services Group business slowed from +18% in Q1 FY 2024 to +11% for Q2 FY 2024. The moderation in revenue growth for Lenovo’s Solutions & Services segment also has an outsized impact on the company’s overall profitability, as this business’ Q2 FY 2024 operating margin of 20.0% was significantly higher than LNVGY’s company-wide operating margin of 3.6% in the latest quarter.

I take the view that Lenovo’s actual FY 2025 and FY 2026 revenue and earnings might disappoint the market as explained above, notwithstanding the growth potential of AI PCs.

Valuations Have Factored In Positives For The Stock

Lenovo is currently valued by the market at a consensus next twelve months’ normalized P/E multiple of 12.8 times (source: S&P Capital IQ). I am of the opinion that Lenovo’s current valuations have sufficiently priced in the positives associated with AI PCs.

According to S&P Capital IQ’s valuation data, Lenovo has traded at a forward P/E range of 4.3-17.5 times in the past five years, which translates into a mid-point P/E ratio of 10.9 times. Lenovo is now trading a relatively higher 12.8 times forward P/E.

In terms of peer valuations, HP (HPQ) and Dell Technologies (DELL) are valued by the market at relatively lower consensus next twelve months’ normalized P/E metrics of 8.7 times and 11.8 times, respectively.

The PEG (Price Earnings-to-Growth) multiple for Lenovo is 1.02 times which is indicative of fair valuation, based on the stock’s forward P/E of 12.8 times and the consensus FY 2025-2028 normalized EPS CAGR projection of +12.6%.

In summary, Lenovo isn’t undervalued according to historical, peers, and growth rate comparisons.

Closing Thoughts

I retain my Hold rating for LNVGY. Lenovo is a good play on the AI PC investment theme, but its current valuations aren’t sufficiently appealing to justify a Buy rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.