gerisima/iStock via Getty Images

Investment Thesis

Years of lower sales, shrinking ROIC, and declining margins add to the many risks ahead for Leggett & Platt, Incorporated (NYSE:LEG). This Dividend King could even lose its crown if their situation does not improve.

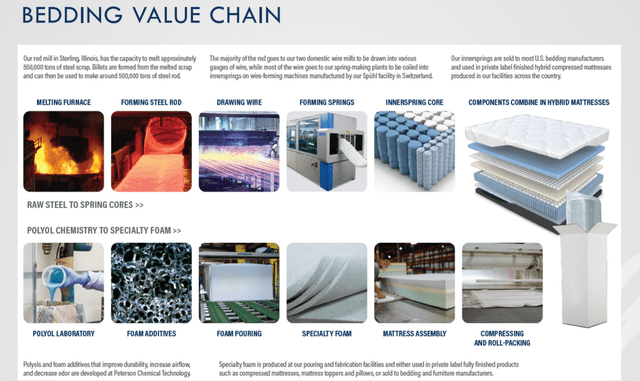

Bedding And Bedding Accessories

Leggett & Platt is a company that makes various consumer-discretionary products, particularly bedding products like mattress springs, adjustable beds, steel rods, and others.

They also offer home furniture products with recliner mechanisms, chair controls, and carpet cushions, among other things.

They round out their product line with more specialized products, such as automotive seat support, aerospace tubing, and hydraulic cylinders for industrial and transportation use.

Leggett & Platt Company Update 2024

The business might seem simple on the surface, but it actually has a relatively long value chain that combines many different materials into bedding components.

Long value chains are more complex to replicate by newer competitors and thus can further widen a company’s moat, especially with specialized know-how and more trade secrets.

Leggett & Platt Company Update 2024

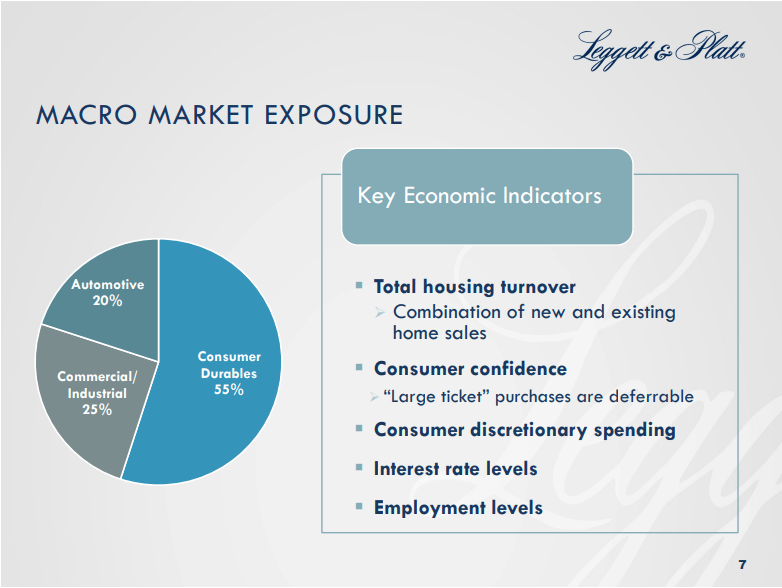

LEG is actually a rather diversified company, as they have facilities that produce bedding components for household use, automotive seat support, and even tube assemblies for the aerospace industry.

This diversification is positive, as the company can pivot into other areas more quickly than more specialized companies; it also opens up new opportunities for exploitation.

I believe it can benefit a company with broader expertise and could eventually lead to cross-innovations among the different product lines. For example, if the automotive department develops a more comfortable type of lumbar support, LEG could more easily translate this into a furniture or bedding product.

Having different sectors with different needs, such as commercial/industrial, consumer, and automotive, can help a company be more robust when a particular sector is facing problems.

I rate this as a net positive for the company.

Money Never Sleeps

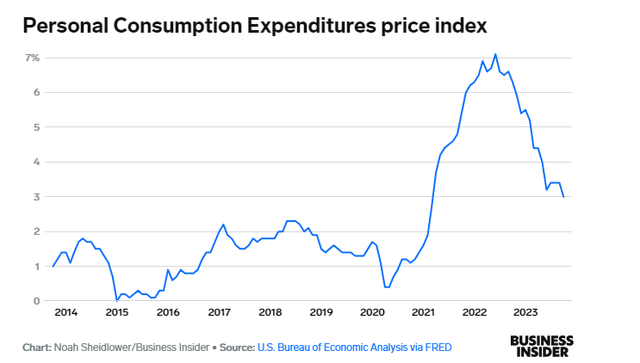

LEG is facing a rough patch in its sales. The consumer sector of household durables is more vulnerable to inflation and lower consumer expenditure than other consumer sectors. With lower demand for goods, furniture, and household durables, trends depend on a more positive economic environment.

Business Insider: Chart: Noah Sheidlower/Business Insider Source: U.S. Bureau of Economic Analysis via FRED

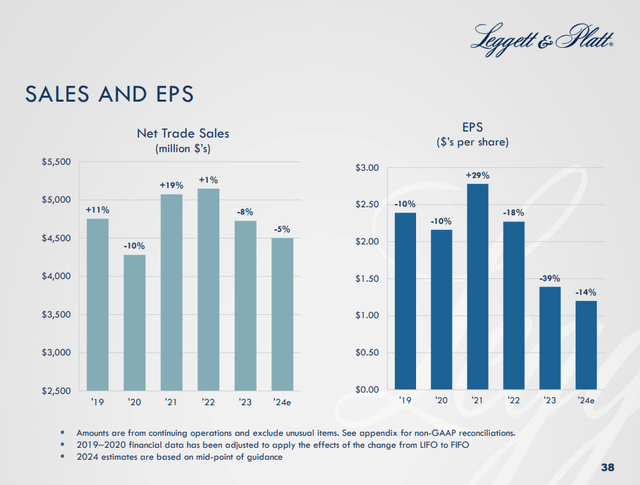

LEG has been a victim of this, having 2023 with a 7% decrease in sales and a 3% lower volume. The year 2022 wasn’t that hot either, with a 1% increase in sales vs. 2021 and 7% lower volume. Growth is sorely lacking for LEG. The company expects 2024 to be another year with lower sales and volume, ranging from 2% to 8% lower sales and a volume drop in the single digits.

Leggett & Platt Company Update 2024

We can see the correlation between consumer expenditures and LEG’s sales and EPS. The company needs a favorable trend.

This is probably the one main factor that influences the rest. LEG is not in a positive secular trend; the falling sales need a turnaround before it’s too late.

Steel, Wool, And Wood, The Basics Of Strong Beds

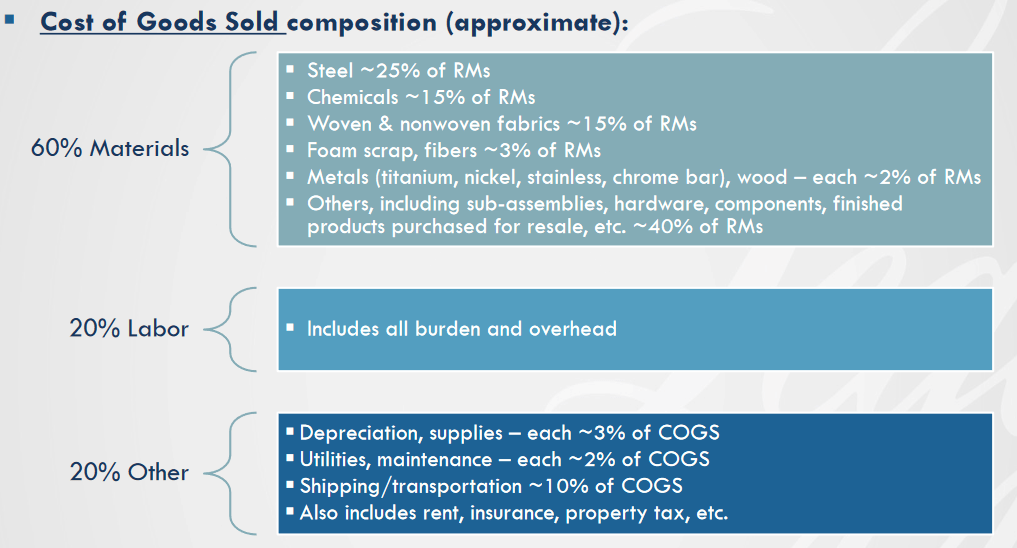

As previously stated, LEG has a rather long value chain that takes metals, fiber, plastics, chemicals, textiles, and foam scrap and turns them into either comfortable home and work furniture or useful automotive, industrial, or aerospace components.

The lion’s share of the costs of goods, of course, comes from materials, with 60% of the costs, in fact, with 15% of the overall costs of goods coming from steel.

The company’s exposure to risk comes in the form of market fluctuations that could push the price of the necessary materials into an unsustainable range. Steel, in particular, seems to be a prime target for tariffs and commercial conflicts between its leading producers.

Leggett & Platt Company Update 2024

I rate this as a possible risk that could compound the other problems and keep pushing the profitability targets further away.

The Comforts Of Efficiency

LEG is not in a comfortable position right now, with problems in its capacity to turn gross profit into net income.

Leggett & Platt Company Update 2024

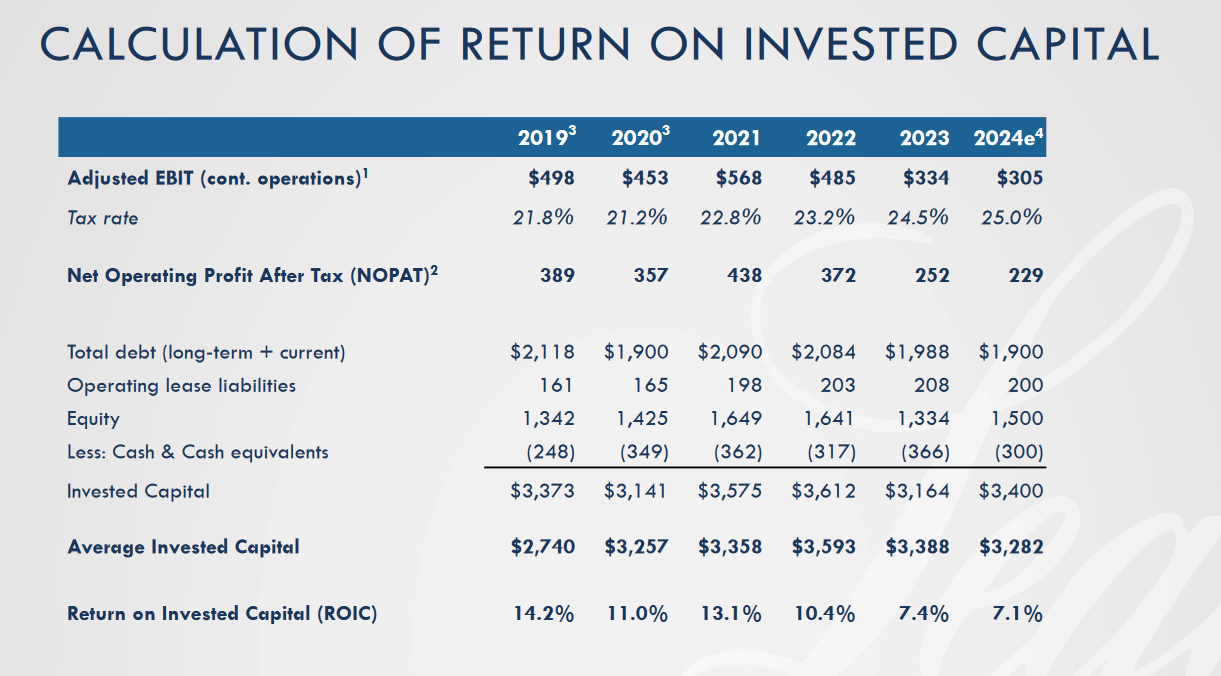

The ROIC, a vital metric for understanding how efficiently a company is using its capital, has been on a steady downtrend since 2019. This is not something investors want to see. Ideally, a company would increase its ROIC with time as it streamlines its operation and negotiates better deals with suppliers and buyers, among other things that improve the margins.

Comparing the ROIC with the WACC, we can understand whether or not the company is creating value. With a WACC of 7.51%, LEG is not creating value at the moment.

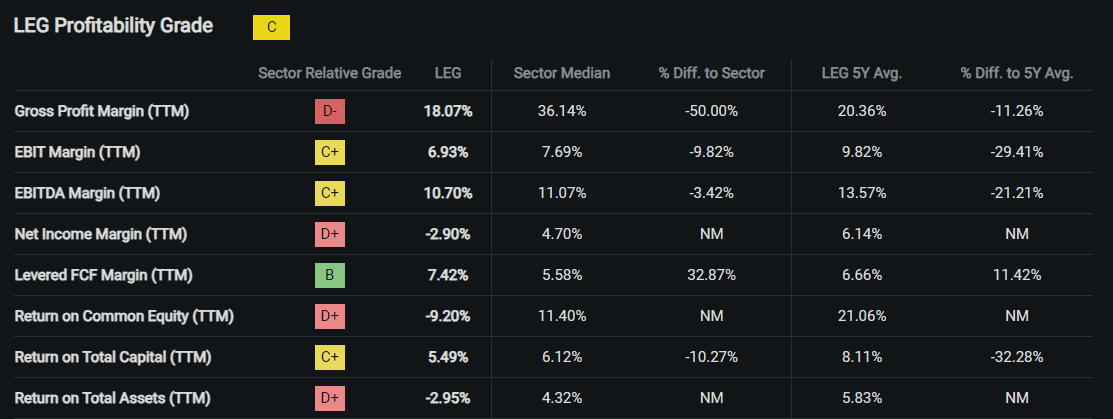

Seeking Alpha Quant

Their gross profit margin is 50% lower than their peers, and the ROTA (return on total assets) is -2.95%. However, the levered FCF margin is 32.87%, superior to the sector’s.

While the company has issues with a low gross profit margin and a negative ROTA, at least it retains cash after paying all debts at a higher level than other companies in its sectors. Overall, the picture is not very positive, and LEG currently depends on the success of the restructuring plan to become profitable again.

The Restructuring Plan

LEG’s management has recognized the company’s situation and has taken steps toward a bold restructuring plan. The plan focuses on innovation and higher value, specifically in the bedding products area. While cutting down on less profitable locations, this leaning down will bring LEG from 50 manufacturing and distribution locations to around 30 to 35.

I believe this is a step in the right direction for any company facing unfavorable headwinds and lower margins. It should take steps to reduce costs and focus on creating more value.

This plan may take until 2025 to finalize, although there is always the risk of delays when trying to cut down.

This is one of the biggest sales points for any bullish thesis on LEG, yet it hinges on the company completing this process and ending up with a more efficient, more streamlined business.

The necessity of this plan is clear from the previous points. Still, I do believe this can potentially compound the risks ahead for LEG, as any significant delays could prolong the date of finally having a profitable business.

2024 will probably be another year with negative growth, so LEG must really make the restructuring plan go right if they aim for positive growth in 2025.

A Dividend Worthy Of A King

Uneasy lies the head that wears a crown.

-William Shakespeare

LEG is a dividend King, which means that instead of “just” 25 years of rising dividends, it has been increasing their yearly dividend for 50 years straight.

In regard to the dividend elite, most dividend aristocrats and kings do not have exceptionally high dividends. Instead of higher yields, investors can find the safety of a long track record in a mature company.

Here, LEG stands out, as it currently has the highest dividend yield of the dividend kings, 9.69%, which is 3.4X times above the Kings’ average yield of 2.85%.

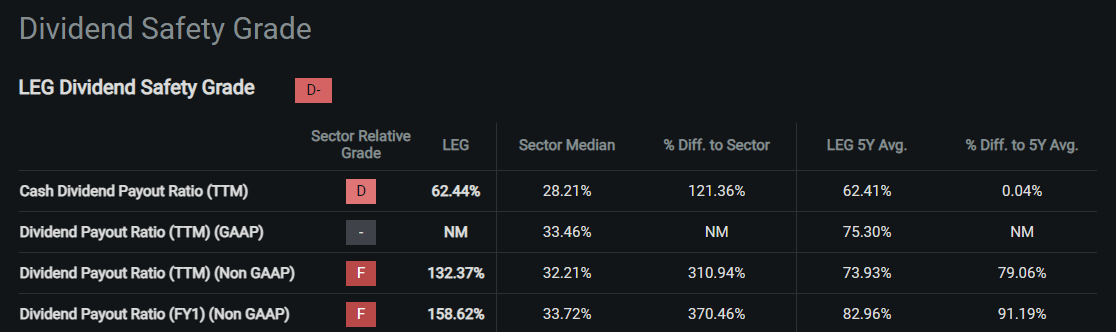

The company has a Dividend Per Share of $1.82 and Earnings Per Share of $-1; clearly, the dividend is not covered. Moreover, the status of LEG as part of the dividend elite is threatened. The company has low or even negative prospects for earnings growth and a payout ratio of -182% if we use Earnings.

Earnings are a rough measure of what the company makes in a year, and they include many items that are not necessarily a good measure of the company’s performance.

Seeking Alpha Quant

Using the Cash Dividend Payout Ratio or the Dividend Payout Ratio (Non-GAAP), LEG is still way worse than its peers. The lower end of the scale places LEG at 370.46% worse than its competitors in terms of its capacity to continue funding the dividend.

I believe Seeking Alpha Quant’s Safety Grade of D- is an obvious sign that the dividend might be attractive for its yield but should be closely monitored for its safety, lest it become a dividend trap.

It is a big possibility that the stock would plunge if the dividend king category were lost, which is a genuine possibility, considering the previous lack of sales growth and shrinking margins.

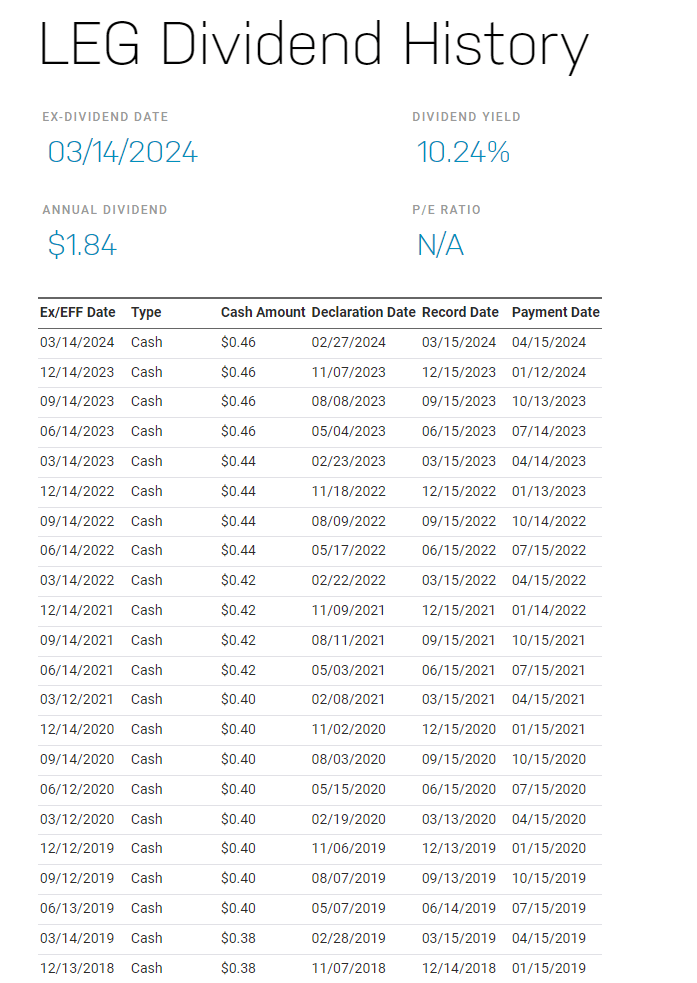

NASDAQ Website LEG Dividend History

Based on its history of dividend raises, I believe LEG will continue in 2024 with a dividend raise of 0.02 and in 2025 with a similar 0.02 raise, thus maintaining its dividend king status but worsening the company’s overall financial situation.

The Cheapest Dividend Yield Among The Dividend Nobility

Valuation is where any investment thesis in favor of LEG shines. The company has the cheapest dividend yield pound-for-pound of any Dividend King.

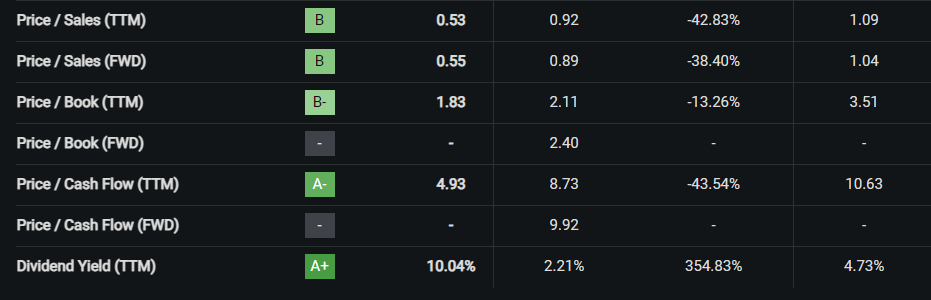

Seeking Alpha Quant

The company offers an attractive valuation compared to its peer in 4 key areas:

- Price To Sales

- Price To Cash Flow

- Price To Book

- Dividend Yield

The Price To Sales is very attractive at 0.55, 38.40% below the rest of the sector; the Price To Book stands at 1.83, and the price to cash flow is also low at 4.93, making it 43.54% cheaper than its peers.

From this, we can say that the LEG stock offers an interesting valuation in some of a business’s most important areas. I think the two best things to consider are the low price to sales and low cost to cash flow, as both are two of the most important things that should be considered when buying a stock.

In the past, such as in the dot-com bubble, when sky-high prices of stocks were the norm, glancing at how much a possible buyer would pay for each dollar, the company made in sales could have helped avoid some of the worst examples of overvaluation.

The same thing applies to Cash Flow. As Warren Buffett says, “Cash is King.” Paying less for more cash flow is always better, and again, in bubbles, companies will have insane valuations, with buyers paying for each cash flow dollar in the dozens or even hundreds.

The Price To Book is also a net positive for LEG; as a company that produces goods, a low P/B proves that we are not in front of a string of costly (to investors) buildings and machines.

Many investors could be thinking now: “But isn’t value investing about finding cheap stocks?”

To quote Warren Buffett: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

LEG’s attractive ratios are based on comparisons with the rest of the market, such as a Price to Sales of 0.52 and a forward P/E of 13.91, but in light of the company’s overall performance, it is clear that we are, in fact, in front of a losing company with a relatively low price and not a great business at a fair price.

Insider Trading

My interest peaked when I saw the term “Skin in the game,” which Warren Buffett popularized. It refers to the importance of aligning the company’s higher-ups’ incentives with the business. I decided to do a quick search of stock trading by management. Of course, this information is public and needs to be registered with the SEC.

Leggett & Platt COMPANY UPDATE November 2023

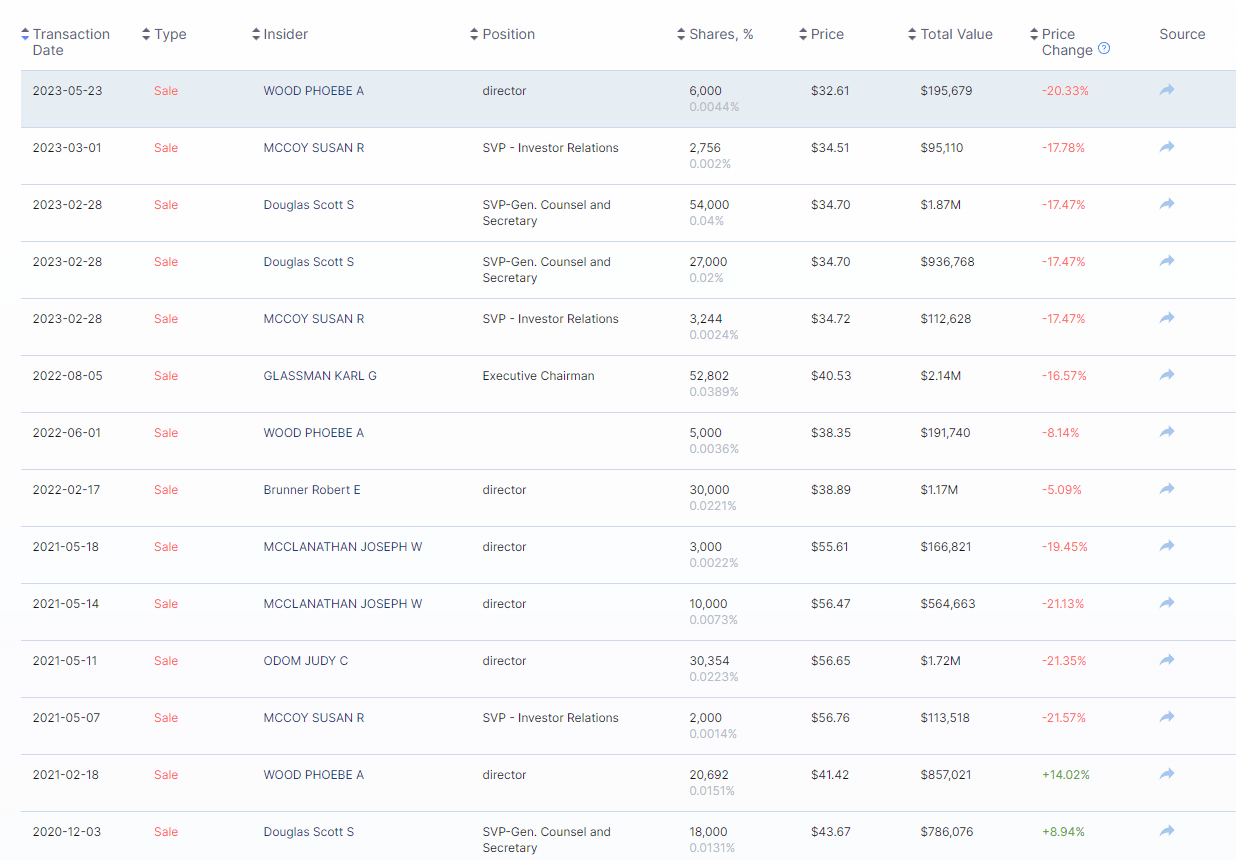

I decided to search and see how many people in this company were trading the stock. In fact, I had to go back to 2015 before I could find a buy. Now, selling stock by management is a natural and normal part of business. Many supplement their salary with the sales of their stock compensations, but it can bring into question how much skin in the game management really has.

Prismo.pro

Competitors

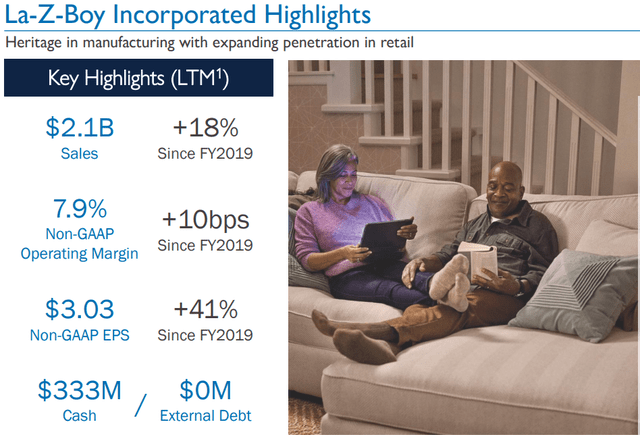

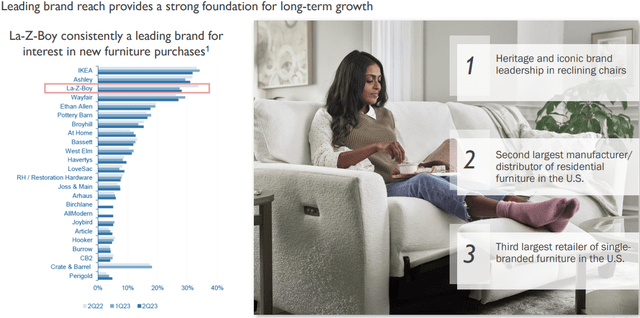

Their biggest rival is probably La-Z-Boy (LZB), a company with pretty strong branding and growing sales since 2019.

LA-Z-BOY Investor Presentation

In fact, the largest strength of LAZB is its powerful brand, which it could continue to leverage with the goal of continually increasing its market share.

LA-Z-BOY Investor Presentation

One advantage LEG has over LAZB is its broader diversification, which could allow pivoting for LEG if the competition starts eating into its market share.

Yet, the case stands that LEG has a pretty strong rival, with superior branding and growing sales.

Capital For Innovation, Capital For Growing

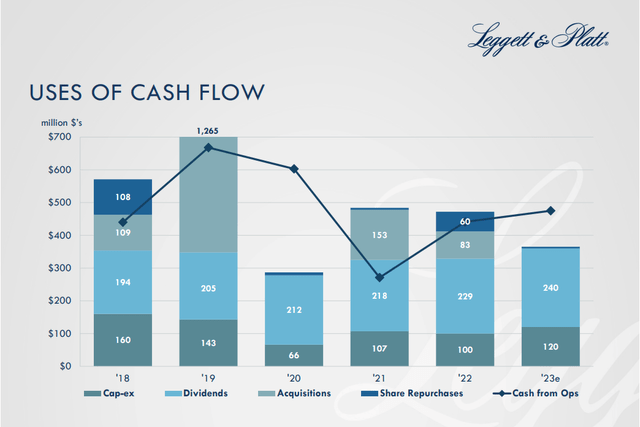

Due to the lack of sales growth, lower ROIC, and the high dividend that must be paid, there is a real chance that cash will flow in an ever-greater proportion towards dividends and away from the necessary CAPEX and high-quality acquisitions that could help the company innovate and grow.

Leggett & Platt COMPANY UPDATE November 2023

If the restructuring plan does not come to fruition in the scheduled time and within the limits of the budget, this could once again compound all the previous problems and might start a spiral that could require more drastic measures.

I rate this as the most significant risk for the company.

Conclusion

I rate LEG as a SELL. The valuation might be cheap, but the prospect of years ahead of negative growth, years of returns and margins on a downtrend, and a mixture of risk really make this stock a SELL for me. I think all the previous problems can potentially pile up on each other and keep dragging this company down.

The margin of safety could become more attractive in time, and if the conditions improve and growth materializes, a revision could be in order.