Pla2na/iStock via Getty Images

The Direxion Daily S&P Biotech Bull and Bear 3X Shares (NYSEARCA:LABU) provides investors 3x daily exposure to a broadly diversified biotechnology index.

Levered ETFs admire LABU are designed to track their underlying indices over a 1-day horizon. Longer holding periods will unveil significant tracking error from positive convexity and volatility decay. Traders interested in the LABU ETF should first make sure they fully grasp the risks involved with levered ETFs by consulting FINRA and SEC warnings.

Despite the risks involved, nimble traders can take advantage of LABU’s positive convexity as a swing trading tool. With financial conditions loosening, there is a macro tailwind behind biotech stocks that may help long-investors. However, due to the heightened volatility and risks of drawdowns, these levered ETFs are not recommended for novices.

Fund Overview

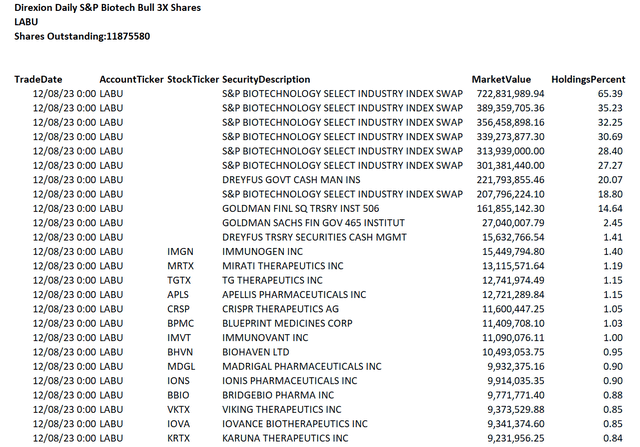

The Direxion Daily S&P Biotech Bull and Bear 3X Shares seeks daily returns that are 3x the return of the S&P Biotechnology Select Industry Index (“Index”). The fund achieves this levered return by holding the stocks underlying the index and entering into total return swaps with the large investment banks that are reset nightly (Figure 1).

Figure 1 – LABU portfolio holds total return swaps and stocks (Author created with portfolio holdings report)

Levered ETFs Only Designed To Work On Short Time Horizons

Investors considering the LABU ETF should be mindful that levered ETFs only works as intended on short-period time frames. When we start to look beyond the 1-day horizon, volatility and convexity will start to unveil tracking error.

For example, if we started off with $100 invested in LABU, if the index returns 5% on day 1, the position will grow to $115 (3 times 5% return). If the index returns 5% again on day 2, the position will grow to $132.25, more than three times the theoretical 2-day compounded return of 10.25% or $130.75.

Conversely, if the index returns were consecutive -5%, then the initial investment will end up at $72.25, versus a three times the 2-day compounded loss of 9.75% or $70.75.

Finally, if the return go through is +5% followed by -5%, investors end up with $97.75, significantly less than the three times the 2-day compounded loss of 0.25% or $99.25. This ‘decay’ is from volatility.

It is important to recollect levered ETFs have ‘positive convexity’ in the direction of its bet (i.e. the exposure grows as the bet is winning), and it loses value from ‘volatility decay’.

Levered Long ETFs As Swing Trading Instruments

However, levered ETFs are not necessarily bad investments. They can be useful tools for sophisticated investors. Some swing traders admire to use levered long ETFs admire LABU precisely because of its positive convexity. For example, from its recent October 27th lows of 4,991, the underlying index is up 23.8% (Figure 2).

Figure 2 – S&P Biotechnology Select Industry Index returns (spglobal.com)

However, the LABU ETF, in contrast, has returned 78.7%, more than three times the underlying 23.8% return (Figure 3). This difference is due to the positive convexity mentioned above.

Figure 3 – LABU has returned more than 3x underlying returns since October 27th low (Seeking Alpha)

In extreme circumstances when the underlying index rallies mostly one-way for a long period of time, levered ETFs admire LABU can deliver truly extraordinary returns.

From its COVID lows of 5,142 on March 18, 2020, the S&P Biotechnology Select Industry Index gained 163% to 13,513 on February 8, 2021. However, due to positive convexity and the minimal drawdowns, the LABU ETF gained an incredible 1,147% (Figure 4)!

Figure 4 – LABU returned more than 11x from March 2020 to February 2021 (Seeking Alpha)

The challenge, of course, is to figure out when to enter these swing trades and when to take profits, as the position size can grow very quickly, and if profits are not taken along the way, they can disappear just as quickly on pullbacks because drawdowns are magnified by the leverage.

For example, even though the LABU ETF returned more than 11x from March 2020 to February 2021, if investors had bought at the absolute COVID lows from March 18, 2020 and held until today, they would still have lost almost 70% of their capital (Figure 5).

Figure 5 – However, LABU is down 70% when measured from COVID lows (Seeking Alpha)

Focus On Developing A Trading System Before Considering Leverage

Before investors venture into levered ETFs in explore for treasure, they should have a consistent trading system/strategy that can deliver profits on unlevered assets. The leverage from levered ETFs admire LABU is a tool that only enhances the underlying trading returns, be it positive or negative.

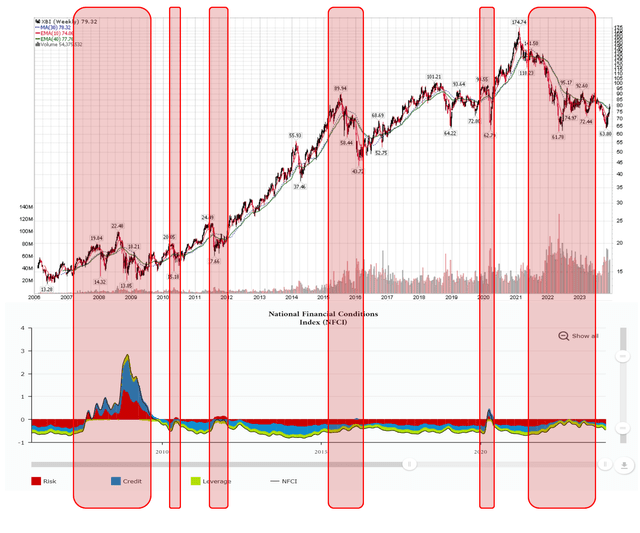

Loosening Financial Conditions A Tailwind For Biotech

Biotech companies are usually pre-revenue hyper-growth companies and are dependent on well-functioning capital markets and loose risk-appetites to finance their operations. When financial conditions tighten, equity financing becomes scarce and biotech stocks tend suffer. We can see this relationship graphically by overlaying the SPDR S&P Biotech ETF (XBI) against the Chicago Fed’s National Financial Conditions Index. When financial conditions tightened admire they did in 2008-9, 2011, 2015-2016, 2020, and more recently, biotech stocks usually struggle (Figure 6).

Figure 6 – Biotech stocks suffer when financial conditions tighten (Author created with price chart from stockcharts.com and data from Chicago Fed)

More recently, despite the Fed claiming to tighten monetary policies to combat inflation, financial conditions have actually been gradually loosening, with November 2023 readings back to early 2022 levels.

Loosening financial conditions is reigniting animal spirits, as seen from the recent rally of cryptocurrencies to speculative stocks admire biotech. As long as financial conditions remain loose, biotech stocks should have a tailwind.

Conclusion

In conclusion, levered long ETFs admire the LABU only deliver their stated levered returns over a 1-day horizon. Holding periods longer than 1-day will see significant tracking error due to positive convexity and volatility decay. Traders should be mindful of these risks when considering levered ETFs.

Biotech stocks are benefiting in the short-term from loosening financial conditions. As long as these conditions persist, the LABU ETF should continue to have a tailwind.

Although I am personally hesitant to trade levered ETFs admire LABU, nimble sophisticated traders may look to capitalize on the improved risk sentiment by swing trading the LABU.