DavidBGray

A Quick Take On Kyverna Therapeutics

Kyverna Therapeutics, Inc. (KYTX) has filed to raise $100 million in an IPO of its common stock, according to an SEC S-1 registration statement.

The firm is a clinical-stage biopharma developing treatments for various autoimmune diseases.

When we learn management’s pricing and valuation assumptions, I’ll provide an update.

Kyverna Overview

Emeryville, California-based Kyverna Therapeutics, Inc. was founded to develop gene-based treatments and CAR T-cell treatments for serious diseases such as lupus, systemic sclerosis, myasthenia gravis, multiple sclerosis, irritable bowel syndrome and other various indications.

Management is headed by Chief Executive Officer Peter Maag, Ph.D., who has been with the firm since October 2022 and was previously Executive Chairman of CareDx (CDNA) and, prior to that, was President, Novartis Diagnostics.

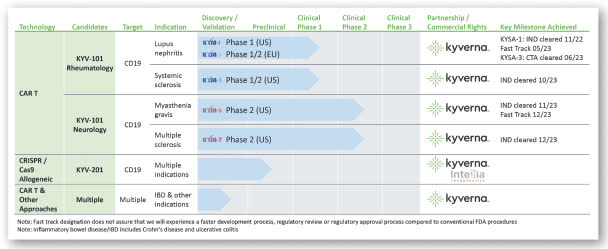

The company’s lead program, KYV-101 Neurology, is in Phase 2 trials for the treatment of myasthenia gravis and multiple sclerosis.

Below is the current status of the company’s drug development pipeline:

SEC

Kyverna has booked fair market value investment of $184.1 million as of September 30, 2023, from investors, including Northpond Ventures, Westlake BioPartners, Vida Ventures, Gilead Sciences, RTW Investments, jVen Capital and Bain Capital Life Sciences.

Kyverna’s Market & Competition

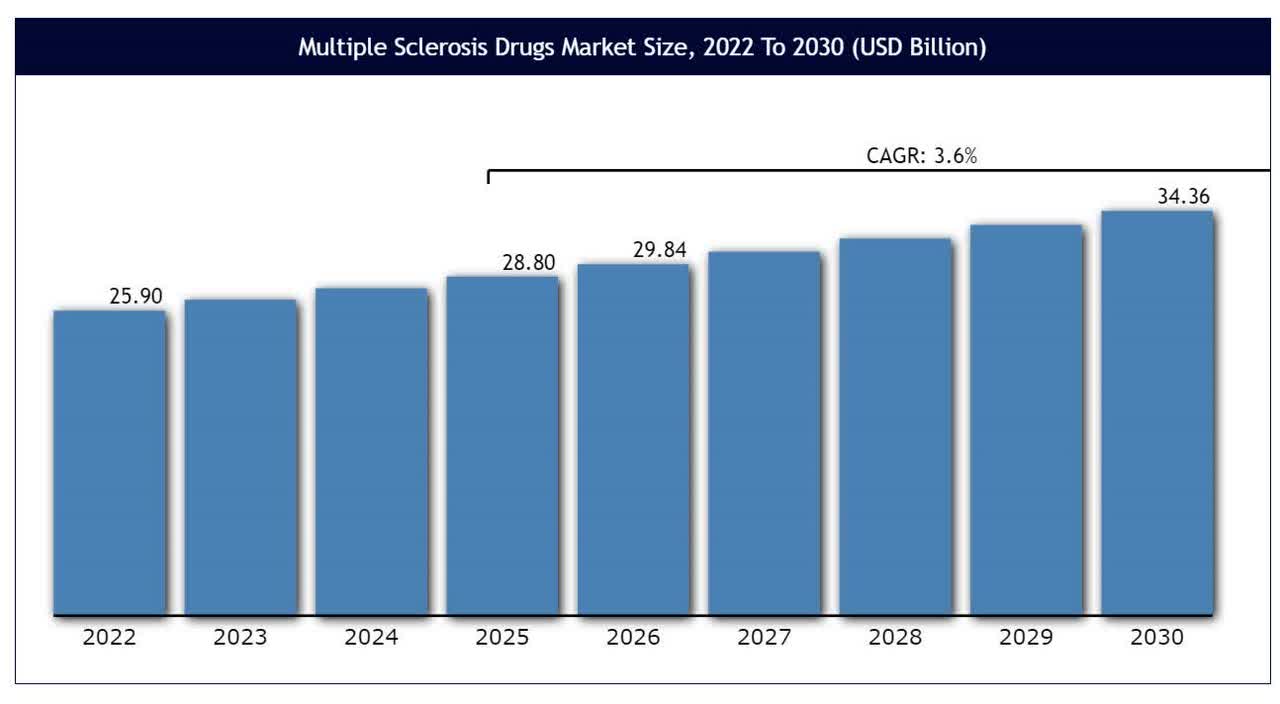

According to a 2023 market research report by Vantage Market Research, the global market for multiple sclerosis treatments was an estimated $25.9 billion in 2022 and is forecasted to reach $34.4 billion by 2030.

This represents a forecast CAGR (Compound Annual Growth Rate) of only 3.6% from 2024 to 2030.

Key elements driving this expected growth are an increasing prevalence of the disease as a function of a growing elderly population worldwide.

Also, the chart below shows the historical and projected future growth trajectory of the multiple sclerosis treatment market from 2022 to 2030:

Vantage Market Research

In 2021, the North American region dominated the market in terms of market demand.

Major competitive vendors that provide or are developing related treatments include the following companies:

-

Roche Holding AG

-

AbbVie

-

Johnson & Johnson

-

Bristol-Myers Squibb

-

Novartis

-

Polpharma Biologics

-

Genzyme

-

Teva Pharmaceuticals

-

Others

The company is also developing drug treatments or gene-based therapies for other serious health conditions.

Kyverna Therapeutics’ Financial Status

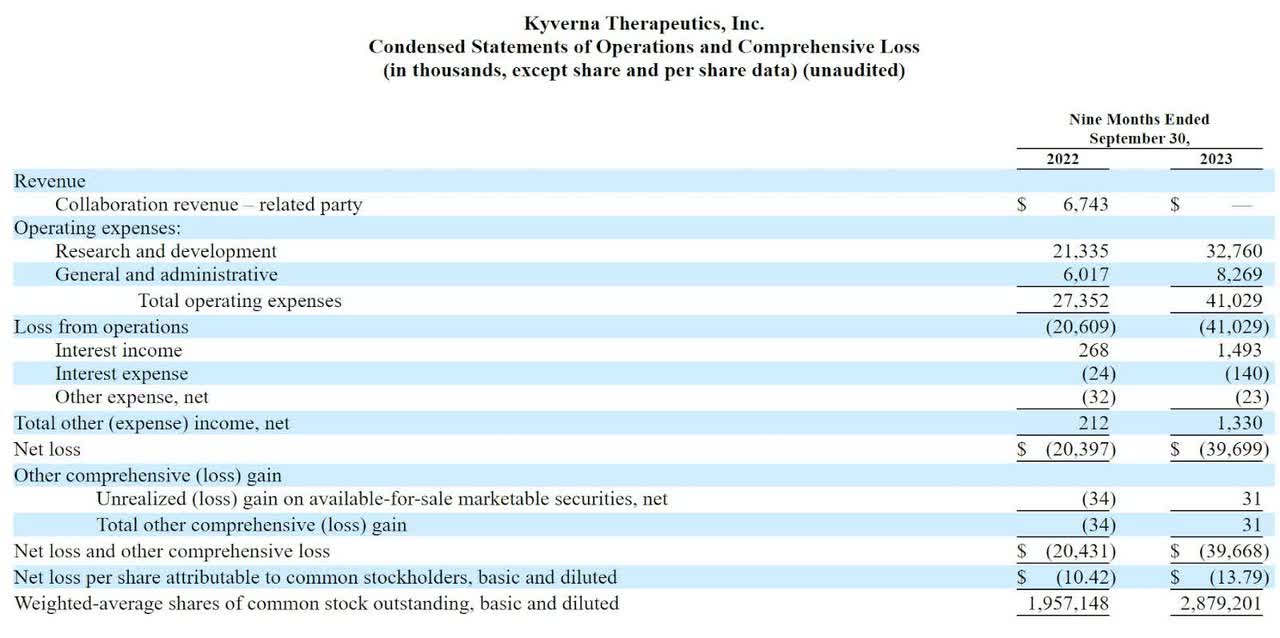

The firm’s recent financial results are normal for a development-stage biopharma in that they feature little or no revenue and significant R&D and G&A expenses associated with its pipeline advancement efforts.

Below are the company’s financial results for the indicated periods:

SEC

As of September 30, 2023, the company had $77.3 million in cash and $23.7 million in total liabilities.

Kyverna Therapeutics, Inc. IPO Details

Kyverna intends to raise $100 million in gross proceeds from an IPO of its common stock, although the final figure may differ.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Management has indicated the company is an ‘emerging growth company’ and a ‘smaller reporting company.’

These designations enable the firm to disclose materially less information to shareholders.

Assuming a successful IPO, the company’s market capitalization at IPO would likely be in the range of $200 – $300 million, excluding the effects of underwriter over-allotment options.

Management says it will use the net proceeds from the IPO as follows:

to advance clinical development of KYV-101, our lead product candidate, in two broad areas of autoimmune disease: rheumatology and neurology;

to advance KYV-201 through preclinical development and into clinical development; and

the remainder to fund expenses associated with our research and development and additional clinical development, and for general corporate purposes, working capital and capital expenditures.

We may also use a portion of the net proceeds to in-license, acquire, or invest in complementary businesses, technology platforms, products, services, technologies or other assets. However, we do not have any agreements or commitments to enter into any material acquisitions or investments at this time.

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the company is not currently a party to any legal proceedings that it believes would have a material adverse effect on its financial condition or operations.

Listed bookrunners of the IPO are J.P. Morgan, Morgan Stanley, Leerink Partners and Wells Fargo Securities.

Commentary About Kyverna’s IPO

KYTX is seeking U.S. public capital market investment to advance its pipeline of drug treatment candidates through and into clinical trials.

The firm’s lead candidate, KYV-101 Neurology, is in Phase 2 trials for the treatment of myasthenia gravis and multiple sclerosis.

The market opportunity for treating multiple sclerosis is quite large and is expected to grow due to an aging global population. Markets for the firm’s other disease targets are also large to varying degrees.

Management has disclosed a pharma firm collaboration with Intellia Therapeutics for its gene therapy candidate KYV-203 for multiple indications. The candidate is still in the preclinical stage of development.

The company’s investor syndicate includes a number of institutional life science venture capital firms and biopharma company Gilead Sciences as a strategic investor.

KYTX appears to be reasonably well-capitalized given its stage of development, although the company will likely need to raise additional funds to pursue advanced trials for its pipeline since Phase 2 and Phase 3 trials are substantially more costly than Phase 1 safety trials.

Also, the firm is active in developing gene-based treatments, which the US FDA has been slow to approve in other cases.

This has been due to the characteristic of these powerful techniques to produce unintended genetic modifications with catastrophic results.

When we learn more IPO details from management, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.