SrdjanPav/E+ via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the SPDR S&P Regional Banking ETF (NYSEARCA:KRE) as an investment option at its current market price. This is a fund with an objective to “provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P Regional Banks Select Industry Index”.

I regularly review the banking sector as a whole, with a focus mostly on large-cap banks. But regional banks are also on my radar, especially given the volatile year they had in 2023, as well as the fact that this is a sector that historically offers an above-average yield. Nevertheless, I have been cautious on this theme for a while, including when I reviewed it last year. I saw limited potential for KRE and have been proven right in the interim:

Fund Performance (KRE) (Seeking Alpha)

Clearly, KRE has been a weak spot. Even with its run-up since late last year, this fund is dramatically under-performing the broader market. At first glance this could look like a buying opportunity – and I would understand that sentiment. However, I see a number of different headwinds that make me reluctant to put down my hard earned cash with this equity play. I will explain each in detail below.

The Commercial Real Estate Headwind

One of the primary reasons for my caution on this sector has to do with the difficulties facing the commercial real estate sector. With job cuts, hybrid (and fully remote) work, as well as a flight out of urban areas, commercial real estate has seen a difficult environment over the past few years. I see that continuing, and it is pressuring regional banks in a big way.

But, wait – you say – this is an article about regional banks, not commercial real estate. So what gives?

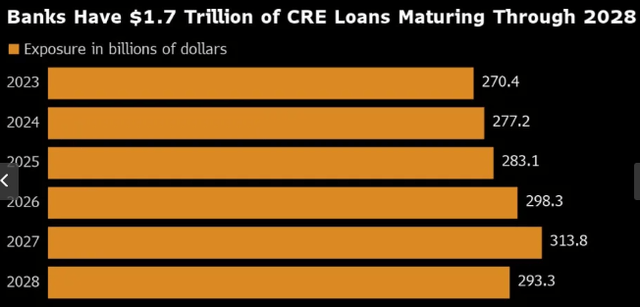

The answer is that regional banks hold a big percentage of the total amount of the $1.7 trillion in commercial real estate debt held by US banks as a whole that is coming due in each calendar year this decade:

Commercial Real Estate Debt (Bloomberg)

This means that the margins and profits of US banks large and small are impacted by the performance of these loans. Throughout 2023, this has not been a good thing, as regional banks like Silicon Valley Bank and First Republican bank failed.

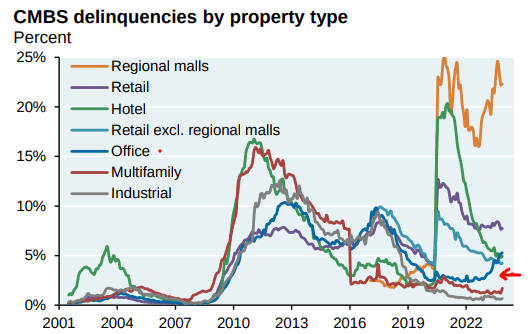

Looking ahead, this is a headwind that is impacted by multiple factors. One, as interest rates rise, this is pressuring the property values over commercial buildings, as well as other real estate assets. For office space in particular, vacancy rates have risen substantially. This means that values are dropping for two reasons – higher cap rates and also the fact that demand is down. This is not unique to commercial real estate by any means, as regional malls and retail space is also seeing an uptick in vacancy rates. But the acceleration of the office space vacancy rate in the near term is my big concern:

Delinquency Rates by Sector (JPMorgan Chase)

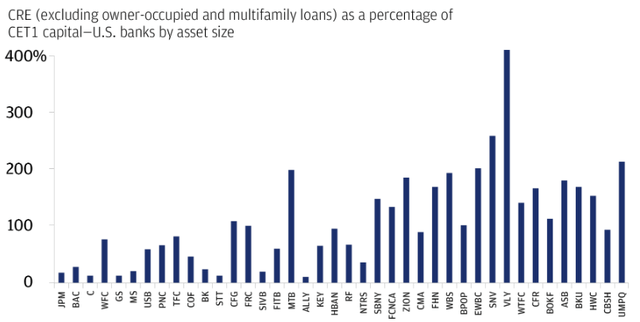

This is raising solvency risks for potentially hundreds of US banks, but as mentioned above, it has a disproportionate impact on smaller (regional ones). This is critical to understand because I am not a “bear” on the Financials sector in total. But for me if I want banking sector exposure, I will focus on the large-cap names rather than the regionals. Part of this determination was made because smaller banks are more exposed (as a percentage of total assets) to the woes of the commercial real estate sector than their large-cap peers:

CRE Exposure (By Bank) (Federal Reserve)

As you can see, with the exception of Wells Fargo (WFC), the largest banks have minimal exposure to this sector. Meanwhile, the regionals (at the far right of the chart) have substantial exposure here. I believe this is a major problem in 2024 because I see these challenges remaining top of mind and probably getting worse, not better. Even if interest rates decline they will be elevated for the first half of the year and office delinquencies are not going to suddenly reverse. In fact, if we see a recession, those rates are only going to get worse. This will stifle lending at regional banks and cause them to have to write-down the assets on their books. None of this is an investable scenario in my view.

Banks Are Preparing For Losses

While the last paragraph is quite bearish, I will take this moment to pause. This is not meant to be an apocalyptic review, and I don’t want to give that impression. There are positives to the banking sector – large and small alike. While I see headwinds that make the sector un-investable for me, I would be doing a disservice if I didn’t present the facts in a rational way.

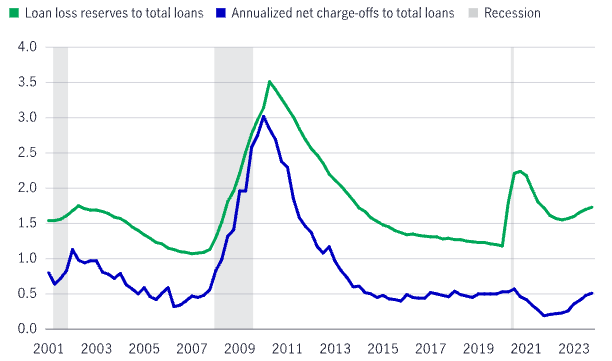

To start with, I want to illustrate that while declining real estate values are a major pain point, they are unlikely to cause more widespread panic. I see Silicon Valley and First Republic as exceptions, not the rule, and believe even smaller, regional lenders are prepared to handle some volatility in this space. The reason for this belief is that the banking sector has ramped up loan loss provisions aggressively in 2023 (on the backdrop of those bank failures). What this looks like in practice is that while charge-offs (losses) are on the rise, banks are capitalized well enough to absorb these losses:

Reserves & Net Charge-Offs (US Banks in Aggregate) (FDIC)

What this illustrates to me is that while losses are rising, banks have been anticipating this and should be able to handle it relatively smoothly. That is central to why I am not an outright bear on this sector – or the individual companies that underlie KRE’s portfolio.

However, just being able to “absorb” losses is not a real enticing investment case. I am differentiating from the fact that these companies can manage this environment against being a fundamentally strong buy argument. Will regional banks go bust because of commercial real estate loans? Based on their preparedness, it doesn’t seem likely. But not going bust isn’t how we find “alpha” – we find it some compelling growth stories. I don’t see that being the case here, so I want to manage expectations on how good this metric really is.

Priced For Trouble

Expanding on the prior paragraph, I recognize the challenges facing regional banks are not exactly unknown. They garnered quite a bit of press last year due to some failures and have remained top-of-mind in many investment discussions and forums. So while I am using this space to reiterate my concerns, I am certainly not the only one!

I bring this up because KRE is priced quite cheaply. Looking at the current P/B and P/E ratios, I see a fund that has some bad news baked in:

Current Valuation Metrics (KRE) (State Street)

This is clearly much cheaper than the broader market (as measured by the S&P 500) and should limit some downside if market or sector volatility picks up going forward. While I think this cheapness is warranted to a degree and I don’t see this as a “value opportunity”, I would emphasize this is not an expensive sector to own. For a contrarian thinker who is more optimistic than me on the opportunity for regional banks in 2024, this valuation metric could be enticing. In my view, I don’t want to get sucked into buying struggling companies just because they appear cheap, but that is a subjective argument. Others may draw a different conclusion and it is important to give this metric some consideration.

Banks Now Want Lower Rates?

Another important headwind from 2023 that continues to this day is the fact that regional banks have seen their deposit costs rise as a result of higher benchmark rates from the Fed. While initially higher interest rates were seen as a good thing – and they were – some of that effect is wearing off with year-over-year comparisons getting difficult to beat.

What I mean is, as rates stayed high, regional banks were forced to increase what they paid in interest to draw in deposits. While large-cap banks kept deposit rates quite low, regional banks have to compete more aggressively for customers. But, simultaneously, the levels they were able to charge for loans hit a ceiling. The regional failures discussed earlier accelerated this upward deposit re-pricing activity as smaller institutions had to convince customers their deposits were safe – and pay them more to convince them!

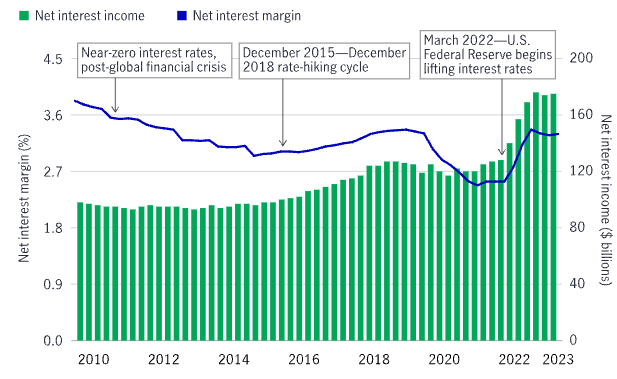

The net result of this is that now regional banks are actually hoping for the Fed to cut rates so they can begin to pay less to hold deposits. This is a far cry from the days when investors (and bank executives) were looking forward to higher rates because net margins would improve. While that initially did happen, margins have plateaued as I mentioned:

Net Income and Margin for US Banks (Aggregate) (Goldman Sachs)

This is why earnings reports haven’t excited investors. There has been an acceleration in costs related to layoffs, FDIC insurance, and deposits, but at the same time margins are stagnating due to credit losses and loan-interest ceilings. Similar to the credit loss provision metric I mentioned previously in this review, this is not an investment story that I can get behind.

And this is not just my opinion. During M&T Bank’s (MTB) fourth quarter earning’s call last week, CFO Darryl Bible was quoted:

Its CFO, Daryl Bible, told analysts that lower rates would help its commercial lending and investment banking businesses.

I get kind of excited, if the Fed just lowers rates just a little bit”

Source: M&T Bank Earnings Conference Call

My conclusion from all this is one that lacks confidence. We heard for years about how banks would perform well and generate alpha as soon as rates went up. Now, with an elevated rate environment, banks are under-performing the S&P 500 and the message from executives is that things will improve once rates go down. It is contradictory at best, and leaves me searching for a better sector to put my investment dollars to work.

Bottom-line

Regional banks, and KRE by extension, are up strongly from late October lows. The market has begun to price in rate cuts this year on the tide of declining inflation and resilient economic growth. Some analysts believe this will disproportionately benefit regional banks, but I have my doubts.

The sector is plagued by poor performing commercial real estate assets, recent bank failures, and expensive deposits. For this sector, I prefer the large-cap names that pay less for cash deposits, have less office space exposure, and actually benefited from the recent bank collapses as they grew their customer base after the fallout. As a result, I am maintaining my cautious outlook on KRE, and urge my followers to consider any positions in this fund very carefully as we navigate 2024.