PM Images

It’s been almost 5-years since Kraft Heinz Company (NASDAQ:KHC) announced they would be writing down the value of their Kraft and Oscar Mayer brands by $15 billion. Things got worse for shareholders as KHC reduced the dividend by -36% and posted a $12.6 billion loss. Since the news broke about, the $15 billion write-down shares have been in limbo, trading between $25 – $45. Since hitting a pandemic low of around $25, shares made a run in May of 2021 to around $45, only to lose their steam and trade in and out of the $30s. Recently, in 2023, KHC sold off again, threatening to dip below $30, but shares have rebounded and are making another run on the $40 level. While KHC may still have a negative stigma, this is a much stronger company than Mr. Market is giving it credit for, and shares look to be undervalued. While KHC is probably a boring company to many investors, considering it doesn’t have the tailwinds of AI pushing it forward, that doesn’t mean management hasn’t worked out the issues. I think there is an opportunity, and KHC is a quintessential example of how a dividend can work to your advantage. While the dividend has remained at the same level since the reduction, investors are getting paid 4.25% to wait for the turnaround. I am going to add to my position as I believe the recent move higher has legs and can continue.

Following up on my previous article about Kraft Heinz

I wrote an article about KHC in October of 2021 (can be read here), and since then, KHC has just traded sideways. Since the article was published, shares of KHC have increased by 0.48%, while the S&P 500 appreciated by 9.13%. Shares of KHC had trailed the market, but when the dividend is factored in, the total return from KHC has been 10.72%, making it slightly outperform the S&P over this period. In the article, I had discussed what went wrong with KHC to cause the company to tumble, and why it looked interesting to me. It looks like I was a bit early, as shares have been trading in a sideways channel. I wanted to write an update as we have significantly more financial data and future analyst estimates to look at. I think the dark days for KHC are behind us, and the numbers justify a move higher.

Kraft Heinz has underperformed the market, but the dividend created a quintessential example about how dividends can change the trajectory of an investment

KHC may not be the most exciting stock, and it may not have the upside potential that an Amazon (AMZN) or Nvidia (NVDA) has, but that doesn’t mean it can’t outperform the market. Despite the reduction in dividends, KHC is paying its shareholders $1.60 per share, which is a yield of 4.25%, while they wait for a turnaround to occur. KHC was a dividend growth company that had increased the annual dividend by 26% over a 5-year period, taking the annual dividend from $2 in 2013 to $2.52 in 2018. Upon the negative news announcements, KHC stopped its dividend growth track record in its tracks and reduced the dividend. The annualized dividend has been stuck at $1.60 since 2019, and the dividend was reduced by -36%.

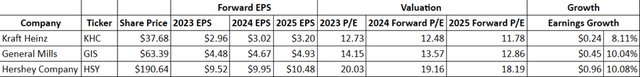

Despite being reduced, the dividend is still creating a yield of 4.25%, and with KHC expected to generate $2.96 of EPS in 2023 and $3.02 of EPS in 2024, the dividend has a 54.05% payout ratio based on 2023 earnings. If KHC doesn’t increase the dividend in 2024, then the dividend payout ratio will be 52.98% based on the 2024 EPS estimates. The combination of KHC keeping the quarterly dividend payment at $0.40 for 20 consecutive quarters and the dividend accounting for less than 60% of their EPS makes me believe that the dividend is safe unless something unexpected goes wrong.

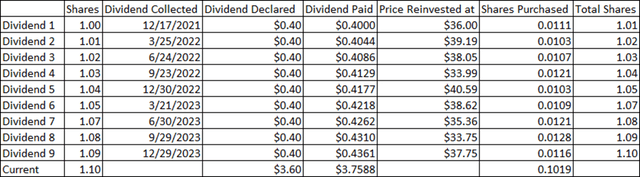

When I wrote my previous article on October 7th, 2021, KHC was at $37.50, and shares have appreciated by 0.48% since then compared to the S&P, increasing by 9.13%. On a share performance level, KHC has underperformed the market. If you had purchased 1 share of KHC at $37.50, you would have generated 9 dividends, paying you $3.60 in dividend income along the way. I logged into the brokerage account where I hold KHC and grabbed the data from when each of KHC’s dividends were paid and at what price the dividend payments were reinvested at. I built the table below to show the compounding effect of reinvesting the 9 dividends paid since my last article on a per-share basis.

For every share purchased on October 7th, 2021, you would have seen $0.18 in appreciation and $3.60 in dividends generated. By reinvesting the dividends, you actually would have generated $3.76 in dividend income, which is an additional $0.18 from the declared dividends from KHC, and your share count would have increased to 1.10. Today the value of each share invested would be $41.52 since you would have 1.10 shares at a current value of $37.68, which is a total return of 10.72% on the invested capital.

KHC is a quintessential example of how dividends can impact an investment. KHC on the surface, is basically flat, but over the period since my first article on October 7th, 2021, the S&P 500 has appreciated by 9.13%, and KHC’s total return of 10.72% by reinvesting the dividend income has outperformed the market. Sometimes, a boring company that pays you to be a shareholder doesn’t have to grab headlines to be a winner, and in this case, KHC’s stock has outperformed the market strictly by the amount of income generated from the dividend.

Why I feel Kraft Heinz is undervalued and why I am going to add to my position

KHC is a global company with some of the most recognized brands, including Kraft, HEINZ, Oscar Mayer, Ore-Ida, Kraft mac & cheese, Velveeta, Smart Ones, CapriSun, Kool-Aid, Jell-O, Philadelphia, Lunchables, and Maxwell House. Food, water, and shelter are the basic needs for humans, and while the food business may not be exciting, it’s one of the most important necessities. The chances of these products not existing or losing their prestige is slim, and the likelihood is that they will remain staples in pantries for decades to come as brand recognition transcends generations.

When I look through KHC’s financials, I see a company that has worked through incredible challenges and isn’t being rewarded for the company they have become. In the 2018 fiscal year, KHC took a charge of -$11.32 billion under their EBT Incl Unusual Items and reported a loss of -$10.19 billion. Their long-term debt finished 2018 at $30.77 billion and in a net debt position of $40.31 billion. KHC generated $7.34 billion in EBITDA for 2018, which placed its net debt to EBITDA ratio at 4.13x.

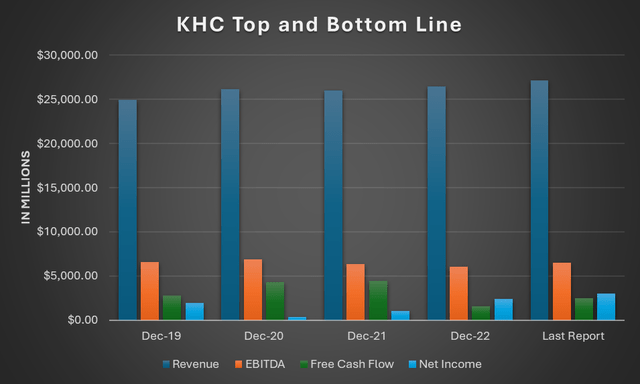

Since the close of 2018, shares of KHC have traded sideways while the financials improved. Over the past 5-years, KHC has generated $130.85 billion in revenue, $32.28 billion in EBITDA, $15.64 billion in FCF, and $8.65 billion in net income. This has allowed KHC to reduce its long-term debt by -37.37% (-$11.5 billion) from $30.77 billion to $19.27 billion, while placing its net debt position at $18.87 billion. In the TTM, KHC has generated $6.49 billion in EBITDA, which puts its net debt to EBITDA ratio at 2.91x, which is significantly lower than the 4.13x ratio at the end of 2018. Despite minimal top-line growth, KHC has utilized its pricing power and profitability to strengthen its financials while putting KHC in a much stronger position. I don’t think the market has given the financial turnaround enough credit, and today, shares of KHC are trading at a -6.18% discount to its book value of $40.16. I think that being able to buy shares of an iconic business with this level of profitability under book value is a golden opportunity.

Steven Fiorillo, Seeking Alpha

KHC is running a profitable business with respectable profitability. In the TTM, KHC has generated $27.16 billion in revenue and produced $6.49 billion in EBITDA, $2.51 billion in FCF, and $2.99 billion in net income. KHC is operating at a 23.88% EBITDA margin, an FCF yield of 9.24%, and an 11% profit margin. The global population is expected to expand and the United States population is projected to increase by 24.8 million people (7.26%) from 341.81 million to 366.62 million by 2040. As the population increases domestically and internationally, more food will be consumed, and this should favorably impact KHC’s top and bottom line.

Steven Fiorillo, Seeking Alpha

I looked at the future earnings for KHC and compared it against General Mills (GIS) And the Hershey Company (HSY). This is not a sector that commands high multiples, but when buying shares of any company, you pay the current value for all of the company’s future revenue and profits. KHC has slightly less EPS growth on the horizon, with 8.11% over the next 2-years compared to around 10% for GIS and HSY. Today your able to pay 12.48 times 2024 earnings for KHC and 11.78 times 2025 earnings. This isn’t a company that is going to disappear and not a company where the analyst community are projecting negative growth. I think that KHC trading under book value and at 11.78 times 2025 earnings is an opportunity, and shares look very undervalued considering the financial position they were in at the close of 2018 and where they are today.

Risks to my investment thesis

The food and beverage industry is highly competitive throughout KHC’s product mix. Their competitors include manufacturers and retailers with their own branded and private label products. KHC may be put into a position where they need to reduce prices or delay increasing prices which could impact margins and profitability due to current competitor pricing methodologies. KHC is also at risk of global macroeconomic conditions and inflationary environments as they could cause commodity and raw materials to increase in price which would directly impact KHC’s cost of revenue. During 2022 oil, wheat, soybeans, and eggs increased to decade high prices. These factors impact costs on manufacturing, shipping, and the input materials needed for KHC to produce its products. Many of the factors that can impact KHC’s margins and profitability are outside of its control which could negatively impact an investment in KHC if we enter into a period where KHC has to sacrifice margin for pricing power.

KHC is also impacted by long-term changes in consumer preferences. There always seems to be a new diet and Paleo which is diet based on consuming fruits, vegetables, lean meats, fish, eggs, nuts and seeds has gained popularity. SUNY estimates that between 1-3 million people follow Paleo at any given time. More influencers including Dr. Jordan Peterson and Joe Rogan publicly discuss the benefits they have seen from implementing Paleo which is also known as the Carnivore diet. The changing of consumer preferences to a different caloric intake mix which moves away from packaged foods is a risk that KHC faces.

Conclusion

While there are always risks to every investment, I am optimistic about KHC. This is a great example of how a stock can tread water for over 2 years and still outperform the market because of the dividend. Today, you can purchase KHC shares at a 6.18% discount to their book value while locking in a 4.25% yield on your invested capital. I can’t predict when the market will turn, but I am willing to pay 11.78x next year’s earnings at a discount to book while being paid to wait. I think KHC could be a candidate to generate moderate yield and generate capital appreciation for long-term focused investors.