sturti

Investment action

I recommended a hold rating for Korn Ferry (NYSE:KFY) when I wrote about it the last time, as the business direction appeared to be uncertain, with multiple positive and negative indicators balancing each other out. My previous take was just to sit on the sidelines and wait for more clarity. Based on my current outlook and analysis of KFY, I recommend a hold rating. The reason for my hold rating is that I want to hear more comments from the Fed in the coming months to get a sense of whether they are going to stick with their view of cutting rates this year.

Review

For those who missed out on KFY 2Q24 earnings, here is a brief update. KFY reported fee revenue of $704 million, a decline of 3.3% on a reported basis and a 5% decline on an organic basis. By various business units, executive search saw revenue decline 9% y/y organically, consulting grew 1%, digital increased 1%, RPO fell 20%, and professional search and interim grew 2%. As for margins, EBITDA margins contracted 400 bps y/y to 14% due to a greater mix of lower margin interim staffing revenue and negative operating leverage. KFY also reported EPS of $0.97, which is modestly above consensus estimate of $0.95.

Results aside, I think KFY has shown more positivity than negativity in the quarter, pushing the business direction towards a more positive one. I would like to start by saying that KFY is reaping the rewards of its strategy to diversify its revenue streams. Consulting and digital now account for around 40% of revenue. This further enhances KFY’s resiliency against the weak macro backdrop (even though the labor market is slowing down). Secondly, it’s great to see that KFY is now generating 25% of its revenue from cross-referrals so far this year. Most of the recommendations come from big accounts like Marquee and Regional. This has huge implications, as it also means that KFY is now a much more resilient business as these large accounts are less likely to go out of business. Thirdly, it looks like the business climate has stabilized. According to management, new business trends, such as RPO for November, will follow typical seasonality. This suggests that KFY has reached the stabilization part of the cycle, and future performance should be consistent with trends seen in previous quarters. Lastly, KFY has also shown us that its cost structure is rather flexible, thereby mitigating the impacts of negative operating leverage (note that the biggest fixed cost in KFY P&L is labor). In order to adjust to the current macro environment and achieve higher productivity, KFY implemented a large-scale headcount reduction initiative in 2Q24, impacting 8% of the workforce. The majority of the reductions, 85-90%, were implemented in F2Q, with the remaining international reductions scheduled for F3Q. With the expected yearly cost savings of $110-120 million and an expected EBITDA margin expansion of ~100 bps y/y to ~15% in 3Q24, this headcount reduction initiative provides confidence that KFY will be able to reach its medium-term EBITDA margin target of 16-18%.

Taking the above into consideration, I would say that my view on KFY has certainly turned out to be much more positive than it was previously. KFY’s performance since then shows that KFY is able to operate in an uncertain macro environment with softening labor trends given its diverse revenue streams and active cost management actions. Additionally, KFY increased its quarterly DPS by a significant 83% to $0.33, showing that management is not sidetracked from its capital allocation priorities even when the business environment turns soft.

However, I think it is still a bit too early to turn bullish on the stock, as the fact is that KFY is still going to experience a soft labor market. For reference, the number of US monthly job creations has seen a significant decline since 2021. In 2021, the figure stood at 605k, which declined to 225k in 2023, with the latest figure at 216k in December (this does suggest stabilization but not improvements yet). While KFY has other growth drivers, the broad industrial slowdown is definitely going to weigh on its executive search, perm placement, and RPO volumes. While the Fed’s intention to cut rates is certainly positive as it means the economy is stabilizing, my expectation is that the Fed is unlikely to cut rates in 1H24 as they might need a few more months of data to confirm their view that the economy is heading in the intended direction. The implication for KFY is that in 1H24, businesses are unlikely to step up on hiring as they await the decision of the Fed, creating a potentially challenging staffing backdrop until then.

Valuation

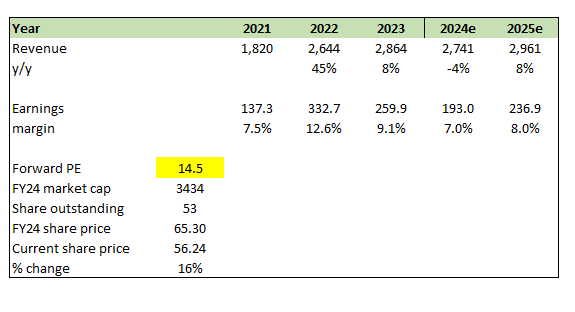

Author’s work

In this post, my model is to illustrate the potential upside if the Fed really cut rates in 2024 (FY25 for KFY). I hold my assumptions the same for FY24, as they are guided by management. However, I am increasing my growth assumptions to high single digits from the previous 5% growth as I expect KFY to benefit from its various growth drivers (e.g., referrals, diversification strategy, etc.) and that the macro situation recovers. I have also modestly increased my net margin outlook to 8% (midpoint of the KFY recent range of 7% and 9%, excluding FY22, which was an outlier given FY20 and FY21 were impacted by COVID).

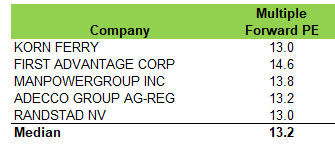

I believe the market is pricing in the fact that KFY has reached a stabilization phase, as reflected in the increase in valuation from 11x forward PE to 13x forward PE today. This positive re-rating was seen across the industry (peers’ valuation has also increased). My opinion is that the next phase of share price appreciation is likely to materialize only when the market sees the Fed cut rates; with that, the market is likely to re-rate KFY back to its historical 14.5x forward PE.

Author’s work

Risk and final thoughts

KFY is still largely dependent on how the macroeconomy moves. For all we know, the macroeconomy could be doing much better than what the Fed expected (i.e., if inflation suddenly steps up sharply again), thereby forcing them to step up on increasing rates. This would spell bad news for KFY, as the market is unlikely to give any benefit of doubt that the business environment is going to turn around anytime soon. The current “stabilization” narrative is also unlikely to stand well against a rising rate environment.

My concluding view is that KFY remains a hold. While recent performance signals positive shifts, particularly in revenue diversification and cost management, uncertainties persist due to the soft labor market and broader economic trends. Importantly, my main reason for the hold rating is that I remain conservative until the Fed’s message over the coming months clarifies their rate-cutting intentions and the broader economic outlook.