Klaus Vedfelt/DigitalVision via Getty Images

Kontoor Brands (NYSE:KTB) is an apparel manufacturer and wholesaler. Kontoor owns Wrangler and Lee, two very well-known denim brands.

Since spinning off from VF Corporation (VFC) in 2019, the company has been driving very good profitability and brand growth improvements.

I believe Kontoor is doing the right things and has a lot of potential, particularly in international markets and in gaining market share in the US.

However, the price is a little demanding in terms of future scenarios, and I believe there is potential for better entry points lower for patient investors. For that reason, despite liking the company’s direction, I believe the stock is a Hold now.

Jeanswear Giants

Great brands: Neither Lee nor Wrangler needs much introduction. Despite being smaller than Levi’s (LEVI), these brands probably rank among the 30 best-known US apparel brands.

Traditional West and streetwear denim: My understanding of the brands’ styles is that Wrangler is a little more traditional Western American denim, with wider cuts and lighter colors, whereas Lee has a younger appeal, more in line with streetwear. Each one can target a different customer, albeit I believe Lee has more cross-cultural appeal (more on this later).

Wholesale US focus: Nearly 75% of Kontoor’s revenues are generated in US wholesale. Specifically, Walmart generates 35% of the company’s revenues, and the top ten customers (including Amazon, Target, and others) account for about 62% of the business.

Some manufacturing integration: About a third of Kontoor’s products are manufactured in their own facilities in Mexico and Nicaragua. I believe manufacturing integration can be a competitive advantage for apparel brands because it allows them to control quality better, absorb a little margin, and mainly innovate in fabrics and fixtures.

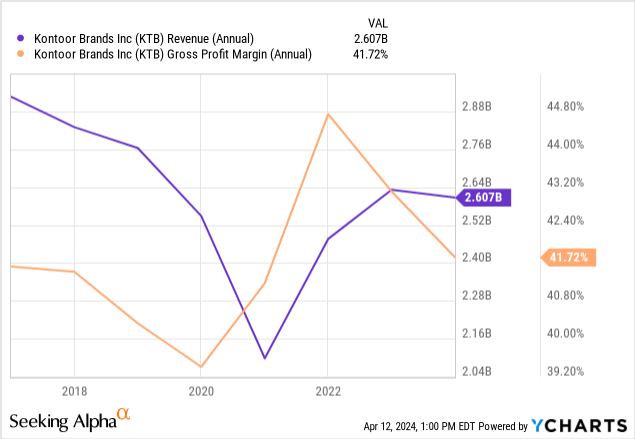

Unattended: Before spinning off in 2019, Wrangler and Lee belonged to VFC, an apparel conglomerate. The brands were not doing well under VFC, decreasing from $2.8 billion in revenues and 19% operating margins in 2013 to a low of $2.5 billion and 12% margins in FY19.

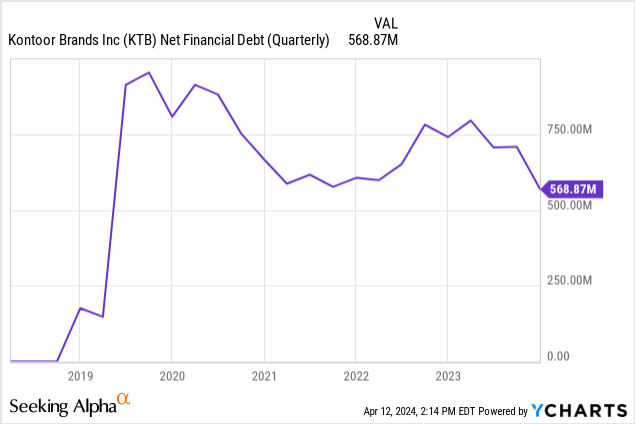

Some manageable leverage: When Kontoor was spun off, it carried almost $1 billion in net debt, a number that has decreased closer to $600 million now. Still, the $800 million in debt ($200 million cash) the company has is actually relatively accretive because it is fixed rate. The company owes $400 million in 4% notes maturing 2029, and $400 million in 4% term loan maturing in 2026. Kontoor could not find this type of financing today, and therefore I believe it should not repay these debts until maturity.

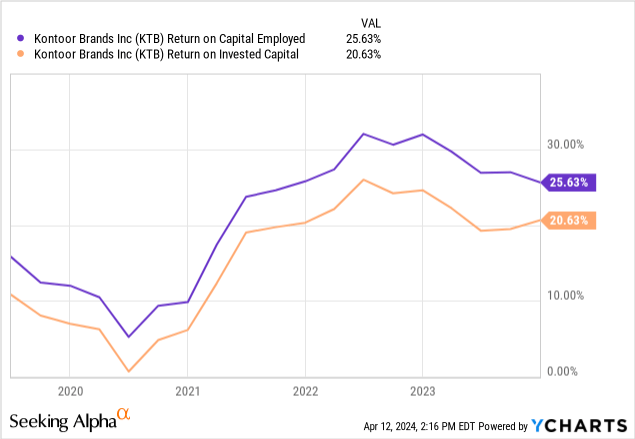

Good return on capital: The brand power of the company’s products, coupled with an efficient wholesale channel, lead to relatively healthy margins that are now hovering around 12% but managed to peak at 19% a decade ago. The returns on capital of the business, even considering its manufacturing base, are really good.

Long-standing management: The management team in charge of Kontoor has been managing these brands since before the spin-off. According to the FY23 proxy, Kontoor’s CEO joined VFC in 2007 and became the company’s CEO in 2018; Wrangler’s President has been at Wrangler since 2005, and Lee’s President since 2017.

No strong shareholder: A problem at Kontoor is the lack of a strong shareholder who can provide stability and direction to the management team. The company’s largest shareholders are Blackrock, Vanguard, FMR, and PNC Bank, that is, providers of passive vehicles. The management team only has 2.5% of the stock.

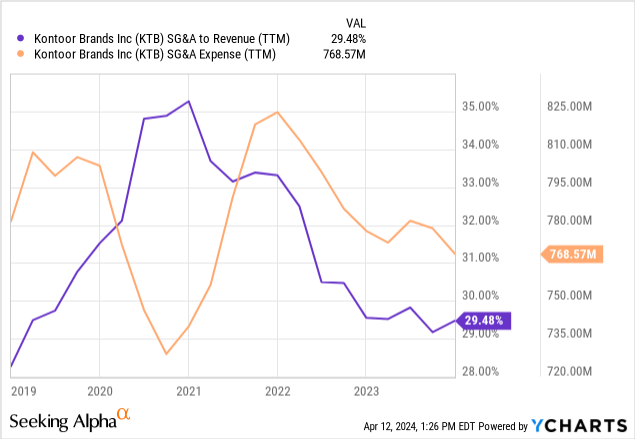

Cost-control: The company has been able to withstand significant revenue movements without showing a lot of operational leverage on the downside, something that is more normal for wholesalers than for retailers but still commendable. Particularly interesting is the fact that Kontoor has been able to decrease SG&A in both absolute and percentage terms.

Independent direction

Since going public, Kontoor established a path to improvement in two stages, called Horizon 1 and 2. The first part, which went from 2019 to 2021, implied a consolidation of the channels (closing some outlet stores and leaving directly operated markets like Latin America) and expanding gross margins. The second stage is building the brands via wholesale, product line, and international expansion.

Brand elevation: This much-repeated concept means moving the brand position in the customers’ minds to a more sentimental rather than product/price engagement. For example, it means moving the customer from thinking that Wrangler has ‘good jeans at an acceptable price’ to thinking that Wrangler has ‘the jeans I would like to wear,’ independently of the price.

Nurturing the brand this way is extremely important because it allows the company to charge higher prices and decommoditize the products. Ideally, Wrangler or Lee’s jeans won’t be ‘jeans’ but rather ‘Wranglers’ or ‘Lees.’

The process is not easy, but I believe it delves into the cultural relevance of the brands. Customers need to see the products in cultural situations (worn by celebrities, artists, athletes, in TV shows, etc.), and associate them with other design and style brands.

Kontoor is moving in that direction, particularly since 2022. The FY19 annual report did not mention collaborations. By 2021, things started to change:

- In 2021, Lee hired Mark Seliger as the creative in charge of the brand’s photography. He has worked with Lee in the collections for 2022 and 2023. Photographers are very important creatives in the higher fashion echelons of the industry. Lee also collaborated with Pendleton, a knitwear company, and Wrangler with Billabong, a surf streetwear company.

- In 2022, Wrangler hired Leon Bridges (an African American soul musician with a very Southern style), and Georgia Jagger (daughter of Mick Jagger) as brand figures for the collection. The company collaborated with Pendleton and Gant, two more elevated brands. It also sponsored the Lollapalooza in the US and Germany. Lee collaborated with more streetwear brands, 7Up in China, Engineered Garments in Korea, Brooklyn Circus, Hundreds and Scoth in the US.

- In 2023, Wrangler hired country-star Lainey Wilson as ambassador. It also signed the Dallas Cowboys, and collaborated with a Barbie collection, and a Staud collection (with jeans selling for upwards of $200). Lee collaborated with Dragonball, Daydreamer (LA streetwear), and Roaring Wild (China streetwear, each bottom piece above $150).

These efforts are crucial to moving the brand upmarket in some lines while making the lower-priced products (for example, the jeans found at Walmart or Amazon for $20/30) aspirational. The collaborations probably don’t provide a lot of revenue or even cost money, but they help influence the more fashionable public, which in turn influences the mass markets.

Kontoor spends about $140 million in advertising, a sizable budget that probably gets mostly dedicated to top of the funnel, brand building activities, given that the company has small retail operations.

International opportunity: Wrangler represents two-thirds of Kontoor’s revenues, but 90% of its sales are in the US. Lee is more established abroad, with 40% of its sales outside of the US. This means both brands have substantial space to expand internationally, particularly Wrangler.

Post-pandemic, Wrangler opened its first flagship stores in Europe and China, a starting point to increase wholesale revenues. Lee has consistently collaborated for the Asian market, like Roaring Wild and 7Up in China and Engineered Garments in Korea.

Although the international market is much more competitive than when the first American apparel brands started opening it more than two decades ago, the very American cultural connotations of Wrangler and Lee’s denim are a good selling point for the brands.

Product line expansion: This strategy implies expanding horizontally to other apparel lines that can be combined in an outfit. This is consistent with moving the brands from a product/function/price basis towards a creativity/concept/style basis. The categories chosen are relatively complementary, printed tops (in which collaborations and licenses play a big role) and outdoor performance workwear. In the case of outdoor, Wrangler’s ATG line already sells more than $200 million (4Q23 earnings call). Non-jean products were 38% of sales in FY22.

Valuation

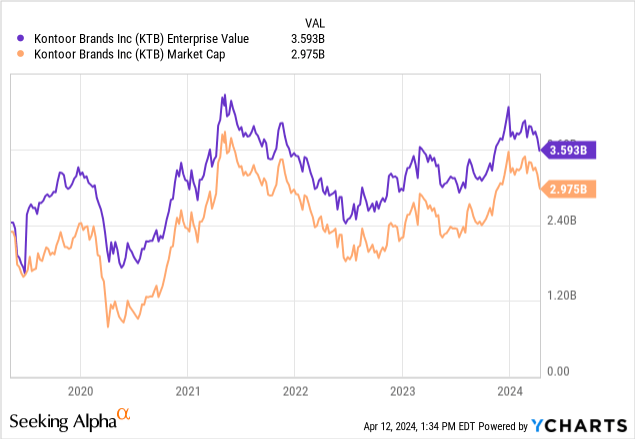

With an EV of $3.6 billion and a market cap of $3 billion, compared with operating profits of $330 million, interest expenses of $40 million, and taxes of about 25%, the company trades at an EV/NOPAT and P/E multiple of about 14.5x (TTM).

I do not believe the multiple is excessive per se, given the good operations, high margins, resilience, low leverage, and good direction that Kontoor boasts. The strategies described above are taking the company in the right direction. Wrangler and Lee are well-known brands but must be elevated to widen their competitive advantage. Those investments are better used over a more comprehensive product line and in a global presence.

However, I also believe that the current stock price has already discounted a significant portion of the positive developments. Suppose you buy a business at a 15x multiple and plan to sell it in five years at a 10x multiple (something I consider a conservative but real assumption for a business that matures). In that case, the company needs to grow profits by 10% compounded for those five years for you to receive a 10% return, which I consider the minimum for holding a stock.

Growing 10% compounded is a great outcome, but considering the current stock price, it is the minimum needed to make a decent return. That is why I prefer to wait for lower prices. For example, for $40, a price visited several times by the stock in the past two years, we only need 3% compounded growth to get the 10% return, and the rest is free upside.

The biggest difficulty in investing is not finding good companies, like Kontoor, but rather being disciplined enough to buy them when the market has overly discounted their positive aspects. For that reason, I think Kontoor is currently a Hold.