Victor Golmer/iStock Editorial via Getty Images

Dear readers/followers,

KION (OTCPK:KIGRY) is a company that has already been paying off quite a bit as an investment for the past few months. My last major buy was made during later periods of 2022 – and my stance has produced a TSR of around 27% including the dividend, compared to the 16% of the S&P500 as of the time of writing this article.

However, I still believe KION has a long way to go in terms of potential upside, and I believe this company can still deliver significant outperformance in both the longer and shorter term. At this time, we do not yet have the 4Q. It’s a strategic choice for me to report and write on KION at this time because I believe that the company’s results will come in better than analysts and many investors expect.

Even if they should not come in as positive as some might expect at this time, the future for this company is, as I see it, very positive – and I’ll show you in this article why exactly this is.

You can find my last article on KION here. The follow-up is with regards to clarifying the sheer upside that I consider to be valid when it comes to this company in the next few years. While we do not yet have annual results, I believe there to be a strong case for actually investing in the company prior to that, and this is what I will cover here.

KION – Plenty to like, even 20% higher than when I last covered the company

KION has now moved over €41/share for the native. That’s a far call from when the company was below €35, but I believe this to only be the beginning.

Why?

KION is the market leader in several crucial technologies not only important for the current development in industrial technologies and materials as well as logistics, but crucial.

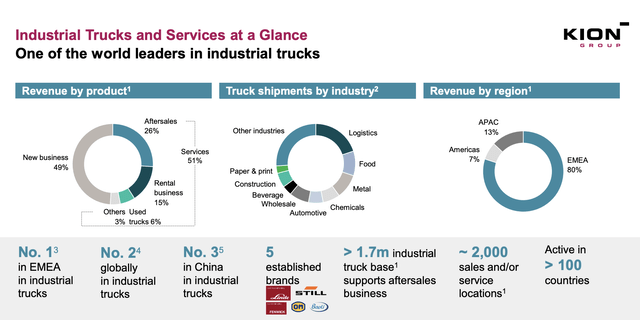

KION is the world leader in industrial truck solutions in EMEA, and the global #2 in the same segment. It’s #1 in global supply chain solutions and can report an annual order intake climbing toward €13B on an annual basis. This has seen some pressure over the past year or so, but the problem with KION and what has caused it to fall is not top-line growth or lack thereof. The company in fact has a well-filled orderbook and excellent demand trends. Still, it’s down to around €11.1B in 2022, with a. new intake of slightly above that. (Source: KION IR)

The company may have seen issues in the last 2 years when it comes to margins, which have declined at times to as low as 2-3%, which for a company that’s usually close to double digits is very challenging.

However, where I believe the market has this is wrong is that the market expects this to be some sort of new normal. It’s not, and the latest sort of trends go a long way to prove it. The company’s new strategy is ongoing.

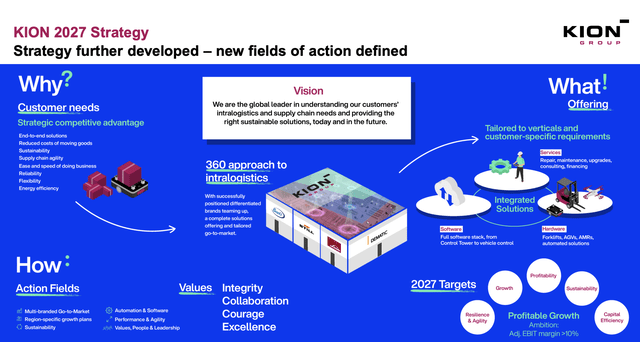

KION IR (KION IR)

The main arguments for investing in this company for me, aside from valuation, which I’ll look at in the latter segment, are:

1. The company operates in very attractive markets where the need for solutions like the ones that KION offers is very strong. These are structural, recurring trends and demands based on things like demographics, sustainable solutions, and demands upon logistic requirements.

2. The company is a global leader in what it does. It’s positioned to outperform the market due to scale and high investments in R&D and new capabilities. This is indicative of a market leader.

3. The company has, I believe, the clear ability to capitalize on significant growth with a good margin upside potential, seeing good agility, scale efficiencies, synergies, and margin upside potential once inflation and macro trends have pushed this company down normalize.

4. Even with the negative results that KION has been seeing in the last 2 years, the company has never been unprofitable and has shown both a resilient and sustainable business model that, during troughs, may dip to 2-4% operating margin, but ultimately delivers value as long as the need for intralogistics solutions with integration persists, which I believe it will.

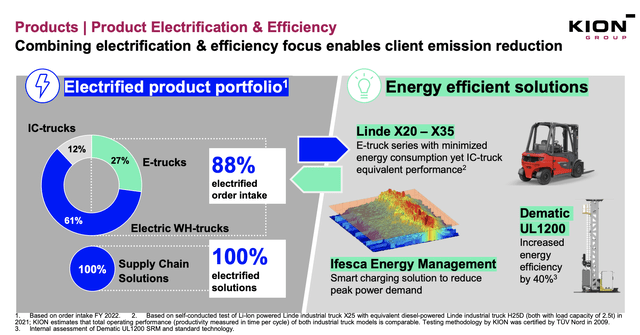

Unlike other areas, I believe EV and electrification have a big upside here – and the company is already deep into that.

KION IR (KION IR)

The company also has a very attractive sales mix, with a high degree of aftermarket and service sales revenue, which actually is higher than the new business revenue, at 51% of sales. The industries are well-diversified, with the only weakness being where the company’s sales and exposures are located. KION is pretty geographically focused.

KION IR (KION IR)

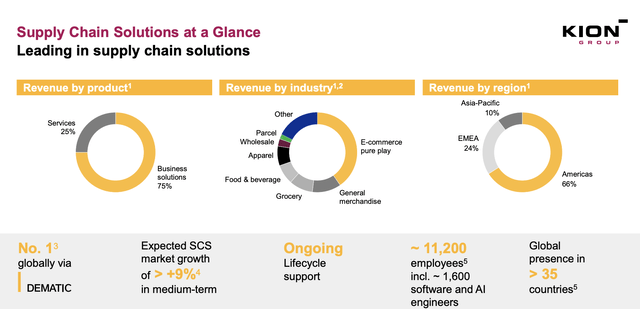

The other leg for the company is Supply Chain solutions, and this is another great example of how the company will likely deliver value going forward. This, unlike the former, is a service-low sales model with only 25% services, 75% solutions, but on a global scale with DEMATIC and expected to grow at close to double digits on a medium forecast, with a global presence in over 35 countries and a far America-heavier sales mix.

KION IR (KION IR)

Again, a clear advantage, as I see it.

The company’s dividend is cut to the bone. Don’t buy KION for the 2023-2024 dividend, yes even for 2024, because the dividend may stay cut for some time, if things don’t materialize a clear upside. The dividend is currently less than 0.6%.

However, the company has less than 35% debt/cap, it’s BBB-rated and investment-safe (on a rating basis), and despite all the negatives, remains profitable. Profitability is my main concern, after value. If I can find a company that is undervalued and profitable, then provided the company is not in a declining market, it’s only a matter of time until an upside is not only likely but potentially inevitable.

I also want to highlight that KION has seen a fair amount of recent insider buying, which is generally a good piece of news in an environment like this or for a stock like this.

And those insider buys have actually been increasing, about during the same time that I have been buying as well. In fact, not a single insider has been selling stock despite the rollercoaster the company has been doing. In fact, several of those insiders have already been seeing some good profits on their respective transactions so far given the significant uptick the company has been seeing in the short term.

I’m posting this before the 4Q because, again, I expect the 4Q to bring about even better results that will send the company upward. I’m also far from the only analyst to expect this (Source: S&P Global) – the overall expectation is in line with the last set of quarterly results, which should see things improve as the situation normalizes, and as the new contracts, pricing levels and trends are applied by the company.

On a 6-month basis, it’s up almost 20%, and I believe this to, again, just be the beginning of a longer-term RoR.

Why is that?

Valuation for KION – A lot of upside remains.

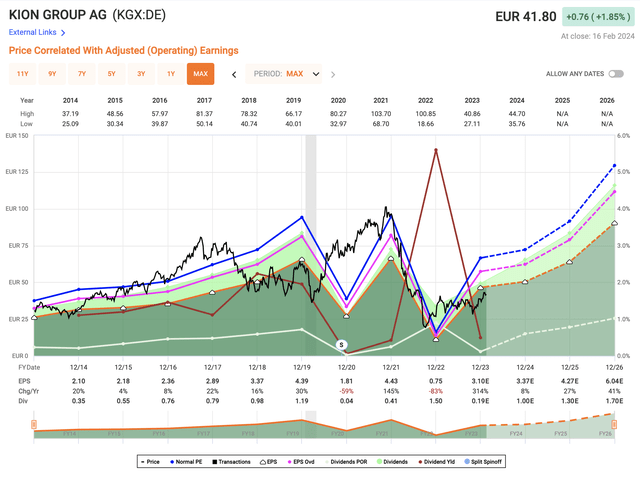

To understand why I believe KION is headed for higher levels, we need to understand just how much the company actually dropped. The company has, since its height of around €100 in COVID, dropped down to less than €50/share. This is in part justified given the depth of the company’s profit decline – first in COVID, and then in 2022 again.

KION upside (F.A.S.T Graphs)

So while you may view the trends as justified, you also have to note the forecasted level of profit and earnings recovery and upside. While there is still a lot of doubt about whether that 2026E level is achievable, I want to point out that it is not far outside of the company’s previous top levels – and if the same sort of development we saw from COVID to the peak in 2021 were to play out again, then you could see something in the vicinity of 160-170% total RoR from this level if that time is any indication.

Even if you forecast the company only at a P/E of 12x, which is below the normalized current P/E of 13x, you could annualize 26% at almost 95% in total, if these forecasts hold. Granted, KION has a fairly negative history of hitting targets, negatively missing on the short term more often than I’d like. In this case, though, I believe industry and recent quarterly trends, which I’ve covered in previous articles, give some sort of confirmation that this may indeed be likely.

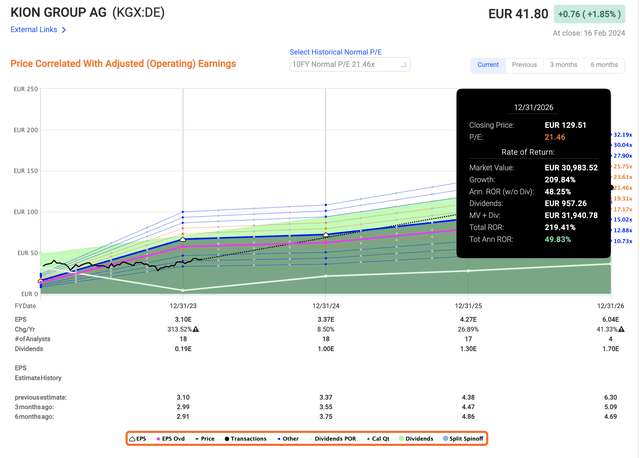

So, I believe the company’s long-term average valuation is somewhat more likely to materialize here. I’m going to forecast KION at the 10-year average which comes to around 21.5x, which at this valuation forecasts an upside that looks something like this.

KION Upside (F.A.S.T graphs)

To be clear, this is the bullish scenario I see here. The company may well do slightly worse – that’s why my official PT is around €78 for this company – which isn’t a full 100% upside, but it’s close to it. I still believe the company to be very capable of that 220% upside over the longer period, but I would make this part of a bull/bear thesis where that 220% is the bullish scenario, the bearish would be around 70-80% total RoR, and the mid-point comes to something of 150%.

That’s why, as you might understand, this company has one of the highest investment potentials and is still considered to be valid at this particular time. That’s why over 1.5% of both my private and my corporate portfolios are firmly invested in this company’s common share, as opposed to options or investing in KION bonds.

Current S&P Global targets for KION range from a bottom-level estimate of €23/share (I’d love to see those estimates and modeling assumptions, but the best I can tell is that they expect the company’s margin recovery to completely “fizzle out”), and a high target of around €77/share, which is more or less along the level that I consider valid. €48/share is the estimate that’s the average here. However, where it becomes interesting is that 15 out of 20 analysts consider the company to either be a “BUY” or “Outperform” here, which implies there is a far better upside here than that average target would spell out – otherwise I don’t expect we’d not see that sort of recommendation conviction here. (Source: S&P Global/TIKR.com)

So I remain at a stance where I say that KION is one of the more undervalued cyclical industrial plays out there. It’s far from a “Yield monster” – in fact, it might remain a lower-yielding stock for some time, but it’s still a very qualitative sort of business to invest in, and that’s where I consider this company interesting and one of my primary picks if one is not yet fully invested in it.

My updated thesis for 2024E is, therefore, as follows.

Thesis

My thesis on KION is as follows:

-

KION Group is an attractive capital goods play with an emphasis on intralogistics solutions, automation, and warehouse technologies – things like forklifts, to put it simply. The upside for 2024E is still there, even if the company has recovered a meaningful amount in its valuation when it once again climbed over €40/share.

-

The company is undervalued and forecasts imply a significant upside over the coming 5 years, with an upside of over 100% – and this upside and undervaluation is still very much there.

-

KION is a “BUY” with a price target of €78/share, but I am not shifting it further at this time, even if a higher upside of €120/share is certainly possible in a bullish context. Because of this, I say that the company is a very good prospect here, if you’re willing to put up with low yield.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (Italicized).

-

This company is overall qualitative.

-

This company is fundamentally safe/conservative & well-run.

-

This company pays a well-covered dividend.

-

This company is currently cheap.

-

This company has a realistic upside based on earnings growth or multiple expansion/reversion.

That means that the company still fulfills all of my criteria for attractive valuation-oriented investing. I’m still at a “BUY”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.