Houston Chronicle/Hearst Newspapers via Getty Images/Hearst Newspapers via Getty Images

Kinder Morgan (NYSE:KMI) closed out FY23 with mixed results. Between sliding revenue due to the soft commodities market and strengthening EBITDA margins, the firm has remained resilient in both managing operations and investing in growth projects and asset acquisition. I believe the runway for Kinder Morgan is strong as the firm bolsters its Texas intrastate assets, its renewable natural gas and renewable diesel assets, and increases its capacity to service the growing LNG export capacity. I recommend KMI with a BUY recommendation with a price target of $18/share, or 8x FY24 DCF.

Someone has recently said in comparing our growth to that of high-tech companies, that we were like the tortoise in Aesop’s Fables compared to the hare represented by high-tech. And that’s probably true. But I like to think that looking at 2024, the tortoise is moving a little faster; and then I would remind you of who won that race in the end.

Operations

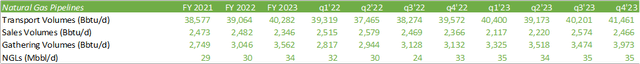

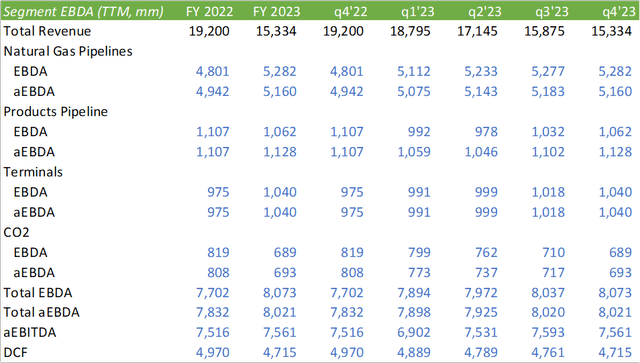

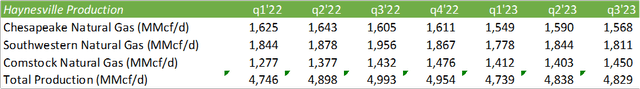

Kinder Morgan experienced strength in natural gas transport for q4’23 with growth of 5% from the previous year, primarily driven by the Texas intrastate for LNG feedgas demand, increased power demand, and EPNG’s Line 2000 being brought back online. Gathering volumes were up 14% sequentially and 27% from the previous year driven by 59% higher volumes in the Haynesville Basin, 14% higher volumes in the Bakken Basin, and 18% higher volumes in the Eagle Ford Basin.

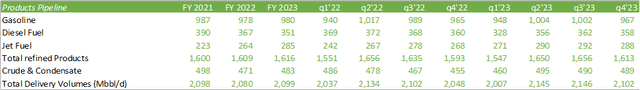

Products experienced a slight uptick in jet fuel with offsetting headwinds from diesel. Management discerned on the call that renewable diesel volumes have significantly picked up throughout FY23, increasing from 700bbl/d to 27Mbbl/d and anticipates volumes to be above 30Mbbl/d in January 2024. Management suggested that they could convert their California diesel facilities into renewable diesel facilities with capacity of 250Mbbl/d. Kinder Morgan is contracting their RD terminal facilities with take or pay contracts to ensure both baseline cash flow and tariffs based on volumes.

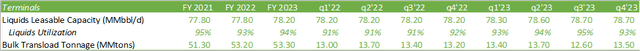

Terminal capacity was 97% leased excluding those out-of-service for inspections with strong utilization rates in the Houston Ship Channel and New York Harbor. Bulk volumes were up 3% with strong demand from metals, pet coke, and soda ash, slightly offset by grain volumes.

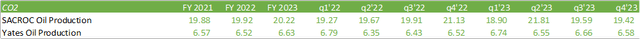

Kinder Morgan experienced some headwinds in their SACROC and CO2 oil recovery with SACROC pulling back by -8% from q4’22. I believe that SACROC may be an area to keep an eye on as CCUS and CO2-enhanced oil recovery becomes more prevalent in the market. I believe this asset can do exceptionally well during a stronger oil market as incremental oil production will make a bigger difference at higher margin production. I believe this method may also be suppressed during softer oil markets as firms cut back on short-cycled production in an attempt to control volumes and improve oil prices. Looking ahead to FY24, I am anticipating a flat-to-soft oil market as many of the cuts OPEC+ has undergone as well as the exogenous geopolitical risks have had little impact on oil prices.

Going down to the financials, aEBITDA and in turn, DCF each experienced a slight pullback from the previous year for q4’23 at -1.6% and -4%. Normalizing the financials using TTM figures, Kinder Morgan’s margin growth showed strength in soft revenue generation. As management had alluded to in their call, the firm’s intrastate margins won’t necessarily be affected by commodity price fluctuations given their offsetting buyers and sellers at each end of the pipeline. For FY23, 93% of cash flows are covered under take-or-pay (61%), hedges (6%), and fee-based (26%) contracts with only 7% of EBDA having true commodity exposure.

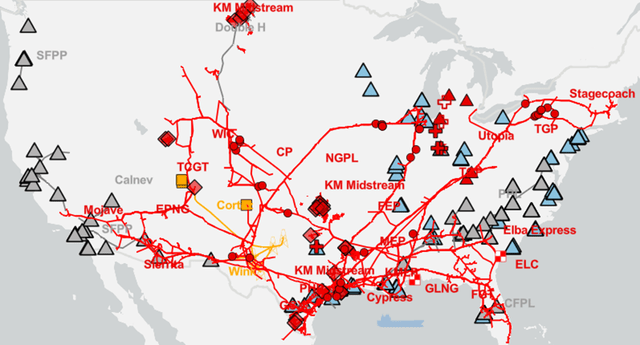

Looking ahead to the future of Kinder Morgan, the firm plans to further establish themselves in the midst of energy transition with 84% of their $3.8b backlog being allocated to lower carbon investing. The firm is focused on continuing to build out capacity for RNG and RD as supply continues to pick up in their core markets. This includes an additional 700MMcf of RNG production capacity coming online in mid-2024 and 600MMcf over the next decade. Management is also optimistic about building out additional transport capacity to cater to the LNG export market, whether it is transporting gas from the Permian or the Haynesville Basins. In the Haynesville/Bossier Basin, Kinder Morgan wholly owns KinderHawk, their 2Bcf/d capacity midstream gathering and processing facilities with 19 interconnections to major downstream pipelines. Through KinderHawk, the firm owns 39.25% of the Greenholly Gathering Pipeline, a 36-mile pipeline system and 1.15Bcf/d of capacity, running from Greenwood Gathering System and partner receipt points to KinderHawk’s North Holly gathering system. The Kinder Morgan Louisiana Pipeline (“KMLP”) originates in Evangeline Parish, LA, interconnects with the Natural Gas Pipeline Company of America (“NGPL”), and terminates at the Cheniere (LNG) (CQP) Sabine Pass LNG Terminal. This pipeline system has total capacity of 2.2Bcf/d. Their Southern Natural Gas (“SNG”) pipeline runs gas from surrounding basins in Louisiana, Mississippi, and Alabama to both marketing areas in the southern region as well as their Elba Island LNG terminal near Savannah, GA. Though much of Kinder Morgan’s operations cater to domestic gas needs, I believe that the firm is well-positioned to service the LNG export capacity that will be coming online at the end of CY24-2025 and beyond. Kinder Morgan currently has 7Bcf/d contracted for LNG export and anticipates 10Bcf/d by the end of 2025. In the long term, management anticipates this to grow to 13Bcf/d.

Considering gas production by three of the independent gas producers that I follow in the basin, it would appear that daily production was up in q3’23 in total with Chesapeake (CHK) and Southwestern (SWN) slightly pulling back production while Comstock (CRK) increased their daily production when compared to q3’22. Given the softness in the market, I believe SWN and CHK each curtailed production in the short term to maintain reserves in anticipation of the Golden Pass and Plaquemines LNG terminals being brought online later in 2024/2025. In addition to this, I do believe the combined firm since the merger announcement will further pull back on production heading into 2h24 to further bolster reserve capacity. I do not anticipate CRK to reduce production in the basin as this is their only area of production.

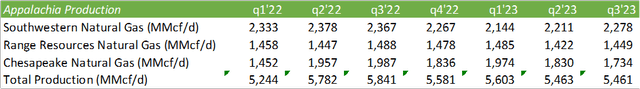

The Appalachia region also experienced a pullback in daily production in q3’23 when compared to the previous year.

Final Thoughts

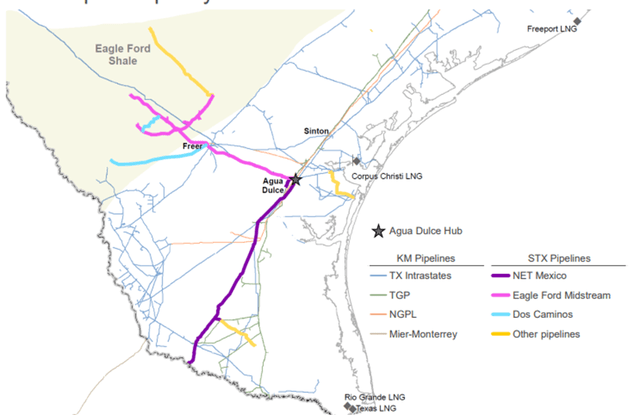

Kinder Morgan acquired NextEra Energy’s South Texas Midstream assets at the end of FY23 for $1.815b which is comprised of 7 pipelines that provide natural gas to Mexico and power producers and municipalities in South Texas with a total capacity of 4.9Bcf/d. This system generated approximately $181mm in aEBITDA for FY23. The pipeline system includes a 90% interest in the NET Mexico pipeline and Eagle Ford Midstream that connects the Eagle Ford Basin to the Aqua Dulce Hub, which connects to Cheniere’s Corpus Christi terminal through the ADCC Pipeline as well as other pipeline systems owned by Kinder Morgan. 75% of the capacity under contract is under take-or-pay contract with an average term of 8 years.

Shareholder Value & Valuation

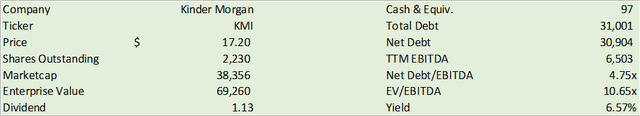

Kinder Morgan increased their dividend rate by 2% for an annualized rate of $1.13, yielding 6.57%. The firm also has a robust share repurchase program with $1.5b remaining under the current approved program. The firm purchased 31.5mm shares throughout 2023 for $522mm with an average price of $16.56 and will remain opportunistic in their repurchases.

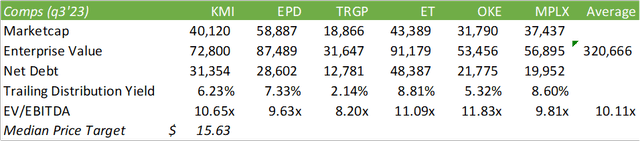

Because other midstream operators have yet to report q4’23 earnings, my comps table below references q3’23.

Looking to FY24 guidance, management anticipates DCF growth of 6% at current WTI prices. Given my outlook for WTI being flat to slightly down for CY24, I anticipate DCF to fall into this range, holding all else equal. At the 6% growth rate, we can anticipate around $2.25/share of DCF and value KMI shares at 8x DCF for a price target of $18/share, or 10.93x FY23 EV/EBITDA. I recommend KMI as a BUY.