metamorworks

Elevator Pitch

I continue to award a Buy investment rating to Keyence Corporation (OTCPK:KYCCF) [6861:JP].

My prior write-up published on October 2, 2023 drew attention to the potential for an increase in Keyence’s future dividend payout ratio and the company’s focus on the long run.

With this latest article, I focus on a key short-term catalyst and a major long-term growth driver for Keyence that keep me bullish on the name. The catalyst for KYCCF in the near term is a recovery in the Japanese factory automation market, while the company’s key growth product for the long run is vision sensors.

Keyence’s shares can be bought or sold by investors in Japan and on the OTC (Over-The-Counter) market. The mean daily trading values for Keyence’s Japan-listed and OTC shares were $300 million and $1.7 million (source: S&P Capital IQ), respectively, for the last 10 trading days. Readers can trade in Keyence’s Japanese shares with higher trading liquidity utilizing the services of U.S. brokerages like Interactive Brokers.

Factory Automation Market Recovery Could Be A Short-Term Catalyst

Keyence’s shares have underperformed the S&P 500 (SP500) in the past six months. In the half-year time period between mid-July 2023 and mid-January 2024, KYCCF’s share price declined by -3.4% as compared to a +7.0% rise for the S&P 500.

I am of the view that a recovery in factory automation order is likely to be the catalyst needed to push up Keyence’s stock price in a meaningful way for the near term.

In the company’s FY 2023 (April 1, 2022 to March 31, 2023) annual report, Keyence refers to itself as “a leading company in factory automation” whose “superior sensing solutions” have offered the “positioning information essential” for automating factories.

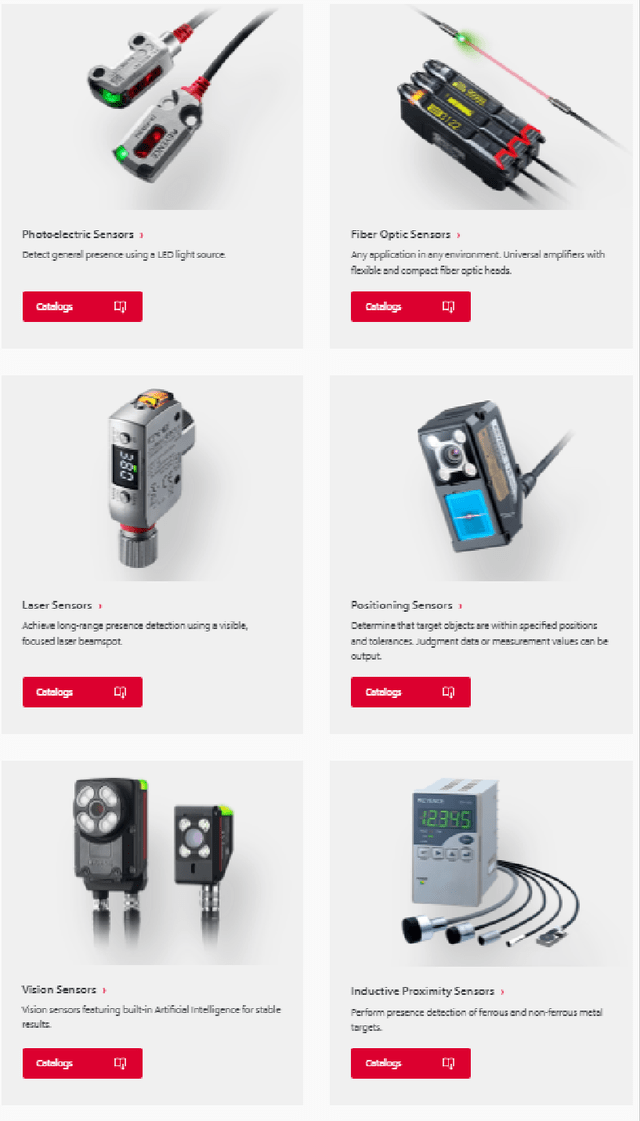

Keyence’s Key Sensor Products

The company’s financial results in recent quarters has been uninspiring, which is likely attributable to weak demand for the factory automation market as outlined in a July 2023 Nikkei Asia news commentary. Keyence’s Q1 FY 2024 (April 1, 2023 to June 30, 2023) top line and operating income in local currency or JPY terms missed the market’s expectations by -4.1% and -11.2%, respectively as per S&P Capital IQ data.

The company’s most recent quarterly revenue and EBIT for Q2 FY 2024 (July 1, 2023 to September 30, 2023) did beat the analysts’ consensus estimates by +1.9% and +3.0%, respectively. But Keyence’s actual Q2 FY 2024 top line and EBIT still decreased by -3.3% and -8.9%, respectively on a YoY basis.

However, there are signs that the worst is over for the factory automation market and Keyence, which points to a potential improvement in the company’s future financial performance.

The latest data released by JMTBA or Japan Machine Tool Builders’ Association on January 15, 2024 indicated that machine tool orders for the Japanese market grew +9.2% Month-on-Month or MoM to JPY126.6 billion in December 2023. It is worthy of note that this was the second straight month running that Japan’s machine tool orders had increased in MoM terms. This might indicate that we have already seen the worst relating to the factory automation market’s weakness.

Separately, the market has become more optimistic about Keyence’s short term growth prospects as per data sourced from S&P Capital IQ. The sell side’s consensus top line estimate for Keyence in FY 2024 was cut from JPY980.0 billion at the end of April 2023 to JPY961.3 billion at the beginning of December last year. But the analysts have subsequently revised KYCCF’s consensus revenue forecast for the current fiscal year upwards to JPY965.8 billion as of January 16, 2024. It is highly probable that the sell-side analysts have considered the potential recovery in Japan’s factory automation market in raising Keyence’s FY 2024 sales projection.

Company’s Vision Sensors Can Benefit From The Rise Of AI

Looking beyond the short-term catalyst for Keyence, the company’s major growth driver is the increase in demand for its vision sensors driven by AI tailwinds.

Keyence’s Vision Sensors

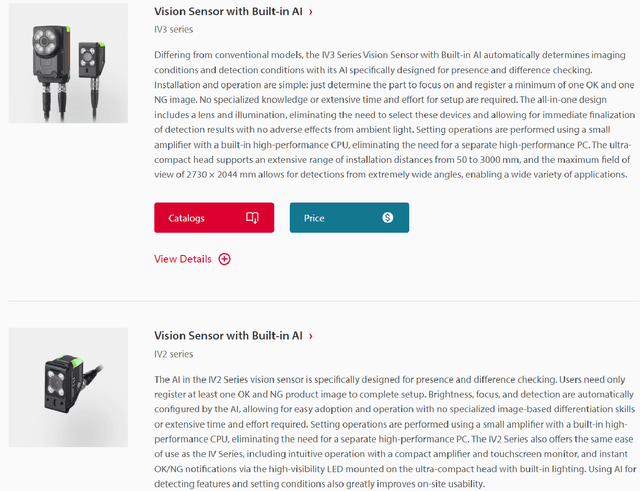

Keyence has launched new AI-related offerings to take advantage of growth opportunities in the vision sensor segment. According to an article published in engineering automation industry publication Control last year, KYCCF’s new AI-powered vision sensor that is part of its IV3 series is the first in the market to differentiate itself from competing products with “both part detection and difference detection built in.”

Based on a December 28, 2023 research report published by The Insight Partners, the worldwide vision sensor market is projected to expand from $3.28 billion last year to $8.33 billion by the end of the current decade. In this report. The Insight Partners highlighted that an increasing number of businesses are creating new “AI-based vision sensors that optimize quality control.” As highlighted in the excerpts taken from Keyence’s corporate website presented below, the company’s AI-powered vision sensors can be used in various sectors.

The Application Of Vision Sensors In Different Industries

The current FY 2024-2028 revenue CAGR projection for Keyence is +9.6% (source: S&P Capital IQ). In comparison, The Insight Partners’ 2022-2030 global vision sensor market CAGR estimate is much higher at +12.4%. This suggests that the market has yet to fully factor in the long-term growth potential of Keyence’s vision sensor products into the consensus expectations for the company.

Concluding Thoughts

My Buy rating for Keyence Corporation remains intact. Keyence is now valued by the market at 40.4 times consensus FY 2025 P/E, which represents more than a 20% discount to the stock’s historical three-year and five-year mean P/E multiples of 51.3 times and 49.2 times (source: S&P Capital IQ), respectively. I expect Keyence Corporation’s P/E multiple to expand and revert back to historical average levels (around 50 times) in the future, taking into account both its short-term catalyst and long-term growth driver.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.