skhoward

A corporate spinout may be a source of alpha for those with a keen eye for value and be willing to do a bit of homework. A spinout can occur for a variety of reasons, but typically, it involves segments or subsidiaries of a larger company that may not get the attention it deserves from analysts and investors. Alternatively, the parent company may want to jettison low growth or low margin businesses so the remaining core business segments can attain a higher valuation multiple.

During the spinout process, the parent company packages together these assets into a separate entity and ‘spins’ it out to shareholders, usually in a tax-free manner. One recent spinout example is Kenvue, Inc. (NYSE:KVUE), formerly the consumer health care division of Johnson & Johnson (JNJ).

Kenvue was spun out of JNJ in order to improve margins and growth at the health care giant. This labeling by JNJ plus a mispricing of the IPO may have caused Kenvue’s stock to underperform in the past year. However, after its steep decline, Kenvue is now fairly valued compared to consumer staple peers.

Company Overview

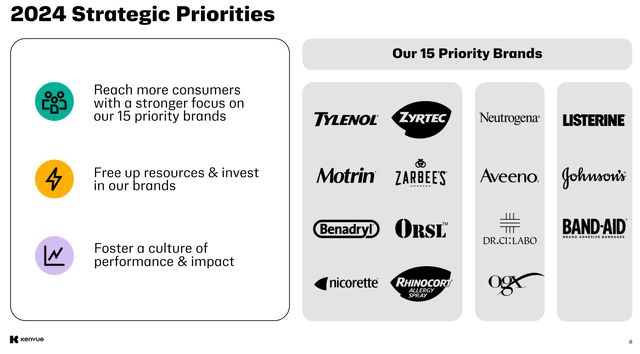

Kenvue Inc. is a consumer health care company that owns well-known household brands like Tylenol, Benadryl, and Band-aid that are the staples of most consumers’ medicine cabinet (Figure 1). The company was recently spun out of Johnson & Johnson in a multi-year process.

Figure 1 – Kenvue overview (KVUE investor presentation)

Low Margins Were The Impetus For Spinout

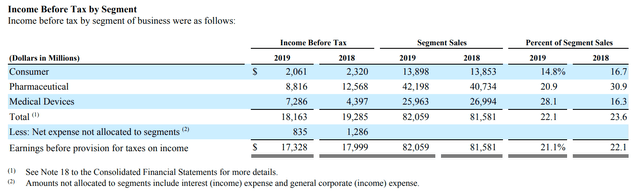

Although the consumer health care division of Johnson & Johnson included many iconic brands like Tylenol and Band-aid, profit margins on these over-the-counter (“OTC”) medicines and remedies were generally thinner compared to the high profit margins of JNJ’s patent-protected medicines and technologies. For example, as we can see in from Figure 2, the Consumer Products division had lower profit before taxes of 14.8% in 2019 compared to the Pharmaceuticals and Medical Devices divisions at 20.9% and 28.1% respectively (Figure 2).

Figure 2 – Consumer products were lower margins (JNJ 2019 10K report)

Furthermore, since consumer products like Tylenol and Band-aid are in mature categories, growth for the consumer health care business has been lackluster at low to mid-single-digits (“LSD to MSD”), dragging down the valuation multiple on JNJ overall. Therefore, JNJ’s management decided in 2019 to package up the these consumer brands into a separate company and spin out the assets to shareholders, such that the remaining businesses can achieve higher growth and valuation multiples from investors.

The multi-year spinout process was completed in May 2023, when Kenvue conducted an Initial Public Offering (“IPO”), raising $3.7 billion from selling 170 million shares (~10.4% of the company) to the public at $22 / share. JNJ retained the other 90% of KVUE in the IPO and in August 2023, JNJ allowed existing shareholders to exchange their JNJ shares for KVUE shares. Following the August transaction, JNJ only held 9.5% of the company.

Spin-out Set Up Stock To Fall

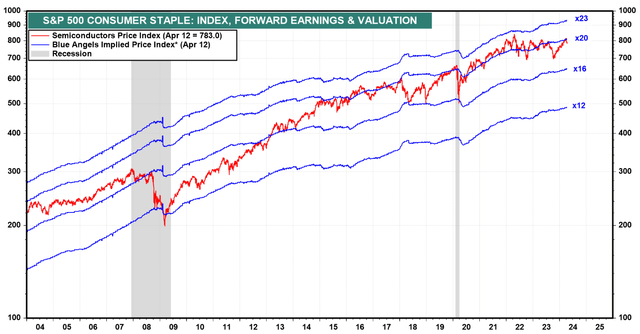

With the above-mentioned setup, is it any wonder that Kenvue’s stock has been in a free-fall since going public (Figure 3)?

Figure 3 – KVUE shares have underperformed (stockcharts.com)

Basically, JNJ was saying that “we have a bunch of low growth and low margin businesses that are dragging down our valuation, and so we would like to spin these assets into a separate company and let shareholders decide what to do with them”. Naturally, health care-focused investors who owned JNJ for its leading pharmaceutical and medical devices franchises were inclined to keep their JNJ shares and jettison their KVUE holdings, putting pressure on KVUE stock from day one.

Valuation Was Also Too Rich

Furthermore, it did not help that KVUE’s IPO set the company valuation too rich at a trailing 27.3x P/E (Figure 4), compared to its consumer staples peers that were trading at sub-20x Fwd P/E (Figure 5).

Figure 4 – KVUE IPO was priced too rich (Seeking Alpha) Figure 5 – Consumer staples traded at sub-20x P/E (yardeni.com)

Valuation Has Been Reset

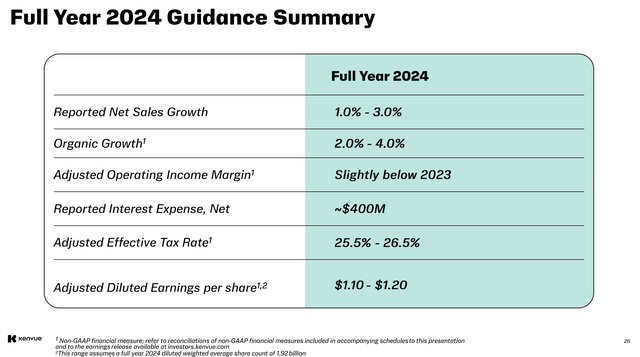

However, after the stock’s steep fall since its IPO last year, I believe Kenvue’s valuation premium has been worked off. For example, looking at the company’s guidance, management is expecting LSD revenue growth and earnings of $1.10 to $1.20 / share in 2024 (Figure 6).

Figure 6 – 2024 guidance (KVUE investor presentation)

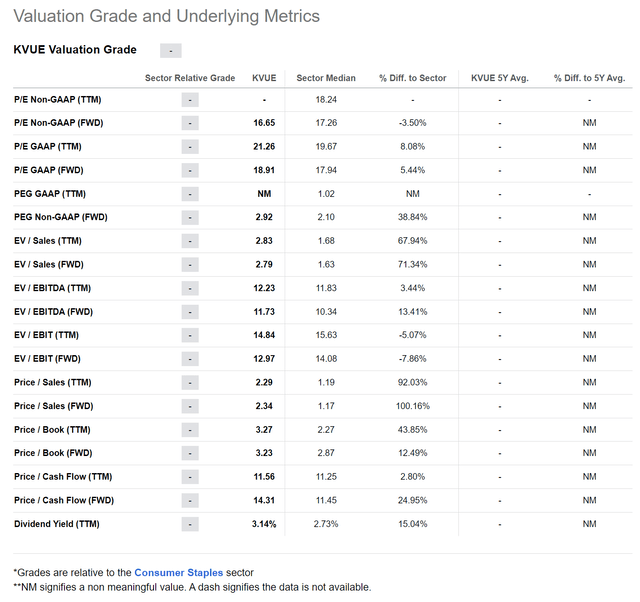

Based on consensus estimates and the midpoint of guidance of $1.15 / share in non-GAAP EPS, Kenvue is now trading at 16.7x Fwd P/E, in line with its consumer staples peers at 17.3x (Figure 7).

Figure 7 – KVUE valuation (Seeking Alpha)

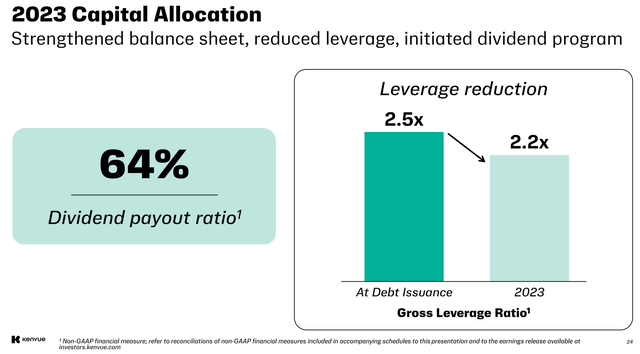

Kenvue also sports a 3.1% dividend yield with a 64% payout ratio (Figure 8).

Figure 8 – KVUE dividend payout ratio (KVUE investor presentation)

In my opinion, Kenvue’s stock now looks fairly valued.

Key Risks To Kenvue

The biggest risk to Kenvue is that the company simply tracks the OTC remedy industry, with no significant avenues for growth. Without growth, investors may simply value KVUE stock like a bond. In this case, Kenvue’s valuation will be sensitive to interest rates, which remain high.

Furthermore, some of Kenvue’s products have been mired in controversy in recent years, including its Johnson’s talc-based baby powder, which contained cancer causing chemicals, and its OTC decongestant products, which were found by the FDA to be ineffective.

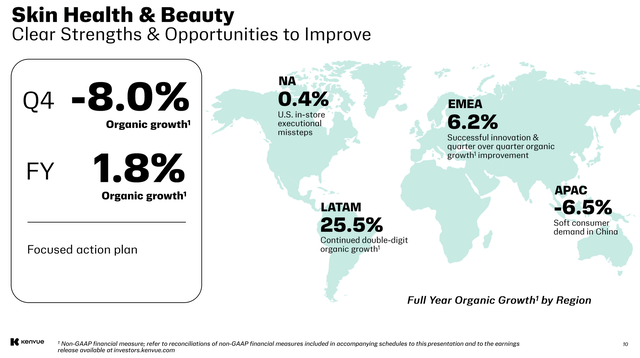

On the upside, Kenvue has been highlighting international markets, especially Latin America, as a source of growth for its skin and beauty products (Figure 9). If Kenvue can leverage this beach-head into higher growth for the rest of the businesses, then overall valuation multiples may expand for Kenvue, lifting its share price.

Figure 9 – Latam is a source of growth (KVUE investor presentation)

Conclusion

Kenvue is a recent consumer health care spinout from Johnson & Johnson. KVUE’s stock fell from day one as the IPO was priced too rich relative to consumer staples peers and the company was labeled as a low growth/low margin business by its parent.

However, after the stock’s steep declines in the past year, KVUE appears to be fairly valued, trading at ~17x Fwd P/E with a 3.1% dividend yield. I rate KVUE a hold and may revisit the company if the stock price pulls back significantly.