LIgorko

Kaman (NYSE:KAMN) just announced an acquisition offer for the company at $46 per share for all shares outstanding in cash, including for all outstanding options and warrants related to equity compensation causing the share price to double. Markets have priced in a certainty that the transaction will go through, hopefully reflecting that allocators that hold substantial shares in the company, and there are a number of them, are going to approve of the transaction. It would be very costly to the company if they didn’t. We feel the multiple is fair, considering outstanding income drags in some of the segments, and feeling the pressure of higher interest costs, which contrary to the market we believe will remain high, with the house view being almost no hope in a soft landing. This is a great moment for the company and its investors, but there’s no opportunity as of now for anyone wanting to trade the stock on the acquisition announcement.

Acquisition

The company is going to be acquired, pending shareholder approval, by a growth oriented PE, offering a $46 per share cash consideration for all stockholders and for management who have future rights for options and warrants associated with equity compensation, representing around 5% of shares outstanding.

For the full brief on the merger, you can consult that here. However, we focus on something critical, which is the “company termination fee”. The fee is actually pretty big, of around $46 million, which is close to 10% of Kaman’s market cap just a day ago prior to the acquisition announcement. It would be very anti-economical to terminate considering that clause.

Further, if the Merger Agreement is terminated because the Merger is not consummated by the End Date or if the Company Shareholder Approval has not been obtained at the Company Shareholder Meeting and prior to such termination but after the date of the Merger Agreement, an alternative acquisition proposal is made by a third party to the Company or publicly announced or is made directly to the Company’s shareholders, and within 12 months after the date of such termination the Company consummates, or enters into a definitive agreement to consummate, such alternative acquisition proposal, then the Company shall be obligated to pay the termination fee of $46,180,000.

8-K Form related to the acquisition announcement, from SEC.gov

Interestingly, the terms of the agreement also reflect the situation of PE in the current environment: interested in indebted companies and flush with dry-powder to settle the debt, and also keen on consummating transactions to justify their existence to increasingly impatient LPs.

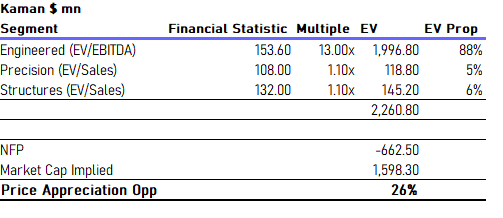

Let’s talk about the valuation. We did a crude SoTP of the business. The reason it is crude is we annualised all the figures despite cost savings initiatives in play for the precision business in particular, which is doing quite badly due to a major wind-down in a helicopter programme.

Valuation (VTS)

We took the multiple for Meggitt for the Engineered segment, as an average between synergy and non-synergy multiples, and then took vague MRO EV/Sales multiple which we felt was fair given the turnaround situation in the other two segments, considering that MRO companies are reasonably profitable while these segments are negative in EBITDA.

A pretty rich multiple of around 13x is somewhat reasonable for bearings and seals, since these markets tend to be targeted perennially by PE as pretty recession resistant and recurring, ignoring the unusual COVID-19 period as the plurality, around 30%, of Kaman’s overall sales mix is for commercial end markets. The valuation also includes dilution effects. The Meggitt acquisition was announced prior to the rate hiking regimes, so we don’t feel the proposed discount is that critical for shareholders voting. Mutliples have since fallen.

Bottom Line

Particularly because of the termination value, we feel that roughly speaking the acquisition price is reasonable. There’s no great reason to complain, especially given the reality of the already entered-into agreement. With the current price almost in line with the acquisition price, there isn’t really anything in this for new onlookers.