FluxFactory/E+ via Getty Images

I recently wrote an article outlining the investment case for Kamada Ltd. (NASDAQ:KMDA), a small manufacturer of plasma-based pharmaceuticals. This is an unexpectedly quick update following Kamada’s announcement of a major commercial agreement.

As explained in my original article, the anti-rabies drug Kedrab is one of the main sources of both revenue and growth for Kamada. It is distributed in the US by Kamada’s larger plasma peer Kedrion and has been one of the major growth drivers for Kamada in 2022 and 2023.

Kamada has now announced an expansion of the distribution deal with Kedrion that extends it for eight more years and interestingly also adds a minimum revenue ensure for the next four years.

The market has reacted very positively to the announcement of the extended deal with the share rising ~20% on the news. I can grasp why: the revenue ensure effectively locks in a significant part of the growth I was basing my investment case for Kamada on. As such, it’s worth spending a little time to look at the details.

Background on Kamada and Kedrion

Kedrab/Kamrab is an anti-rabies immunoglobulin plasma drug developed by Kamada which they license to Kedrion in the US (Kedrion is perhaps the smallest of the “large” plasma players and has a large portfolio of plasma-based treatments). Kamada manufactures Kedrab for selling to Kedrion and also markets it themselves in other parts of the world where it goes by Kamrab.

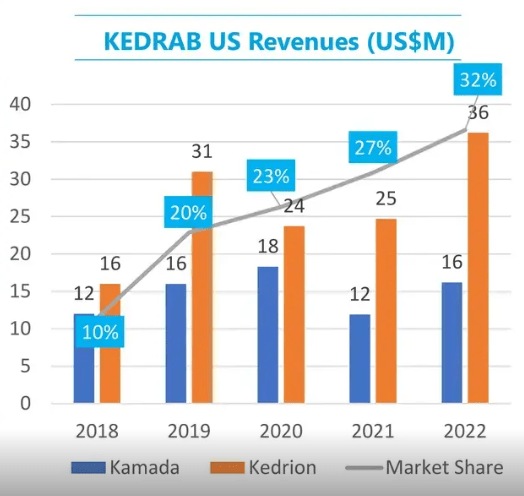

Kedrab is the current main driver of Kamada’s growth overall. It generated sales for Kamada of $16 million in 2022 (at 50% plus gross margin) and is on course to do significantly more than that in 2023. Management doesn’t break out sales by product on a quarterly basis, but based on commentary in earnings calls, Kedrab is the largest growth driver currently.

Kedrab sales 2018-2022 (Kamada Investor Presentation)

The drivers for that growth are multiple based on commentary in Kamada’s earnings calls: a post-covid US rebound in usage, a competing product from Sanofi having been withdrawn from the US market and Kedrab having a commercial advantage in being the only product explicitly indicated for use in children.

Kedrion had recently exercised an option to extend their US distribution agreement until 2026, but this has now been replaced with a more comprehensive expansion of the collaboration.

Details of the new agreement

The new agreement is set to start at the beginning of 2024 and will run for a period of eight years. On a conference call discussing the announcement, Kamada management mentioned the deal has an option for a encourage two-year extension.

Most interesting is the fact that for the first four years of the agreement, Kedrion has committed to buying at least $180 million of Kedrab from Kamada. Likely that $180 will not be evenly split over the four years, but to keep things simple, for now, I’m assuming it will be.

That means $45 million per year of guaranteed Kedrab purchases by Kedrion from 2024 to 2027. As can be seen in the graph above, in 2022 Kedrion only bought $16 million of Kedrab. While Kamada has indicated the 2023 number will be higher without disclosing specifics (I’m assuming ~$25-30 million), $45 million per year still represents significant additional growth.

It is not entirely clear why Kedrion and Kamada are so optimistic about continued growth for Kedrab in the US, but given the ensure in the new agreement, it is to some extent now a theoretical concern only. Kamada management did refer on the conference call that Kedrion expects Kedrab to continue gaining market share in the US, albeit without specifying if that is the main driver of the expected volume growth.

Kamada management also said on the conference call that the new agreement has “improved financial terms” and they expect their margins for Kedrab sales to Kedrion to improve from the current ~50% gross margin without going into specifics.

The announcement also mentions that Kedrion might start selling Kedrab in countries other than the US. Kamada already makes ~$6 million annually from selling Kedrab outside the US, but it does not sound admire this will be cannibalized. Kamada management said at the conference the discussions with Kedrion are about geographies where Kamada currently doesn’t sell Kedrab, so any expanded geographic distribution through Kedrion would be truly new revenue.

Finally, the announcement also mentions Kamada’s Israeli distribution business will start marketing Kedrion products in Israel. No details were provided and until proven otherwise, I would expect the distribution business to remain of little importance to the Kamada investment case (see my first article for why I think so).

Conclusion

My position on Kamada remains unchanged from my original article. I find the company to be undervalued for the combination of profits and growth on offer and rate it as a buy with a price target of $7 (which is still ~20% upside from the current share price).

The expansion of the agreement with Kedrion in my view significantly derisks the investment case. A large part of the growth I was basing my investment case on is now literally guaranteed thanks to the new contract with Kedrion. I think Kamada is well positioned for a rerating by the market: the company has a pristine balance sheet, is generating significant cash flows, and can now add this agreement on top.

Kamada now has two effectively guaranteed revenue streams: ~$45 million annually at 50+% gross margin from Kedrab and ~$10-20 million annually in Glassia royalties which is pure gross profit. At the very least this limits downside risk.

If Kamada can also execute equally well for its other revenue streams, as described in my first article, I think the market will react positively. I expect to revisit my price target once Kamada releases guidance for 2024, as I expect something higher than my current target of $7 can likely be justified.