bodnarchuk

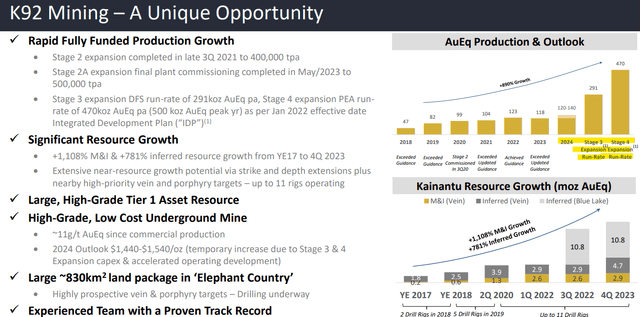

Canada-based K92 Mining Inc. (OTCQX:KNTNF) owns and operates the “Kainantu” Gold Mine in the Asia-Pacific nation of Papua New Guinea. The attraction here is an impressive operating record, including six consecutive years of production growth in what is recognized as a low-cost and high-grade asset.

The company is on track to deliver a major expansion project set to more than double gold production by next year. Indeed, the setup is particularly compelling considering the price of gold is at an all-time high as a strong tailwind for earnings. We expect a big year for the company and see more upside for shares of K92 Mining

K92 Mining Financials Recap

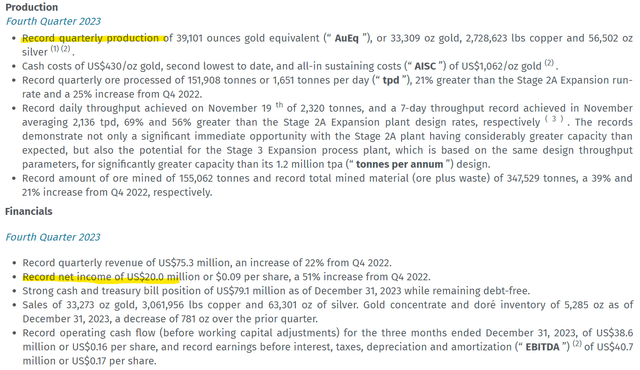

K92 reported its Q4 results in early April, highlighted by record quarterly production reaching 39.1k gold equivalent ounces (AuEq) up 10% year-over-year, capturing a boost in output from the group’s “stage 2” plant commissioning from May 2023. A 15% higher average realized selling price, contributed to total revenue of $75.3 million, up 22% y/y.

Cash costs of $430/oz of gold declined by 17% y/y amid easing operating costs that were pressed in 2022 from elevated fuel, and transportation expenses. That dynamic helped drive net income to $20.0 million, representing an impressive 50% increase over Q4 2022.

Into 2024, the latest update is a Q1 production figure of 27.4k AuEQ ounces, up 28% y/y. K92 is reaffirming full-year AuEQ production guidance between 120k and 140k ounces, a solid 11% y/y increase at the midpoint.

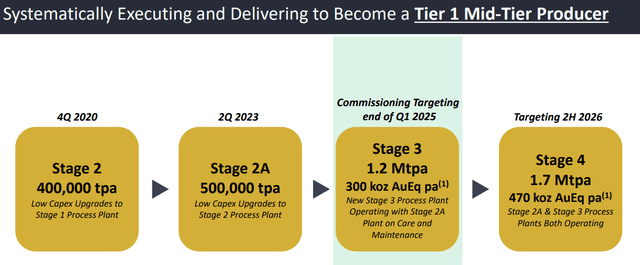

Attention has turned to the “Stage 3” expansion, a new standalone plant capable of processing 1.2 million tonnes per year. The project is scheduled to be commissioned by Q1 2025 setting the stage for a 291k AuEq annual production run rate, or 124% higher than the 2024 forecast.

While an elevated level of CAPEX this year may limit near-term earnings, the expectation is for a ramp-up of profitability from 2025 and beyond.

This expansion is expected to be funded by underlying cash flow and the company’s solid balance sheet, which ended the year with $79.1 million in cash against effectively zero debt.

There is also the “Stage 4” expansion project on the horizon. In this case, the company expects to reach a total AuEQ production annual capacity of 470k, by the second half of 2026.

The outlook here is for near 300% production growth over the next few years, transforming K92 Mining into a global “Tier 1 Mid-Tier Producer.” Operating costs are also expected to be significantly reduced over the period, leveraging the larger economies of scale and higher income.

What’s Next For K92 Mining?

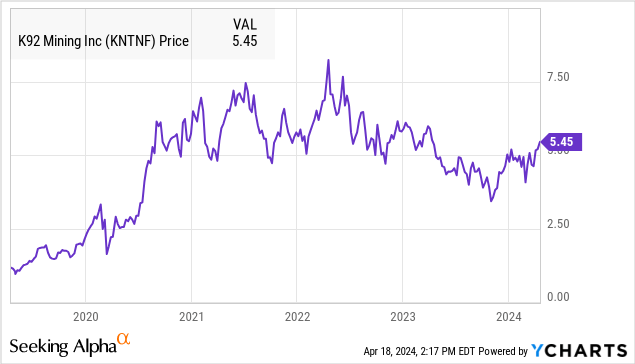

Overall, K92 Mining has a very impressive setup, with the numbers speaking for themselves. It’s fair to say the company has one of the highest expected production growth forecasts among global mining peers, but it also appears some of the positives in its story are already incorporated in its valuation.

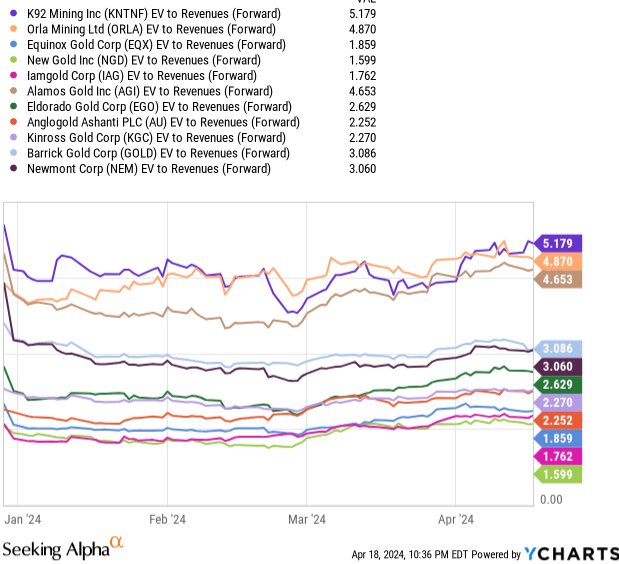

K92 trading at around 5 times year-ahead sales represents a premium relative to a group of comparable gold mining names. The key here is to recognize that 2024 is something of a transitional year ahead of stronger results through 2026.

If we assume revenues will at least double into 2025 given the expected production increase, a 1-year ahead sales multiple closer to 2.5 times would be around the sector average among names like Newmont Corp. (NEM) or Barrick Gold Corp. (GOLD)

yCharts

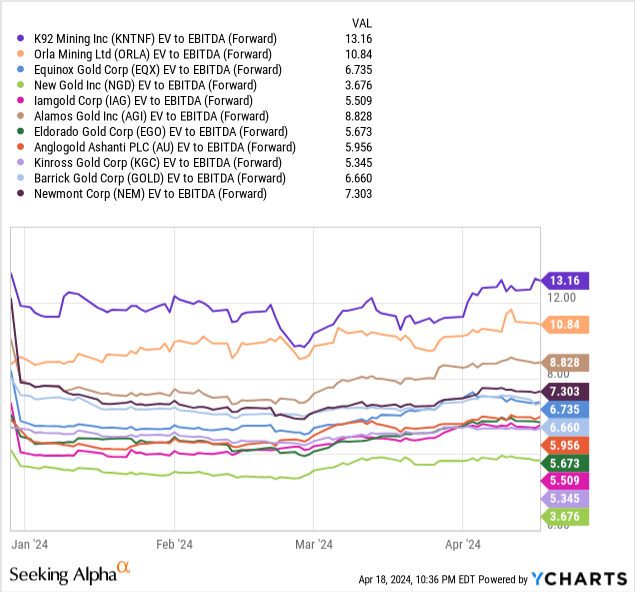

That dynamic is also evident through the EV to forward EBITDA ratio where K92 trades at around 13x the 2024 consensus EBITDA, a level nearly double the sector average where stocks like AngloGold Ashanti plc (AU) or Equinox Gold Corp. (EQX) trade at a multiple closer to 6x.

The argument we make is that this valuation premium has room to widen given the company’s growth outlook. The bullish case here is that K92 will meet or exceed targets and execute its expansion plans, allowing the operation to grow into its valuation.

Keep in mind that all these estimates assume a constant or flat gold price. A scenario where precious metals prices climb higher would make shares even more attractive.

Final Thoughts

We rate K92 Mining as a Buy, looking at shares currently trading above $5.50 and approaching a 52-week-high following a period of volatility last year. Our call is for the rally in KNTNF to continue, with highs from 2022 above $8.00 per share on the table as an upside target.

Overall, the company is a suitable option to gain exposure to the bullish momentum in the price of gold and the broader precious metals industry.

In terms of risks, there are some important points to consider. First, K92 Mining’s operating jurisdiction in Papua New Guinea is understood to be a higher-risk jurisdiction in terms of its legal system and political stability. This hasn’t been a problem for the company historically but could add to volatility.

We can also bring up the weakness of any mining company that has operations concentrated in a single asset. This contrasts with larger global mining players that have a greater scale of diversification. For K92, the risk is that a Force Majeure type of event at Kainantu would bring the entire business to a standstill.

Finally, a scenario where the price of gold (XAUUSD:CUR) takes an extended correction lower would likely pressure the stock and force a reassessment of the earnings potential.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.