Clive Beagles describes the past five years running a UK equity investment fund as ‘like running up a down escalator’ – very hard work. Yet he believes the down switch may have been turned off, potentially heralding a period of attractive returns from the UK stock market.

Beagles, joint manager of the £1.6 billion JO Hambro Capital Management UK Equity Income fund, says an intoxicating mix of factors bodes well for UK equities. These include lower inflation, interest rate cuts before the end of the year, an improving economy and a recognition among an increasing number of investors that UK equities represent good value for money.

‘For quite a while, life has been grim for UK fund managers and UK investors alike,’ he says, ‘but I sense that the mood music is getting better.’

Although continued conflict in the Middle East could upset the apple cart, he sees no reason for the Bank of England not to make a couple of rate cuts this year.

He says that if this happens, greater consumer confidence could lead to more spending, fuelled in part by the savings many households banked during the pandemic. This, in turn, he says, would help boost the shares of some of the retail companies held by the fund – such as furniture retailer DFS, DIY specialist Wickes, Marks & Spencer and electrical goods retailer Currys.

‘If we could see the consumer back spending like in 2019,’ says Beagles, ‘these retailers would do well as a result of the significant market share they hold in their respective sectors.’

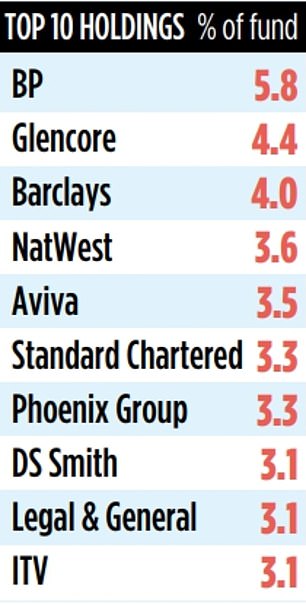

The fund holds stakes in 60 companies and generates an attractive dividend yield from them – equivalent to about 5 per cent a year. Indeed, its dividend record is exemplary, with growth averaging 9 per cent per annum over the near 20 years that the fund has been running.

Beagles says a focus on dividends ensures the fund steers clear of the worst of the collateral damage caused when stock market bubbles burst. It also forces him and fellow manager James Lowen to concentrate on undervalued stocks that tend to provide the most attractive dividends in yield terms.

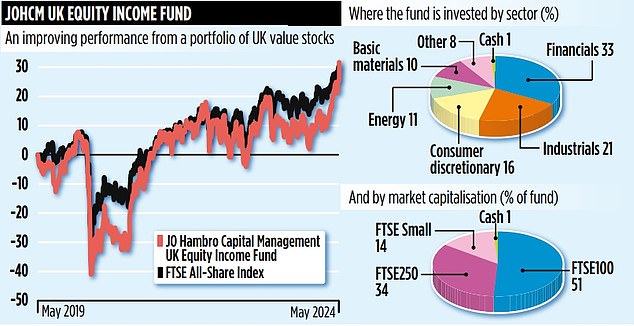

Unlike some of its rivals, the JOHCM UK Equity Income fund is not totally focused on FTSE100 dividend-friendly stocks. Just under half of the portfolio by value is in FTSE250 or small cap stocks – areas that most investors have ignored for a long time.

Beagles says shares in many small cap stocks resemble ‘coiled springs’ while most bank stocks are seriously undervalued and ‘could double from here’. Barclays, NatWest and Standard Chartered are among its top ten holdings.

Beagles is nonplussed about the decision of Coutts Bank – part of NatWest – to embark upon a £2.7 billion sale of UK equities. The move has been justified by the bank on the grounds that it needs to diversify its investment portfolios and improve returns.

‘It’s understandable in some ways,’ says Beagles. ‘Stocks in the United States now account for 65 per cent of world indices, but the US market won’t always outperform. We still see plenty of opportunities to make money from our destination stock market.’

Over the past 12 months and five years, the fund has given returns of 18 and 37 per cent. Respective returns from the FTSE All-Share Index are 11 and 36 per cent, while the average UK equity income fund has generated total gains of 11 and 31 per cent.

Total annual fund charges are reasonable at just under 0.7 per cent, while dividends are paid quarterly.