Thomas Barwick/DigitalVision via Getty Images

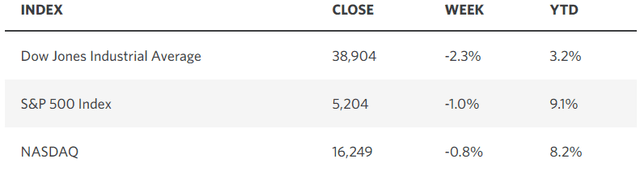

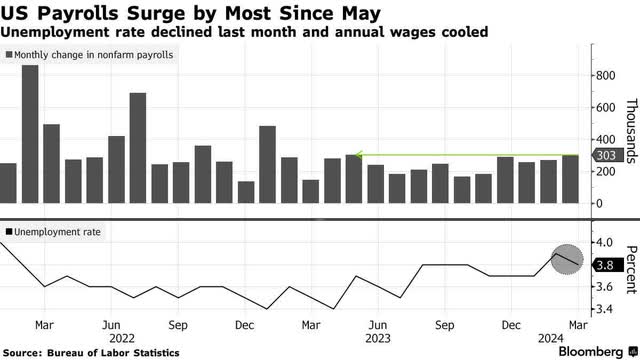

Stocks took a breather last week, as investors interpreted labor market data for March as too strong to allow the Fed to start lowering interest rates by June. The Job Openings and Labor Turnover Survey (JOLTS) revealed a small increase in the number of jobs available. The ADP report showed 184,000 jobs created last month, which was much stronger than expected. That was followed with Friday’s payroll report, resulting in a stunning 303,000 new jobs, along with a decrease in the unemployment rate from 3.9% to 3.8%. As a result, the probability that the Fed’s rate-cut cycle will begin in June fell below 50%, which is a huge divergence from the six rate cuts expected at the beginning of this year. Yet investors don’t seem overly concerned, and I think rightly so.

Edward Jones

I still see at least three quarter-point rate cuts this year by the Federal Reserve, as the rate of economic growth slows, and the rate of inflation continues its decline towards 2%. That said, if the economy remains resilient in the face of prevailing rates, then the entire debate about when rate cuts start and how many we have may be irrelevant. We analyze all this data from one month to the next to determine where we are in the business cycle and when this market will pivot from bull to bear and back again. The soft landing scenario is still the most probable, which is why the bull market continues in full force. Those who failed to see both developments keep looking for reasons to poke holes in the optimism, but they keep coming up short. With respect to jobs, investors would be better served focusing on consumption when it comes to leading indicators for economic growth and inflation.

Bloomberg

The reason the economy creates jobs is that consumers spend more money on goods and services, which increases the need for more workers. Granted, new jobs produce extra income, which is then spent on goods and services, thereby increasing consumer spending, but spending is what leads. This is why the most informative leading indicator of economic activity is the year-over-year increase in real consumer spending growth rather than job creation. Consumption is the tip of the spear, yet market commentators spend far more time analyzing the monthly payroll report, which is subject to huge revisions and lags rates of change in spending.

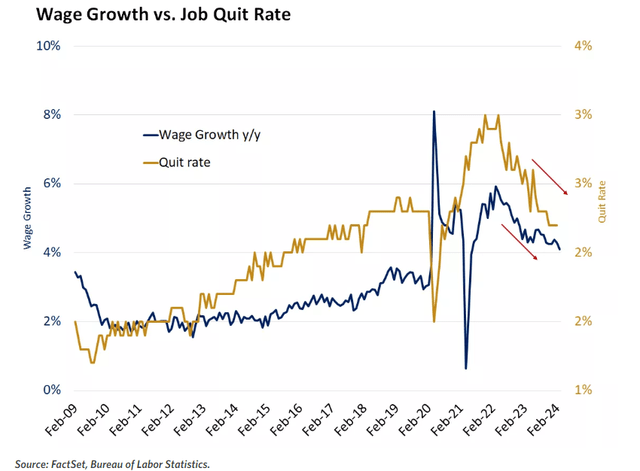

With respect to the jobs report, the most relevant detail is wage growth. An increase or decrease in wage growth for a labor force of some 160 million is far more impactful than whether the economy created 100,000 more jobs than expected in any given month. The rate of wage growth is decelerating, which is disinflationary. Thankfully, at 4.1% it is still modestly above the rate of inflation, resulting in real wage growth. That increases the likelihood that we sustain real consumer spending growth, which keeps the economy growing. The quit rate is also decelerating, which further pressures wage growth. Both trends are friends to the soft landing narrative.

Edward Jones

The stock market is the ultimate leading indicator, and its continuous grind higher this year tells us that the soft landing is on track. The rate of inflation continues to decelerate, while the economic expansion continues. This is a goldilocks economy and a bull market that should continue well into 2025. The continued skepticism from market commentators is largely unjustified, but I appreciate it from the standpoint that it means there are still investors who have yet to participate in this bull market, which means we have more upside to go. Enjoy the ride!

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.