Christmas cheer: The Grinch is doing his worst

Grinch 1

I was rather perturbed to receive a copy of a text sent by the Department for Work & Pensions to someone whose entitlement to Personal Independence Payment (PIP) is being reviewed.

Although reviews of individual payments – made to those with long-term physical or medical conditions that make carrying out everyday tasks difficult – are a feature of PIP, they can be traumatic experiences, sometimes requiring a medical assessment to be carried out. They can also result in the payment being stopped.

It was therefore somewhat insensitive of the DWP to send notification of an impending review (via text) to a PIP recipient on Christmas Day at just after eight o’clock in the morning. Especially given the woman who received it has mental health issues that are only controlled by strong epileptic medication.

According to her mother, the text caused her daughter to suffer a panic attack and anxiety symptoms that ruined the festive day for her and her family.

It has also resulted in a dark cloud hanging over her while the ‘interminable’ review process ‘grinds slowly to a conclusion’. I asked the DWP whether it thought it was appropriate to send out such an insensitive text on a key family day of the year for so many people. I also asked how many texts it had sent on Christmas Day notifying PIP claimants of impending reviews.

Its press office responded by saying that the information I had requested was not available, other than through a Freedom of Information request – insensitively, it offered no comment on the poor timing of the text.

I have made the Freedom of Information request – and will update you when I receive it.

Grinch 2

Remaining on the Christmas theme, a dear friend (Adrian) received a note through his family home’s letterbox on December 21 from Royal Mail. It wasn’t a letter of apology for its all-round appalling service, but notification that he must pay a £5 fee before a specific item would be delivered to his home.

Assuming that it was a package, Adrian did what he was instructed to do, paid the £5 and gave Royal Mail the date when he would like it delivered. When the item arrived a few days ago (amazingly, on time), Adrian was rather miffed to discover that it wasn’t a package after all, but a Christmas card from a family friend that had been sent without any stamps on it.

Adrian believes the £5 fee is rather excessive given that a first-class stamp costs £1.25 while a second-class one is 50p cheaper. It is, but Royal Mail remains in a parlous financial state (losses of £319 million in the six months to September 24 last year) so needs every pound it can grab from customers.

The irony of the message on his friend’s Christmas card was not lost on Adrian: ‘Special Christmas delivery.’

Could you be £1,200 better off?

Hats off to retirement specialist Just Group for highlighting the poor take-up of means-tested benefits among the elderly.

According to its latest research, eight in ten pensioner homeowners eligible to claim benefits are failing to do so, in the process losing out on an extra average income of £1,231 a year. A further nine per cent are not claiming their full entitlement.

Benefits not being widely claimed include guarantee and savings pension credit, council tax reductions and universal credit (for those under state pension age).

Many pensioners living in rented accommodation are also not claiming housing benefit.

Just Group says a failure to apply for pension credit, payable to those over state pension age and on a low income, precludes households from a host of other benefits. These include free NHS dental care, cold weather payments and a free TV licence (for the over-75s).

The message is clear. If you think you are missing out, speak to Citizens Advice or Age UK who can help you make a claim. There are also some useful calculators at: gov.uk/benefits-calculators.

Fight your corner…whatever your age

Among the hundreds of emails I have received in the last few days from readers recently stung by rocketing insurance premiums (thank you, thank you), two caught my eye straightaway.

They were from retired police officers Hugh Colin Penfold and Derek Bradley who both passed advanced driving courses while working for the Metropolitan Police. Although Hugh and Derek are now 85 and 90 respectively, they passionately argue that the driving skills they learnt while working have never left them.

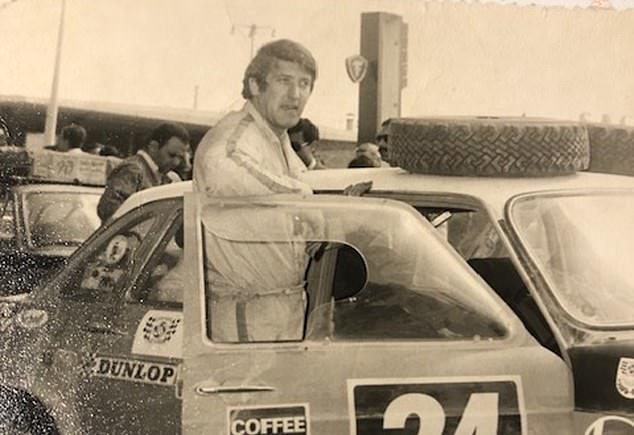

Hugh, from Epsom Downs in Surrey, took part in the 1970 London to Mexico Car Rally, and insists that today he could give a professional driver like Lewis Hamilton a run for his money. For the record, he has never had an accident.

Advanced driver: Hugh Colin Penfold took part in the 1970 London to Mexico Car Rally

Meanwhile, Derek, from King’s Lynn in Norfolk, has never had to make a claim for an accident where he was at fault – although four years ago he did make a no-fault claim after somebody drove into the back of his car in stationary traffic. He remains a member of IAM RoadSmart, previously known as the Institute of Advanced Motorists.

Both resent the fact that insurers look upon them as poor risks because of their age. Hugh says that car insurers regularly view him as ‘an old man who is probably too dodgy on the road, a danger to others, and should not be driving’.

Although Derek admits some elderly drivers should no longer be on the road, he is angry insurers adopt a blanket approach to people of his age. ‘Older drivers are discriminated against,’ he contends. ‘Indeed, some such as NFU Mutual won’t insure me because of my age. To this day, I drive according to the way I was taught as a police officer.’

Yet Hugh and Derek are made of stern stuff and are quite happy to challenge their insurers when presented with renewal premiums that they believe to be unfair. Every year, Hugh’s insurer tries to push up the cost of his cover, only for him to get on the phone and fight back. Last November was no exception.

By arguing his case with insurer AA and agreeing to pay a chunk of his annual premium upfront, Hugh managed to limit the increase to £5 rather than the £205 originally demanded. Derek’s insurer – a subsidiary of Liverpool Victoria – wanted to increase his premium by 25 per cent to around £1,000, but by agreeing to forgo his protected no-claims bonus, he managed to limit it to 12.5 per cent.

Yes, both Hugh and Derek had to give a little to keep their premiums affordable but the insurers ended up taking less than they wanted to. Irrespective of age, fight your corner.

Tax deadline looming

Just a gentle reminder. The self-assessment deadline (midnight, January 31) is looming. So please do all you possibly can to file your tax return ahead of the deadline – and pay any tax due (for the tax year ended April 5, 2023).

As you probably know, late filing will result in a £100 fine, irrespective of whether you owe any tax.

Don’t give His Majesty’s Revenue & Customs the opportunity to diminish your household finances any more than it already does.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.