Investment house Seven Investment Management is a success story. Over the past 22 years, it has built a business that manages £20 billion of assets on behalf of individuals, families and charities.

The company, which badges itself 7IM, knows a thing or two about investing. Every week, one of its experts opines pithily on a particular aspect – anything from the merits of portfolio diversification through to surviving bear markets. Like mini-Easter eggs, I devour them.

Its recent missive on dividends caught my eye, reminding me of the pulling power dividends have in persuading investors to put money into particular companies.

It said: ‘Dividends are a strong driver for shareholders to invest in a company. When a company offers a dividend, it’s making a statement: ‘Business is booming, and while we’ve reinvested some of our earnings into the business, we’re also rewarding our shareholders by giving some of their investment back.’ ‘

These words came rushing back into my mind a few days ago when investment trust Alliance announced its final quarterly dividend for 2023, a payment of 6.34p per share. It meant that last year, the £3.4 billion stock market-listed fund paid shareholders dividends totalling 25.2p, an increase of five per cent on the year before.

Looking up: The pulling power of dividends can persuade investors to put money into particular companies

More impressively, it extended the trust’s record of growing its annual dividend to 57 years. Only trusts City of London and Bankers, both managed by Janus Henderson, have consistently grown their dividends over such a long period of time.

Although ‘booming’ is not a word I would necessarily use to describe Alliance, there is no doubt that this 135-year-old trust ticks many boxes for investors.

Its assets are invested worldwide, the annual running costs are low (0.62 per cent) and, unusually for an investment trust, it draws upon a team of fund managers to generate returns for shareholders.

Pulling the strings is investment house Willis Towers Watson (WTW) which parcels out the trust’s assets to some of the world’s leading managers to run. Currently, they are in the hands of ten fund groups (the likes of Dalton, GQG, Jupiter and Vulcan) which all add something different in terms of investment expertise. Each runs a portfolio of no more than 20 stocks, apart from GQG which also runs a parcel of emerging markets assets. WTW oversees the managers and occasionally replaces some if they are not delivering the goods – or better ones are found.

The result is a 200-strong portfolio with nearly 60 per cent of the trust’s assets in the United States. More importantly, the process works. Over the past three and five years, it has delivered overall returns of 39 and 73 per cent, respectively. Only one trust among its global peer group – Brunner – has a better record.

Last year’s dividend of 25.2p compares to a current share price of £11.72. Although the annual income is modest in percentage terms – a tad over 2 per cent – it is in growth mode.

Seven Investment Management says investors should be aware that companies sometimes don’t get their dividend policy right – overpaying shareholders when they should be investing more in their business.

Yet this cautionary advice doesn’t apply to Alliance. It is a prudently managed business which has plenty of income – more than a year’s worth – tucked away in reserve if things cut up rough.

It’s the kind of investment that should lie at the core of a well-balanced Isa or DIY pension portfolio.

Evil. Only word for fiend who tried to target my late mum

Good memories: Jeff with his mum

I would love to find the fiend who recently cloned my mother’s personal details so as to take out a current account with Santander in her name – and presumably then go on a short-term spending spree.

I won’t tell you what I would really like to do to them if I discovered who they were. But maybe a stretch in HMP Wakefield would allow them to see the error of their ways.

Although their application, thankfully, caught the attention of the bank’s fraud operations team and was rejected (thank you, Santander), the actions of this financial criminal will stick in my craw for a while. Not only did they despicably target a vulnerable 88-year-old, but Mum (or Helen of Troy as I call her) died late last month after a long battle with cancer. Her funeral will take place this week.

Mum had died by the time Santander wrote informing her of the attempted fraud, so she was spared the distress its letter would inevitably have caused. But it raised my blood pressure into dangerous territory.

Financial crime may be non-violent, but it is still evil and needs to be stamped on from a great height.

My thriving hometown… but still the banks shut

My hometown of Wokingham in Berkshire remains in quite good nick despite the continued cost-of-living crisis. It is in growth mode as new developments pop up everywhere.

Even retirement home specialist McCarthy Stone seems to like it, judging by the fact that it has just built its second complex in the town (Oakingham Place) – a five-minute walk from its longer-established Queen’s Gate (no, I don’t have an eye on one of them quite yet).

Yet, like many towns up and down the country, the banks seem disinterested in supporting Wokingham with branches that residents and small businesses can use to do their banking.

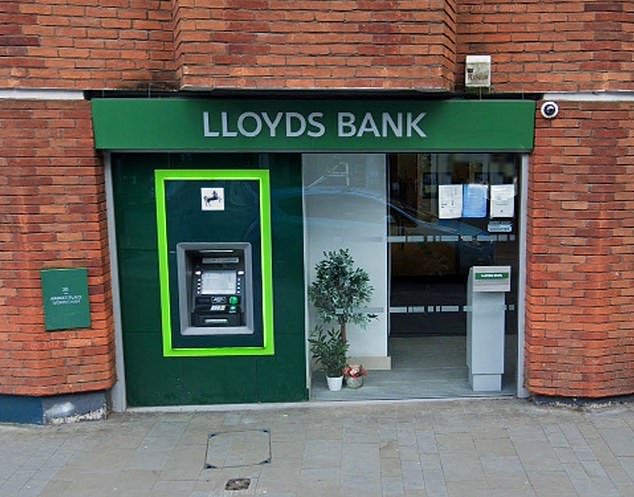

Disinterest: Lloyds’ branch in Wokingham looks set to be the latest to close in the town

Since I rocked up in the town in early 2020, Barclays, Santander and NatWest have all shut their branches. This leaves building society Nationwide (of course), HSBC and Lloyds clinging on – while the Post Office provides banking services at the back of a rather tired looking WH Smith. But it now looks as if Lloyds will be next to go. The council has just approved a new development for the land that Lloyds and retail neighbour Robert Dyas sit on. It will embrace 60 flats, three new shops and a public square.

The proposals have already attracted criticism because of no social housing being incorporated into the project. One councillor says Wokingham is turning into ‘a town for only the rich’ – an understandable view given that prices for a two-bedroom flat start from £300,000.

Maybe, Lloyds will occupy one of the new development’s three shops – if it does, I will eat the brown hat I loved, but my late mother despised.

The more likely outcome is that the bank will desert the town. As local Steve Ross – a 68-year-old retired electronics engineer – told me, if things carry on as they are, it won’t be long before Wokingham is eligible for a banking hub (a shared bank branch).

One final observation on bank branches. Seven days ago, I was in Staines-upon-Thames, Surrey, after participating in a rather muddy running event. Given the town centre has seen better days, I was rather surprised to see three banks on its high street, occupying consecutive buildings – Lloyds, Barclays, and NatWest. Illogical in a world where banks are shelving branches? Yes, although I’m not knocking it.

- Does your town have a similarly impressive line-up of banks? Email jeff.prestridge@mailonsunday.co.uk.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.