Ake Ngiamsanguan

Overview

My recommendation for Jamf Holding Corp. (NASDAQ:JAMF) is a buy rating as execution remains strong, as shown in the revenue, ARR, and earnings growth, despite the weak macro backdrop. The near-term growth might still be impacted by the weak macro; however, I think the long-term upside remains attractive. Note that I previously rated a buy rating for JAMF as I expected earnings growth to speed up in the upcoming quarters, which should drive the share price up. JAMF’s long-term growth should also follow the evolution of Apple products.

Recent results & updates

JAMF reported 3Q23 revenue of $142.6 million, growing 14.5% in 3Q22, driven by recurring revenue growth of 16.9% offset by a service revenue reject of 24.2% and License revenue reject of 79.7%. Below the revenue line, gross margin was reported at 82.1%, an boost of 50 bps annually. These performances drove a 320bps boost in adj EBIT margins to 8.7%, which led to an adj EPS of $0.08, double from 3Q22 $0.04. In short, the performance was outstanding and, in my opinion, in line with my expectations that earnings growth will start to speed up. This is a good start, with 80% adj EBIT y/y growth and 100% y/y EPS growth.

While Service and License revenue reject, they should not be a major concern given the minor profit contribution. The focus should be on continuous, strong adoption of JAMF products, as evident from the 15.5% growth in total ARR (annual recurring revenue) to $566.8 million. Total devices under management [DUM] also grew 8.5% Y/Y to 31.8 million, an improvement of 500k vs. 2Q23. I would highlight that DUM growth is not on a admire-for-admire basis, as JAMF growth was pulled forward during COVID (CY2020), and as such, the Education market is still digesting the purchases made back then. If we adjust for that impact, growth should be in the 10+% range. From a unit economic standpoint, ARR/device was up again for consecutive 10 quarters to $17.81, indicating continuous successful efforts in cross-selling products to existing cohorts. My bullish thesis that JAMF is able to ride on the evolution and growing adoption of Apple products is playing out nicely. The more Apple products users and businesses adopt, the bigger the TAM for JAMF, and I believe there is still a lot of room to cross-sell as only 23% of customers are using at least one management and security solution. I also think there is an emerging secular tailwind that will boost JAMF’s cross-sell ability—the growing need for cyber security. McKinsey estimated that this market could be worth as much as $2 trillion. While JAMF will not be able to penetrate 100% of this $2 trillion market, the sheer size of this market indicates the proliferation of cyberattacks. I expect this growing awareness will drive more users to adopt JAMF security solution.

One negative point shining in JAMF’s results is that net revenue retention [NRR] continues to reject, touching 108% in 3Q23, which represents the 3rd consecutive quarter of reject. I believe the reject was largely due to the weak macro environment rather than a sign of demand softness (recollect that ARR is up 15.5%). The weak environment has forced many businesses to cut headcount or slow down the pace of hiring, which impacts the rate of device adoption. As the macro environment eases, NRR should start to speed up back to historical levels as JAMF continues to cross-sell successfully. That said, I admit that this might take some time as the macro environment has not shown any signs of recovery yet. Management 4Q guidance also does not imply any improvement.

Taking a step back and looking at the long-term, I think JAMF’s competitive position remains strong in the industry, as nothing fundamental has changed. Execution remains very strong, as seen in the results, despite the worst macro environment ever since the subprime. I expect JAMF to continue showing resilience as they have a significant number of customers (74k as of 3Q23) that diversifies concentration risk. Furthermore, JAMF has a bunch of education customers who are unlikely to go out of business; as such, I think it has quite a defensive position to tide through this macro weakness.

Valuation and risk

Author’s valuation model

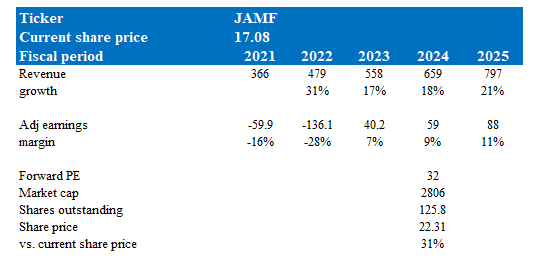

According to my model, JAMF is valued at ~$22 in FY24, representing a 31% boost. This target price is based on my accelerating growth forecast over the next 2 years, as I expect the macro environment to gradually ease. I note that JAMF was growing as high as 39% pre-covid; as such, it should not come as a surprise that growth can advance speed up from here. JAMF’s 3Q23 results also showed that margins are expanding at a much faster pace. 3Q23 adj earnings margin is already near 8%. With advance growth, 9% in FY24 is not a stretch at all. I modeled another 200bps boost in FY25. My valuation methodology remains the same as before, where I looked at the 2-year forward earnings valuation to benchmark my assumption. Note that JAMF is growing earnings at a rapid rate; as such, the 1-year forward earnings multiple will be elevated.

The risk to my investment case is that the macro environment deteriorates advance from here. However defensive the JAMF business might be, a continuous sluggish environment would hurt businesses, which would advance reduce device adoption. As much as I admire the JAMF execution so far, they cannot escape the wrath of a recession if it comes.

Summary

To summarize, I reiterate my buy rating for JAMF as it continues to show robust performance despite the prevailing weak macroeconomic conditions. While short-term growth might be affected by the macro environment, I preserve a bullish outlook on its long-term prospects, anticipating acceleration in earnings growth. The growing need for cybersecurity should also boost JAMF cross-sell ability.