vejaa

JAKKS Pacific (NASDAQ:JAKK) just released Q4 2024 results:

- Revenue of $127.4M (-3.4% Y/Y):

- Q4 Non-GAAP EPS of -$1.04 (+27% Y/Y)

- Gross margin of 26.5%, up 480 basis points vs. Q4 2022, led by improved landed product cost and reduced inventory obsolescence expense

- Adjusted net loss attributable to common stockholders (a non-GAAP measure) of $10.5 million (or $1.04 per diluted share), compared to adjusted net loss attributable to common stockholders of $13.9 million (or $1.42 per diluted share) in Q4 2022

- Adjusted EBITDA (a non-GAAP measure) of $(10.9) million vs. $(12.1) million in Q4 2022

Good results have been obtained, with revenues practically equal to those estimated by the market of $127.4M ($128.7M estimated) and an adjusted EPS of $-1,04, a figure that has exceeded market expectations ($-1.14).

Here the most important data has been the gross margin, which at 26.5% has improved by 480 basis points compared to last year’s data.

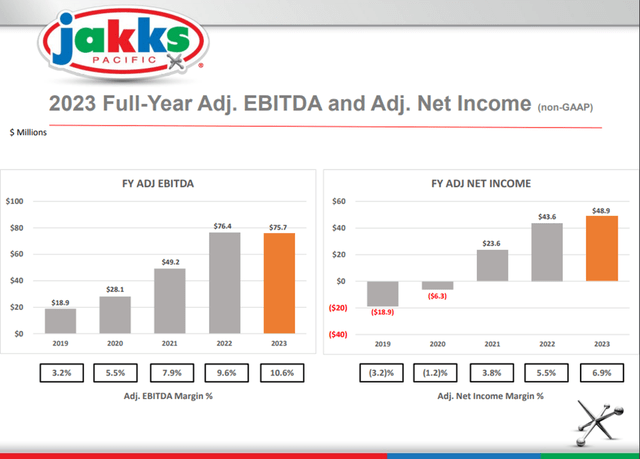

These results confirm the good trajectory of the company, which manages to increase the adjusted net profit attributable to stockholders in 2023 (+$4.63) compared to 2022 (+$4.29), even with a small 10% drop in revenue.

The good management of the administrators, with a reduction in operating costs, better inventory management and lower freight transportation costs, has led to good annual gross margin and EPS data.

In terms of revenue, the small drop compared to the previous year 2022 can be explained because the year 2022 was an exceptional year for JAKKS with record revenue of almost $800 million (close to a 30% year-on-year increase).

In Q4 CC, the company spoke very cautiously about the prospects for the current year 2024, due to the lack of films planned during the first half of 2024. Regarding the second half of 2024, they are more confident due to the seasonality of the business where the third quarter is typically the strongest of the entire year, and the promising movies expected to be released during the second half of the year (including potential with movies like Minions 4, Moana 2, a new Ghostbusters movie, Kung Fu Panda 4 and Sonic the Hedgehog 3, all of which the company has licensed). On top of all this, in November, the company signed a long-term deal with Authentic Brands Group, adding several new products to JAKKS sales starting in 2024. Additionally, the company signed a multi-year deal with SEGA for the brand. Sonic the Hedgehog among other agreements.

I get the feeling that the company doesn’t want to give overly enthusiastic expectations and that they are underestimating the revenue potential that JAKKS has for this year and beyond.

As for the company’s valuation, it is frankly very undervalued. As we will see later, using different valuation methods, they all agree on the great undervaluation that JAKKS currently presents, being the cheapest among its peers.

And what was the justification for the sharp drop in the share price last Friday, just after the presentation of the fourth quarter results? In my opinion, there are several factors that could have explained it:

- JAKKS is a stock with low trading volume, which translates into high share price volatility. On the chart, you can see large fluctuations in a short time. In fact, after the publication of the results for the fourth quarter of 2022, the price plummeted drastically by 30% (approximately equal to last Friday’s drop). In a few weeks, it recovered, rising 72%. Most likely, the price will now follow the same pattern.

- Since the publication of the results of the last third quarter of 2023, the shares had appreciated approximately 100% until before the publication of the fourth quarter. It was very likely that a technical price correction could occur.

- In Q4 CC, the company has been very cautious with the prediction for the current year 2024 (especially for the first half). I think they have underestimated the real income and profit potential they can achieve.

For all these reasons, I believe that after the recent great collapse in the stock price, now is a very good time to enter or load more. It is very likely that in a short time, the shares will begin to recover, and even break the resistance around $37.

JAKKS Profile

JAKKS designs and produces its own toys and those of several famous brands through various licenses (Disney (DIS) and Nickelodeon. Walmart (WMT) and Target (TGT) are JAKK’s two largest customers, each representing more than 25% of your sales.)

JAKKS expects a soft first half of 2024 and recovery in late 2024 and 2025. Average gross margin will most likely remain at high levels (>30%).

The company expects a soft 2024 due to several factors, such as the lack of success of the Thanksgiving film of 2023 and the actors’ strike last year. It was precisely the strong follow-up to the 2021 Thanksgiving film (Disney’s Encanto) that led to the strong revenue growth in fiscal 2022.

Precisely this prudent forecast discussed in the fourth quarter is what, in my opinion, has caused panic sales two days after the publication of Q4 results with a share price drop of around 36%.

And the relatively light volume this year tends to lead to a somewhat softer overall business.”We are extremely proud of our performance during this time but are only looking forward to another year that will inevitably prove challenging, but we feel is still filled with major opportunities…

Source: Q4 CC

This a totally exaggerated market reaction because as we will see below, there are good reasons to expect a good second half of the year 2024 and a very good year 2025.

For the second half of this year 2024, an increase in revenue is expected thanks to promising films (Disney’s Moana 2, Sonic the Hedgehog 3, Sony’s Ghostbusters: Frozen Empire, Illumination Entertainment’s Despicable Me, Embassy Universal’s Wicked and Kung Fu Panda 4).

In addition to JAKKS strong portfolio of Evergreen-licensed intellectual property, from Disney princesses to lilo & Stitch, Nintendo, Sonic, Pokémon, Halo, and Minecraft, just to name various whose rights belong to JAKKS and which can make the income return to grow at the end of 2024 and throughout 2025.

On the other hand, it is expected that at the end of 2024, a whole series of high-brand items from renowned companies with which collaboration agreements were signed last fall will begin to be marketed (Element, Quicksilver, Roxy, Juicy Couture, Sports Illustrated and Prince, only for name a few.)

From a content perspective, we are delighted to hear the news that Disney plans to release Moana 2 in theaters this holiday season. The film tells us the next chapter in the world of Moana, their successful 2016 film.” “Sonic the Hedgehog 3, the third film in the Sonic the Hedgehog franchise, which is launching in theaters in December of this year.

Create Your World, a three-year Disney Princess brand campaign launching this fall, celebrating the magical world you would create through the Disney Princess brand and the world of products. JAKKS’toys will be featured throughout that campaign.

In addition, In 2025, JAKKS will be launching a complete line of outdoor products, including chairs, umbrellas, canopies, beach accessories, inflatable pool floats, sand and splash mats, foldable wagons and extensive lines of dolls and doll accessories infused with fashion elements from Roxy, Quicksilver, Forever 21, Prince, and Sports Illustrated.

Source: Q4 CC

Therefore, it seems that we are now at a brief impasse for a few months until the second half of 2024, when the new promising films and products that will go on sale as a result of the

Agreements and licenses signed last fall will generate income growth again. The company itself expects a promising year in 2025:

It’s with that voice that we continue to engage customers and licensors about opportunities for 2025, while also lining up and delivering orders for this coming season. More on costumes in the second half of today’s materials.

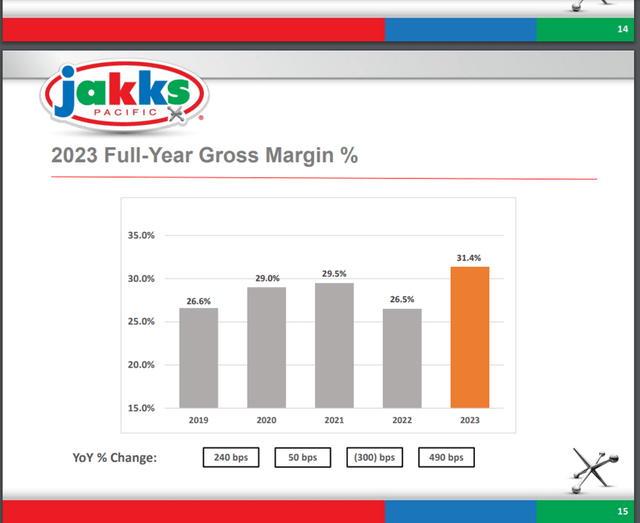

Despite expectations of a soft first half of the year 2024, gross margin is very likely to remain at high levels similar to 2023, where it averaged 31.4%, thanks to good management of production costs, inventories and freight transportation costs.

For next year 2025, expectations are very promising as reported in the Q4 CC.

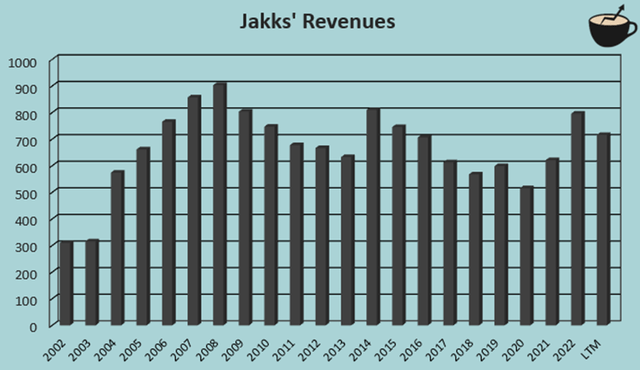

The main bearish thesis that can be read lately is that JAKKS has traditionally had a very cyclical business with large fluctuations in revenue. Thus, in the Seeking Alpha article: “JAKKS Pacific: I am cautious despite great potential” it is noted that JAKKS’ revenue history has been very fluctuating with the consequent risk that we will enter a new bearish revenue cycle:

The graph shows the good year 2022, the result of the success of the Disney film “Encanto” and the return to post-Covid consumption, with many JAKKS customers requesting massive orders to replenish inventories after two years of the pandemic with a pause in orders. It was foreseeable that the previous year, 2023, could not exceed the income of 2022. To realistically compare the evolution of income, we would have to start from the pre-Covid year 2019 when just under $600M was raised. In 2023, $711.6M was generated, and this year 2024, expectations are around $700M/$710M. For next year 2025, expectations are 738.8 million dollars. It can be clearly observed that, without taking into account the years 2020, 2021 and 2022 (years of Covid-2019 impact), the trend is clearly increasing. To this, we must add the improvement in the gross margin, which has implied sustained growth in EBITDA, net profit and EPS in recent years:

Therefore, the bearish thesis does not seem to have a good foundation. Simply looking at historical behavior does not guarantee that it will happen again in the future.

Everything seems to indicate that this year 2024 will be a year of certain stability in income compared to 2023, but that the good performance of the gross margin could compensate for this to obtain a good net profit (similar to 2022). The numerous licenses and rights

that JAKKS has in the promising films of the second half of the year 2024 and numerous products from well-known brands will lay the foundation for a return to revenue growth at the end of this year 2024 and 2025.

JAKKS Intrinsic Value Estimation

Next, we will estimate the company’s intrinsic value using various valuation methods and compare it to its peers:

1) Valuation using the EV/Sales (fwd):

|

Company |

JAKKS |

Solo Brands (DTC) |

AMMO (POWW) |

Clarus Corporation (CLAR) |

Escalade Incorporated (ESCA) |

Funko (FNKO) |

Average |

|

EV/S (fwd) |

0,30 |

1,12 |

1,66 |

0,94 |

1,04 |

0,64 |

0,718 |

Source: Author

As you can see, JAKKS is the cheapest compared to its peers (more than twice as cheap).

Using the average EV/S (fwd) ratio as a reference, JAKKS’ share price should be around $50 (x2 the current price).

2) Valuation according to the EV (Enterprise value)/EBITDA ratio:

|

Company |

JAKKS |

Solo Brands |

AMMO |

Clarus |

Escalade Incorporated |

Funko |

Average |

|

EV/ Ebitda |

3,15 |

7,83 |

13,33 |

10,63 |

11,42 |

29,02 |

12,56 |

Source: Author

As you can see, JAKKS is clearly the cheapest, being 4 times below average.

Based on the EV/Ebitda ratio, JAKKS’ share price should be around $100 (x4 the current price).

3) Valuation according to the Price/Cash Flow:

|

Company |

JAKKS |

Solo Brands |

AMMO |

Clarus |

Escalade Incorporated |

Funko |

Average |

|

P/CF |

2,62 |

1,48 |

6,32 |

4,54 |

4,93 |

16,39 |

6,04 |

Source: Author

Once again, according to this valuation method, JAKKS is among the cheapest, being two times cheaper than the average.

Based on the P/CF ratio, JAKKS’ stock price should be around $50 (X2 the current price).

Therefore, as evident from these three valuation methods, JAKKS is currently clearly undervalued. The intrinsic value is in range of between $50 and $100. This assessment coincides with what Geoffrey Seiler states in his article: “JAKKS Pacific: Sell-Offs Looks Overdone“.

Risks

The main risk that I consider is the fact that it is a cyclical business and

closely linked to the success of the films for which it is licensed, a

Less success for any of these films could have an impact

negative in the income generated.

Also, the possibility of entering an economic recession could

mean less spending by families on toys for children, which would imply a lower level of income for JAKKS.

Conclusion

JAKKS published the results for the last quarter of the year 2024 a few days ago. These results have been reasonably good with Adjusted EBITDA, EPS and adjusted EPS higher than expected by the market due to the good performance of the gross margin (has located above 30% annually). The annual income has fallen slightly by 3% annually.

The company stated in the fourth quarter call conference that it was satisfied with the behavior of the year 2023 and predicted the year 2024 with some challenges due to the lack of films for the first half of the year.

This cautious forecast for the beginning of 2024 has caused the share price to plummet 35% in two sessions, something totally exaggerated.

If we do not take into account the years of COVID-19 impact (2020, 2021, and 2022), the evolution of revenue, gross margin, EBITDA, and EPS is clearly positive.

On the other hand, the best is expected for the end of 2024 and the entire year 2025 thanks to numerous promising films to which JAKKS has the rights. Furthermore, the company signed the past fall a commercial agreement with Authentic Brand Group (ABG), owner of numerous brands of recognized prestige (QuickSilver, element, etc.) for the sale of items starting next fall. All of this predicts a good end in 2024 and a good year in 2025.

JAKKS valuation using multiple parameters (EV/S, EV/EBITDA, EV/Cash flow) shows the great undervaluation that currently presents the company compared with its peers. Using these valuation parameters, we can affirm prudently that JAKKS is a $50 stock, which is a potential revaluation of approximately 100% at current prices.

For all these reasons, the recommendation is to take advantage of the enormous drop in the share price to take positions or lower the average.