shapecharge

Introduction

In a prior article, I established coverage of Jack Henry (NASDAQ:JKHY), a vertical software company serving the small bank niche. I suggested it was a pivotal but undervalued stock in the fin-tech sector that supports small banks through specialized software solutions, which helped them compete against much larger peers.

I claimed that despite its significant role in leveling the playing field for smaller banks against more prominent institutions, the company had been overshadowed in the market, particularly amid last year’s banking crisis, which negatively impacted its core customer base.

However, I noted the importance of its strategic acquisitions, consistent revenue growth, and high returns on invested capital, highlighting its efficiency and potential as a promising long-term investment.

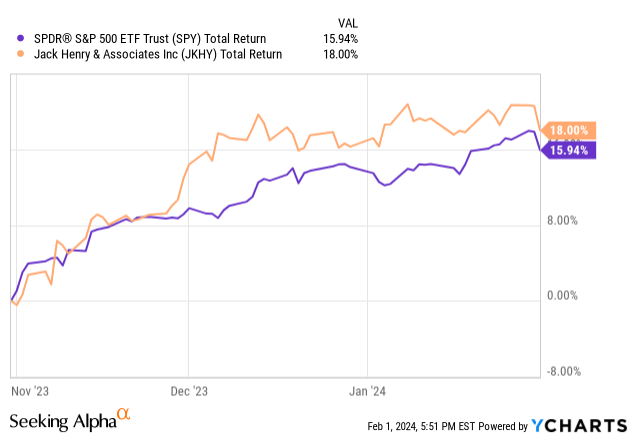

Since then, the stock has largely tracked the overall market performance. In today’s article, I’ll explore what has happened since then and how I believe that may impact the company’s share price moving forward.

Management Change

Since my last article, there has been an especially notable change: a significant leadership transition, promoting seasoned insider Greg Adelson to the role of CEO and President starting July 1, 2024.

Adelson’s internal promotion from President and Chief Operating Officer marks a strategic move, perhaps a long time in the making, ensuring continuity in the company’s culture and vision. With a commendable tenure at Jack Henry since 2011, Adelson has been instrumental in steering the company’s growth trajectory, overseeing vital business lines, and spearheading innovative initiatives like the PayCenter™ payments hub.

I believe his prior roles within the organization and exposure to M&A have helped groom him for this top position.

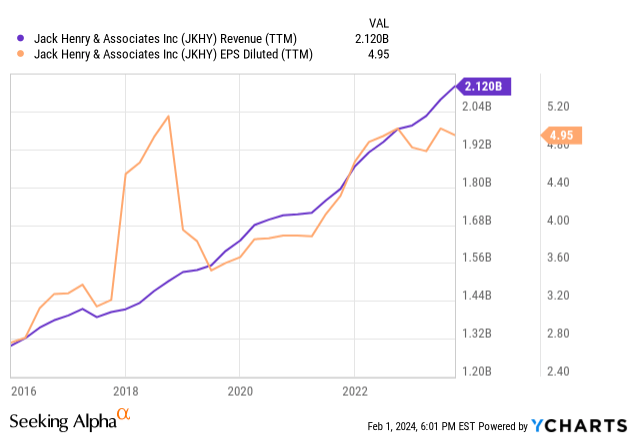

The current CEO, David Foss, is set to transition into the role of Executive Board Chair after a distinguished period at the helm. Under Foss’s leadership, Jack Henry has grown substantially, with revenue and net income soaring since 2016.

Foss’s leadership was marked by over 25 acquisitions and the implementation of significant projects, further positioning Jack Henry as a leader in the banking VMS niche. Given the new CEO’s track record and the fact he is an internal hire, I believe investors can anticipate a continuation of the company’s proven growth strategy, combining organic growth with M&A.

A Nice Tailwind

Moving forward to economic developments, contrary to initial assumptions, the financial markets have seemingly adapted with relative ease to the landscape of elevated interest rates. While troubles remain in some sectors of the debt markets, the threat seems to have abated for many.

This period of increased stability has resulted in a reduction in the immediate concerns surrounding the banking sector.

This more favorable economic scenario fosters a supportive environment for the expansion and broader adoption of Jack Henry & Associates’ software suite.

As banks are able to position for growth once again, Jack Henry is likely to see a bolstered demand for its product offerings.

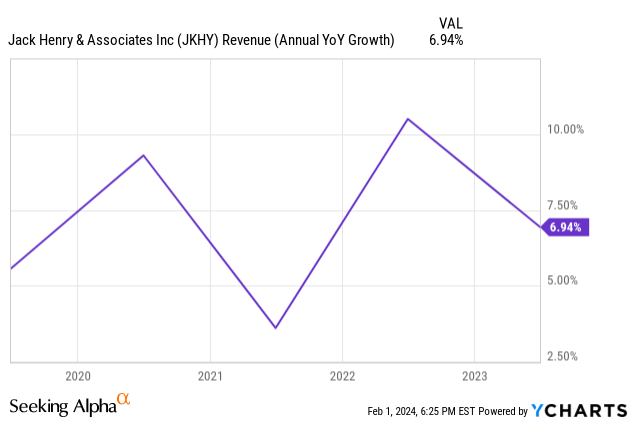

Some of Baird’s findings further support this, as their survey indicated a positive growth outlook for banks in 2024, with spending expectations averaging 4.3% and a healthy market sentiment rated at 6.5 out of 10. This environment, alongside a shift towards digital solutions and increased implementation of services like FedNow, is expected to drive core processing revenue growth. Jack Henry, in particular, was projected to see over 8% organic constant currency revenue growth.

Combine 8% growth with some extra growth from M&A, and 2024 could wind up being a solid year for Jack Henry, perhaps the strongest year in some time.

Earnings Call Insights and Q&A

Turning our attention to Jack Henry’s latest earnings call, I believe investors can find much to learn from. Starting with the headline, the company had an 8% increase in total revenue, showing a robust, inflation-beating performance for the quarter.

Management noted that contrary to the typically slow start expected after a historically strong sales quarter, the company kicked off the fiscal year on a high note. They mentioned that the sales pipeline entering the new fiscal year was the largest ever, which helps lay a solid foundation for continued growth.

The company’s multi-pronged approach seems to be paying off, with the core segment, payments segment, and complementary solutions businesses all reporting substantial growth. Looking at some of the individual offerings, management noted that Payrailz and the cloud-native Banno Business offering are moving forward successfully.

Q&A Insights

Later in the earnings call, David Togut from Evercore ISI brought up an important point about the company’s efforts to serve larger banks. In responding to this, David Foss shared an optimistic view, highlighting the interest from larger banks in Jack Henry’s solutions, particularly its cloud environment capabilities. The attention from banks with assets in the multi-billion-dollar range at the company’s client conference signals Jack Henry’s growing appeal and potential in the broader market. If Jack Henry gains a substantial foothold with the largest banks, this could drastically increase the TAM.

Capital allocation was another key topic during the call, sparked by John Davis from Raymond James. Foss explained the company’s balanced approach between paying down debt and buying back shares while maintaining a solid dividend policy. He mentioned the quiet M&A scene, indicating a selective and strategic approach to acquisitions, ensuring that each move aligns with long-term growth and value for shareholders. We’ll see if the new CEO takes the same view in the coming months.

Future Catalysts – 2024

As the banking industry navigates through a phase marked by economic slowdown and an evolving financial landscape, the drive to remain competitive while controlling costs is intensifying, potentially boosting demand for IT services like those offered by Jack Henry.

A Deloitte report underscores this narrative, noting that “Banks globally will face a unique mix of challenges in 2024,” especially in generating income and managing costs in a divergent economic environment. This situation is further complicated by persistent high deposit costs, which are likely to strain banks’ net interest margins even as interest rates begin to drop.

In this context, banks are increasingly looking towards technological solutions to streamline operations and enhance customer offerings, positioning companies like Jack Henry at the forefront of this transformation. The report articulates that “A slowing global economy coupled with a divergent economic landscape will challenge the banking industry in new ways in 2024,” implying that banks must innovate and adapt to maintain their competitive edge and financial robustness.

By investing in IT services, banks aim not only to navigate these complexities but also to redefine their customer engagement models, making them more resilient in the face of economic and regulatory shifts. In essence, the current economic and competitive pressures are likely to catalyze investment into IT services, highlighting Jack Henry’s potential role in aiding banks to reduce operational costs and bolster their digital offerings effectively.

2024 sets the stage for Jack Henry’s growth, fueled by banks investing in its standout IT solutions to thrive in a competitive landscape.

What to look for in the in the Q2 Earnings Report:

Later this week, Jack Henry will publish its Q2 earnings report, wrapping up the first half of its fiscal year; in light of that, here is what I will be paying extra attention to in that call:

- Comments from the new CEO as to the overall strategy and capital deployment priorities.

- Any and all commentary on the M&A market, as this has historically been a big growth driver for Jack Henry. 2023 was a slow year for M&A broadly.

- Has the pace of IT investment from their customers has the increased stability increased their appetitive to spend on IT solutions like Jack Henry as predicted?

- What/if any, large banks are expanding their relationship with Jack Henry? This is important because while there are fewer large banks, the deposit base is much larger, and those deals could really move the needle.

I’ll resist making specific calls or providing my earnings estimate; I believe the best way to succeed with investments is to keep one’s eyes laser-focused on the long term. That’s why in these earnings calls, I pay most attention to the factors that could impact the long-term growth trajectory, not merely the EPS of one quarter.

Valuation

| Company | Current Stock Price | EPS 2025 Est. | 2025 P/E |

| JKHY | $167 | $5.62 | 29.7 |

| ROP | $546 | $20.12 | 27.1 |

| SAP | $177 | $6.86 | 25.8 |

| ORCL | $116 | $6.21 | 18.6 |

| INTU | $633 | $18.79 | 33.7 |

Created by author using EPS Estimates from Yahoo Finance

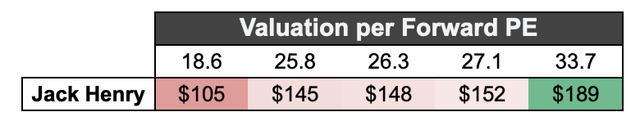

Moving on to valuation, with its stock price at $167 and a projected PE ratio of 29.7 for 2025, Jack Henry’s valuation is neither the highest nor the lowest among its peers. It’s less expensive than Intuit (INTU), which has a higher PE of 33.7, but it’s priced a bit higher than companies like Oracle (ORCL), which sits at a lower PE of 18.6. Meanwhile, it’s pretty close to Roper Technologies (ROP) with a PE of 27.1 and SAP (SAP) at 25.8. This middle-range valuation suggests that the market sees Jack Henry as a solid, dependable company with potential for growth in a field where valuations can vary quite a bit from one company to the next. Given its long track record for sustained growth, I would say a premium is warranted for Jack Henry.

Author’s note: I’ve selected these peers as opposed to fintech peers like Toast (TOST) because I consider Jack Henry closer to an application software company like Intuit’s Quickbooks or one of Roper’s many offerings. In addition to that, Jack Henry is highly profitable; meanwhile, a number of fintech peers are not. As such, I believe the peers I selected are more relevant.

The Big Risk: M&A Engine Slowing Down

As acquisitive companies like Jack Henry expand and scale up through strategic acquisitions, the risk of diminishing returns on capital becomes more pronounced. This phenomenon is often attributed to the law of large numbers, where the relative impact of each successive acquisition diminishes due to the company’s larger scale. As the base of invested capital grows, maintaining the same percentage of return becomes increasingly challenging.

Furthermore, integration complexities, cultural mismatches, and overvaluation of acquired assets can dilute the returns on newly invested capital. Additionally, the company’s sheer size may lead to bureaucratic inefficiencies and slower decision-making, further hindering the ability to generate high returns on each investment. Hence, while acquisitions can fuel rapid growth, they also bring risks that could potentially erode the profitability of capital deployment over time.

Conclusion

Looking ahead, the future for Jack Henry is bright. The upward revision of its financial forecasts signals the company’s confidence in its operational effectiveness and market standing. This optimism is anchored by a noteworthy 20% return on invested capital, underscoring Jack Henry’s astute and impactful approach to capital utilization. Even with a modest decrease in free cash flow conversion, the company’s dedication to maximizing shareholder returns stands firm.

When you marry this impressive capital return rate with an 8% organic growth and a reasonable valuation, Jack Henry emerges as an attractive investment option. Echoing the sentiments of my previous analysis, my outlook on Jack Henry remains positive, and I continue to recommend the stock as a buy.