Matteo Colombo

Investment thesis

Our current investment thesis is:

- Itochu represents more than just a bet on a Japanese revival (Which Buffett seemingly supports). The company is diversified by geography and industry, with this only increasing over time. Its portfolio of companies is highly attractive due to its positioning for the future, which we can attribute to Management.

- Buffett stated that Berkshire would be willing to invest alongside Itochu (and the other Sogo Shosha), at a time when they all are actively seeking new investments. We could be at an inflection point in many industries where disruption is reaching a peak, representing opportunities for new and existing entrants.

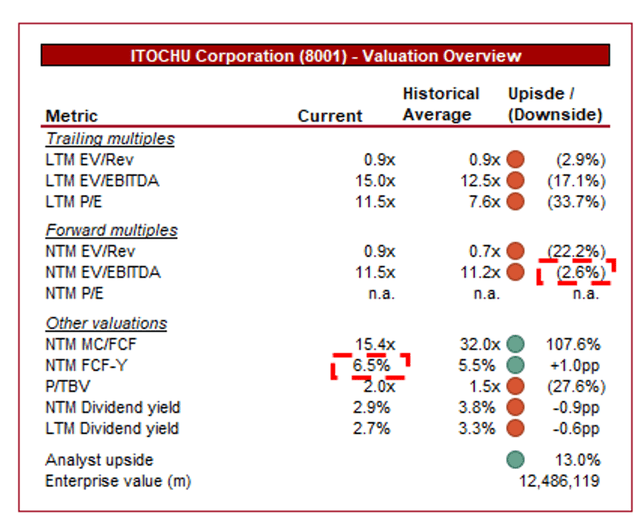

- At an FCF yield of 6.5%, we see further upside with Itochu. Even if we solely bank on its existing portfolio, Management has confirmed distributions will increase and growth will still be respectable.

Company description

Itochu Corporation (OTCPK:ITOCY) is a Japanese conglomerate with a global presence, engaging in trading and investment activities across various sectors. Established in 1858, it has evolved into a key player in industries such as textiles, metals, food, machinery, energy, and finance. Itochu’s business model extends from sourcing raw materials to manufacturing and distribution, making it a significant contributor to global trade.

Itochu is one of Japan’s 5 largest “Sōgō Shōsha”, the equivalent of a diversified Western conglomerate/trading company.

Warren Buffett (BRK.B) (BRK.A) has been building an equally (large) position in all 5 stocks over the last few years, drawing interest again back to Japan.

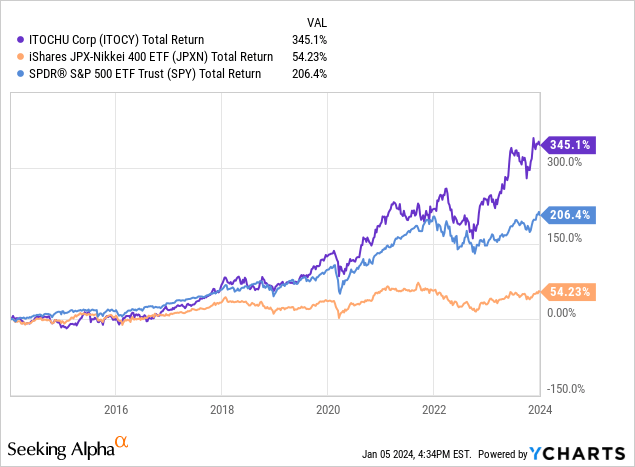

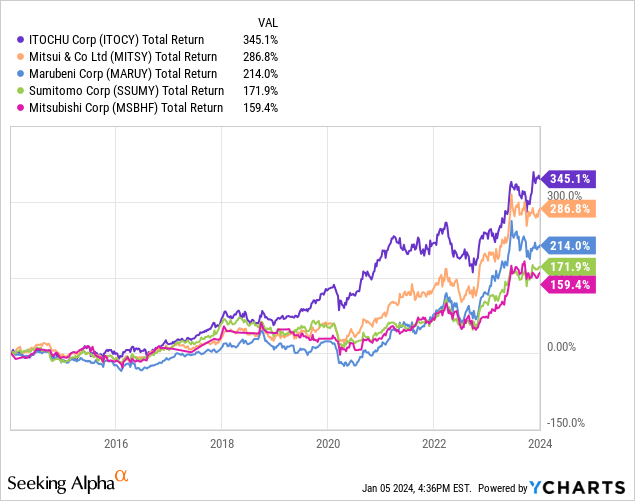

Share price

Itochu’s share price performance during the last decade has been impressive, returning over 300% to shareholders and outperforming both the S&P 500 and a wider set of Japanese equities. This is a reflection of Itochu’s growth story during this period, alongside its strategic execution and positioning for the future.

Not only this but Itochu has outperformed its direct peers, implying its execution and fundamentals, not only its strategy, are superior.

Financial analysis

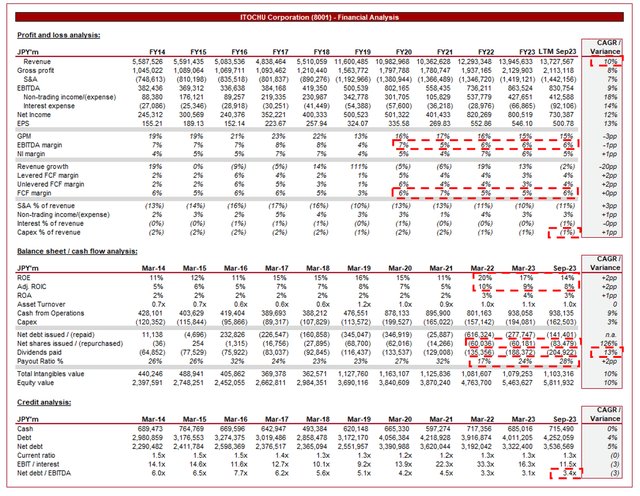

Itochu financials (Capital IQ)

Presented above are Itochu’s financial results.

Revenue & Commercial Factors

Itochu’s revenue has grown well during the last decade, with a CAGR of +10%. This trajectory is naturally impacted by Itochu’s product mix, a portion of which is driven by commodity prices. Further, its profitability has broadly matched this, with EBITDA growing by +9%.

Introduction

Itochu’s business model is fundamentally based on the concept of diversification. It operates across a broad range of business segments, including Textile, Machinery, Metals and Minerals, Energy, Chemicals, Food, and ICT. This is not a case of diversification for diversification’s sake but rather than identification of industries, segments, and opportunities that can generate alpha for the business through Itochu’s funding and expertise.

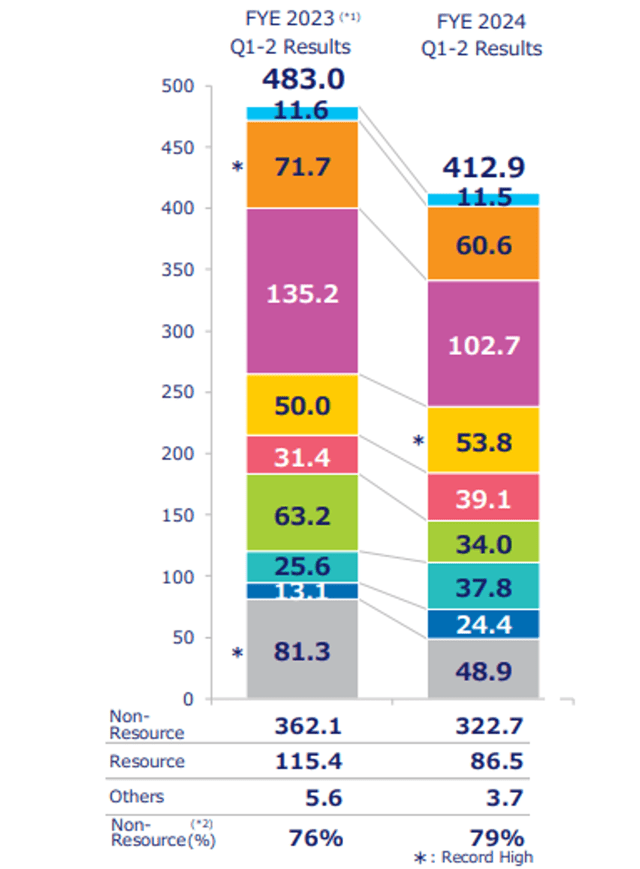

Itochu is fundamentally a trading company, engaging in the import and export of goods and commodities. Importantly in Itochu’s case, non-resource profitability is the vast majority of its net profit (~73%), which is our preference given it reduces volatility and improves growth potential beyond GDP.

With a significant global footprint, Itochu has a presence in various countries and regions. This global reach facilitates access to diverse markets, enabling the company to leverage opportunities and navigate geopolitical and economic changes. As of FY23, ~77% of revenue is generated in Japan, followed by Singapore and the US (~6%).

Business Portfolio

To appropriately cover Itochu’s portfolio would require a paper on each of the segments, which is clearly not feasible, and so we will seek to rapidly and succinctly review each segment.

- Textile:

- 3% of net profit, 70% domestic, 3.6% of total assets, 3.9% ROA.

- Itochu operates a full-spectrum value chain, both up and downstream capabilities, and is a market leader among its Sogo Shosha peers.

- Itochu has acquired the rights and licensing for Reebok in Japan, expanding its relationships with Western brands, which already include Forever 21 and Barbour.

- Management is progressing well against its strategic initiatives, with a focus on growth in Asia through the development of its brand portfolio.

- Machinery:

- 13% of net profit, 50% domestic, 11.2% of total assets, 5.6% ROA.

- Itochu operates a very broad Machinery business, comprising trading (e.g. automotive, construction, etc.), as well as business investment (wholesale, retail, financing, etc.).

- Strong international relationships have allowed for a growing pipeline of potential deals and partnerships for future projects.

- Strong focus on sustainability and the energy transition. This is the bedrock of its growth strategy.

- Metals and Minerals (“M&M”)

- 31% of net profit, 10% domestic, 9.5% of total assets, 17.2% ROA.

- Development of projects, trading of raw materials, steel businesses, and decarbonization efforts.

- High-quality assets, particularly in iron ore and coking coal, with strong relationships in the market allowing for asset base growth (such as the acquisition of interest in an Iron ore project in Canada).

- Focus is on transitioning to sustainability and environmentally friendly materials and sourcing.

- Energy and Chemicals

- 14% of net profit, 70% domestic, 11.9% of total assets, 6.0% ROA.

- Development of projects (Oil, LNG, Petroleum, NatGas, hydrogen, renewables, etc.), chemical products and trading, and solutions business (power generation, heat supply, solar panels, etc.).

- Broad value chain capabilities, developed through relationships and collaborations with business partners, have allowed Itochu to offer a comprehensive suite of services that are positioned extremely well for the energy transition. Its fuel capabilities in particular are impressive.

- Food

- 3% of net profit, 80% domestic, 16.3% of total assets, and 2.5% ROA.

- Full-spectrum services, including resources, production and processing, and marketing and distribution.

- Global supply chain across a number of sub-segments and a leading position in the distribution and retail networks across Japan.

- Leveraging growth and efficiency capabilities to improve value, such as technological capabilities and planet-based food products.

- General Products and Realty (“GP&R”)

- 12% of net profit, 30% domestic, 9.3% of total assets, 5.9% ROA.

- Full suite of products including (but not limited to): Paper/pulp, rubber products, wood products, and logistics, as well as development of real estate.

- Consistent global demand across product types given their nature, with synergies across its business units.

- ICT and Financial

- 8% of net profit, 80% domestic, 10.7% of total assets, 4.9% ROA.

- Traditional ICT services, Communications, and Financial Services.

- Strong synergies across its portfolio companies through support. Management is developing a strong retail business by further deepening this segment’s relationship with portfolio companies.

- Also leveraging relationships globally to invest in leading start-ups.

- The 8th Company

- 2% of net profit, 100% domestic, 16.5% of total assets, 0.7% ROA.

- Itochu acquired FamilyMart for ~$5.5b in mid-2020, with grand plans to transform this company. Management is seeking to deliver a revolutionary new service, underpinned by technological capabilities while seeking to generate synergy benefits through its other 7 segments.

Overall, we like Itochu’s portfolio. Our key takeaways are as follows:

The good:

- A strong commitment to future trends – Itochu is investing heavily in, and always looking toward, the future. All segments are focused on how to respond to future trends and where the company needs to be. We believe Itochu will likely be a key player in the global energy revolution.

- Global relationships – The company is consistently leveraging its relationships to access market-leading assets. Its willingness to partner with businesses, rather than seeking preferential treatment in all cases, has been highly beneficial for future expansion.

- A clear focus on technology – All businesses have a defined digital strategy and how technology will drive operational improvement at a minimum, if not commercial development, also.

- Minimal exposure to low-return segments – We prefer to see limited exposure to lower-return segments such as Textiles and Foods, although appreciate the benefit of having these in the portfolio (particularly now with the FamilyMart acquisition).

The not-so-good:

- The 8th Company – Is also the weakest company. This was always going to be difficult to execute but Covid-19 has only made this more difficult. In theory, the potential is massive due to the synergy/cross-selling potential, as well as the modernization scope and increase in customer contact points. This said it’s yet to be seen how this will develop.

- Weighting in Japan – We would prefer to see greater exposure outside of Japan, particularly in its non-commodity segments.

- Falling behind in realty – Itochu’s development in the real estate segment has lagged behind some of its peers, at a time when Western real estate (in particular) has grown in value considerably. We note significant opportunities in the market still (such as building data centers), which Itochu appears to not be wholly exploiting.

Business model and Value creation

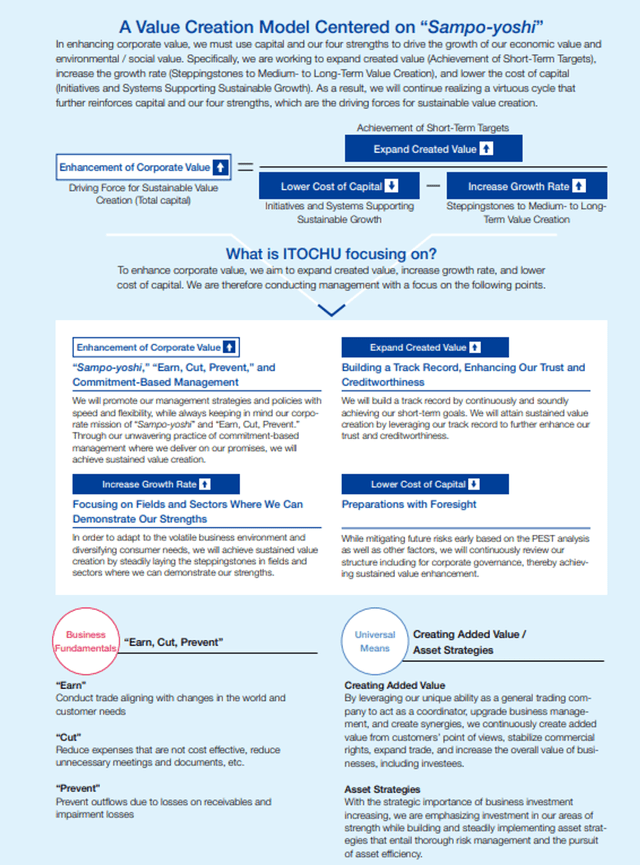

Itochu’s fundamental approach is to acquire and develop good businesses or enter attractive industries, with the objective of generating strong long-term returns.

Itochu seeks to utilize its core capabilities and advantages, namely financial resources, knowledge and expertise (3 words but the most significant of the list), synergistic potential through its existing portfolio companies, and existing relationships in the market.

Through active management and ongoing support, Itochu seeks to be a partner of these companies, in many cases eventually absorbing them wholly within their existing operations.

In addition to this approach, Itochu actively forms strategic alliances and partnerships with other companies. These collaborations allow the company to share resources, technology, and expertise, enhancing its capabilities and expanding its market reach, while entering riskier segments or bespoke opportunities that are not available on a standalone basis.

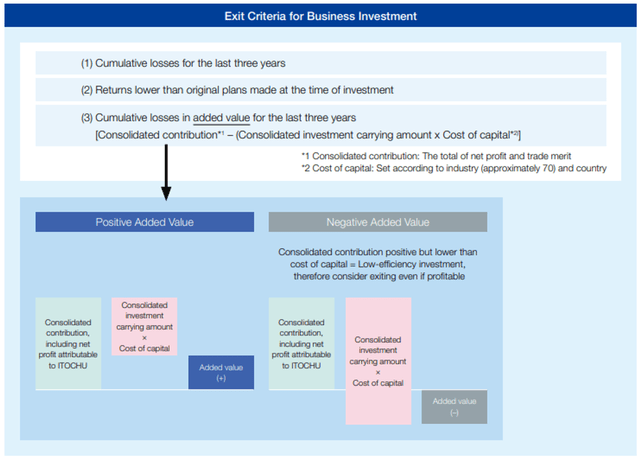

Unlike many Western companies, Itochu acknowledges that investments can go wrong and in some cases, wins turn to losses. The company is constantly assessing and reassessing investments and is willing to divest assets and reinvest periodically to ensure its returns remain high.

In recent years, the company has actively sought to adjust its portfolio to improve its profitability efficiency, disposing of a number of low-profit companies.

Although we generally dislike corporate diagrams, most of which are incredibly confusing and overly polished, the following is a clear and concise reflection of how Itochu reinvests its capital to drive shareholder returns. We have reviewed a number of case studies of historical acquisitions against these criteria, noting a good track record.

Competitive Positioning

We consider the following factors to be key competitive advantages of Itochu and highly attractive qualities:

- Global Economic Trends – Itochu’s global presence allows it to capitalize on emerging economic and social trends worldwide. Its relationships are an underappreciated factor allowing for this.

- Strategic Investments – Strategic investments across various industries position Itochu to benefit from the success of higher-risk ventures, without a material risk to its existing business.

- Diversification and Risk Mitigation – Its diversified portfolio across industries and geographic regions enables Itochu to mitigate risks associated with economic downturns in specific sectors or regions.

- Long-Term Investments – Management truly takes a long-term view and is active in business development and collaboration, increasing the likelihood of long-term value appreciation.

- Adaptive Management – Management does not appear “stuck in their ways”, seeking new opportunities to improve returns in changing market conditions.

- Financial Strength and Prudent Risk Management – The company’s financial strength and prudent risk management practices contribute to its overall stability.

- Market Intelligence – Itochu’s understanding of and experience in a wide range of markets is rivaled by few, positioning it as a leading partner in new initiatives.

- Sustainability Initiatives – Itochu’s engagement in sustainability initiatives aligns with global trends and changing consumer expectations.

Competition

Itochu competes with industry leaders in its various verticals, as well as its Sogo Shosha peers: Mitsubishi Corporation (OTCPK:MSBHF), Sumitomo Corporation (OTCPK:SSUMF), Marubeni Corporation (OTCPK:MARUF), and Mitsui (OTCPK:MITSF).

Opportunities

As discussed above, we consider the following as key growth drivers going forward:

- Renewable Energy Investments – Seizing opportunities in the global shift towards clean energy.

- Technological Integration – Leveraging technology for enhanced efficiency in trading and supply chain operations.

- Strategic Partnerships – Forming alliances to strengthen market presence and explore new business ventures.

- Unique Opportunities – Identification of growth opportunities, such as start-ups, which are available to Itochu due to its expertise.

- Economic development – Real estate and M&M capabilities benefit from economic growth.

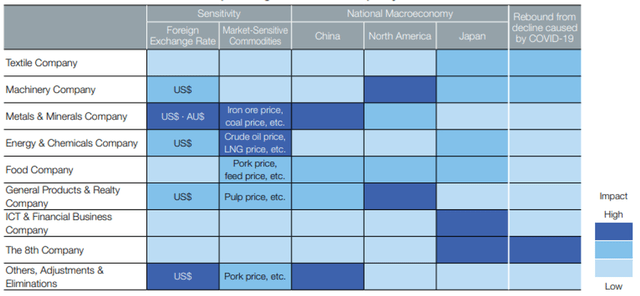

Economic & External Consideration

Diversification has limited the impact of economic conditions on the trajectory of Itochu, although we note the business is still exposed, particularly in certain verticals and geographies. The largest risk to the business currently is commodity prices, as the risk of a global recession increases.

With this in mind, we could see softening demand across its other segments also, namely textile, GP&R, and ICT and Financial. This said, on a relative basis to the wider market, we suspect its diversified nature should ensure a softer landing.

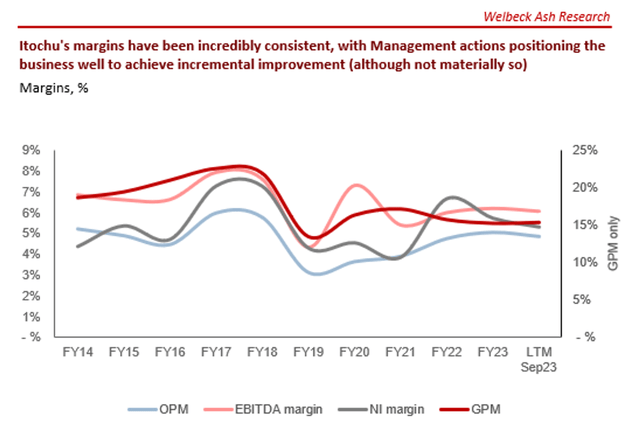

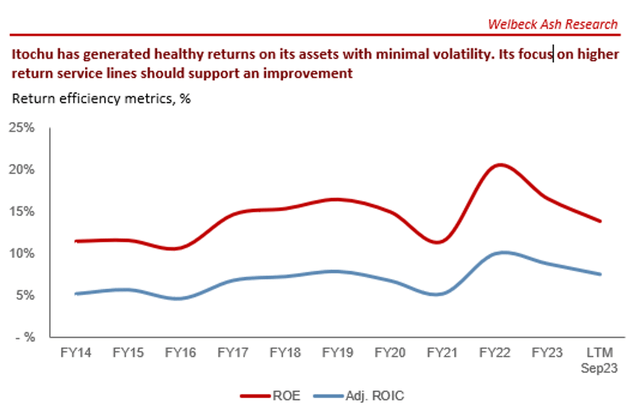

Margins

Itochu’s consistent margins, despite commodity cycles, reflect its strong business model and gradual value accumulation. Given the size of the company, Management initiatives will not be seen overnight. We believe there is scope for improvement in the coming years, particularly as Itochu transitions to sustainable energy sources and executes its operational improvements.

Recent results

Itochu’s net profit declined from ¥483b in 2023 to ¥412.9b in 2023 (-14.5%), primarily due to a decline in M&M (-24%), GP&R (-46%), and Other (-40%).

Key takeaways from the current half-year include:

- [M&M] Commodity prices, namely coal and iron ore. This is an expected decline given the current market conditions.

- [GP&R] Softening demand across businesses, as well as a one-off driven higher comparable period. The construction/material segment appears to be materially slowing, the future reflecting the macroeconomic impact of a high-interest rate environment.

- [Other] Decreased due to lower earnings in CITIC Limited resulting from the absence of revaluation gain in the prior period.

- FamilyMart is growing. Same-store sales are positive, with growth in spend and visits. Management appears to be executing, although further progress is required and expected.

- In August ’23, Itochu issued a tender offer to increase its stake in Itochu Techno-Solutions.

Balance sheet & Cash Flows

Itochu has a bulletproof balance sheet. The company’s healthy free cash flow generation has allowed it to fund growth, as well as distribute healthily to shareholders. We are likely seeing the impact of Buffet’s investment (and internal discussions between the two), with Management promising an improvement in long-term shareholder returns, through both dividends (payment & payout ratio growth) and buybacks.

Unlike the West, the access to debt and cost of debt in Japan is still good, meaning Itochu is still well-placed to execute its strategy.

This said, the cost of capital has stepped up and so the pressure to optimize its portfolio, alongside growing its distributions, is higher. Management appears aware of this and we suspect an uptick in ROE is possible.

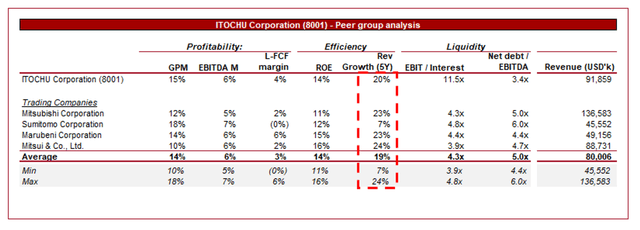

Peer analysis

Financial comparison (Capital IQ)

Presented above is a comparison of Itochu to a cohort of its directly comparable peers.

Itochu performs comparably to its peers, although notably has a higher FCF margin, at a larger average size. Further, the company has greater scope for leverage, which has the potential for also enhance distributions. This positions the company well for greater absolute returns going forward.

Valuation

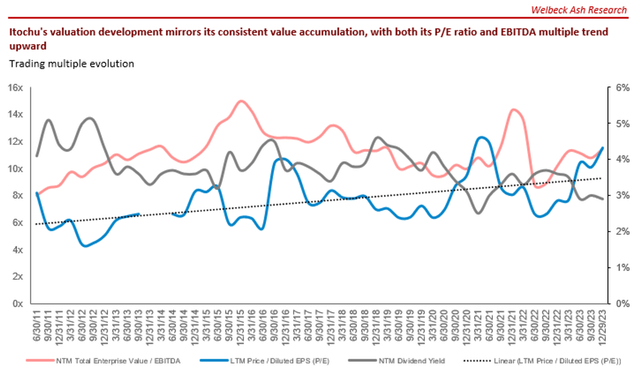

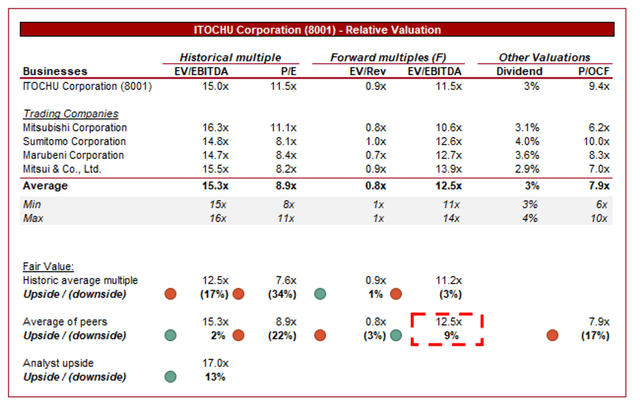

Itochu is currently trading at 15x LTM EBITDA and 12x NTM EBITDA. This is a premium to its historical average.

A premium to its historical average is warranted in our view, owing to its positive business model development during the period, alongside the current outlook and Itochu’s position in these markets. We suspect, M&M aside, Itochu can improve its organic growth trajectory. At a ~3-17% discount on an EBITDA basis, we consider the stock slightly undervalued. We believe this is reflected in its FCF yield, which is now 6.5%. Given the expectation for distributions to improve, investors’ direct cash yield is highly attractive.

Valuation evolution (Capital IQ) Peer valuation comparison (Capital IQ)

As a secondary check, we have considered Itochu’s valuation relative to its peers. The company is broadly trading in line with its peers on a LTM EBITDA basis, although a small discount on a NTM EBITDA basis. Given the comparable financial performance, this discount appears unwarranted.

Key risks with our thesis

The risks to our current thesis are:

- Impact of geopolitical tensions on international trade.

- FX exposure (JPY has depreciated against the USD during the last decade).

- Greater than expected economic downturn.

- Exposure to unforeseen disruptions in commodity markets.

Final thoughts

From our deep dive into Itochu, we understand why Warren Buffet has been buying up the shares of the 5 Sogo Shoshas. The company is essentially a smaller version of Berkshire Hathaway. Despite another lost decade for Japan, Itochu has marched on impressively and is positioned for another greater decade.

The company is positioned well for a number of industry tailwinds while continuing to find new opportunities daily. Its core fundamentals are also strong, with a range of high-quality companies.

Itochu’s valuation is not as attractive as it was last year, however, we still see value at an FCF yield of ~6.5%.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.