Britons have one month to benefit from ‘ISA loophole’ before it closes (Image: GETTY)

Britons can make the most of an ISA “loophole” this tax year before the rules change next month.

The loophole enables certain savers to invest nearly £30,000 tax-free this fiscal year – much more than the personal allowance for both Junior ISAs and adult ISAs.

Laith Khalaf, head of investment analysis at AJ Bell said: “There is currently a bit of a loophole in the rules, which means children between the ages of 16 and 18 can apply for a £9,000 Junior ISA and a £20,000 adult cash ISA at the same time.”

He said this would “provide them with a potential ISA contribution of £29,000 in total” before adding it would be “the biggest allowance anyone at any age receives”.

However, Mr Khalaf noted: “This loophole is being closed from April 5 this year when the minimum age to open a Cash ISA will be raised from 16 to 18.”

A number of ISA rule changes will be enacted in the new tax year (Image: EXPRESS)

So, those looking to put away more money this tax year should should act promptly to take advantage of the savings, particularly as higher interest rates are increasingly pushing more savers into higher tax brackets.

Junior ISAs enable parents, grandparents, or any other interested party to contribute up to £9,000 per year to an ISA for a child.

Delving into the details, Mr Khalaf explained: “The child can start to manage the JISA from age 16 and gets access to it from age 18, so it can be used to help them through university, travel during a gap year, or go towards a house deposit.

“There are both cash and stocks and shares Junior ISAs available, with many parents opting for the cash option.”

However, Mr Khalaf noted that given the long-term investment horizon most children have, it makes “a lot of sense” for parents to consider the stocks and shares route.

Cash ISAs, on the other hand, come with a larger annual personal allowance of £20,000 and at the moment, are available to savers aged 16 and over. However, the minimum age will rise to 18 on April 5.

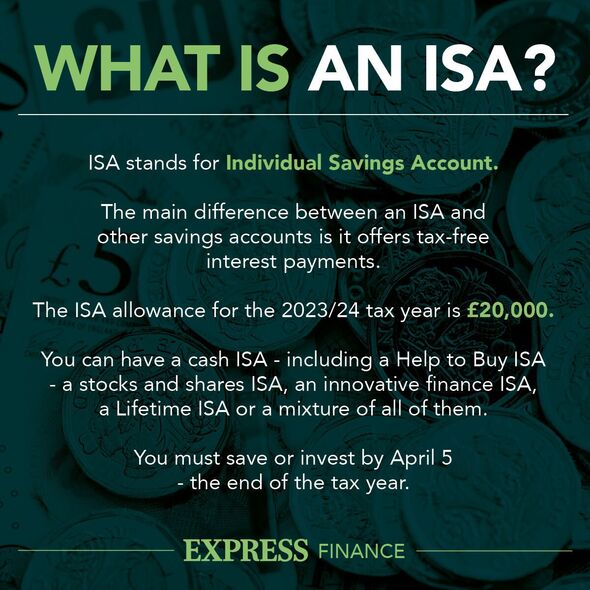

There are four types of ISAs people can invest in – cash ISAs, stocks and shares ISAs, innovative finance ISAs and lifetime ISAs.

If they meet the eligibility criteria, people can have as many ISAs as they like however, only one of each type can be paid into per tax year at present.

However, a range of new changes to ISA terms were announced during Chancellor Jeremy Hunt‘s Autumn Statement last November, and are set to come into effect in April.

Savers will be able to have more than one of the same type of ISA. They will also be able to transfer part of their savings between different providers during the year, and there won’t be a need to reapply for an existing dormant account.

However, the limits for different types of ISAs will remain the same (£20,000 for cash and stocks and shares ISAs, £9,000 for a junior ISA, and £4,000 for a Lifetime ISA).

Analysts also predict Mr Hunt will introduce a few more changes to ISAs in this week’s Spring Budget.

Writing on X, formerly Twitter, Mr Lewis said: “Lifetime ISA win coming in budget?! Good news! @POLITICOEurope has a scoop by @JamesFitzJourno that Chancellor will follow my suggestion and wipe the 6.25% Lisa withdrawal fine for anyone buying a home.

“If true, this’d fix the current dire system whereby when people are priced out and have to buy a home above £450,000 limit the state fines them to get access to their cash.” (sic

Mr Lewis said the scoop also suggests “less firmly” that the limit may rise to £500,000 too.

This follows Mr Lewis’s open letter to the Chancellor in January, in which he requested the Government “index-link the £450,000 limit to house prices (backdated to 2018) and reduce the withdrawal penalty for those buying a first-time property above the limit to 20 percent”.

At present, people can save up to £4,000 a year in a Lifetime ISA, after which the Government will add a 25 percent bonus of up to £1,000 to the savings.

However, withdrawals can only be made to purchase a qualifying first house up to the value of £450,000, or for retirement after the age of 60. Otherwise, a 25 percent Government penalty is applied.

If Mr Lewis’s proposed changes go ahead, savers will have more room to purchase higher-value homes and face smaller penalties for those who exceed that.

Jeremy Hunt will announce the Spring Budget on Wednesday, March 6.