It’s been a wild few days for Spirit Airlines (SAVE -12.42%) stock. Last week, a federal judge blocked its proposed merger with JetBlue Airways (JBLU -1.85%) due to concerns over potential price increases from the latter. Spirit’s stock fell 50% on the news, putting shares down over 90% over the past 10 years, significantly underperforming the broad market indices over that time span.

Now, in the last few days, Spirit’s stock has started to rise again. After hitting a low of roughly $4.30, the stock is now at $7.77 as I write. It is unclear exactly why. It could be because of the two airlines filing an appeal to put the merger through, traders looking to buy the dip on a bombed-out stock, or short-sellers covering their positions. Maybe a mix of all.

Whatever the reason, there are a lot of people asking themselves whether they should join the party and buy some Spirit Airlines stock right now.

Merger denied; appeal in process

This Spirit Airlines saga began in early 2022, when it and Frontier Airlines decided to merge for $6.6 billion, valuing Spirit’s business at $2.9 billion. Jet Blue decided to try and outbid Frontier and put in an offer of $3.6 billion to acquire Spirit Airlines. After some waffling, shareholders eventually approved the better financial offer, which would take out Spirit’s stock in an all-cash deal at $33 per share.

Then, in early 2023, the United States Department of Justice sued to block Jet Blue from acquiring Spirit, stating that such a deal would risk increasing prices by as much as 30%-40% for people looking for cheap airline tickets. The case went to court and last week a judge decided to block the merger over these price increase concerns.

Jet Blue and Spirit have decided to bring the matter to the U.S. Court of Appeals, although it is unclear what the timeline for the appeal will be. Even if success for Jet Blue and Spirit is unlikely, investors and traders likely took this as news that the merger isn’t entirely dead yet. With the stock under $8, an acquisition price of $33 would mean huge gains for any Spirit shareholders who buy today.

Consistent cash burn, looming pile of debt

Of course, buying Spirit shares today doesn’t come without risk. Which brings us to the company’s cash flow and balance sheet. Long story short, the company is in major trouble, and it is unsurprising that it was looking for a bailout from one of its larger competitors.

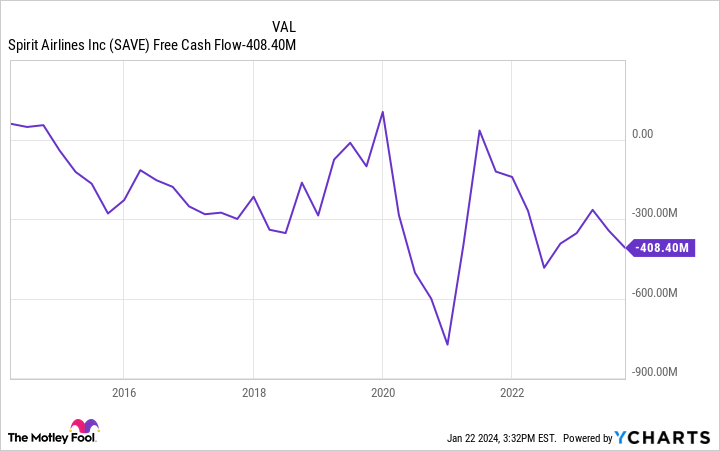

Spirit Airlines has consistently burned free cash flow, a key measure of profitability. Over the last 10 years, it has only twice generated positive free cash flow over a trailing-12-month period, spending most of the time in the red. Over the past 12 months, it has burned $400 million in free cash flow. This cash burn may only get worse in the coming quarters with the company’s new contract with its pilots, which came with a 30% pay bump over two years.

Positive cash flow is a must for Spirit because of the debt coming due on its balance sheet. The company has around $1.1 billion in debt due in 2025. It currently has over $800 million in cash on its balance sheet, but this will all be gone by then if it keeps burning $400 million a year. A report from The Wall Street Journal said Spirit was exploring a way to restructure its debt and possibly file for bankruptcy protection. However, it is unclear who wants to finance Spirit’s operations as it has never proved it can generate positive cash flow.

SAVE Free Cash Flow data by YCharts

Is the stock a buy?

It’s clear there is only one reason an investor should buy Spirit Airlines stock: They are confident the merger with Jet Blue will go through. Spirit’s financials are in shambles, and a bankruptcy filing is not out of the question if it is forced to operate on its own.

Sure, the stock might trade higher over the next few weeks. Perhaps a lot higher. But betting on short-term price movements is not what smart investors do. If you have high conviction that Spirit’s deal with Jet Blue will go through, it makes sense to buy the stock at these prices. But if you don’t, there’s no reason to buy Spirit Air stock today.

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.