As 2023 draws to a close, Nvidia (NVDA -2.28%) has clearly been one of the standout performers on the stock market with terrific gains of 211%. Investors may be wondering if they should be buying this high-flying chipmaker right now in anticipation of more gains, especially considering its dominance in the lucrative market for artificial intelligence (AI) chips.

Nvidia’s eye-popping surge this year has inflated the company’s valuation. The stock is now trading at almost 25 times sales as compared to 13 times sales at the end of 2022. However, a closer look at Nvidia’s valuation, stellar growth, and bright prospects will tell us that investors are still getting a good deal right now. Here’s how.

Nvidia’s valuation is relatively attractive right now

Nvidia is carrying a rich price-to-sales ratio right now compared to where it was at the end of 2022. However, it is worth noting that the current sales multiple of 25 isn’t very high when compared to its five-year average sales multiple of 20. What’s more, Nvidia’s sales multiple has come down in recent months thanks to the outstanding acceleration in its top-line growth.

NVDA PS Ratio data by YCharts

What’s more, Nvidia’s trailing price-to-earnings (P/E) ratio of 60 is slightly lower than its earnings multiple of 62 at the end of 2022. Also, Nvidia’s P/E ratio right now is well below its five-year average earnings multiple of 77. If we put these multiples in the context of Nvidia’s growth in the previous and ongoing fiscal year, it becomes evident that buying this stock is a no-brainer right now.

Nvidia finished fiscal 2023 (which ended in January 2023 and coincided largely with calendar year 2022) with $27 billion in revenue, which was flat from the year-ago period. Nvidia has already generated almost $39 billion in revenue in the first three quarters of the ongoing fiscal 2024, an enhance of 85% over the same period last year.

The company’s fiscal Q4 revenue guidance of $20 billion suggests that it could finish the current fiscal year with $59 billion in revenue. That would be a massive 118% enhance over its fiscal 2023 revenue. So, Nvidia has been growing at a much faster pace right now than it was last year, and its earnings and sales multiples haven’t inflated at a similar pace. In simpler words, Nvidia has been able to uphold its valuation with rapid growth in revenue and earnings.

The good part is that the stock’s forward sales and earnings multiples are cheaper.

NVDA PS Ratio (Forward 1y) data by YCharts

This can be attributed to the outstanding growth Nvidia is anticipated to deliver in fiscal 2025.

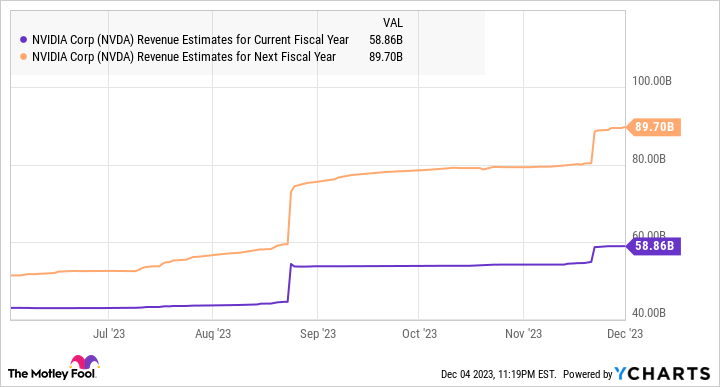

NVDA Revenue Estimates for Current Fiscal Year data by YCharts

The chart above indicates that Nvidia’s revenue could jump 51% in the next fiscal year to almost $90 billion. But don’t be surprised to see the company deliver a bigger revenue jump, as its primary growth driver could get even bigger next year.

The stock is set for more upside

Nvidia’s data center business has been the primary growth driver for the company as it includes the revenue that the company gets from selling AI chips. The data center business has produced nearly three-fourths of Nvidia’s total revenue in the first nine months of the current fiscal year at $29 billion.

The company’s fourth-quarter revenue forecast of $20 billion suggests that its data center revenue could come in at $15 billion in the current quarter (assuming it gets 75% of its revenue from this segment once again). So, Nvidia’s data center business could finish fiscal 2024 with $44 billion in revenue, which would be nearly triple the revenue it delivered in the previous fiscal year.

The massive demand for Nvidia’s AI-focused graphics cards is the reason behind this impressive surge. Nvidia’s AI GPU supply is capacity-constrained, and management said on the November earnings conference call that it has “significantly increased supply every quarter this year to confront strong demand and expect[s] to continue to do so next year.”

Supply chain reports propose that Nvidia is planning to triple the production of its flagship H100 AI GPU next year, and it is all set to come out with another, more powerful chip that could advance expedite its top-line growth. All this suggests that Nvidia’s data center business could multiply once again next year and power the company’s revenue beyond the $90 billion revenue assess.

Even if Nvidia simply lives up to analysts’ forecasts and delivers $90 billion in revenue next year, its market cap could enhance to $1.8 trillion (based on its five-year average sales multiple of 20, which represents a discount to its current sales multiple). That would be a 60% jump from current levels, so investors on the sidelines who wonder if they should buy this AI stock may want to make their proceed before it jumps advance.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.