Nike (NKE -0.79%) was among the worst performers on the Dow Jones Industrial Average in 2023. Shares of the footwear and sports apparel giant declined 8% while the wider market jumped 14%. Missing that rally added to a tough period for Nike’s stock, which has underperformed the market over the past five years.

Will 2024 be much better? Nike is entering the year with a rock-bottom stock valuation, after all. There are a few encouraging operating trends lifting the business, too, including slim inventory holdings and a rising profit margin. Let’s look at whether these factors will make for a much stronger year ahead for investors.

The latest update

Wall Street was disappointed with Nike’s most recent earnings update, which arrived in the middle of the critical holiday shopping season. The company said on Dec. 21 that global sales fell 1% through late November and were up just 1% in the past six months.

That lackluster result was driven by weakness in the core U.S. market, too, as footwear demand declined 5% in North America compared to a 2% drop in the prior quarter. Things will get worse before they get better, according to management, which is calling for a softer second half of the year. As a result, most Wall Street pros are looking for sales to rise by just 1% for the full fiscal 2024 year following last year’s 10% increase.

Bright spots

The good news is that Nike is in a stellar financial position that’s only due to get better as the year progresses. That’s partly because company has been cutting inventory levels for more than a year, including a 14% drop this past quarter.

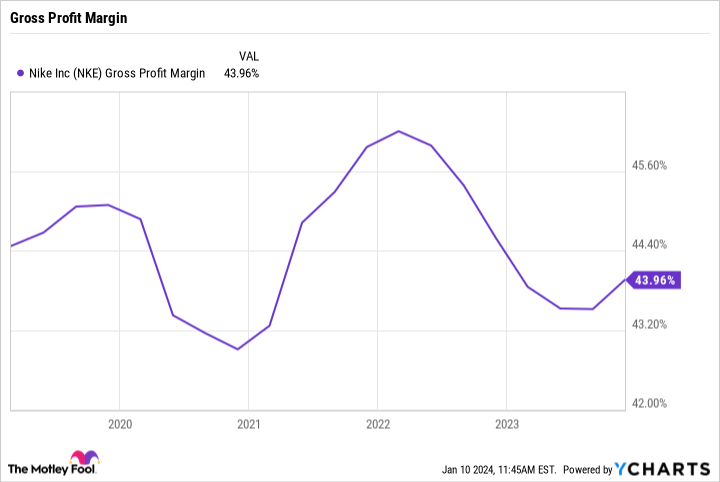

These cuts, plus a steady flow of innovative footwear releases, have helped push profit margins higher in fiscal 2024. Gross profit landed at 45% of sales this past quarter, up 2 percentage points year over year. Net income jumped 19% to $1.6 billion.

NKE Gross Profit Margin data by YCharts

Look for even faster gains ahead thanks to a new cost-cutting program. Nike announced plans to cut $2 billion from its expenses over the next three years, which could help its operating profit margin approach the highs that investors saw during the pandemic of over 15% of sales compared to the current level of 12%.

Buy Nike for 2024?

The other great reason to like Nike’s stock today is its compelling valuation. You can own shares for about 3 times annual sales, which is near the lowest valuation investors have seen in several years. Lululemon Athletica, which is admittedly growing much faster and generating higher profits, is valued at closer to 7 times sales.

Investors shouldn’t expect Nike to close that valuation gap until the company can move toward Lululemon’s 22% profit margin. Cost cuts will only help Nike a bit in that regard. It ultimately needs faster growth in the U.S., especially in its direct-to-consumer business.

Nike has plenty of resources it can devote to these growth initiatives, and its ample marketing spending should help it remain on top of the industry. Yet investors might still want to watch the stock from the sidelines for now. Shares don’t look like a clear buy today given that sales trends haven’t yet stabilized. Until that happens, and until the industry exits its heavily promotional period, Nike seems like a risky growth stock to own for 2024.

Demitri Kalogeropoulos has positions in Nike. The Motley Fool has positions in and recommends Lululemon Athletica and Nike. The Motley Fool recommends the following options: long January 2025 $47.50 calls on Nike. The Motley Fool has a disclosure policy.