The broader energy industry has steadily shifted over the past few decades. Today, renewable energy contributes about 20% of electricity in the United States, recently surpassing coal for the first time.

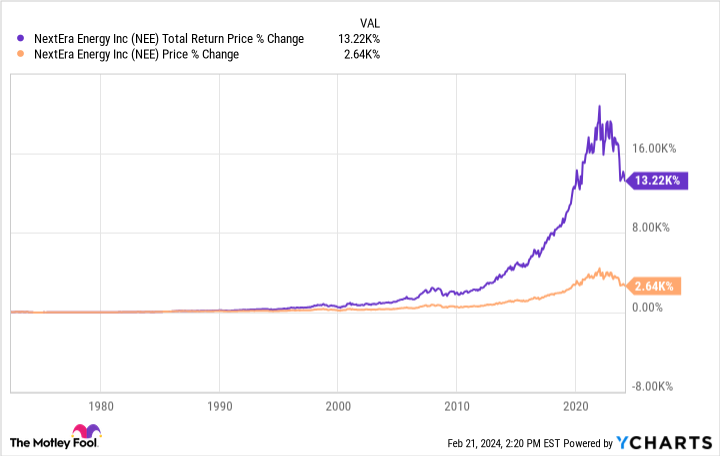

NextEra Energy (NEE 0.19%) has benefited both as an electric utility and a renewable energy producer. The stock has returned a stellar 13,000% over its lifetime, turning a $1,000 investment into $133,000 with dividends reinvested.

The stock is currently down nearly 40% from its high. While nobody likes to feel like they’re catching a falling knife, this dip could set up the next generation of investors who could make millions by buying and holding the stock.

Here is why NextEra’s long-term prospects look so promising.

Two primary businesses are thriving

NextEra Energy is a unique company that is both an energy company and a utility. Its subsidiary NextEra Energy Resources is the world’s largest solar and wind energy producer. It’s currently operating 28,000 megawatts of renewable energy capacity with another 18,000 in development. Its utility subsidiary, Florida Power & Light, is America’s largest electric utility, providing power to over 12 million people across 6 million accounts.

Both business units have a ton of momentum. The International Energy Agency (IEA) estimates that global solar and wind additions will double from 2022 to 2028, supporting a continued shift away from coal and other fossil fuels. Meanwhile, Florida Light & Power is investing heavily in its power grid. Utility companies negotiate rate increases with regulators to help pay for these investments. In other words, it’s a cycle of improving the grid, which drives financial growth.

Florida has one of the fastest-growing populations in America, and the state’s economy is growing. This all points to higher demand for electricity in the future, further incentivizing Florida Power & Light to invest and grow.

NextEra Energy’s earnings grew 9.3% year over year in 2023, and management is guiding for 6% to 8% annualized earnings growth through 2026. Management strongly implied performance will be at the top of this range, and analysts agree, calling for 8% annualized earnings growth over the next three to five years.

A strong dividend is a wealth-building superpower

Dividends are passive income. I don’t think they get enough credit for their role in total returns, though. NextEra Energy is an outstanding dividend stock. It has a solid dividend yield (3.6% today), and management has raised the dividend for 29 consecutive years.

You can see below how much the dividend has boosted the stock’s investment returns:

NEE Total Return Price data by YCharts

Fortunately, the dividend appears healthy, which bodes well for long-term investors. Management has raised the dividend by an average of 11% annually over the past 10 years and has stated its intent to stick to that growth rate through at least this year. That’s supported by a healthy 52% dividend payout ratio and steady high-single-digit earnings growth.

The stock’s dip is a great buying opportunity

Market-beating stocks don’t often come cheap. NextEra Energy has enjoyed a premium valuation from Wall Street, likely for its business quality and excellent dividend history. Shares have averaged a price-to-earnings ratio of more than 28 over the past decade.

Investors had jumped all over the stock, especially in recent years when low interest rates made stocks like NextEra an attractive way investors could generate a decent yield on their money.

Interest rates have soared over the past 18 months, giving investors more yield alternatives. Higher rates also make borrowing more expensive for companies like NextEra, which often borrow to fund projects.

Today, shares trade at a forward P/E of just over 16, which is very reasonable for a business growing earnings at a high-single-digit pace. For the first time in a while, long-term investors aren’t being asked to pay through the nose for this remarkable dividend stock.

Is NextEra a millionaire-maker?

Famous investor Warren Buffett has said it’s far better to pay a fair price for a great company than a cheap price for a bad one. NextEra’s consistent growth on green energy tailwinds makes it a great long-term investment idea at this price. Years of solid dividend and earnings growth can compound wealth. NextEra Energy has done it before, and it looks like it can still make millionaires.

The stock’s price tag was the only thing out of place these past few years, and that’s finally no longer a concern. Investors can buy and hold NextEra Energy confidently.

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends NextEra Energy. The Motley Fool has a disclosure policy.