Shares of Toast (TOST 1.00%) have gained an eye-popping 38% in less than three months. The maker of cloud-based restaurant management software also looks expensive in terms of profit-based valuation ratios, trading at 62 times forward earnings and 611 times free cash flows today.

These figures make Toast seem like an overpriced market darling, but that’s not the full story. Is it too late to jump aboard Toast’s high-growth bandwagon in February 2024?

Let’s take a closer look.

Putting Toast’s recent gains into context

Toast’s recent stock price gain may look impressive at first blush, but it’s actually just a rebound from a deep dip into Wall Street’s bargain bin. The stock is down by 5.7% in the last 6 months, 18% on a yearly basis, and more than 70% from the all-time high recorded soon after its initial public offering (IPO) in 2021.

In other words, Toast’s stock is not soaring in the stratosphere yet — just getting back on its feet after an unfortunate tumble. And with a $10.3 billion market cap, shares are changing hands at an affordable 2.9 times sales.

Have you seen these stellar business trends?

Those sales are growing at a remarkable pace. Toast’s revenues added up to $3.6 billion over the last four quarters, 45% above the year-ago tally.

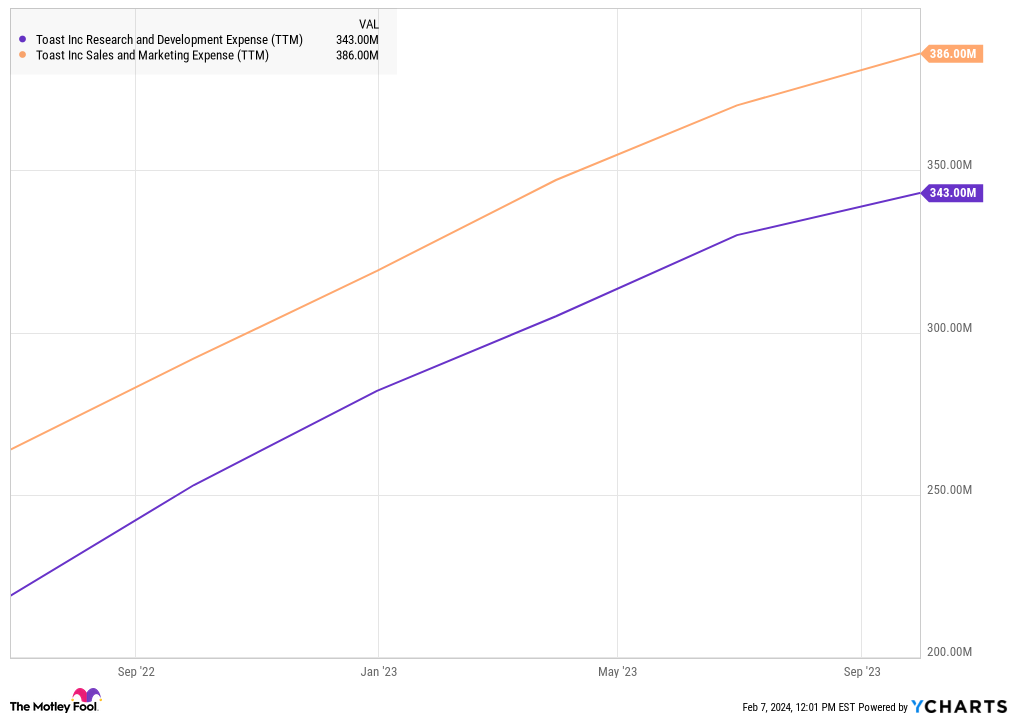

The flourishing top-line result explains a lot about Toast’s lacking bottom-line profits. You see, the company isn’t trying to generate profits yet. Instead, it spends every penny of surplus cash on growth-boosting strategies, such as developing more and better software or bolstering its own sales and marketing efforts.

TOST Research and Development Expense (TTM) data by YCharts

It’s classic Growth Stock 101 stuff. The money you spend in the early growth phase should build a robust customer base and revenue stream for the long haul. Profits can wait a few years. Toast’s earnings are inching closer to the breakeven point, quarter by quarter, but I won’t mind the company taking a while to rise above it.

How Toast fuels that intense growth story

By the numbers, Toast sends value hounds looking elsewhere while growth-chasers may want to know more about this underpriced revenue rocket. That’s where it gets interesting. In my view, Toast is in the early stages of disrupting the enormous restaurant management market, armed with an award-winning all-in-one platform and aiming for global domination.

Today, most restaurants, bars, hotel services, fast-food joints, and other food service locations rely on a patchwork of software solutions for various purposes. Your menu management may come from one company, inventory tracking from another, and payment processing from a third, and staff scheduling might be done on a whiteboard in the break room.

These separate tools are rarely designed to work together, so good luck pulling detailed sales data from one system and loyalty-program demographics from another to come up with an effective local advertising program. Toast does all of that and more, happily sharing useful data between different parts of the platform.

I’m not planning to open a Swedish pancake and meatball food truck or anything, but if I did, I’d be looking for this kind of end-to-end software platform on day one. Paired with Toast’s intense expansion strategy, where the company floods a small number of local markets with sales teams and consultants to build an effective word-of-mouth buzz, the company’s thunderous growth rate isn’t surprising at all.

Carpe Toastem (Seize the Toast)!

The stock started sliding lower six months ago, in lockstep with the most volatile market indices, as the economic recovery hit a plateau. The drop was punctuated by Toast’s Q3 earnings release, which exceeded expectations but set a low bar for fourth-quarter results. After a quick 20% haircut, Toast’s stock reconnected to the broader trends of volatile growth stocks amid brighter economic signs.

So you may have missed an even deeper discount in recent weeks, but Toast’s stock looks deliciously undervalued right now. I can’t wait to see how rejuvenated restaurant traffic fed Toast’s business over the holidays, and how market makers might react if management sets the guidance bar a bit higher for the next fiscal year.

Only time will tell, of course. Either way, I highly recommend taking a bite of this scrumptious growth stock before it really takes off. The recent economic pressure notwithstanding, Toast strikes me as a terrific long-term investment at this bargain-bin price-to-sales ratio.