Nvidia (NVDA -0.65%) stock has soared in recent times, climbing more than 200% over the past year, thanks to the company’s crucial role in the high-growth area of artificial intelligence (AI). The tech giant’s graphics processing units (GPUs) have become the go-to chip for powering AI models.

Demand in the world of AI may be just getting started. The market, at a compound annual growth rate of 36%, could reach more than $1.3 trillion by 2030, according to a Markets and Markets report. This means there should be plenty of business ahead for Nvidia.

Still, considering the stock’s enormous gain, you may be wondering if a lot of the good news is already priced in at today’s level. Is it too late to get in on this AI giant?

Image source: Getty Images.

The power of GPUs

First, a bit of background on this top technology stock. Nvidia isn’t only an AI stock. In fact, its first major success story happened in the world of gaming, where GPUs revolutionized the visuals and speed needed to make games come to life for users. GPUs break down one main problem into multiple tasks and process these tasks simultaneously, resulting in tremendous speed.

Already successful in gaming and graphics applications, the GPU’s speed made it the perfect fit for many other uses, especially AI. In 2007, Nvidia launched CUDA, a parallel computing platform that lets coders apply GPUs to AI and general purposes. Since then, the company’s GPUs have become a key tool in the “deep learning” of AI models because the operation involves the processing of massive quantities of data.

Today, Nvidia holds more than 80% of the AI chip market, but others aim to challenge this leadership. For example, in December, Advanced Micro Devices launched a new chip series — the MI300X — to compete with Nvidia’s star H100. Though the new product looks promising, Nvidia says its H100 still remains twice as fast.

It may not be too difficult for Nvidia to maintain its lead because the company has progressively increased its research and development (R&D) spending. In the most recent quarter, R&D expenses increased 18% to $2.2 billion. So, yes, rivals are working on increased performance, but so is Nvidia — and it has the advantage of already being the fastest kid on the block.

Nvidia’s record revenue

Nvidia can afford to make these investments because the company’s earnings have skyrocketed — thanks to its data centers business, which includes AI. In the most recent quarter, revenue rose more than 200% to a record of more than $18 billion. Data centers accounted for $14 billion of that. And net income advanced more than 1,000% to $9.2 billion on a GAAP basis.

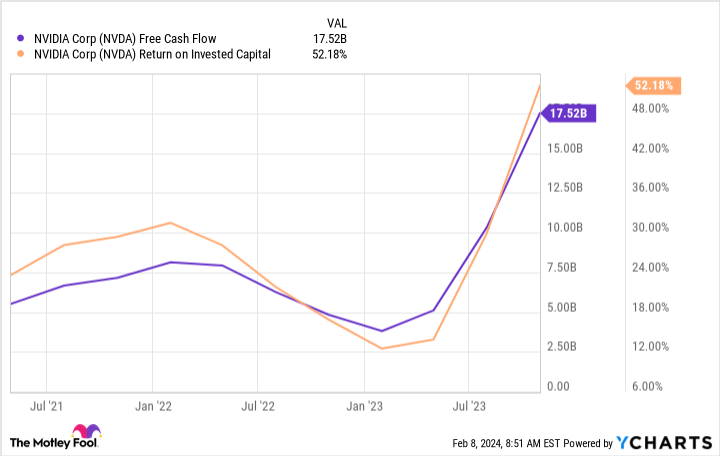

The company also is reporting high levels of free cash flow, and its return on invested capital shows it’s been benefiting from its investment decisions.

NVDA Free Cash Flow data by YCharts.

All of this means Nvidia has what it takes to ensure its leadership position from a technological and financial point of view. This is extremely important, considering that so much of its business now is linked to use outside of the gaming industry.

Now let’s get back to our question: Is it too late to get in on this top-performing stock? After all, the future looks bright, but the stock has climbed in the triple digits in a short period.

A look at the company’s valuation shows that, even after such a gain, it trades for only 33x forward earnings estimates, a dirt cheap level for a profitable company growing revenue in the triple digits.

Considering the growth forecasts for the AI market, there’s reason to believe Nvidia could keep the momentum going for quite some time — if it can remain a step ahead of its rivals. That’s why it’s not too late to buy shares of this top AI stock today because its story in the industry may just be getting started.

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.