Amazon (AMZN 2.71%) investors are raking in the chips to kick off 2024. Thanks to the e-commerce and cloud giant’s record closeout of 2023, the stock has been climbing higher. As of this writing, shares are already up 11% so far this year, and they’re homing back in on all-time highs last reached in late 2021.

A key factor in Amazon’s renewed success involves generating higher profitability, not just all-out growth like in the 2010s. There could be massive amounts of fuel left in the tank, but is it too late to buy the stock now?

Amazon turns over a new leaf

Software-based business models (of which Amazon really has two, an e-commerce marketplace and public cloud services) are often called “infinitely scalable.” Amazon has certainly demonstrated this seemingly “infinite” ability to keep selling more goods and services over time. It hauled in $575 billion in revenue in 2023, far and away above the other tech giants (Apple came in at second place with $386 billion in sales in the last reported 12-month period).

That’s quite impressive for “young” Amazon, which will just be celebrating its 30th birthday later this year.

Of course, much of this revenue is recorded as “product” sales ($256 billion in 2023), aligning much of Amazon’s e-commerce business with the likes of Walmart. Selling products, especially online, isn’t exactly a high-margin business.

However, Amazon founder Jeff Bezos always envisioned the company as a big tech player, a platform of sorts for the digital era. And now that it has scale of epic proportions, Amazon is only just beginning to flex its “infinitely scalable” superpowers. To wit, in 2022, Amazon recorded more full-year “service” revenue than “product” sales for the first time, and it’s the services side that has the margins investors want to see.

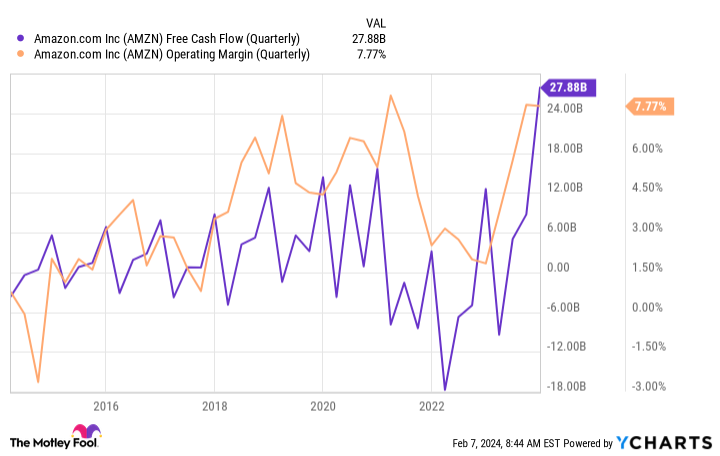

During the pandemic’s height, operating expenses started to get out of control. Since 2022, Amazon has begun right-sizing its e-commerce distribution centers, as well as its data centers in support of cloud customers. The results since then, as measured by operating profit margins and free cash flow generation, have been impressive.

Data by YCharts.

Amazon stock is “expensive,” but that’s OK

There is plenty of room for improvement here. Amazon’s “international” segment still operates at a loss with full-year revenue of $131 billion generating a negative 2% operating margin. That’s mindboggling, to say the least.

Then, there’s the cloud segment: Amazon Web Services (AWS), the leader in public cloud infrastructure and services. AWS generated a 29.6% operating margin in Q4 2023, up from 24.4% in the year-ago quarter when the bear market was still going strong. With cloud computing very much a high-growth market, AWS still has incredible potential.

In its core North American e-commerce market, Amazon is really in the early stages of unlocking profitable gains. For example, it recently launched ads on Prime Video and continues to tout its ads, product distribution, and other services to third-party merchants.

It would appear that Amazon’s big jump in profitable growth is only just beginning. My base case scenario was for free cash flow of $50 billion in 2024, and that looks like an easy ask if the most recent trajectory holds. But based on this assumption, Amazon stock trades for about 35 times this 2024 free-cash-flow estimate. It isn’t a cheap stock, but if you believe Amazon will continue growing and ratcheting up profit margins for years to come, this remains a top buy-and-hold stock for the long haul.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Nicholas Rossolillo and his clients have positions in Amazon and Apple. The Motley Fool has positions in and recommends Amazon, Apple, and Walmart. The Motley Fool has a disclosure policy.