If you like Berkshire Hathaway, you’ll love Fairfax Financial Holdings (FRFHF 2.24%). Both companies run essentially the same business model, with multiple decades of proven success.

Since 2000, Fairfax stock has appreciated by 689%, besting the S&P 500‘s return of just 238%. But with a market cap of only $23 billion at recent prices, it’s still unknown to many investors. Should you be taking a closer look?

Fairfax is a miniature Berkshire Hathaway

At its core, Berkshire’s long-term success is the result of a simple approach. A collection of insurance businesses generate cash by underwriting policies and collecting premiums. It can take months or even years for a claim to be made on any single policy. That means Berkshire can invest that cash in the interim, earning a profit on what amounts to a free loan.

Fairfax operates essentially the same business model, but instead of Warren Buffett directing the investment portfolio, the company is led by a lesser-known figure: Prem Watsa, a Canadian billionaire. He may have less name recognition, but don’t sleep on Watsa’s ability to generate long-term profits for shareholders. Since Fairfax’s founding in 1985, Watsa and his team have compounded book value at 18.5% annually, a feat only the likes of Berkshire can match.

The good news is that while Berkshire is a behemoth, valued at nearly $800 billion, Fairfax remains relatively small — 97% smaller, to be exact. That likely means Fairfax has more room to grow. It is, after all, easier to double $23 billion than $800 billion.

Like Berkshire, Fairfax is dependent on the performance of its insurance businesses, but mostly, its success stems from Watsa’s terrific investment results. Looking ahead, is Fairfax’s portfolio positioned to continue its impressive run?

This is a good bet, with a catch

Fairfax has an eclectic portfolio, diversified across dozens of sectors and geographies. There are, however, a few common themes. It owns stakes in a cluster of mining companies including Altius Minerals and Foran Mining; several bank stocks like Eurobank Ergasias and Commercial International Bank; plus a couple sizable investments in India, with partial ownership over businesses such as Fairfax India (FFXDF 0.01%) and Thomas Cook India.

Like Buffett, Watsa isn’t afraid to make a concentrated bet when his conviction is high. Fairfax’s Altius Minerals position, for example, is worth around $109 million, less than 1% of its common stock portfolio. Its Eurobank Ergasias stake, meanwhile, is worth $1.5 billion, commanding just over 10% of its publicly traded portfolio.

Not all of Fairfax’s portfolio is publicly traded. Watsa regularly dedicates billions of dollars to private deals, capitalizing on opportunities not available to the public. These investments, though generally successful over the long run, can take years to fully play out. Last year, for example, the firm increased its stake in Bangalore International Airport, one of the fastest-growing travel hubs in the world. It was an off-market deal with limited competition. Fairfax secured a great deal, but there’s almost no liquidity. It may be a decade or more until shareholders realize anything other than paper profits.

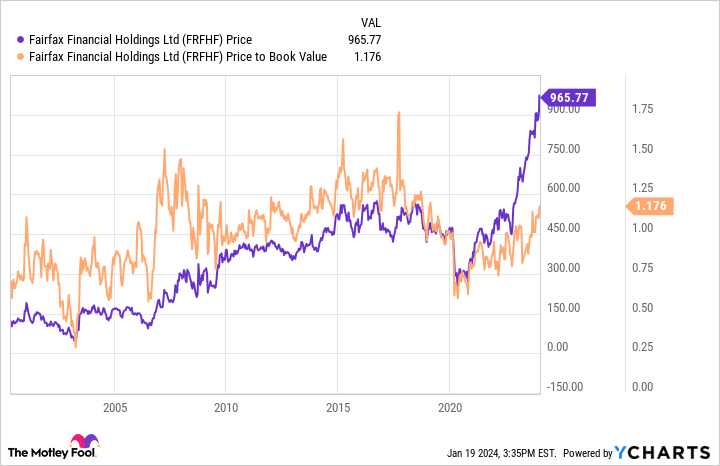

Occasionally, the market isn’t willing to wait for these bets to pay off. This is the biggest catch with Fairfax stock. While its long-term track record is tremendous on an annualized basis, most of its returns have come over small periods of time. From 2003 through 2007, for example, shares traded sideways only for the stock to double in value the following year. From 2015 through 2021, Fairfax stock traded sideways again only to double over the past 24 months. Lumpy returns have been a consistent trend since 1985.

Should you buy Fairfax stock?

To invest in Fairfax, you need to invest like Watsa and Buffett. That is, you must have a long-term time horizon. Watsa’s bets can take years, even decades, to come to fruition. If you can’t stomach holding onto a stock this long, it may not be right for you.

There’s one other potential pitfall to watch out for. As with Berkshire, no single bet is large enough to sink Fairfax. But the success of its portfolio is heavily reliant on a strong world economy. From international bank stocks to globalized industrial producers, Fairfax’s investments require healthy trade markets and ample access to liquidity to succeed.

So far, rising geopolitical tensions and increased borrowing costs haven’t hurt global markets as much as many feared. Any future slowdown, however, will hit Fairfax hard, since its portfolio is so sensitive to macroeconomic downturns.

Over the decades, Fairfax investors who have held on through multi-year droughts and sudden surges have been heavily rewarded. The company’s portfolio looks primed to continue this success, with Watsa focusing capital on high-growth industries and geographies while pursuing lucrative private market deals.

Despite a recent run-up, shares still trade at just a small premium to book value — right around its 10-year average. The stock looks attractive, but only for investors with very long time horizons.