One of the reasons investors have put money into Bitcoin (BTC 4.37%) is the belief that it can be a possible hedge against the U.S. dollar. Fluctuating currency valuations can add risk for investors and hedging against that can help reduce a portfolio’s overall volatility. But just how effective is Bitcoin in doing that?

Bitcoin versus a U.S. dollar index

When there’s currency-related risk or risk in general, investors often go to safe-haven investments, including gold, to help offset the uncertainty. Bitcoin has at times been referred to as “digital gold,” as another potential store of value and way for investors to diversify their holdings. While it’s a lot more volatile than gold, it could have a similar purpose for investors, to hedge against uncertainty.

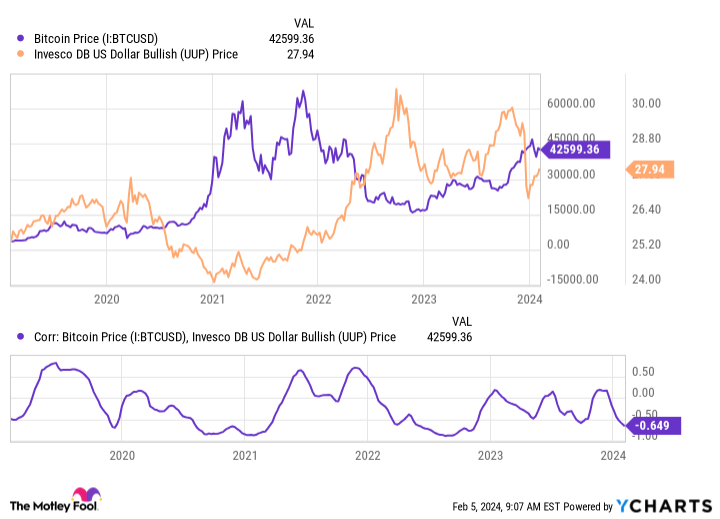

A way to gauge this effectiveness is by comparing Bitcoin to the Invesco DB US Dollar Index Bullish Fund, which helps to track how the U.S. dollar is doing against six major currencies: the euro, the British pound, the Canadian dollar, the Japanese yen, the Swiss franc, and the Swedish krona. When compared to the fund, Bitcoin does appear to have an inverse correlation.

Bitcoin Price data by YCharts

A negative correlation of just under 0.65 is fairly significant, and suggests that Bitcoin does rise in value when the fund is declining in value and the reverse is also true.

It’s important to note, however, this doesn’t mean it will follow this pattern every time or that a 10% drop in the U.S. dollar will result in a 10% increase in the value of Bitcoin. A correlation simply tells investors what has happened over time and the pattern of the assets relative to one another. But that doesn’t mean there’s a cause-and-effect relationship or that the pattern will even continue.

This could make Bitcoin an attractive asset, even to risk-averse investors

What’s holding Bitcoin back right now is the inherent risk with the asset. There can sometimes be sudden swings in Bitcoin’s valuation, which makes it too risky for many investors to consider holding it in their portfolios. But if it can be used as a hedge against the U.S. dollar, then that could make it a more attractive asset to hold, knowing that it can be used as a way to bring down a portfolio’s overall risk.

Bitcoin does appear to be effective with respect to this purpose, and as long as it remains that way, there could be more of a justification for investors to hold it in their portfolios. And by giving investors more of a reason to hold the digital currency (besides just for speculative reasons), that can help increase the level of adoption for Bitcoin and potentially other cryptocurrencies as well. That, in turn, can lead to a higher price and more upside for Bitcoin in the long run.

Should you hold Bitcoin in your portfolio?

Bitcoin is showing that it can have a useful application for investors, in a form of hedging against the U.S. dollar. But it’s still debatable whether that will hold up over the long term. The past four years, in particular, have been volatile, and it’s hard to assess amid all that noise whether Bitcoin has proven it can be an effective hedge against the U.S. dollar. The early results are promising, but they are by no means definitive.

The digital asset remains risky, but investors who want to use it has a hedge may want to consider allocating a small fraction of their portfolios to Bitcoin.

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.