AbbVie (ABBV) has been on a buying spree the past few weeks. On November 30, they announced an all-cash acquisition of the small-cap company commercializing antibody treatments for cancer, ImmunoGen (IMGN), for $10.1 billion. Yesterday, they announced an $8.7 billion all-cash acquisition for a firm developing therapies for neuroscience diseases, Cerevel Therapeutics (CERE).

As soon as the PR firms sent out their media links and let the world in on what’s happening, three ways to make “riskless” profits on this special situation opened up – using a unique hedge fund strategy called “merger arbitrage.”

Both deals are expected to close in the middle of 2024. That’s key here because we’re over six months away from it, and there’s uncertainty in the air. And in the acquisition space, the more uncertainty there is, the better the chance at making money with arbitrage.

Essentially, merger arbitrage is speculation about whether the deal(s) will go through… If we can get past the rugged regulators.

In my opinion, the two acquisition targets are highly specialized, and I doubt there’ll be much of a problem when the antitrust overlords take a look into it next year.

Which means we need to take a look at the details of the deal.

AbbVie is purchasing ImmunoGen at $31.96 per share. The latter’s trading a few dollars below that right now. AbbVie’s purchasing Cerevel at $45 per share, which is also trading a few dollars down.

If the world knows they’ll get paid out at a higher price… why wouldn’t everyone invest in them? It’s the uncertainty we were just talking about. If the situation falls through, Cerevel is NOT worth $42 per share.

But since we’re making the assumption that the deal will go through… buying the stocks outright is the best and easiest way to play this.

The “kicker” is a play on AbbVie.

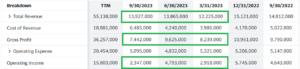

It’s been adding to its cash position the past few years, revenue is growing, profit margins are fluctuating (such is always the case with biotechs), and it’s been paying down debt.

However, the nature of an acquisition is always uncertain because the acquirer uses cash for the purchase AND takes on all the debt it assumes from the other company. In this case, that’s around $500 million currently. Sure, that doesn’t sound admire much for a $250 billion company, but a hit on a major cash position with rates as high as they are and the macro world on edge as it is feels a bit too tenuous for me.

Try buying a long-dated put option to benefit from lowering prices shortly after the deals close.