Bloomberg/Bloomberg via Getty Images

IRSA Inversiones y Representaciones (NYSE:IRS) is one of Argentina’s leading real estate developers. The company controls over half of the country capital’s market share in malls. It also owns offices, hotels, and a significant landbank.

Given the company’s recent profitability from its mall operations, plus the fair value it has calculated for its properties, coupled with speculation on an Argentinian real estate market recovery, many consider IRSA an opportunity.

However, in this article, I argue that the company’s results and potential fair value of its assets are insufficient to justify an investment. First, the results are not as good as presented. Second, realizing the company’s potential primarily depends on external factors: a macro recovery and political support for real estate developments. Third, governance issues increase the premium required to invest in the company.

The good: profitable, promising properties

Today, IRSA is almost solely a real estate company, concentrated in four areas: malls, offices, hotels, and development.

Its most valuable assets in terms of profitability are, by far, the malls. They generate 80%+ of the company’s EBITDA. IRSA owns the main mall in almost every large city in Argentina and, most importantly, almost every valuable mall in the capital, Buenos Aires. Further, the Buenos Aires assets are almost guaranteed to become much more valuable in the long run, given that the city has very little space left to build any mall of comparable size.

Buenos Aires is a crowded city, outside from the green park areas (Google Maps)

The company used to own a lot of office space, as much as 120 thousand square meters. Still, over the years, it has slowly abandoned that segment, which does not generate much income today and represents only a portion of the company’s fair value of assets. The same can be said of the joint venture positions in hotels. What these two segments represent, in my opinion, is the memory of the time when IRSA was a much larger player and developer company. Years of macroeconomic mayhem have reduced the company’s ability to take credit and exercise its leading role in Buenos Aires’ real estate market. But before the credit scarcity time (and hopefully sometime in the future), IRSA was a mighty developer in charge of some of the most important projects in the city.

Finally, IRSA owns land that is much touted. Most of those properties are also in Buenos Aires and are some of the green stripes in the map above. Again, these are valuable properties because of the city’s scarcity of contiguous patches of undeveloped land. One of those patches could become a large 800 thousand square meter development over 15 to 20 years called Costa Urbana. The risk with this landbank, including the Costa Urbana area, is that a lot of people, particularly the neighbors, claim for those areas to become public parks because the city is perceived to lack green areas. This means that IRSA could be forced to sell some of those, at probably not great prices, if enough political force was put into it. This does not mean that the landbank is worthless, quite the contrary, but rather that a valuation cannot be sustained on it alone.

Operational perspective

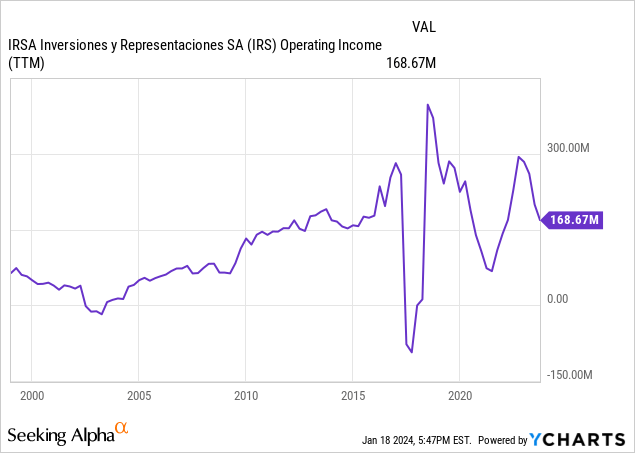

How profitable are the properties? The company’s investor presentation shows almost $170 million in EBITDA, most of it from the malls, for FY23 (ended in June). The problem is that the calculation was based on the official exchange rate, and IRSA‘s income is not tied to the dollar, so it should be converted using the financial rates. The company’s financial statements show that the malls generated about ARS 35 billion in operational EBIT when the effects of fair value accounting are removed. This would be closer to $60 or $70 million by dividing by the then prevailing ARS 500 per USD 1 financial rate. The offices and hotels added another ARS 6 billion or another $10 to $12 million.

I would consider that 2023 is a good base year going forward for two reasons: previous years still carried either the vacancies or the lower rent prices of COVID, and Argentina’s economy could not be in a much worse position than today. The malls are back to 90%+ occupation and rates should normalize from 2024 onwards (contracts last 3 years on average), and because the malls generate variable rent depending on sales, a macroeconomic recovery should improve their profitability.

Interestingly, that level of profitability is more reasonable given that IRSA values its malls at $700 million, or close to a 10% pre-tax cap rate. It would be strange for the company to be cashing $140 million from those prized malls to sell them at a 5x multiple.

With an EV of about $900 million, the multiple on NOPAT earnings, considering income taxes of 35% in Argentina, is above 15x. With $25 million in interest, net income is closer to $40 million, implying a P/E ratio above 20x.

These are high multiples, even for assets with a high potential to generate more profits in the future (such as the malls).

Balance sheet perspective

But then we should also take a look at the assets. IRSA claims that the fair value of their properties (plus some other liquid assets) is about $2.5 billion. Some $700 million from the malls, $500 million from the offices, and $1.2 billion from its landbank ($800 million from the Costa Urbana project).

These assets (particularly the more readily sellable offices) provide a cushion against future financial problems. The company has bonds for $300 million, about $125 million of which is current this year, against only $40 million in USD-denominated cash. The Argentinian market is still hungry for debt because of the limitations to moving capital abroad, so there should be no problem rolling over these $125 million or even more.

Comparing the balance sheet of mostly $2.5 billion in properties minus $300 million in debt. The company sounds more attractive at a market cap of $900 million (or conversely at an EV of $1.2 billion against $2.5 billion in property assets). Theoretically, someone could buy the whole company, pay all the debt, then sell the landbank, pay himself back, and still own the offices and malls for free.

Plus, the Argentinian real estate market is still in a bottomless fall, at least since 2017. It is not that these assets are valued based on a peak, bubbly market, but rather the contrary. Therefore, the gap between price and value is even larger.

But, as mentioned in the above section, developing or even selling landbank properties requires a normalized Argentinian credit market. Otherwise, neither IRSA nor a potential buyer could develop the projects. This means the risk of this approach to valuing IRSA is that the portfolio will take (potentially much) longer than expected to realize its value. As mentioned above and below, some properties in the landbank are not yet zoned for development, but these are not included in the fair value of properties calculation (according to IRSA’s financial statements).

Governance and reporting

Until very recently, IRSA was a complex conglomerate and is still today part of an even more complex conglomerate, Cresud (CRESY).

I’m not referring to the 600 pages of financial reporting of the company’s 20-F. Instead, accounting and consolidation decisions make understanding the company difficult.

One such decision was to consolidate inside an Argentinian real estate company, a much larger Israeli conglomerate, IDBD. IRSA purchased a controlling stake in IDBD in 2014 when its parent company was in financial distress. By 2017, IDBD represented several times the other businesses combined, and by 2020, it was bankrupt.

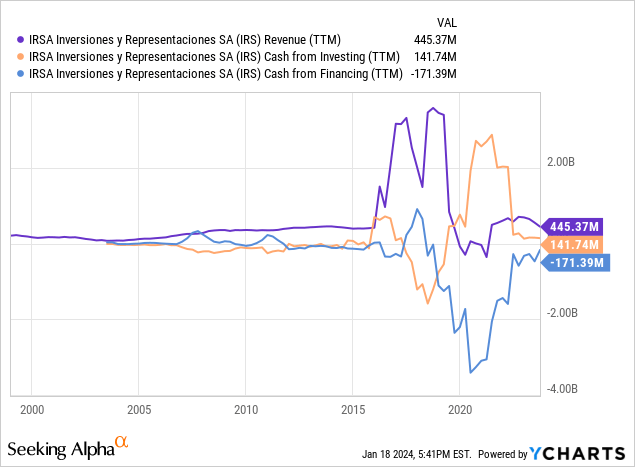

The problem is not only the problematic history of the company but also that explanations to shareholders were scarce. In 2020 and 2021, as seen below, the company’s cash flows from investing and financing ballooned to 20 times their previous average levels because of IDBD. However, IRSA only reported that those movements belonged to ‘discontinued operations’ and didn’t provide more details about their nature. The same can be seen with the enormous revenue boom and collapse between 2017 and 2019.

Another example is the decision to carry their investment properties at fair value, measured in US dollars, but to present their financial statements in Argentinian pesos. This generates enormous movements in fair value accounting that distort the income statement and are not even related to actual movements in the properties’ fair value (which is never measured in pesos in the real estate market). Further, IRSA decided to present those movements in fair value as part of operating activities, making any time series of operating income useless to understand the company’s true profitability potential, especially after the country’s currency started devaluating rapidly in 2018. Our calculations of operating income in the above sections completely ignored any changes in the fair value of properties.

Foggy risks and opportunities

Then, it is difficult to understand a large conglomerate’s opportunities and risks from the perspective of a minority shareholder. This is especially bad for a politically sensitive conglomerate such as IRSA.

For example, IRSA faces lawsuits from the Argentinian state claiming the land on which one of its main malls (Distrito Arcos) is located. In the past, the company had to return lands adjacent to the Costa Urbana project (the Tandanor properties) because the Justice determined the sale had originated under fraudulent conditions. The company faces claims in Israel related to the bankruptcy of IDBD. These are all risks that are extremely difficult to evaluate from outside.

On the other hand, the opportunities also require political readings. The company’s land properties cannot be developed without significant federal or local government political support. The Costa Urbana project faced massive protests and had to be specially authorized by the Legislature of Buenos Aires after several negotiations to leave most of the property as public parks. A Judge later halted the project, and only a higher instance reallowed groundwork to continue. Many of IRSA’s landbank properties do not have any zoning authorization yet and may not get it without solid political support (these properties are not included in the fair value of properties assessment).

Wrap-up

I approach IRSA’s valuation from two perspectives: income, mainly from malls, and its balance sheet (mostly landbank fair value).

Both approaches share a source of margin of safety: Argentina’s current bottomless real estate market. Both the malls’ and offices’ profitability and the value of the landbank are correlated with the value of properties in Argentina (and mostly in Buenos Aires). This market is in shambles. Therefore, any upside is not yet included in the valuation, and the downside is somewhat more floored (although not completely, as the market keeps falling).

From the income perspective, I believe IRSA is expensive, trading at a 15x EV/NOPAT or a 20x P/E. The malls are operationally leveraged to an Argentinian recovery, but this recovery may take time and is not guaranteed. Apart from that macro driver, there is not much that IRSA can do to increase the profitability of its current properties.

On the other hand, the properties could justify the high earnings ratios because even under today’s standards, they greatly exceed (on paper fair value) the company’s market cap and EV. However, this value is not easily realizable, and it may take years before the availability of credit and political support for the landbank to be developed or sold.

This, in my opinion, is not a great situation. The company offers a lot of potential, but that potential depends entirely on external factors (macro recovery and political support). Managers, and even more so minority shareholders, can only sit and wait. I prefer companies with a more active role in their potential.

Finally, IRSA has had a history of questionable reporting and governance decisions. Transparent reporting and governance are critical when the company is part of a controlled conglomerate, and therefore, minority shareholders are at a natural informational disadvantage. I believe IRSA’s lack of transparency on this front requires a further discount on its operations and assets.

For those reasons, I do not believe IRSA is an opportunity unless the investor is willing to buy and just sit and wait, potentially for a very long time. I believe there are other, more actionable, more intrinsically-determined opportunities in the Argentinian market.