Violka08/iStock via Getty Images

IonQ, Inc. (NYSE:IONQ) is a company operating in the field of quantum computing. Quantum computing is an advanced area of technology that holds the potential to revolutionize how computations are performed. Unlike classical computers that use bits (0s and 1s) to process information, quantum computers use quantum bits or qubits, which can exist in multiple states simultaneously due to the principles of quantum mechanics.

Quantum computing leverages phenomena such as superposition and entanglement, allowing it to perform complex calculations much faster than classical computers for specific types of problems. IonQ specializes in a specific approach to quantum computing known as trapped-ion technology, which involves trapping and manipulating individual ions to serve as qubits.

IonQ describes itself as a company at the forefront of quantum computing, in a revolutionary shift in computing technology by harnessing the unique properties of quantum mechanics to perform computations with unprecedented speed and efficiency.

While the story around quantum computing catches the eye at first glance, there are many uncertainties surrounding the sustainability of IonQ’s business model. Although its latest blockbuster earnings may appear appealing, IonQ has seen its losses widen and the company’s ambitious technological goals and strategies are also highly questionable, in my opinion. In its quest to capitalize on the surging share price, IonQ recently conducted a cash raise, but the purpose behind this proceed raises eyebrows, with intentions to utilize the funds for mergers and acquisitions.

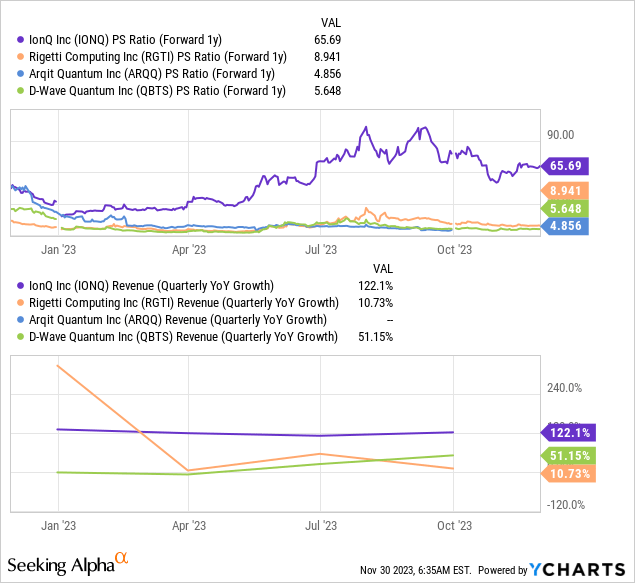

Short sellers have been squeezed over the past year, as IONQ shares are up over 300% from their lows in late 2022. In contrast to quantum computing competitors such as Rigetti Computing, Inc. (RGTI), D-Wave Quantum Inc. (QBTS), and Quantum Computing Inc. (QUBT) shares of IonQ have rebounded from their initial sell-off after going public via a SPAC with MY Technology Group III. The SPAC allowed IONQ to raise over $600 million to commercialize its quantum computers.

Earnings

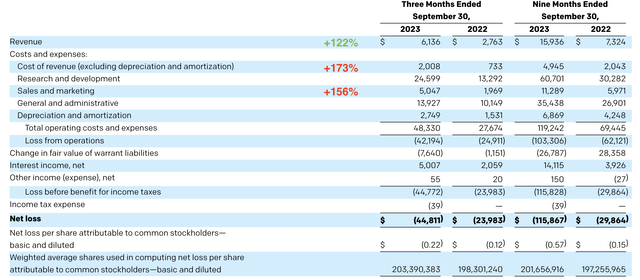

IonQ’s earnings look visually appealing, although the underlying numbers are less convincing, in my opinion.

IonQ reported revenue of $6.1 million for the third quarter, which exceeded their previously provided range and represents an enhance of 122% year-over-year (YOY). While this might seem positive, it’s worth noting that they posted a net loss of $44.8 million and an Adjusted EBITDA loss of $22.4 million during the same period, up sharply from last year.

While revenue increased 122% YoY, its cost of revenue increased proportionally faster, growing 173% YoY. More importantly, its sales & marketing expenses increased 156% YoY, representing 82% of the costs of its total revenues. This compares to just 71% in the year before. Such S&M costs would even be considered high for highly scalable recurring software companies. I believe its high sales and marketing costs are able to inflate its growth in bookings from customers who are interested in the technology. I also believe that if IONQ was so convinced in its cutting-edge quantum technology and its competitive edge, it is difficult to comprehend why it is investing in unprofitable marketing at such an early stage, as opposed to investing more in Research & Development.

Unsurprisingly, its losses nearly doubled to $44 million, up from $23 million in the year prior, while its interest income of $5 million helped to offset even greater net losses.

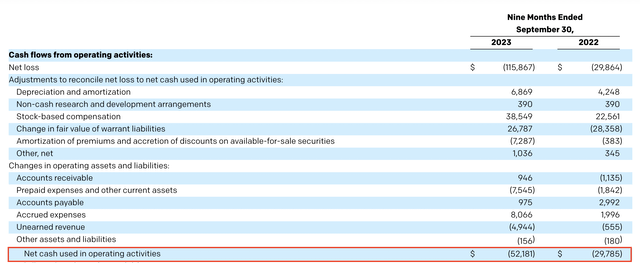

Furthermore, its free cash flow deteriorated from an outflow of around $30 million to over $50 million in the nine months ended 2023. While it is not unusual for tech stocks to grow their net losses in early growth stages due to stock-based compensation, growing losses in free cash flow is worrying, in my opinion. As IonQ is using up its IPO proceeds, shareholders could be advocate diluted in the future.

Valuation

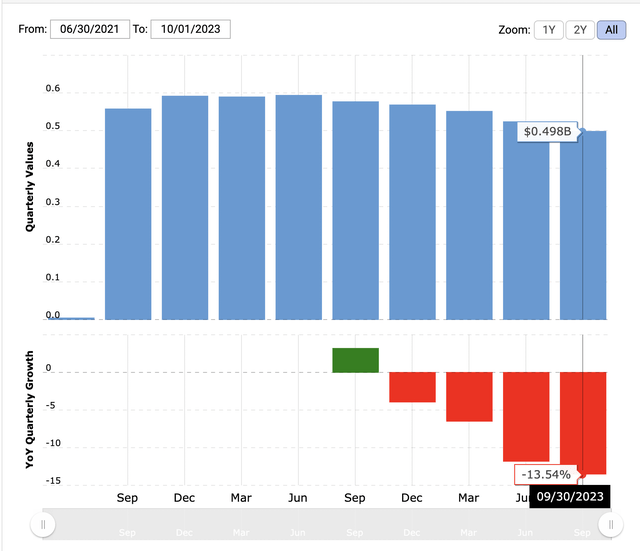

While IONQ is growing revenues at over 100% YoY, a valuation of over 100 times its trailing 12-month revenue seems too far stretched, in my opinion. Even high-margin, recurring software companies such as Snowflake Inc. (SNOW), CrowdStrike Holdings, Inc. (CRWD), and SentinelOne, Inc. (S) growing revenues at over 80% per year in their early stages, barely traded at above 100 times Price to Sales.

It is important to note software stocks such as CrowdStrike and Snowflake grew their free cash flow alongside revenues and hold free cash flow margins of around 30%. It is difficult to see IonQ accomplish such margins in the foreseeable future, or any positive free cash flow at all.

As a result of its significant cash outflows, IonQ is slowly but steadily using up its IPO proceeds, reflected in its shrinking shareholder equity, which has been accelerating in recent quarters. Therefore, I believe part of its recent $500 million raise will be used to fortify its balance sheet, although management stated that the proceeds will be utilized for potential mergers and acquisitions to drive growth. However, few cutting-edge technology start-ups sell for less than $500 million, and if IonQ was as disruptive as it claims to be, it would likely use the proceeds for R&D or growing its headcount to advocate fortify its salesforce in my opinion.

Takeaways

While IonQ’s story sounds enticing, I am not buying into the hype. Quantum Computing is in its early innings and the uncertainties surrounding IonQ’s technological capabilities are still too great, in my opinion. With all other SPAC quantum peers having sold off substantially from their IPOs, IonQ is the only one standing. IonQ has been able to hold up its growth story as it holds substantially higher liquidity than its peers, part of which it funneled into its Sales and marketing to hold up its growth rates. However, the company is nowhere near profitability and is trading at above 100 times annual revenues. The fact that its co-founder and chief scientist Chris Monroe announced he would be leaving the company to return to his academic position isn’t convincing me either.

Quantum computing is still in its early stages, and IonQ competes with industry giants admire International Business Machines Corporation (IBM), Alphabet Inc. (GOOG) (GOOGL), and Microsoft Corporation (MSFT). Given the challenges and past struggles in this field, it’s unlikely that a single player will emerge as the dominant winner. Success in quantum computing requires ongoing innovation and addressing technical hurdles, making it a highly competitive and uncertain space for all players, including IonQ.